| Study Period | 2019 - 2030 |

| Market Size (2025) | USD 21.04 Billion |

| Market Size (2030) | USD 37.71 Billion |

| CAGR (2025 - 2030) | 12.38 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

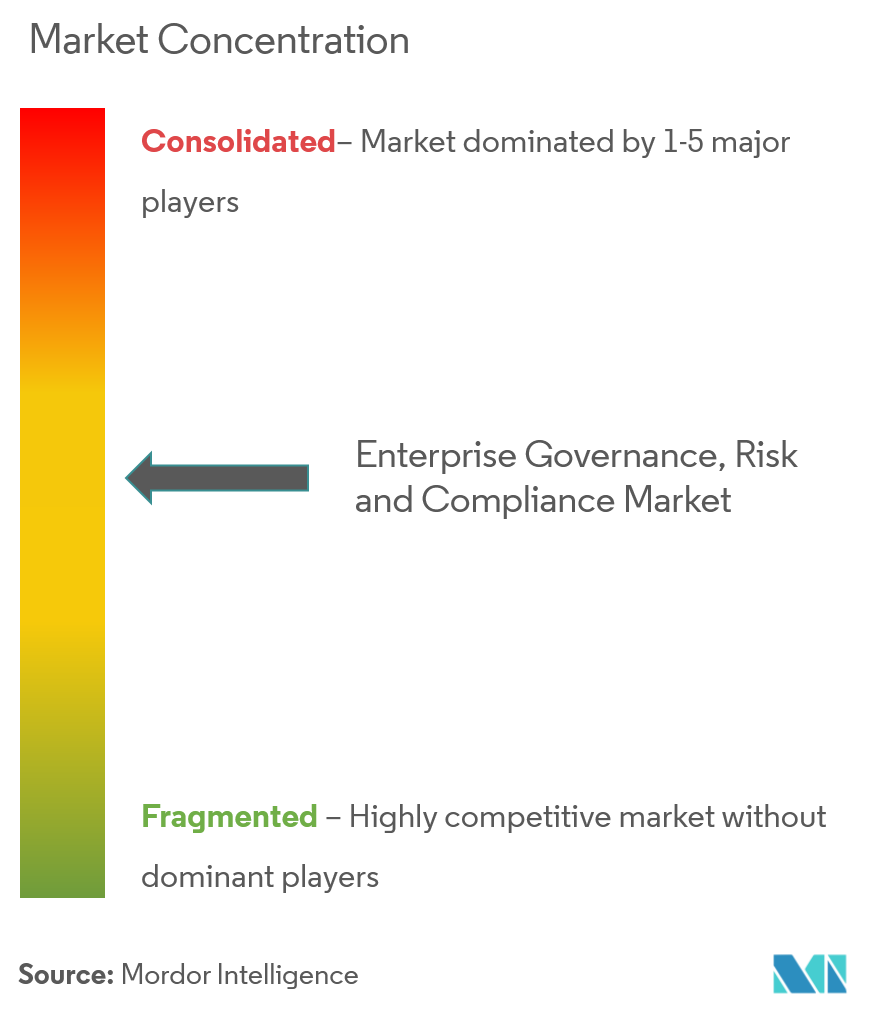

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Enterprise Governance, Risk and Compliance (eGRC) Market Analysis

The Enterprise Governance, Risk And Compliance Market size is estimated at USD 21.04 billion in 2025, and is expected to reach USD 37.71 billion by 2030, at a CAGR of 12.38% during the forecast period (2025-2030).

Organizations usually operate in a complex and highly dynamic global environment. Hence, managing risk and compliance due to the various impacts of the changes around it is one of the significant challenges that an organization faces.

- Enterprise GRC helps organizations anticipate, understand, and holistically manage their risks. As a result, organizations can balance risks and opportunities, make strategic decisions effectively, and respond efficiently to the changes occurring within and outside the enterprise.

- Implementing stringent regulations and mandates by the government across various end-user verticals has increased the need to adopt eGRC solutions that fulfill the need for compliance, audit, risk management, etc.

- Moreover, the rising threats amongst organizations due to digitalization and the sharing of vast data have led to different forms of cyber threats and attacks. Hence, there lies an increasing need for efficiency in financial assessment and cost-saving solutions, which is further expected to fuel the market's growth opportunities. Therefore, the cybersecurity threat is one of the critical drivers for eGRC software adoption.

- However, a lack of awareness about the various benefits of eGRC, especially in small and medium businesses, has hindered market growth. Furthermore, continuous changes in the company's code of conduct and organizational structures are likely to curb market growth.

Enterprise Governance, Risk and Compliance (eGRC) Market Trends

Demand from BFSI segment is expected to Witness Significant Growth

- Ensuring compliance and managing risks have become vital parts of the business goals and the non-negotiated components of corporate strategy. In the present strict regulatory environment, with new mandates and standards coming into effect, the need to conform to the regulatory changes to ensure safety has emerged to be a significant priority for any bank.

- Major banks globally saw a sharp increase in phishing and other related attacks after the pandemic. Multiple banks relaxed security standards to maintain business continuity, including authorizing money transfers via e-mail.

- Moreover, remote employees with access to company information without banks' internal firewall protections and monitoring are among the biggest security threats. This has led the enterprise to be exposed to various sorts of cyberattacks and threats, thereby driving the demand for the market significantly.

- Additionally, cybercriminals have demonstrated their capabilities against the financial sector by exploiting ATMs and defrauding bank customers while also employing such tactics as banking Trojans, launching ransomware attacks, and deploying point-of-sale malware. Thus, as technological advancements have supported most financial services vendors globally, there is a push toward the fundamental need for security and reliability, which is further expected to enhance the market's growth opportunities.

