Energy Efficient Elevators Market Analysis

The Energy Efficient Elevators Market is expected to register a CAGR of 15.14% during the forecast period.

- Due to the increasing demand for energy-efficient systems, the energy-efficient elevators market is expected to witness considerable growth in the coming years, owing to the growing need for commercial energy management systems and residential energy management systems. ThyssenKrupp Elevator Company installed 73 elevators in the World Trade Center, New York, along with the energy management software and controls to monitor and reduce energy consumption.

- Due to mounting electricity prices, especially in high-traffic applications, various advanced technologies (such as destination dispatching and access control systems) are being used to reduce energy consumption.

- Owing to the increasing incidences of COVID-19, the Government across the globe are focusing on building quarantine centers, and hospitals to stop the spreading of the virus. These newly developed buildings will create opportunities for the manufacturers to supply the energy-efficient elevators for hassle-free patient management.

- The COVID-19 has impacted the elevator manufacturing in a greater way. For instance, Thyssenkrupp, which is a significant player in the market, has suspended production at its German elevator factory after two employees tested positive for the rapidly spreading coronavirus. Another elevator manufacturer, Kone, said that the coronavirus is expected to have a major impact on the company's Q1 sales and other operating results. However, the company has stated that its maintenance & installation services in Italy will continue with some exceptions.

- The major restraints of the energy efficient elevators market are the lack of information and awareness of the actual electricity consumption of elevator systems, the lack of information and awareness of the energy-efficient technologies in the market, and the low state of knowledge on the economic efficiency of the technological measures.

Energy Efficient Elevators Market Trends

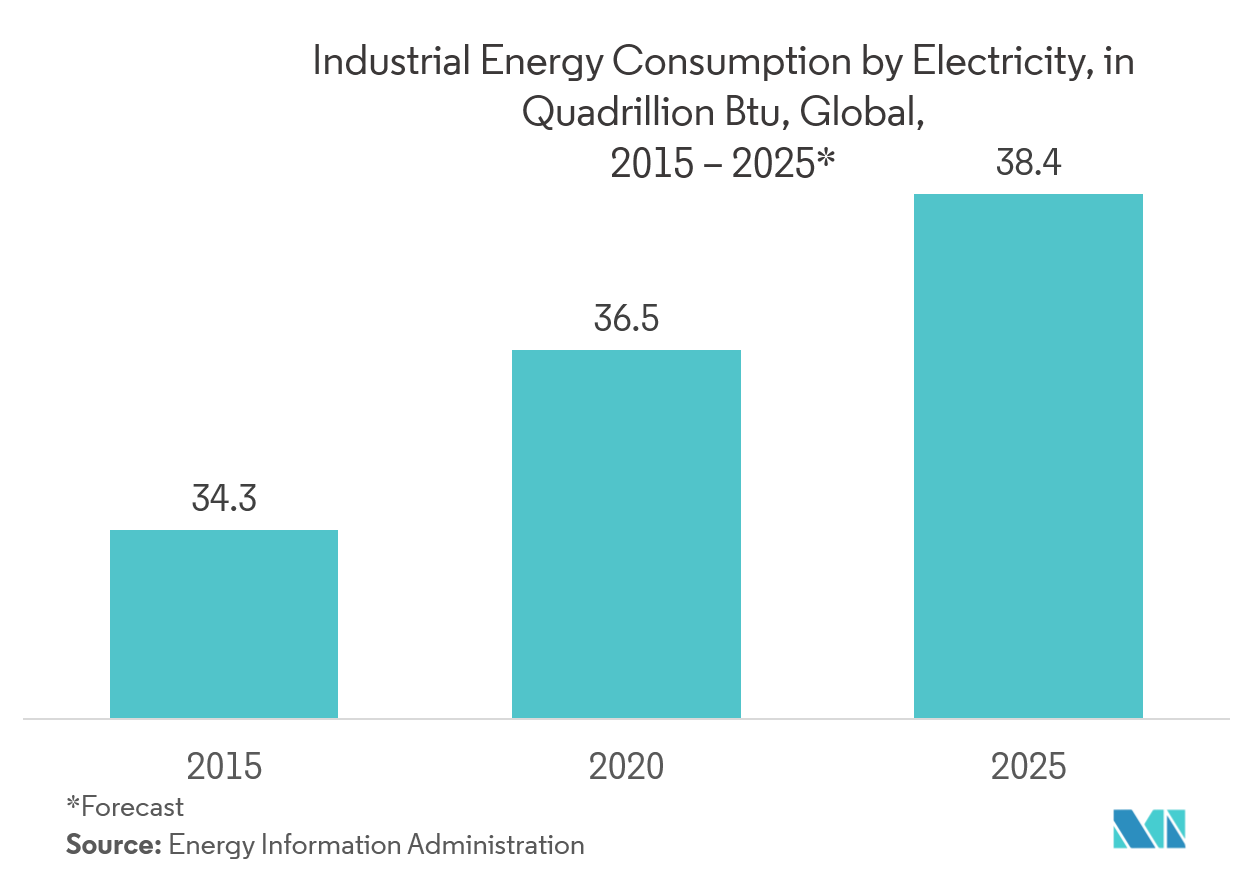

Industrial Sector to Significantly Contribute to the Market Demand

- The industrial sector uses more energy than any other end-user sectors. Elevators are the crucial elements that make it practical to live and work several floors above the ground.

