Density Meter Market Analysis

The Density Meter Market size is estimated at USD 1.12 billion in 2025, and is expected to reach USD 1.37 billion by 2030, at a CAGR of 4.25% during the forecast period (2025-2030).

- The growth of the density meter market can be attributed to smart factories' development and the increased demand to accurately measure the density of the fluids used in or during various production processes. Also, the stringent government regulations in the United States and European countries to regulate emissions drive market growth.

- A comprehensive quality assurance covering the entire production process is essential in any industrial operation. Density measurements are commonly used for this purpose, especially in the chemical, pharmaceutical, petrochemical, and food & beverage industries. They allow the manufacturer to analyze raw materials, semi-finished and finished products, and the manufacturing steps regarding several factors.

- For instance, in chemical plants, a density meter is used for many reasons for the common bulk chemicals and the specialty and proprietary products. Acids, caustics, solvents, resins, slurries, polymers, elastomers, and more are measured using a density meter. Furthermore, pure chemicals and solutions are also measured.

- Also, rapid industrialization, in line with the technological advancement in water treatment technology, plays an essential role in the demand for liquid density meters. High growth and innovation in the water and wastewater industry create the need for a simple laboratory device to maintain and operate. Because of this, the demand for ultrasonic liquid density meters increased significantly. Further, growing applications of density meters in the plastics and rubber industry create growth opportunities.

Density Meter Market Trends

Oil and Gas Industry to Hold Significant Market Share

- Oil and gas is a wide-ranging industry encompassing many processes and applications. Some of these might be roughly grouped into basic categories: exploration, extraction, production, processing, distribution, and transportation. Most applications include monitoring the density of oil and gases transported for various purposes.

- The oil and gas sector is one of the largest end-users of density meters. In the oil and gas industry, density meters are utilized in downstream processes, wherein purification and assessment of the purified sample are measured before manufacturing. Also, the dense meter is used in various application sectors such as tanker truck and railcar loading stations, product identification on multi-product pipelines, product quality control in the production process, and mass measurement in aircraft refueling applications.

- The oil and gas industry is expanding with the growth of industrialization and the demand for energy resources. For instance, according to the International Energy Agency, the Asia-Pacific region was the highest importer and consumer of natural gas. China alone accounted for two-thirds of the demand for natural gas globally.

- Moreover, the process industries depend on technical equipment to maintain uniformity and quality throughout the crude material, wherein the density meter plays an important role. The transition would force the oil and gas production sector to accelerate the production rate, increasing demand for machinery and testing equipment, including density meters, thereby driving the market's growth.

- The oil and gas sector is one of the key end users of density meters. The primary market demand comes from the downstream sector of oil and gas. The purity of the sample is measured before manufacturing to ensure operational safety and efficiency in downstream facilities, such as plants and refineries.

- According to OPEC, in 2023, global crude oil demand, inclusive of biofuels, stood at 102.21 million barrels per day. Forecasts anticipate a rise in economic activity, projecting a potential surge in oil demand to over 104 million barrels per day by year-end.

Asia-Pacific to Witness Significant Growth

- The increasing industrialization in Asia-Pacific makes the region one of the potential markets for density meters. The process automation industry is also expected to avail of various opportunities in Asia-Pacific. India is expected to provide more opportunities for the process automation industry in the coming years because of its political and global reformation.

- According to the India Brand Equity Foundation, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. The oil demand in India is projected to register a 2 times growth to reach 11 million barrels per day by 2045.

- The Asia-Pacific's oil product demand by 2050 is expected to rise to 38.8 million b/d. The increased demand for oil products can be ascribed to the rapid development in the region, particularly in countries such as India, China, Indonesia, and Japan.

- According to MOSPI, the fertilizer industry is India's largest natural gas consumer, accounting for 32 percent of total consumption in the financial year 2023. The petrochemical and sponge iron sectors along with the fertilizer industry is approximatly 37 percent of India's non-energy consumption of natural gas that year.

