Data Center Testing Market Analysis

The Data Center Testing Market is expected to register a CAGR of 11.04% during the forecast period.

- The increasing adoption of the hyper-scale data centers is expected to boost the data center testing market over the forecast period. For instance, according to Cisco Systems, the hyperscale data centers are expected to grow from 338 in number at the end of 2016 to 628 by 2021 that represents 53% of all installed data center servers by 2021.

- The rising need for performance testing that allows the user to gain insight into how the application performs under scenarios relevant to his organization, help him further optimize his deployment is expected to boost the adoption of solutions such as data center testing.

- In order for the data centers to support increasing bandwidth demands and reduced operational and management costs has resulted in the modernization of the network architecture, making testing an integral part. It is estimated that the global data center IP traffic will reach 20.6 Zettabytes by the end of 2021, up from 6.8 Zettabytes per year in 2016, according to the Cisco Systems. This is expected to fuel market growth over the forecast period.

- Also, the rising need for maintaining the uptime that allows the data center providers to provide smooth and optimal efficiency is expected to boost the adoption of the data center testing solutions.

Data Center Testing Market Trends

E-Commerce is Expected to Witness Significant Growth

- In August 2018, according to HP, the increasing shift to digitization is expected to change the way consumers interact with businesses, and mobile devices alone will influence USD 1.4 trillion in U.S. sales by 2021. This is indicative of the fact that there lies a lucrative opportunity for PCaaS providers to grab the market.

- The increasing initiatives by the government and the related regulatory bodies to boost the security regime are propelling the e-commerce giants for the adoption of the data centers is expected to boost the adoption of the data center testing throughout the forecast period. In August 2018, IT Ministry of India urged the e-commerce giants such as Amazon, Flipkart o set up their data centers in the country

- Although e-commerce not being completely ecological, the major emissions for e-commerce come from the heavily-powered data centers. This makes the testing of such data centers for such emissions imperative thereby contributing to the growth of the market over the forecast period.

