India Desktop Virtualization Market Analysis by Mordor Intelligence

The India Desktop Virtualization Market size is estimated at USD 2.66 billion in 2025, and is expected to reach USD 5.53 billion by 2030, at a CAGR of 15.76% during the forecast period (2025-2030).

Owing to the technological advancements that support newer work lifestyles, the face of business has changed dramatically. According to Dataquest, India is the fourth-largest market for VDI (virtual desktop infrastructure) in the world.

- India is leading the global market, with an increase in the rate of adoption for desktop virtualization in financial services, IT-enabled services, and retail sectors. These sectors are driving the demand for VDI in India. In these sectors, the data storage, management, and data security are of the utmost importance. The VDI plays a prominent role in managing data efficiently and providing flexibility. The COVID-19 pandemic is spurring the adoption of cloud services across all sectors as they support remote work and collaboration; this, in turn, has increased the demand for desktop virtualization in the country.

- Desktop virtualization can be treated as a push to change with the rising trend of the remote workforce. The percentage of employees telecommunicating from different locations has been on the rise with the introduction of several innovative solutions being offered by market leaders, such as Dell Inc. and Microsoft Corporation, among others. The advantage of enabling the teleworking and remote location of staff, without compromising on safety and security of tools and applications being used, has given rise to increased work productivity, which is one of the major priorities for all end-user industries.

- However, some of the major advantages of desktop virtualization are central management, improved flexibility, lower support and administration cost, enhanced security, and improved disaster recovery capability.

