Emergency Lighting Market Analysis

The Emergency Lighting Market is expected to register a CAGR of 7.22% during the forecast period.

- The growing emphasis on strict fire and safety regulations by governments across the world is driving the market. For instance, the regulations, such as Occupational Safety and Health Administration (OSHA) Code of Federal Regulations, NFPA 70 - National Electric Code, NFPA 101 - Life Safety Code, International Fire Code, NFPA 1997 5-9.3, and Standard Fire Prevention Code 1999, are some of the regulations for testing and maintaining 'Exit and Emergency Lighting' systems across the world.

- The growing number of construction projects across the world is promoting the growth prospect for emergency lighting. According to CSCEC, the newly added housing construction area in China increased by over 43%, from 2015 to 2018.

- The government regulations for industrial emergency lighting are driving the growth of the market. For instance, Larson Electronics launched a vast line of portable LED lighting systems for use in industrial and combustible environments. These explosion-proof LED units can be used in Class I, II, and III flammable environments, hazardous locations, and confined spaces.

Emergency Lighting Market Trends

LEDs Are Expected to Witness Significant Growth

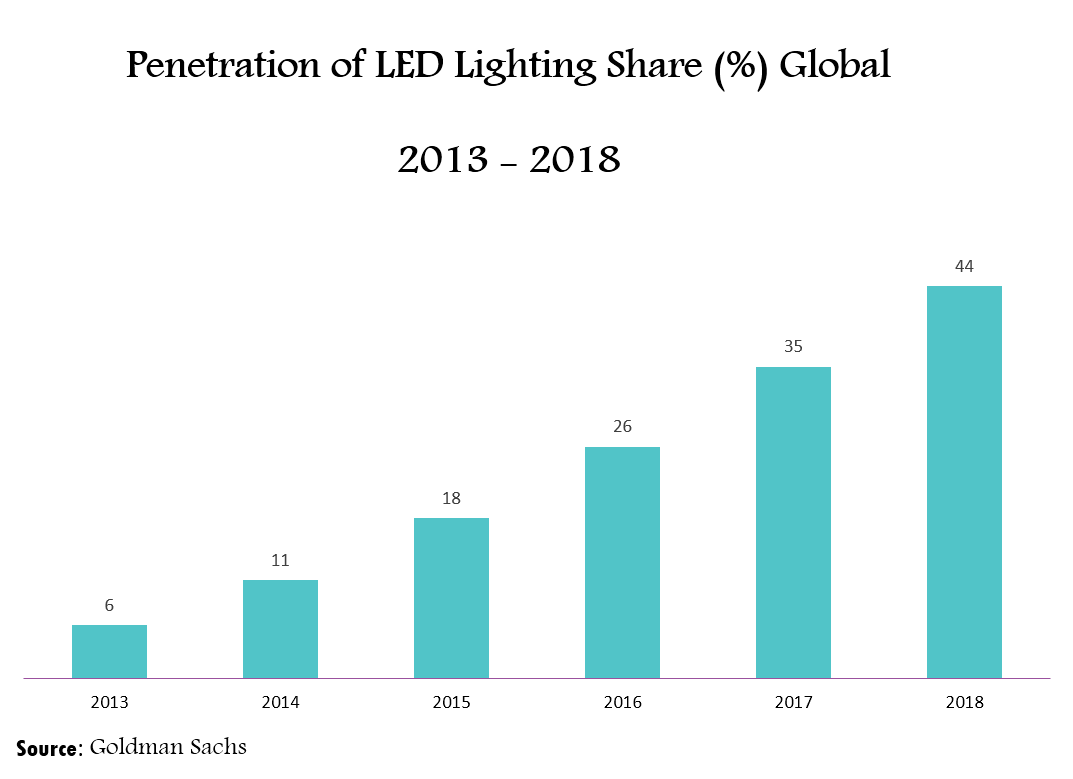

- The increasing government policies, such as ban in the usage of incandescent light, and the energy-efficient and cost-saving nature of LEDs, are increasing the penetration of LEDs. Moreover, LEDs are highly controllable, as the integrity of LEDs can vary based on the requirements when integrated with a driver.

- For instance, in April 2018, the Council of Australian Government's Energy Ministers announced to replace halogen lamps with LED lamps, to improve energy efficiency.

- Also, the Indian government's initiative of 'AHO', i.e., Automatic Headlamp On, is a safety measure used in two-wheelers where the headlights are kept on throughout the day, which makes the spotting of two-wheelers easy.

- LEDs in the industrial environment can help in saving up to 70%. As LEDs are highly controllable, the integration of LEDs with the security industry is expected to have a significant impact on the emergency lighting market.