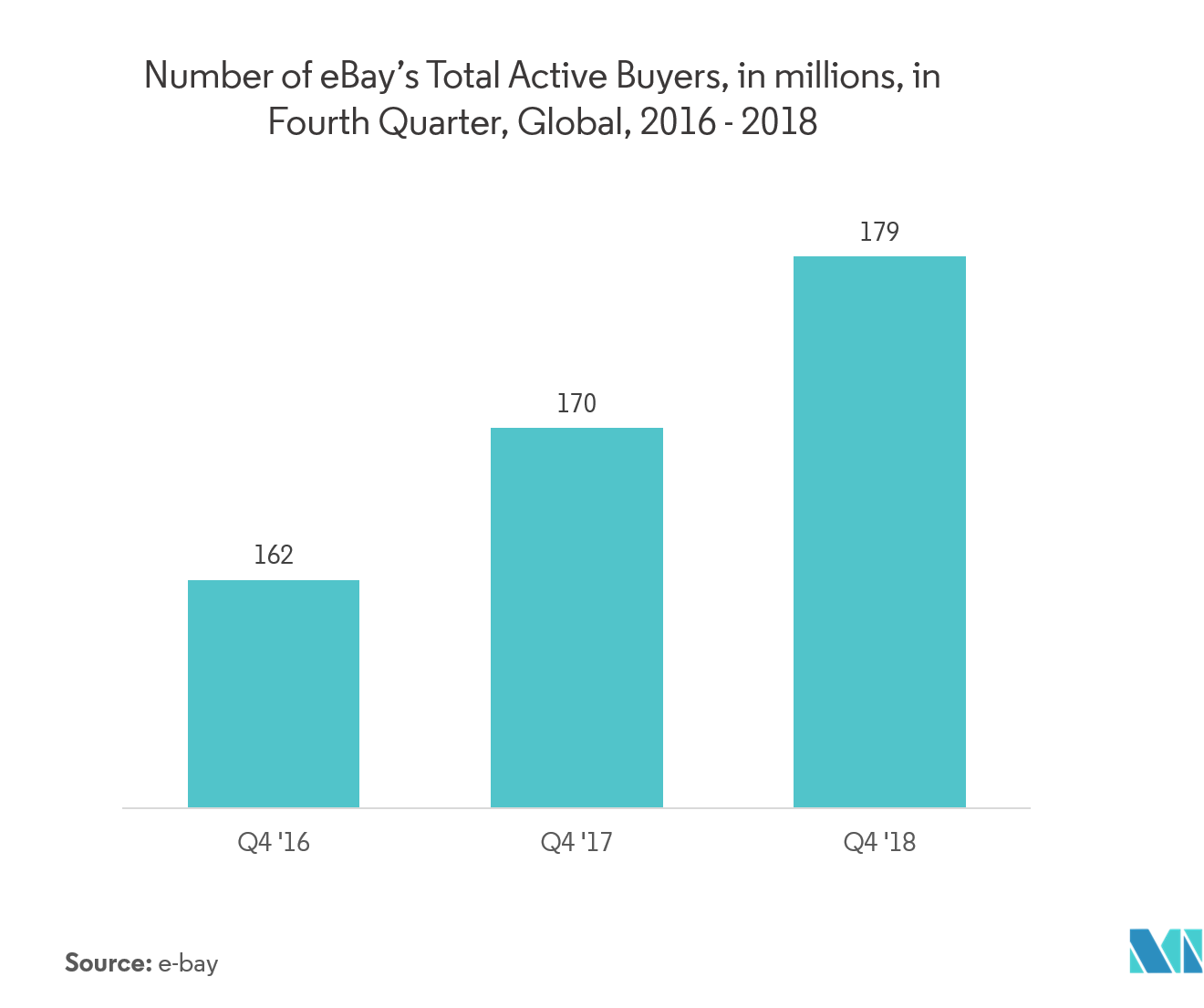

- The increasing number of active users on the platforms of such e-commerce giants has resulted in the increased workloads on their data centers. This is propelling the players in the industry to have solutions such as data center testing to continually test the performance, in turn, enabling the players to provide a smooth and better experience to its consumer base.

