Feed Processing Equipment Market Analysis

The Feed Processing Machinery Market size is estimated at USD 24.29 billion in 2025, and is expected to reach USD 27.48 billion by 2030, at a CAGR of 2.5% during the forecast period (2025-2030).

- A rise in animal-based food product consumption all over the world is anticipated to boost the demand for feed. Changes in customer dietary habits toward the quality of dairy products and meat are likely to contribute to the growth of the feed industry which drives the feed processing machinery market. Nevertheless, with the rise in meat consumption across the world, the compound feed industry is estimated to witness a huge demand for better-quality meat. According to the FAO, growth in global consumption of meat proteins over the future is estimated to rise by 14% by 2030, compared to 2020-2022, propelled largely by population growth and income. Protein availability from poultry, beef, pork, and sheep meat is anticipated to grow by 17.8%, 5.9%, 13.1%, and 15.7%, respectively, by 2030.

- Aquafeed manufacturers worldwide are increasingly focusing on the burgeoning aquaculture sector. Aquaculture requires a proportional increase in nutrient and feed inputs to sustain its growth. Yet, with the static production of aquatic ingredients and competition from other sectors for the same resources, challenges arise. Nonetheless, as aquaculture flourishes and the demand for species like tilapia and catfish intensifies, many small-scale producers are shifting towards processing their feeds instead of buying pre-made fish feed. This trend is driving these producers to invest in feed-processing machinery. In 2022, Cargill made a significant move by investing USD 50 million in R&D, establishing facilities in China, near Elk River, Minnesota, and in the Netherlands, specifically targeting animal nutrition and feed development.

Feed Processing Equipment Market Trends

Poultry Feed is the Significant Segment by Feed Type

Recently, poultry has emerged as one of the fastest-growing segments within the agricultural sector. Over the past two decades, the poultry sector has undergone significant structural changes. These changes can be attributed to the introduction of modern intensive production methods, genetic enhancements, improved preventive disease controls, and stringent biosecurity measures. The surge in poultry meat consumption is particularly pronounced in East and Southeast Asia and Latin America, with China and Brazil leading the charge. Over the last decade, developing countries have increased their share of global poultry meat consumption. Projections indicate that due to rising incomes, diversifying diets, and expanding markets, poultry meat production and consumption in these countries will grow at an annual rate of 3.6%. According to the OECD Agricultural Outlook, global per capita poultry meat consumption rose from 28.1 kg in 2022 to 28.5 kg in 2023. However, as global meat consumption rises, the feed industry anticipates a burgeoning demand for higher-quality meat.

As the demand for livestock products grows, significant changes are occurring on the supply side, all aimed at enhancing poultry product yields. Capital-intensive technologies have enabled industrial-style poultry production facilities to sprout across regions like North America, Europe, and Asia-Pacific, especially in land-constrained countries. The anticipated growth in poultry meat and egg production is set to propel the global poultry market. For instance, data from FAOSTAT reveals that global poultry meat production jumped from 136.4 million metric tons in 2021 to 139.2 million metric tons in 2022.

Moreover, heightened investments in Europe to bolster poultry production are further propelling market growth. In 2021, MHP, a Ukrainian poultry producer, allocated a substantial USD 41 million towards poultry production in Serbia. Similarly, Cobb Venture, another poultry producer, expanded its hatchery facility in the UK in 2021, boosting its capacity to set 1.5 million eggs. Such ongoing expansions in poultry production underscore the rising demand for premium feed, fueling the market's growth.

Asia Pacific Dominates the Global Market

In Asia, the livestock industry is an essential part of agricultural development that has grown remarkably in the last few decades. Large-scale livestock production helps meet the surging demand for livestock products. In addition, farm animals, like poultry, swine, cattle, etc., play an essential economic and social role in Asian countries. With rapid economic growth, the demand for meat protein rose significantly in Asia, especially in India, Malaysia, China, and Thailand. The growing demand for meat protein triggered meat production and consumption in the region, where the uptake of high-quality feed increased considerably and is anticipated to show a further increase. High-quality feed use in China is growing due to the country's strong demand for chicken meat. The production of chicken meat increased from 92.5 million metric tons in 2021 to 94.7 million metric tons in 2022, according to the Food and Agriculture Organization (FAO).

Further, the Asia Pacific is leading the market with the presence of the highest number of feed manufacturers and machinery suppliers. China remains the top feed producer and user of feed processing machinery due to an increase in economic growth and rapid urbanization. The major drivers for the market are increasing the concentration of domestic feed processing machinery companies, the establishment of feed mills, technology innovation, and government subsidies for mechanization as a result of the growing population. In 2024, Gold Coin China expanded its feed production capacity with the completion of a new USD 23.1 million mill in Yunnan, China. It will produce feed for swine, poultry, aquaculture, and ruminants as well as premix. Further, the poultry industry is also benefiting from government incentives to support recovery and restocking. Additionally, several leading broiler enterprises in China invested in new broiler construction projects, with a total investment of up to RMB 7.4 billion (USD 1 billion) in 2020.