- Further, owing to the increase in the number of food & beverage and pharmaceutical companies in Asia-Pacific and the focus on expanding the operations & manufacturing units across different parts of Asia-Pacific, the demand for density meters is predicted to grow substantially. Moreover, the water and wastewater treatment industry's government initiative is vital in developing the density meter market across the Asia-Pacific region.

Density Meter Industry Overview

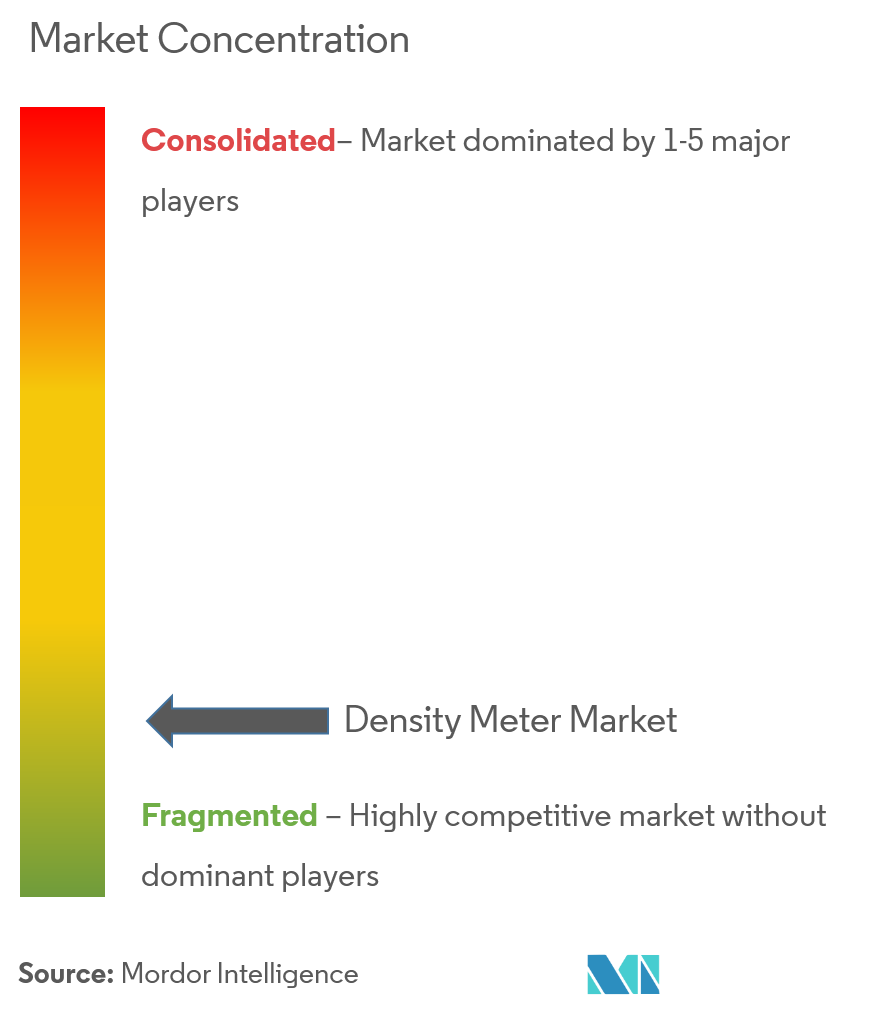

The global density meter market is very competitive. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world.

Some of the significant players in the market are ABB Ltd, Azbil Corporation, Endress+Hausar AG, Emerson Electric Corporation, Toshiba Corporation, Honeywell International Inc., and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In February 2023, Modulyzer Flavour and Fragrance is a new analytical system developed by Anton Paar that combines density meters, polarimeters, and refractometers with an automated option to provide comprehensive information – in a single measurement cycle – on substances in the flavor and fragrance industry. Users in the quality control field can benefit from cost-reduction opportunities due to a variety of features, such as the requirement for only 10 ml sample per measurement and the ability to recover and reuse samples after a measurement. Additionally, the system can be integrated with AP Connect – Anton Paar's lab execution software – to enable the collection, review, and categorization of measurement data directly from a desktop computer.