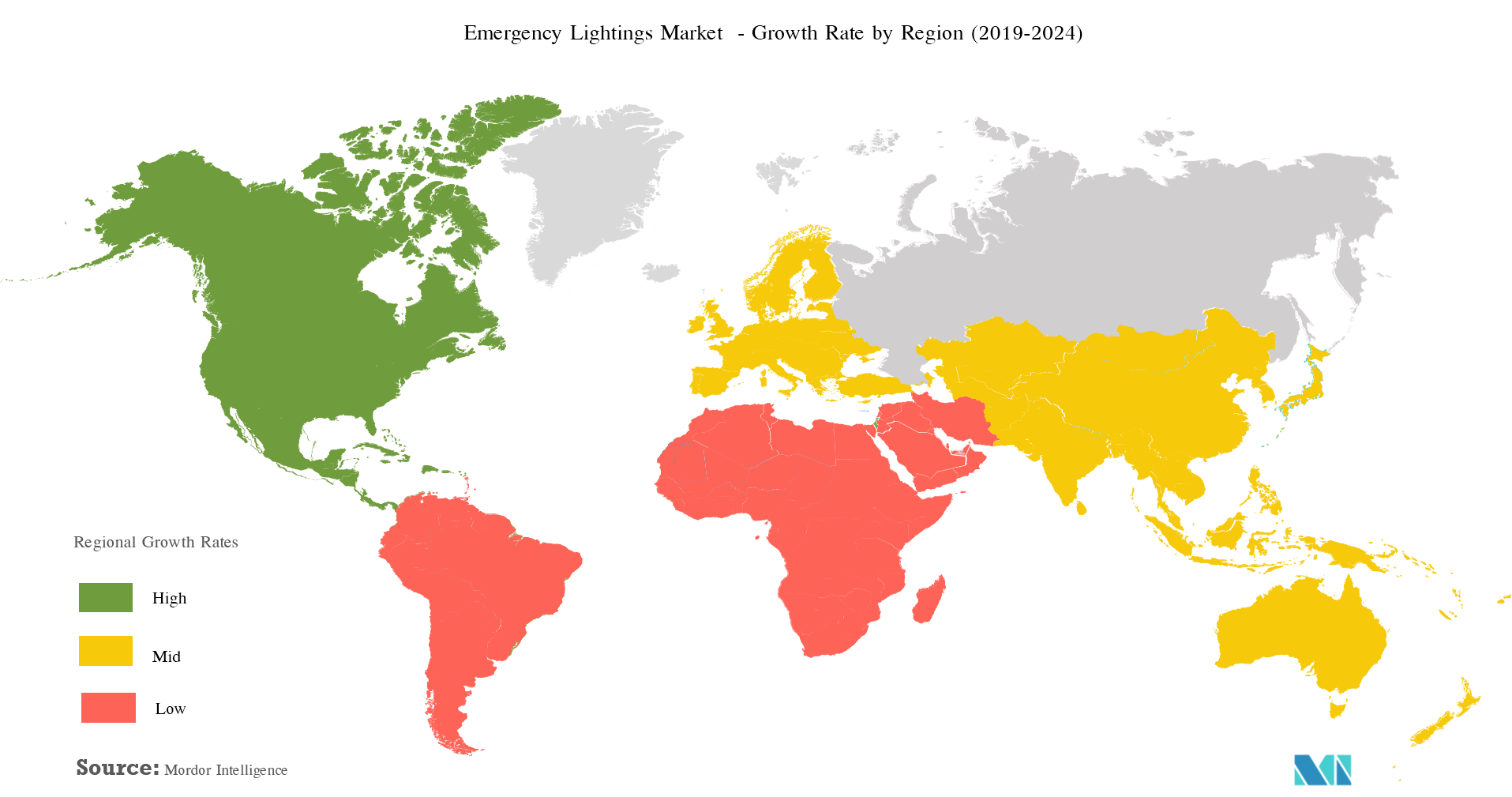

Asia-Pacific Region is Expected to Register a Faster Growth

- The Asia-Pacific region is expected to have the highest growth rate, over the forecast period. The governments in the Asia-pacific countries are actively promoting the adoption of emergency lighting, which is leading to the growth of the market.

- Various government flagship programs, including Housing for All, Atal Mission for Urban Rejuvenation and Transformation (AMRUT), Make in India, and Power for All, are expected to drive the growth of emergency lighting in the region.

- The rapid urbanization in developing countries, such as India, China, Japan, and South Korea, is also leading to an increase in construction. A significant infrastructure spending is witnessed in Australia, Hong Kong, the Philippines, Singapore, Taiwan, Thailand, Myanmar, and Vietnam.