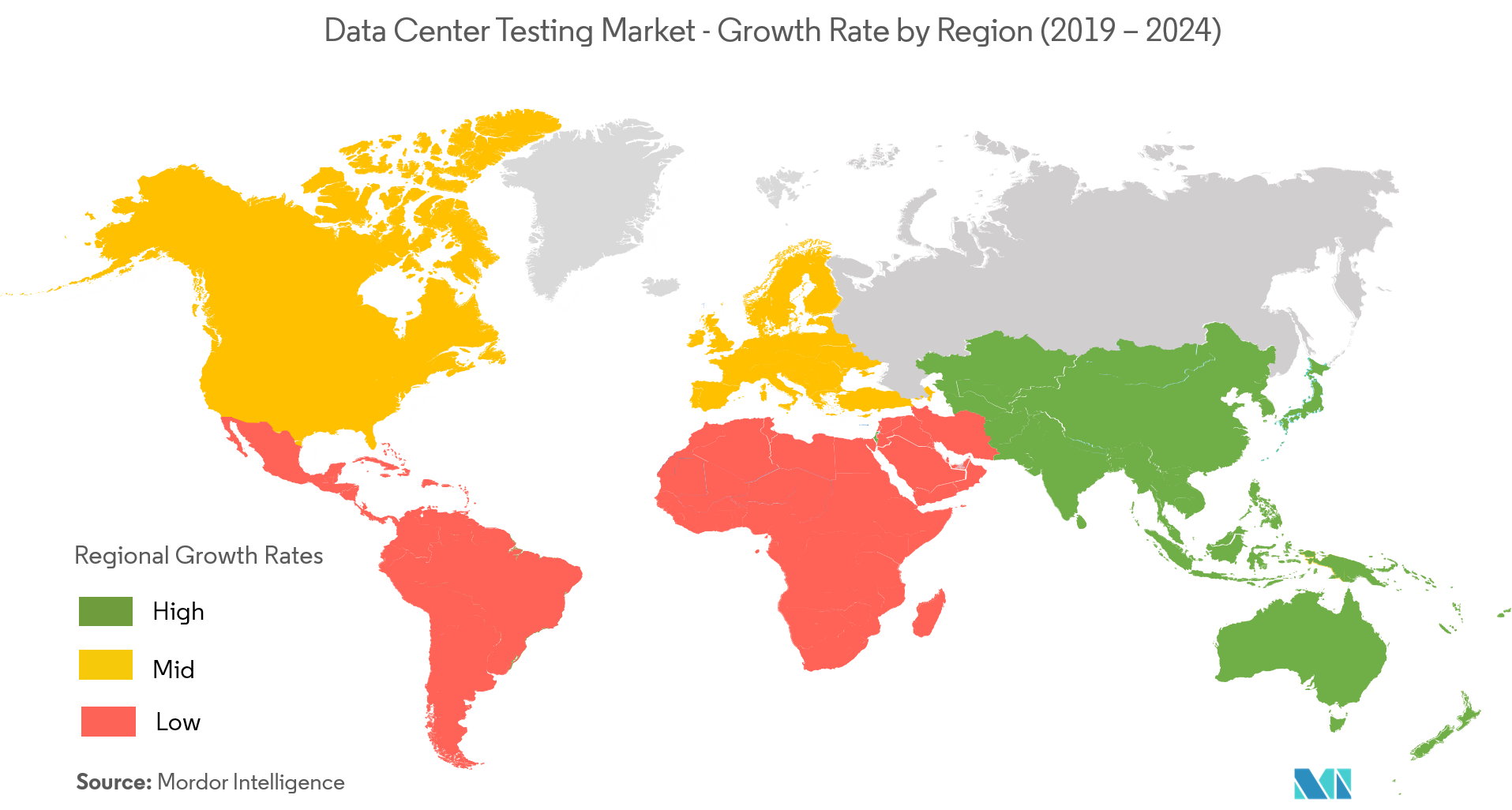

North America is Expected to Hold a Significant Share

- The Americas contains numerous data center clusters throughout the country which in itself presents as a lucrative opportunity for the data center testing providers to tap the market. This is expected to fuel market growth over the forecast period. For instance, According to Cloudscene, there are a total of 2510 data centers as of 2018 in the United States.

- Cisco states that the total data center workloads and compute instances in the region by the end of 2021 would be 207 million. Part of the reason is the enhancement of data handling technologies, Cloud economics, including server cost, scalability, and product lifespan, along with developments in cloud security. This is expected to provide a major boost for the adoption of the solutions such as data center testing over the forecast period.

- The region being home to some major players such as Google, Microsoft amongst others are continuously investing in the expansion of its data center facilities that are expected to contribute towards the growth of the data center testing market.

- For instance, in May 2018, Google announced that it is beefing up the infrastructure it needs to run G-Suite applications, with a EURO 150m expansion of its data center in Dublin’s Grange Castle business park.