India Desktop Virtualization Market Trends and Insights

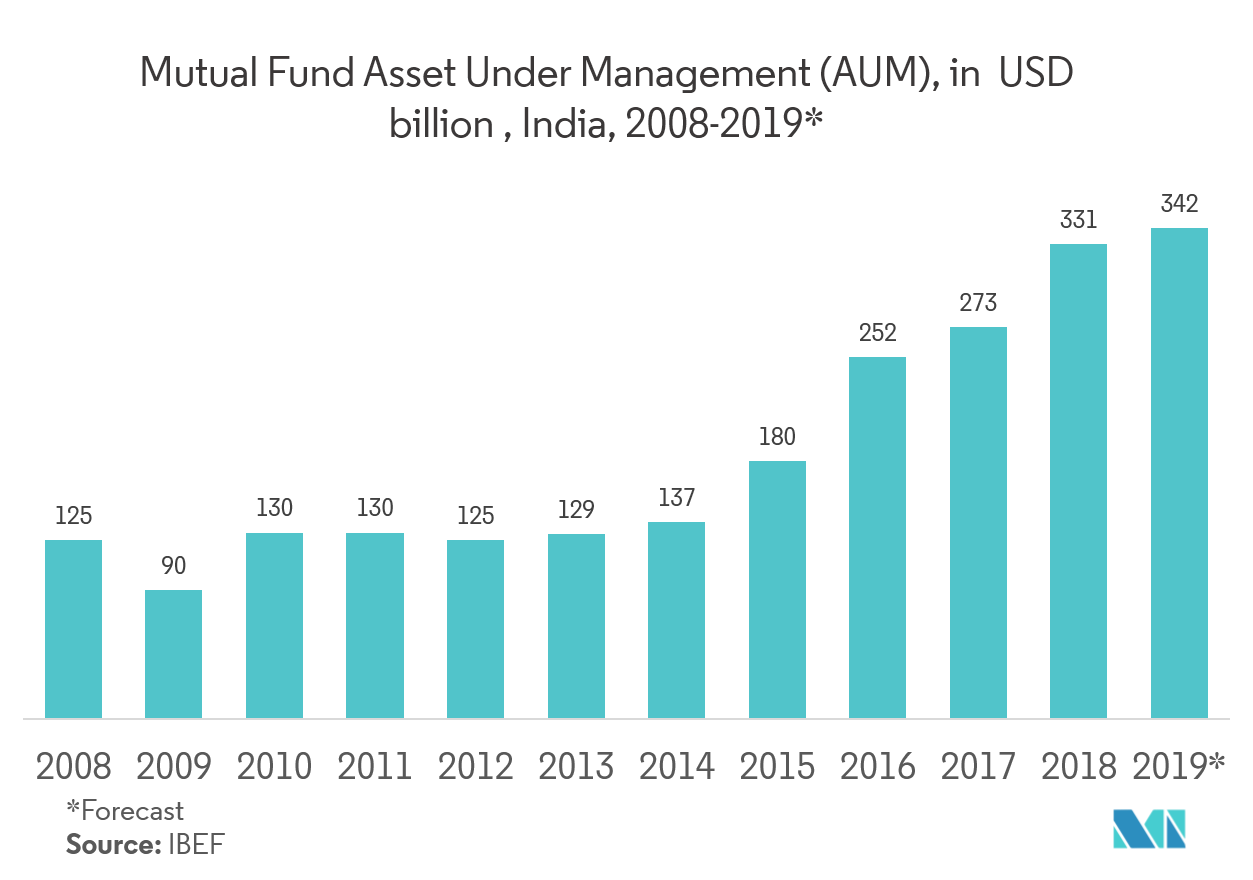

Accelerating Growth in Financial Services to Boost the Desktop Virtualization Market in India

- Desktop virtualization is one of the vital IT strategies for financial services organizations of all sizes. These organizations can improve the time to market through desktop virtualization, as technology enables the transition toward IT mobility. Indian organizations, those offering financial services, operate across various time zones, globally, where a narrow downtime can cause a devastating business crisis.

- Clients of these organizations, who pay huge amounts for financial services, will not compromise on any services outrage. Hence, many of the financial services organizations were not so keen on deploying desktop virtualization, due to high installation and maintenance costs, and complex infrastructure. However, there has been a shift in trend recently, as rapidly evolving technologies made virtual desktop infrastructure quite affordable.

- The latest desktop virtualization solutions offer great flexibility levels, which is vital for VDI deployments in the financial services sector. The increase in competition among vendors of cloud services has made it easier and cost-effective for the financial services organizations, to supply workloads to the cloud and support merger and acquisition and seasonal activities during tax reporting and temporary and long-term partnerships.

- The importance of desktop virtualization is rising, as more flexible and mobile workforces are increasing productivity, reputation, and customer satisfaction that are vital for a financial services organization.