Emergency Lighting Industry Overview

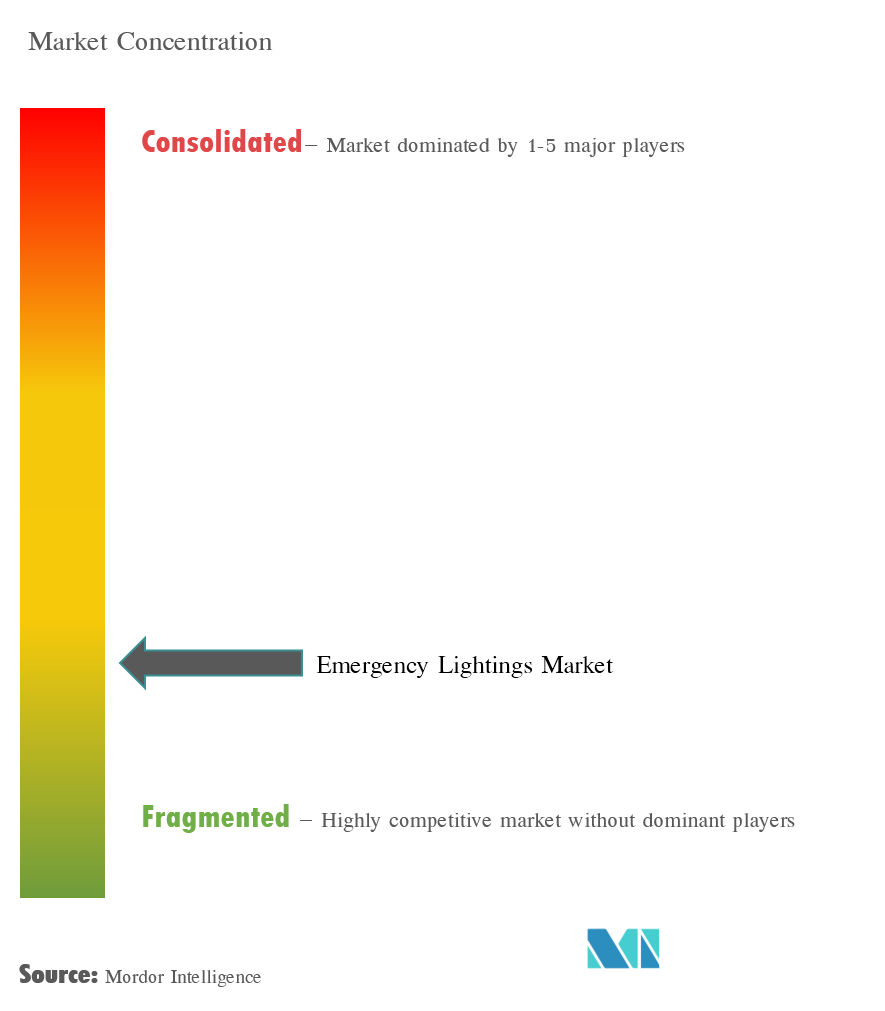

The competitive rivalry between the players in themarket studied is high due to the presence of some major players, like Eaton, Emerson, Schneider Electric, Syska, and LeGrand, among others. Their ability to constantly bring innovations in their products or launch new products, as per the needs of their consumers, helped these firms gain competitive advantage. These firms are able to achieve a greater market share by continuously investing in R&D activities,mergers and acquisitions, and strategic partnerships with otherfirms or institutions.

For instance, in May 2018,Eaton Corporation patterned with the Research and Innovation Group of the European Association of Automotive Suppliers (CLEPA), to research energy innovation in the automotive sector, including both electrified and traditional internal combustion vehicles.

Emergency Lighting Market Leaders

-

EATON CORPORATION

-

Emerson Electric Co.

-

Schneider Electric

-

Hubbell Lighting Inc.

-

Legrand SA

- *Disclaimer: Major Players sorted in no particular order

Emergency Lighting Industry Segmentation

Emergency lightening ensures that the lighting is provided consistently and automatically for a sufficient amount of time during a power outage or certain emergency situations that enable the people trapped in such blackout situations to evacuate safely. This report segments the market by the light source, end-user application, and region.

| Light Source | LED | ||

| Fluroscent Lamps | |||

| High-intensity Discharge (HID) Lamps | |||

| End-user Application | Industrial | ||

| Residential | |||

| Commercial (Office, Malls, etc.) | |||

| Other End-user Applications ( Railways, Aircraft, etc.) | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Latin America | ||

| Middle-East & Africa | |||

Emergency Lighting Market Research FAQs

What is the current Emergency Lighting Market size?

The Emergency Lighting Market is projected to register a CAGR of 7.22% during the forecast period (2025-2030)

Who are the key players in Emergency Lighting Market?

EATON CORPORATION, Emerson Electric Co., Schneider Electric, Hubbell Lighting Inc. and Legrand SA are the major companies operating in the Emergency Lighting Market.

Which is the fastest growing region in Emergency Lighting Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Emergency Lighting Market?

In 2025, the North America accounts for the largest market share in Emergency Lighting Market.

What years does this Emergency Lighting Market cover?

The report covers the Emergency Lighting Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Emergency Lighting Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Emergency Lighting Industry Report

Statistics for the 2025 Emergency Lighting market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Emergency Lighting analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.