- Due to the increasing requirements of elevators, energy consumption in the industrial sector (such as in the manufacturing sector for workforce, component and equipment transfer) is increasing. This is one of the leading reasons for the increasing amount of CO2 emissions.

- The demand for energy efficient systems in the industrial sector, therefore, increased in the last few years. The rising electricity prices have also been a major contribution to the demand for more energy efficient solutions.

- Energy efficient elevators use a relatively small amount of energy compared to the overall energy consumption of a building. At the same time, these elevators provide daily carrier service for passengers as well as contribute to the user’s experience with the building. Hence, these can be included in sustainability planning.

Europe to Record a Significant Growth Rate Over the Forecast Period

- The European energy efficient elevators market is fueled by the growing demand for modernization of buildings and an increase in the construction activity. According to the Institute of Energy Economics and the Rational Use Of Energy, about 75% of the current energy generation capacity is expected to be replaced by 2030. This is a driving factor for energy-efficient solutions.

- The energy-efficient elevator manufacturers in European regions are focusing on new product developments for having better product penetration over the region. For instance, in November 2019, Mitsubishi announced that it developed its new MOVE elevator model featuring fast delivery, space savings, and low environmental impact primarily suited to use in medium and low-rise office buildings and apartments in Europe. The development and manufacturing of this product are being handled by subsidiary Mitsubishi Elevator Europe B.V. (EMEC), who will market the model in the Netherlands, France, the United Kingdom, and other European countries.

- The residential and industrial sectors consume a greater part of the overall energy generation in Europe. In addition, the changing lifestyle is a factor that demands more comfort in buildings, which, in turn, increases the energy consumption rate. The national energy agencies can play a major role in improving the awareness of the selection and proper operation of energy-efficient lift and escalator systems.

Energy Efficient Elevators Industry Overview

The energy efficient elevators market is fragmented, with the players focusing on integrating advanced technologies like IoT, offering products catering to the latest trend of smart city development. A combination of accelerating growth in the end-user applications and continuous technological advancements results in a strong rivalry in the market. The key players are Hitachi Ltd, Mitsubishi Electric Corporation, Hyundai Elevators Co. Ltd, etc. The recent developments in the market are:

- June 2019 - Hitachi announced a contract with Phoenix Group to supply a total of 106 elevator units. Through this contract, the company will supply elevators for large-scale office buildings, Phoenix Spaces 285 and Phoenix Aquila, which are to be constructed in Hyderabad.

- March 2019 - Mitsubishi Electric Corporation announced that its subsidiary, Mitsubishi Elevator India Private Limited (IMEC), will launch the NEXIEZ-LITE MRL elevator. This Indian-produced model does not require a machine room. The model will be added to the NEXIEZ-LITE series of elevators for midrise and low-rise residences, office buildings, and hotels in India.

- February 2019 - KONE Corporation, which is a prominent player in the elevator and escalator industry, received an order to provide energy-efficient elevators and a destination control system for an office tower that is under construction at Vancouver, BC, Canada. The project consists of a 25-story building with the ground floor as a retail space and 24 levels of office space.

Energy Efficient Elevators Market Leaders

-

Hitachi, Ltd.

-

Mitsubishi Electric Corporation

-

Hyundai Elevators Co., Ltd

-

Fujitec Co., Ltd

-

Honeywell International, Inc.

- *Disclaimer: Major Players sorted in no particular order

Energy Efficient Elevators Industry Segmentation

The energy efficient elevators industry is influenced by the increased demand in the emerging markets and widening applications. A traction elevator travels up and down on a steel rope and has a counterweight on the other end. These are more energy-efficient than hydraulic hoists. By replacing the outdated hardware and investing in some of the sophisticated software, the building owners can make immediate and substantial energy savings.

| Control Systems | Elevator Control System | ||

| Access Control System | Card-based Access Control Systems | ||

| Biometric Access Control Solutions | |||

| Keypad-based Access Control Systems | |||

| Automation Systems | Motors and Drivers | ||

| Sensors and Controllers | |||

| Building Management Systems | |||

| End User | Industrial | ||

| Commercial | |||

| Residential | |||

| Other End Users | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Russia | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia Pacific | |||

| Latin America | Brazil | ||

| Mexico | |||

| Argentina | |||

| Rest of Latin America | |||

| Middle East and Africa | Saudi Arabia | ||

| United Arab Emirates | |||

| South Africa | |||

| Rest of Middle East and Africa | |||

Energy Efficient Elevators Market Research FAQs

What is the current Energy Efficient Elevators Market size?

The Energy Efficient Elevators Market is projected to register a CAGR of 15.14% during the forecast period (2025-2030)

Who are the key players in Energy Efficient Elevators Market?

Hitachi, Ltd., Mitsubishi Electric Corporation, Hyundai Elevators Co., Ltd, Fujitec Co., Ltd and Honeywell International, Inc. are the major companies operating in the Energy Efficient Elevators Market.

Which is the fastest growing region in Energy Efficient Elevators Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Energy Efficient Elevators Market?

In 2025, the North America accounts for the largest market share in Energy Efficient Elevators Market.

What years does this Energy Efficient Elevators Market cover?

The report covers the Energy Efficient Elevators Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Energy Efficient Elevators Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Energy Efficient Elevators Industry Report

Statistics for the 2025 Energy Efficient Elevators market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Energy Efficient Elevators analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.