| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| CAGR | 6.14 % |

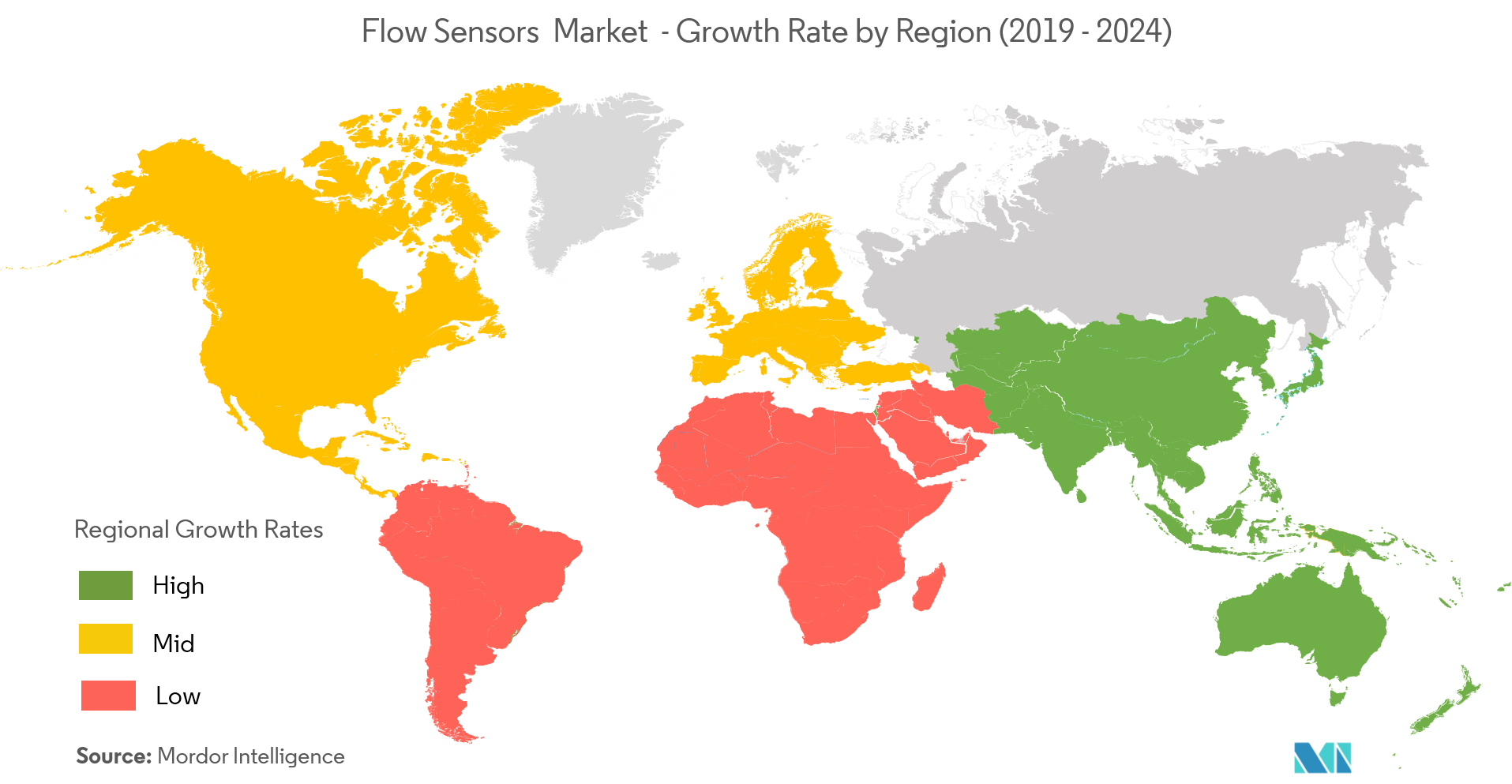

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Flow Sensors Market Analysis

The Flow Sensors Market is expected to register a CAGR of 6.14% during the forecast period.

- The revival of the oil and gas industry and the expanding infrastructure in the water and wastewater industry are likely to drive growth in the medium- to long-term. There are growth opportunities in developing economies, such as China and India, which have developed their oil and gas, and chemical industries.

- Emerging technologies, such as IIoT, asset management, and advanced diagnostics, are helping in forming new collaborations among users and suppliers. Moreover, strategies for both end-users and suppliers have leveraged advancements in networking and cloud platforms as well as service offerings, including data and analytics.

