Europe Metal Fabrication Equipment Top Companies

-

TRUMPF GmbH

-

Dürr AG

-

Amada

-

GF Machining Solutions

-

DMG MORI

*Disclaimer: Top companies sorted in no particular order

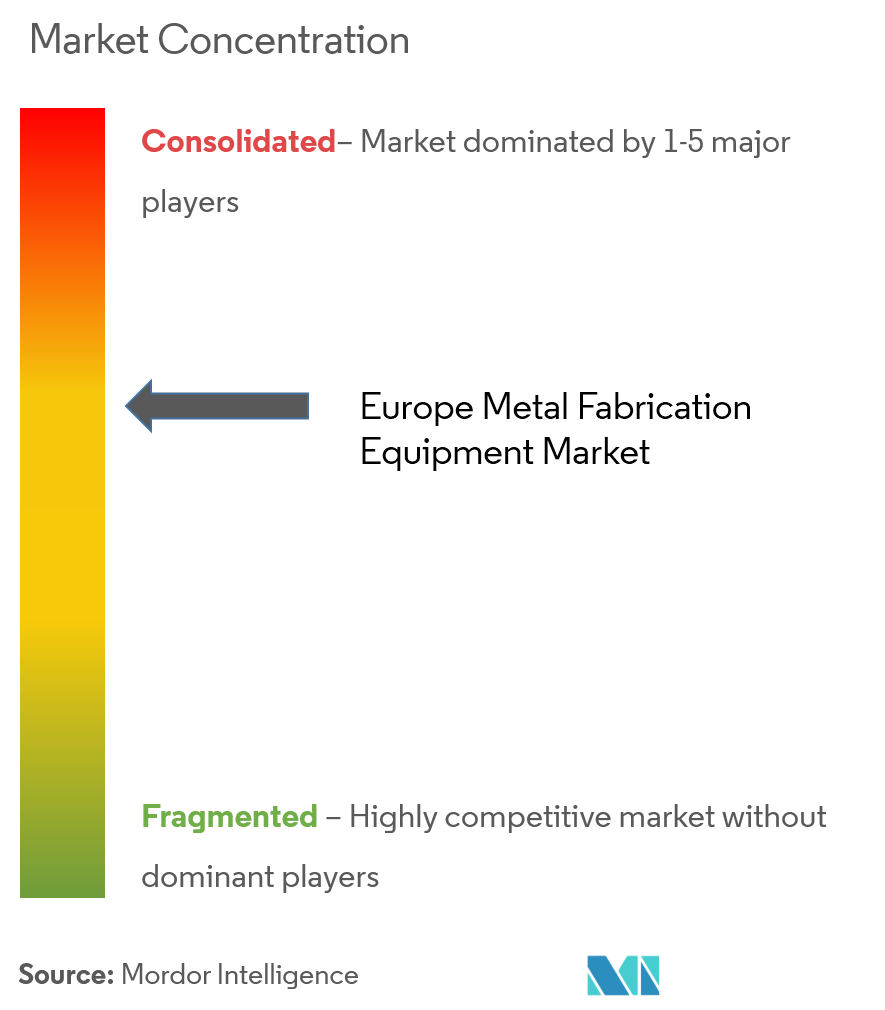

Europe Metal Fabrication Equipment Market Concentration

Europe Metal Fabrication Equipment Company List

-

TRUMPF GmbH + Co. KG

-

Durr AG

-

Amada Europe

-

GF Machining Solutions

-

DMG MORI

-

Schuler AG

-

GROB-WERKE GmbH

-

Bystronic Maschinen AG

-

Feintool International Holding AG

-

Mazak U.K. Limited*

Specific to Europe Metal Fabrication Equipment Market