Feed Processing Equipment Industry Overview

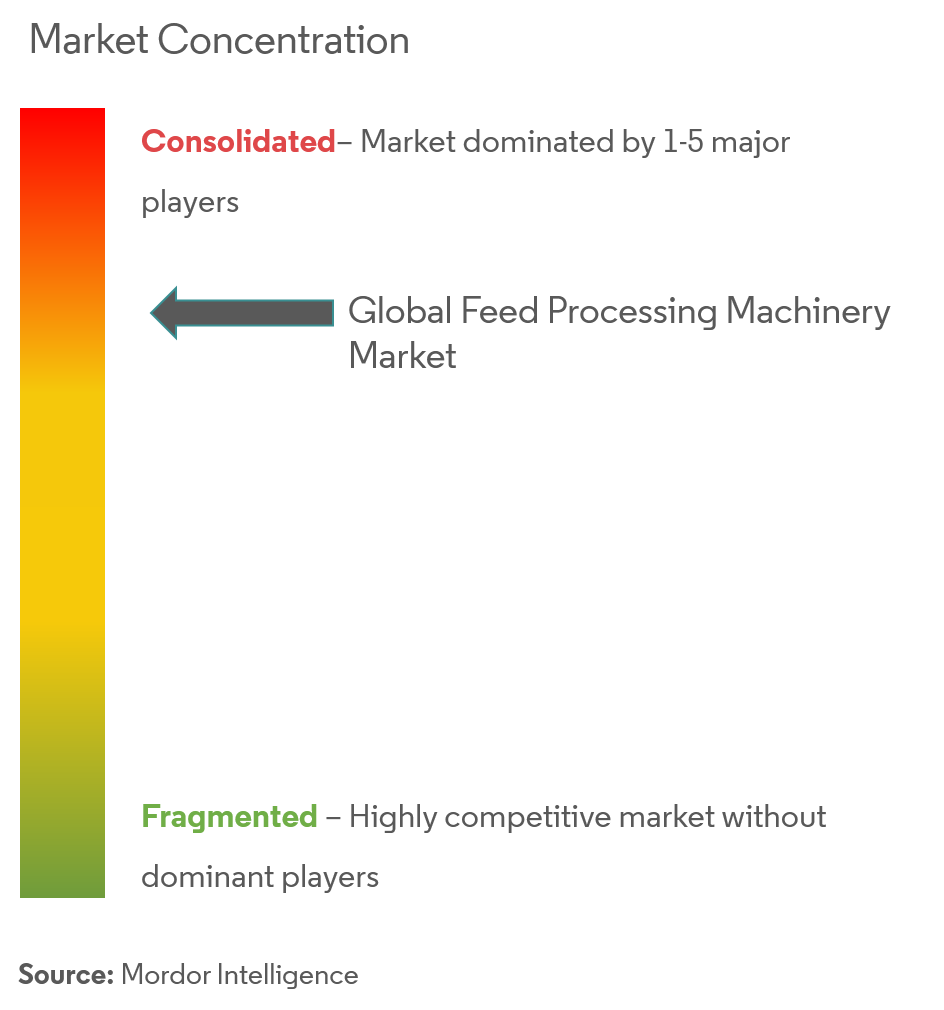

The feed processing machinery market is consolidated in nature with major players accounting for major market share. The major players in the market are Buhler AG, Clextral, Dinnissen BV, Andritz AG, and Bratney Companies, among others. Most of the major companies in the market are concentrating on developing new machinery, partnerships, and mergers, to achieve a competitive edge over other market players.

Feed Processing Equipment Market Leaders

-

Buhler AG

-

Clextral

-

Dinnissen BV

-

Andritz AG

-

Bratney Companies

- *Disclaimer: Major Players sorted in no particular order

Feed Processing Machinery Market News

- June 2023: Aboitiz established feed mills in both China and Vietnam. Pilmico and Gold Coin have earmarked USD 51 million for their international feed mill expansions, specifically targeting Long An in Vietnam and Yunnan in China.

- November 2022: Bühler unveiled its Granulex® 5 series, a new hammer mill lineup featuring numerous innovations that collectively enhance performance. This pioneering modular system not only ensures top-notch product quality and safety standards but also delivers notable energy savings and flexibility.

Feed Processing Equipment Industry Segmentation

Feed processing equipment is a machine that produces animal feed by processing the raw material. The Global Feed Processing Machinery Market is Segmented By Function (Pelleting, Mixing, Grinding, and Extrusion), Feed Type (Ruminant Feed, Poultry Feed, Swine Feed, Aquaculture Feed, and Other Animal Feed), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of value in (USD) for all the above segments.

| Function | Pelleting | Pellet Mills | |

| Pellet dies | |||

| Conditioners | |||

| Others (Coolers and Dryers) | |||

| Mixing | Mixers | ||

| Dosing and Batching | |||

| Others (Dust-filters) | |||

| Grinding | Hammer mill | ||

| Fine Pulverizer | |||

| Others (Roller Mills and Screening Devices) | |||

| Extrusion | Extruders | ||

| Fat Sprayers | |||

| Others (Pre-conditioners) | |||

| Feed Type | Ruminant Feed | ||

| Poultry Feed | |||

| Swine Feed | |||

| Aquaculture Feed | |||

| Other Animal Feed | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle East & Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle East & Africa | |||

Feed Processing Machinery Market Research FAQs

How big is the Feed Processing Machinery Market?

The Feed Processing Machinery Market size is expected to reach USD 24.29 billion in 2025 and grow at a CAGR of 2.5% to reach USD 27.48 billion by 2030.

What is the current Feed Processing Machinery Market size?

In 2025, the Feed Processing Machinery Market size is expected to reach USD 24.29 billion.

Who are the key players in Feed Processing Machinery Market?

Buhler AG, Clextral, Dinnissen BV, Andritz AG and Bratney Companies are the major companies operating in the Feed Processing Machinery Market.

Which is the fastest growing region in Feed Processing Machinery Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Feed Processing Machinery Market?

In 2025, the Asia Pacific accounts for the largest market share in Feed Processing Machinery Market.

What years does this Feed Processing Machinery Market cover, and what was the market size in 2024?

In 2024, the Feed Processing Machinery Market size was estimated at USD 23.68 billion. The report covers the Feed Processing Machinery Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Feed Processing Machinery Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Feed Processing Equipment Industry Report

Statistics for the 2025 Feed Processing Machinery market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Feed Processing Machinery analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.