- Flow sensors offer a range of advantages, due to which, they are increasingly used in coal-fired, fuel oil and natural gas, geothermal, hydroelectric, and nuclear power plants. Increasing stringency in regulations related to the control of emission of toxic gases gas from power plants has increased the adoption of flow sensors.

- However, unskilled labor, lack of understanding pertaining to operational processes of smart flow sensors, and high initial costs associated with these advanced products are factors likely to threaten market growth. Similarly, lack of adequate calibration facilities in Middle East & Africa (MEA), coupled with political instability in the region, will adversely impact the region's growth.

Flow Sensors Market Trends

Oil and Gas Vertical is Expected to Hold a Major Share

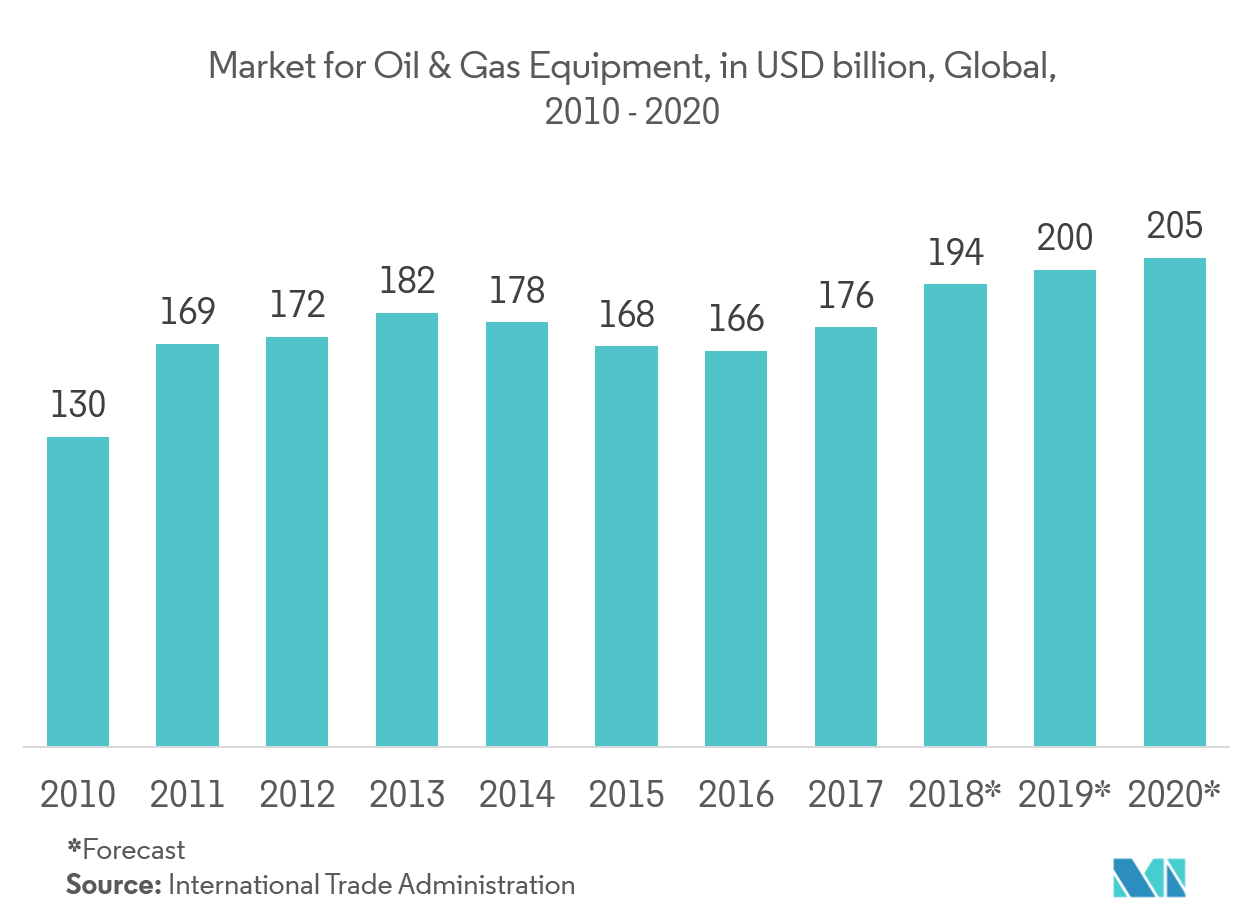

- The demand for oil and gas equipment is increasing consistently and as a result, it is expected that the adoption of flow sensors will also proportionally increase.