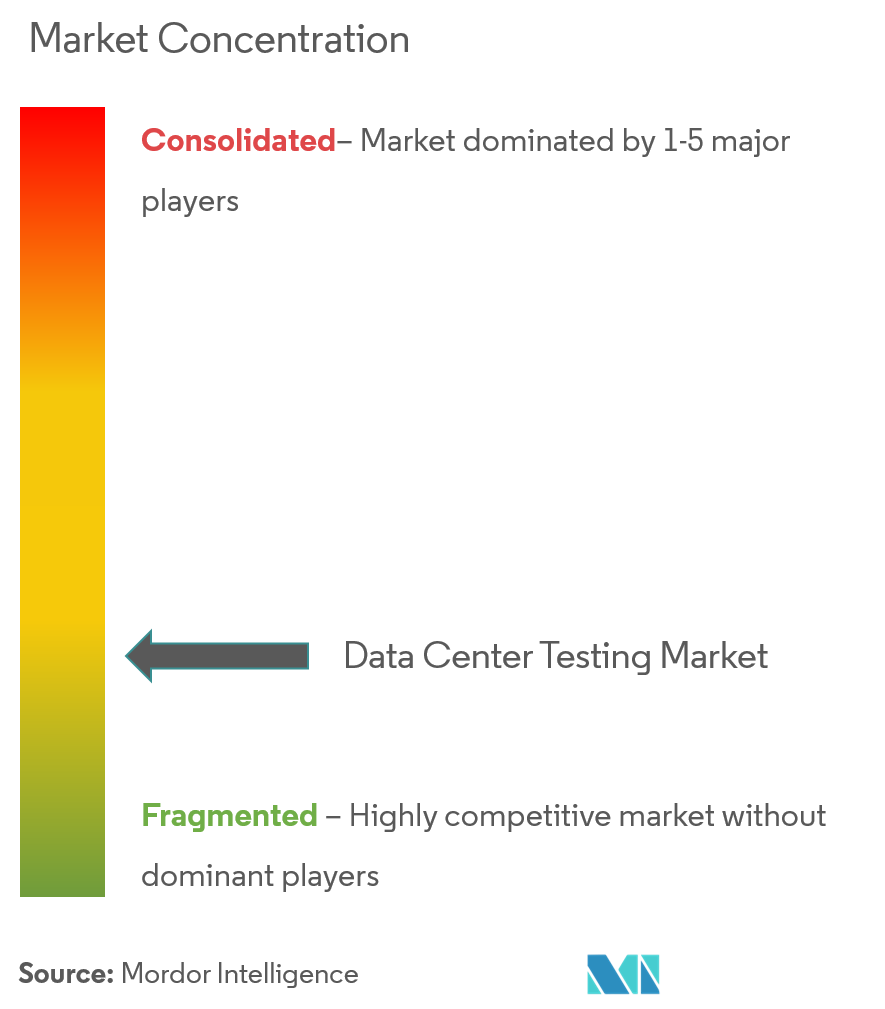

Data Center Testing Industry Overview

The competitive rivalry in the data center testing market is high owing to the presence of some key players such as AT Tokyo, EXFO, Spirent amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over other players. Through strategic partnerships, and mergers & acquisitions these players have been able to gain greater footprint in the market.

- July 2018 -Spirent Communicationsplcintroducedthe Industry’s Highest Density 400G Ethernet Solution for Next Generation Network Testing.

Data Center Testing Market Leaders

-

Spirent Communications plc

-

EXFO Inc.

-

ABM Industries Inc.

-

AT TOKYO Corporation.

-

VIAVI Solutions Inc.

- *Disclaimer: Major Players sorted in no particular order

Data Center Testing Industry Segmentation

Datacenter testing enables the userto reduce downtime, improve energy efficiency, and identify innovative, cost-saving solutions to ensure optimal facility performance. This report segments the market byType (Solution, Service), End-User Vertical ( BFSI, Retail/E-commerce, Healthcare, Government & Defense, IT & Telecom), and Geography.

| By Type | Solutions |

| Services | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Data Center Testing Market Research FAQs

What is the current Data Center Testing Market size?

The Data Center Testing Market is projected to register a CAGR of 11.04% during the forecast period (2025-2030)

Who are the key players in Data Center Testing Market?

Spirent Communications plc, EXFO Inc., ABM Industries Inc., AT TOKYO Corporation. and VIAVI Solutions Inc. are the major companies operating in the Data Center Testing Market.

Which is the fastest growing region in Data Center Testing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Data Center Testing Market?

In 2025, the North America accounts for the largest market share in Data Center Testing Market.

What years does this Data Center Testing Market cover?

The report covers the Data Center Testing Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Data Center Testing Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Data Center Testing Industry Report

Statistics for the 2025 Data Center Testing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Data Center Testing analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.