On-premise Segment Holds the Largest Market Share

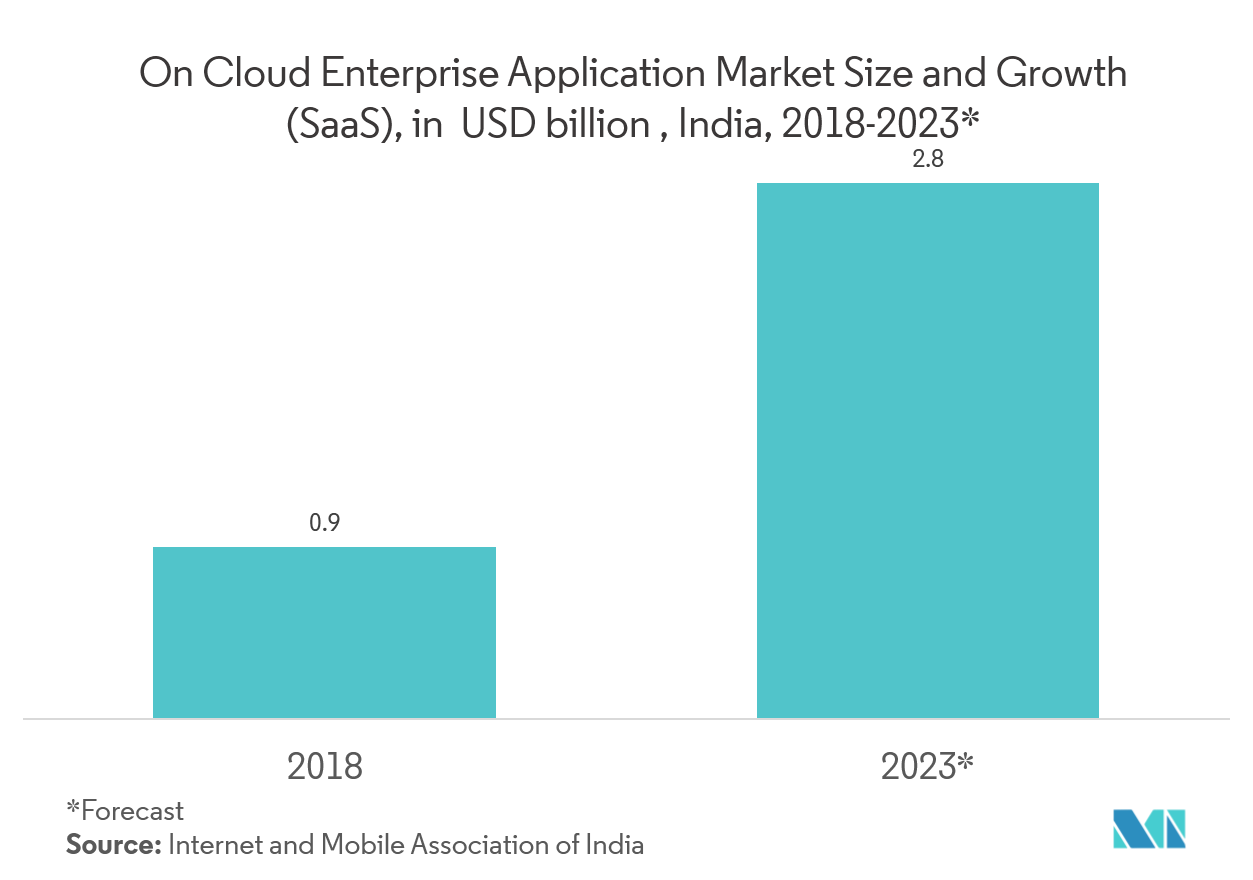

- In the initial stages of adoption, organizations deploying desktop virtualization solutions were skeptical of the security and control of these systems. With the on-premise segment providing a significant control and security over a cloud, this deployment model has seen rapid adoption over the last few years.

- Although the on-premise segment, currently, dominates the Indian desktop virtualization market, the growing rate of adoption of cloud services and the demand from small- and medium-sized businesses are expected to increase the adoption of cloud deployment model in India, during the forecast period.

- Most organizations find it difficult to source licenses for cloud systems, as cloud-service providers offer service-level licenses, while the software and OS licenses are to be handled by the clients. Sourcing licenses for on-premise are comparatively simpler. Connectivity and customization advantages also support the on-premise model.