- Flow measurement is critical in the upstream oil and gas sector. It is required in upstream operations that span offshore to onshore activities, which include well testing, enhanced oil recovery, fractionation, completion, and separation, to recovery and preparation of crude oil and natural gas.

- During the exploration and drilling stages at oil and gas fields, there is a need for accurate and dependable flow instrumentation to ensure production is optimized.

- When a shale gas reserve is found, the first stage of the extraction process is to pump water-based solutions into the well to release the trapped gas. Here monitoring the flow is necessary to verify the outputs of hydraulic-driven equipment, such as power units on drilling rigs, and to monitor test machinery and tools for proper fluid flow rates.

- The choice of the suitable flow sensor for fuel gas to flare and acid gas measurements as well as monitoring liquefied natural gas (LNG) during the processing, transportation, and storage is critical. Further, the adoption of automation across the oil and gas value chain also had a major impact on the adoption of flow sensors, due to the greater need for efficiency and accuracy in the operation of the equipment.

North America to Account for the Largest Share

- North America holds the largest market share of the flow sensors market, due to the thoroughly developed oil and gas, chemicals, and power generation industries.

- The North American renewable power generation sector was expected to continue to invest significantly in new projects, in 2017. According to the US Department of Energy, the hydropower sector is expected to grow from the current capacity of 101 GW, to almost 150 GW by 2050.

- An improving US economy (the United States is expected to hold its strong position as an exporter of chemicals) and a rebounding manufacturing sector are further expected to contribute to the growth of this market.

- North America has been a frontrunner in the deployment of smarter manufacturing infrastructure based on IoT techniques. Companies establish and maintain an operational process across control methods, manufacturing, and business processes.

Flow Sensors Industry Overview

The flow sensors market is fragmented.The flow sensor market has witnessed an increase in demand for intelligent meters, due to the integration of IoT, which requires the implementation of smart flow rate measurement solutions. The competitive rivalry among existing competitors is high. Moreover, the product innovation and expansion strategies of large companies expected to boost the demand of the flow sensors market.Some of the key developments in the area are:

- February 2018:At the Electronica and COMPAMED 2018 trade fairs, Sensirion presentedits liquid flow sensor, the SLF3S-1300F. Combining Sensirion's excellent 20-year track record in low and lowest flow rate sensing with a radically optimized mechanical design, the SLF3S-1300F tookthe well-established functionality to the next level in price-performance ratio.

Flow Sensors Market Leaders

-

Siemens AG

-

Emerson Electric Co.

-

First Sensor AG

-

OMEGA Engineering

-

Rechner Sensors

- *Disclaimer: Major Players sorted in no particular order

Flow Sensors Industry Segmentation

Flow sensors are the devices that are used to measure the flow rate, often for fluid. These sensors are usually a part of a flow meter, which can record the flow rate. Global flow sensors are segmented by type: liquid and gas. IT is differentiated by technology: Coriolis, differential flow, ultrasonic, vortex, and other technologies. Different industries, like oil and gas, water and wastewater, paper and pulp, chemical, power generation, food and beverage, are using flow sensors to strengthen their growth rate in respective fields.

| By Type | Liquid | ||

| Gas | |||

| By Technology | Coriolis | ||

| Differential Flow | |||

| Ultrasonic | |||

| Vortex | |||

| Other Technologies | |||

| By End-user Vertical | Oil and Gas | ||

| Water and Wastewater | |||

| Paper and Pulp | |||

| Chemical | |||

| Power Generation | |||

| Food and Beverage | |||

| Other End-user Verticals | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Latin America | |||

| Middle East & Africa | |||

Flow Sensors Market Research FAQs

What is the current Flow Sensors Market size?

The Flow Sensors Market is projected to register a CAGR of 6.14% during the forecast period (2025-2030)

Who are the key players in Flow Sensors Market?

Siemens AG, Emerson Electric Co., First Sensor AG, OMEGA Engineering and Rechner Sensors are the major companies operating in the Flow Sensors Market.

Which is the fastest growing region in Flow Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Flow Sensors Market?

In 2025, the North America accounts for the largest market share in Flow Sensors Market.

What years does this Flow Sensors Market cover?

The report covers the Flow Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Flow Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Flow Sensors Industry Report

Statistics for the 2025 Flow Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Flow Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.