In March 2022, digital density meters were used in the pharmaceutical industries for quality control, research, and development. Thermo Fisher and Symphogen have extended the collaboration involving improved data workflow, which supports the discovery and development of new cancer treatments. The companies provide biopharmaceutical discovery and development laboratories with innovative tools and streamlined workflows to characterize complex therapeutic proteins efficiently.

Density Meter Market Leaders

-

Anton Paar GmbH

-

VWR International (Avantor)

-

Thermo Fisher Scientific

-

Emerson Electric Co.

-

Mettler Toledo

- *Disclaimer: Major Players sorted in no particular order

Density Meter Market News

- March 2024 - Rosatom partners with Nornickel, providing advanced radioisotope instruments. These instruments, including a radioisotope density meter, empower Nornickel to monitor liquid industrial products seamlessly, even in challenging operational environments, without halting production. Collaboration with Rosatom in nuclear instrumentation not only signifies a strategic alliance but also promises enhanced precision and swiftness in the production processes.

- March 2024 - Rheonics, a hardware and software vendor, has joined forces with the Modbus Organization. This group promotes the Modbus communication protocol suite for distributed automation systems across various market segments. By sharing protocol information and certifications, the Modbus Organization aims to streamline user implementations and reduce costs. Rheonics has integrated Modbus RTU and Modbus TCP/IP into their density meters and viscometers, accessible via a 2-wire RS-485 interface and Ethernet port.

Density Meter Industry Segmentation

Density meters are analytical measuring instruments used to determine the density of liquids or gases. It is also known as a densimeter. Density measurements are defined as mass per volume. They are an essential quality control parameter, as the calculations indicate the purity, consistency, and concentration of substances used in industry and research. The applicability of the density meter has a broad scope, wherein quality assurance and testing are critical roles performed by the device.

The density meter market is segmented by type (benchtop, module, portable), by application (coriolis, nuclear, ultrasonic, microwave, gravity), by end-user industry (water and wastewater, chemicals, mining and metal processing, food and beverage, healthcare and pharmaceuticals, electronics, oil and gas), and by geography (North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa). The report offers market forecasts and size in value (USD) for all the above segments.

| By Type | Benchtop | ||

| Module | |||

| Portable | |||

| By Application | Coriolis | ||

| Nuclear | |||

| Ultrasonic | |||

| Microwave | |||

| Gravitic | |||

| By End-user Industry | Water and Wastewater | ||

| Chemicals | |||

| Mining and Metal Processing | |||

| Food and Beverage | |||

| Healthcare and Pharmaceuticals | |||

| Electronics | |||

| Oil and Gas | |||

| Other End-user Industries (Power and Utilities, Research) | |||

| By Geography*** | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Asia | China | ||

| India | |||

| Japan | |||

| Australia and New Zealand | |||

| Latin America | |||

| Middle East and Africa | |||

Density Meter Market Research FAQs

How big is the Density Meter Market?

The Density Meter Market size is expected to reach USD 1.12 billion in 2025 and grow at a CAGR of 4.25% to reach USD 1.37 billion by 2030.

What is the current Density Meter Market size?

In 2025, the Density Meter Market size is expected to reach USD 1.12 billion.

Who are the key players in Density Meter Market?

Anton Paar GmbH, VWR International (Avantor), Thermo Fisher Scientific, Emerson Electric Co. and Mettler Toledo are the major companies operating in the Density Meter Market.

Which is the fastest growing region in Density Meter Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Density Meter Market?

In 2025, the Asia Pacific accounts for the largest market share in Density Meter Market.

What years does this Density Meter Market cover, and what was the market size in 2024?

In 2024, the Density Meter Market size was estimated at USD 1.07 billion. The report covers the Density Meter Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Density Meter Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Density Meter Industry Report

Statistics for the 2025 Density Meter market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Density Meter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.