Competitive Landscape

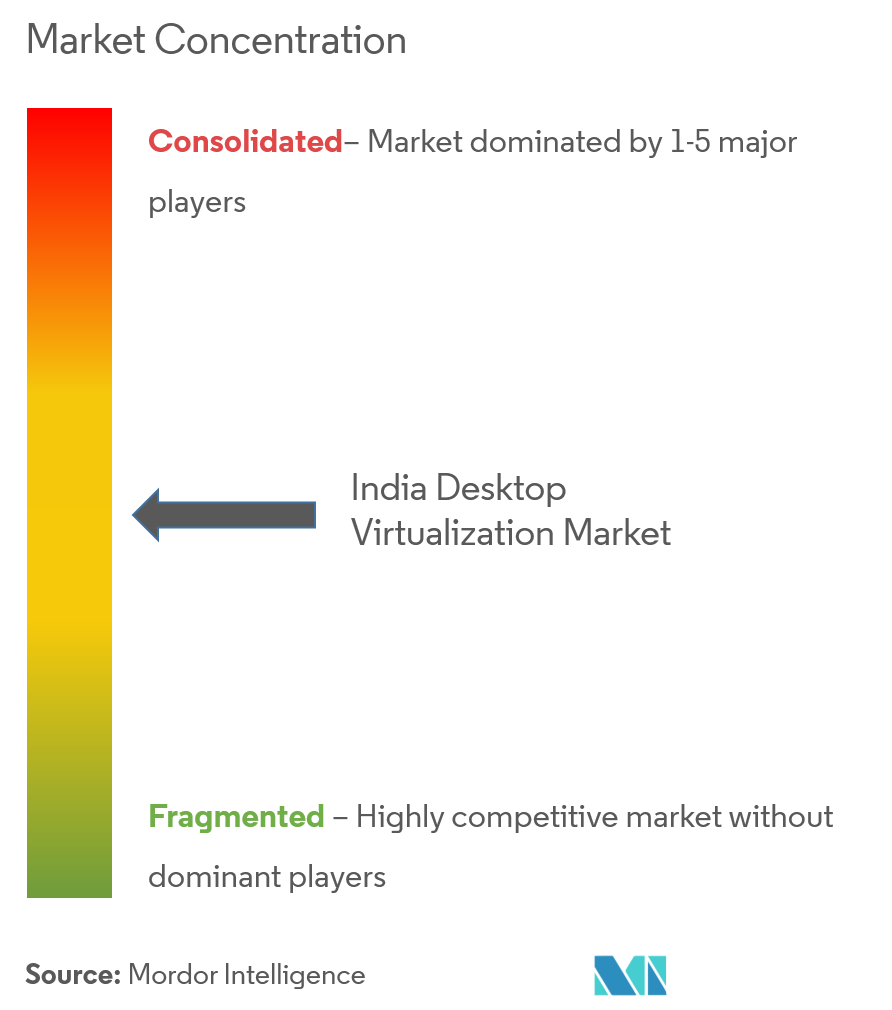

The Indian desktop virtualization market is neither consolidated nor fragmented. With large scale adoption of VDI in the Indian IT sector, the market is expected to witness many innovations and developments pertaining to desktop virtualization.Some of the key players, includeMicrosoft Corporation, Dell Inc., Wipro Limited, Hewlett-Packard Company, Symantec Corporation, Citrix Systems Inc., HCL Technologies Limited,and Huawei Technologies Co. Ltd, among others.

- Apr 2019 -Dell Technologies, VMWare, and Microsoft planned to make their workplace software and cloud computing technologies work better together. Microsoft's Azure cloud computing customers can use VMWare's Virtualization software, to manage their IT operations in Azure.

- Mar 2019 -Microsoft Corporation introduced Azure Stack HCI Solutions, which is a new implementation of its on-premise Azure product for hyperconverged infrastructure hardware.

India Desktop Virtualization Industry Leaders

-

Microsoft Corporation

-

Wipro Limited

-

Amazon Web Services Inc.

-

Dell Inc.

-

Hewlett-Packard Company

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- Jan 2021 - IBM and Atos formed a strategic global alliance to help companies accelerate their digital transformation and optimize business processes. The expanded alliance includes an intended focus on the development of joint offerings built on Atos' vertical decarbonized solution and service delivery assets, powered by IBM.

India Desktop Virtualization Market Report Scope

Desktop virtualization is a technique that separates personal computing desktop from a physical machine, using the client-server model of computing. This has become a mainstream IT strategy for companies of all sizes. Desktop virtualization involves the separation of the physical client device from the operating system. The data needed for the desktop is stored in a centralized or remote server and not in the client’s device. This allows users to access their data from anywhere and at any time.

| Hosted Virtual Desktop (HVD) |

| Hosted Shared Desktop (HSD) |

| Other Desktop Delivery Platforms |

| On-premise |

| Cloud |

| Financial Services |

| Healthcare |

| Manufacturing |

| IT and Telecommunication |

| Retail |

| Energy Sector |

| Education |

| Other End-user Verticals |

| By Desktop Delivery Platform | Hosted Virtual Desktop (HVD) |

| Hosted Shared Desktop (HSD) | |

| Other Desktop Delivery Platforms | |

| By Mode of Deployment | On-premise |

| Cloud | |

| By End-user Vertical | Financial Services |

| Healthcare | |

| Manufacturing | |

| IT and Telecommunication | |

| Retail | |

| Energy Sector | |

| Education | |

| Other End-user Verticals |

Key Questions Answered in the Report

How big is the India Desktop Virtualization Market?

The India Desktop Virtualization Market size is expected to reach USD 2.66 billion in 2025 and grow at a CAGR of 15.76% to reach USD 5.53 billion by 2030.

What is the current India Desktop Virtualization Market size?

In 2025, the India Desktop Virtualization Market size is expected to reach USD 2.66 billion.

Who are the key players in India Desktop Virtualization Market?

Microsoft Corporation, Wipro Limited, Amazon Web Services Inc., Dell Inc. and Hewlett-Packard Company are the major companies operating in the India Desktop Virtualization Market.

What years does this India Desktop Virtualization Market cover, and what was the market size in 2024?

In 2024, the India Desktop Virtualization Market size was estimated at USD 2.24 billion. The report covers the India Desktop Virtualization Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the India Desktop Virtualization Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

India Desktop Virtualization Market Report

Statistics for the 2025 India Desktop Virtualization market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Desktop Virtualization analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.