North America Expected to Dominate the Market

- North America accounts for a significant portion of the global demand for enterprise governance, risk, and compliance solutions, owing to the disappearing boundaries in the hyper-extended enterprises.

- With the rise in the hyper-extended enterprises, the security-related risks tend to grow and emerge. This factor has resulted in an increased focus on identity and access management, for which the government in the country is framing stricter regulations. Therefore, enterprises must comply with federal laws, regulations, standards, and governance relevant to identity management.

- North America is projected to continue its dominance in terms of revenue in the forecast period. This is majorly due to the early adoption of enterprise governance, risk, and compliance management solutions in the region. Demand for eGRC solutions is highest in the United States due to stringent corporate governance regulations.

- Moreover, there has been a significant rise in cyber-attacks in the last few years in the region. Also, with the emergence of technologies, such as Big Data, IoT, and cloud-based software, the growth of GRC software is anticipated to propel over the forecast period, driving the market’s growth opportunities significantly.

- With the enterprise governance, risk, and compliance strategy, the IT, finance, operations, and legal domains are expected to collaborate on their requirements to apply the same control to different regulations. For instance, the hospitals in the region use the same control to ensure compliance, as enterprise governance, risk, and compliance offer a process that reduces redundancy and repetition and improves efficiency and consistency.

Enterprise Governance, Risk and Compliance (eGRC) Industry Overview

The enterprise governance, risk, and compliance market is a relatively highly competitive and moderately concentrated market. The major companies have been using new product development, acquisition, and collaboration strategies to strengthen their market share. Some of the are as follows:

- June 2023 - MetricStream, a provider of integrated risk management (IRM) and governance, risk, and compliance (GRC) solutions, launched AiSPIRE, the industry's first AI-powered, knowledge-centric GRC product. AiSPIRE would be leveraging large language models, GRC ontology-based knowledge graphs, and generative AI capabilities to unlock the full potential of an organization's existing GRC and transactional data. By providing cognitive insights across all aspects of enterprise GRC, AiSPIRE enables greater efficiency and predictive and data-driven decision-making.

- June 2023: Copyleaks, an AI-based text analysis, plagiarism identification, and AI-content detection platform, launched its Generative AI Governance, Risk, and Compliance (GRC) solution, a full suite of protection to ensure generative AI enterprise compliance, reduce organization-wide risk, and safeguard proprietary data.

Enterprise Governance, Risk and Compliance (eGRC) Market Leaders

-

Dell EMC

-

IBM Corporation

-

Maclear

-

MetricStream Inc.

-

Future Shield Inc.

- *Disclaimer: Major Players sorted in no particular order

Enterprise Governance, Risk and Compliance (eGRC) Market News

- October 2023 - Pathlock, the provider of application governance, risk, and compliance (GRC), launched a new release of its Application Access Governance (AAG) product within the company's risk and compliance platform, Pathlock Cloud. It is mainly a risk and compliance management platform that automates the controls testing and enforcement for various business applications and enterprise resource planning (ERP). ThePathlock AAG also automates the broad majority of manual processes needed to minimize the risks associated with application access throughout critical business systems.

- June 2023 - Federal bank regulatory agencies issued final joint guidance that is mainly built to assist banking organizations in managing risks that are associated with third-party relationships involving relationships with financial technology companies. The final guidance comprises illustrative examples to help banking organizations, particularly community banks, align their overall risk management practices with their third-party relationships' nature and risk profile.

Enterprise Governance, Risk and Compliance (eGRC) Industry Segmentation

Enterprise GRC is defined as a company's coordinated strategy for managing the broad issues of corporate governance, enterprise risk management (ERM), and corporate compliance concerning regulatory requirements. The integrated collection of capabilities enables an organization to achieve objectives reliably, address uncertainty, and act with integrity.

The Enterprise Governance, Risk and Compliance Market is segmented by Type (Software, Services), Size of the Enterprise (Small and Medium Enterprise, Large Enterprise), End-user Industry (BFSI, Healthcare, Manufacturing, IT, and Telecom), and Geography (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). The market sizes and forecasts are in terms of value (USD) for all the above segments.

| Type | Software |

| Services | |

| Size of the Enterprise | Small and Medium Enterprise |

| Large Enterprise | |

| End-User Industry | BFSI |

| Healthcare | |

| Manufacturing | |

| IT and Telecom | |

| Other End-User Vertical | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

Enterprise Governance, Risk and Compliance (eGRC) Market Research FAQs

How big is the Enterprise Governance, Risk And Compliance Market?

The Enterprise Governance, Risk And Compliance Market size is expected to reach USD 21.04 billion in 2025 and grow at a CAGR of 12.38% to reach USD 37.71 billion by 2030.

What is the current Enterprise Governance, Risk And Compliance Market size?

In 2025, the Enterprise Governance, Risk And Compliance Market size is expected to reach USD 21.04 billion.

Who are the key players in Enterprise Governance, Risk And Compliance Market?

Dell EMC, IBM Corporation, Maclear, MetricStream Inc. and Future Shield Inc. are the major companies operating in the Enterprise Governance, Risk And Compliance Market.

Which is the fastest growing region in Enterprise Governance, Risk And Compliance Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Enterprise Governance, Risk And Compliance Market?

In 2025, the North America accounts for the largest market share in Enterprise Governance, Risk And Compliance Market.

What years does this Enterprise Governance, Risk And Compliance Market cover, and what was the market size in 2024?

In 2024, the Enterprise Governance, Risk And Compliance Market size was estimated at USD 18.44 billion. The report covers the Enterprise Governance, Risk And Compliance Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Enterprise Governance, Risk And Compliance Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Enterprise Governance, Risk and Compliance Industry Report

Statistics for the 2025 Enterprise Governance, Risk And Compliance market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Enterprise Governance, Risk And Compliance analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.