Customer Analytics Market Analysis

The Customer Analytics Market size is estimated at USD 14.82 billion in 2025, and is expected to reach USD 35.37 billion by 2030, at a CAGR of 19.01% during the forecast period (2025-2030).

Due to the variety of cloud-based solutions already on the market, more businesses are expected to migrate to the cloud. Companies might also learn how to exploit the potential of cloud analytics, where the bulk of the components, such as customer data sources, data models, processing apps, computing capacity, analytic models, and data storage, are hosted. This might assist in incorporating intelligence into existing procedures and improve operational decision-making.

- Other factors driving the growth of the customer analytics market include the need to understand customer purchasing behavior to provide a more personalized customer experience, in addition to the advancement of technology such as artificial intelligence (AI), machine learning (ML), and business process automation to streamline marketing processes.

- The industry under consideration is rapidly developing due to the rising need for greater customer pleasure. Customer analytics are used in retail to produce tailored communications and marketing strategies. They know which consumers buy what, and tailoring marketing to them based on shopper data may increase customer experience and loyalty. According to the ACSI Retail and Consumer Study, retailers may sigh relief as consumer satisfaction remains relatively stable in the previous year due to a great shopping experience via repeat purchases, customer loyalty, customer referrals, revenues, and participation.

- Another element propelling the industry is the rise in social media awareness. Social media analytics enhances the benefits of social networking by increasing brand exposure, increasing brand value, and expanding consumer reach through social media platforms by linking their product list with e-commerce sites, which assists in monitoring people and connection development. Amazon and Walmart have utilized social media sites such as Facebook, Instagram, YouTube, and Twitter to promote their items. Social platforms are modern-day shops that act as a conduit between customers and entities.

- In recent years, there has been a rise in security and privacy breaches. As a result, customers began to worry more about their privacy and security. This has been a critical impediment to the expansion of the customer analytics sector. Significant data architecture in consumer analytics may become increasingly crucial to safeguard, threatening data loss.

Customer Analytics Market Trends

Growing Retail Sector to Drive Market Growth

- In the retail sector, consumers value and demand a personalized omnichannel experience. As a result, many retailers are turning to technology like customer analytics to understand better what their consumers want and need.

- As retail sales grow, customer analytics is increasingly used to create personalized communications and marketing campaigns. Knowing consumers' purchase patterns and adaptable marketing strategies improve customer experience and loyalty.

- Online purchasing has increasingly developed as Internet usage has increased. E-commerce has emerged as a critical platform in the retail and distribution industries. The number of orders climbed by 15% in 2021 compared to the previous year, fueling development in cross-border commerce. Online buyers from different nations are more likely to make significant purchases. Amazon alone accounts for around 40% of US sales and 80% of the increase in online sales.

- Predictive analytics is a popular trend in business intelligence solutions, allowing organizations to accurately forecast future customer purchasing preferences. Many predictive analytic models are developed primarily to give better service to existing customers, reduce churn, and build stronger connections.

- When merchants can analyze consumer activity, including flows, timing, and stops, they may draw significant insights. Motionlogic, a T-Systems tool, captures and analyzes motions to help brick-and-mortar retailers understand customers' journeys and motives. These traffic patterns may be linked to specific triggers to indicate attractive areas and destinations, which may aid retailers in comprehending real-time customer data.

North America Accounts for Major Share

- North America is expected to have the largest market share due to its robust presence. As the demand for big data projects to improve customer experience grows in this area, organizations' perspectives on data consumption, collecting, and analysis are changing.

- Corporations in the United States are likely to maintain or increase their marketing expenditures, resulting in a low growth rate for the region compared to other locations.

- To provide a single customer view, United States Bank established an analytics system incorporating data from online and physical channels in the United States. The bank raised its lead conversion rate by more than 100% and created more personalized experiences by providing relevant leads and suggestions to the contact center.

Customer Analytics Industry Overview

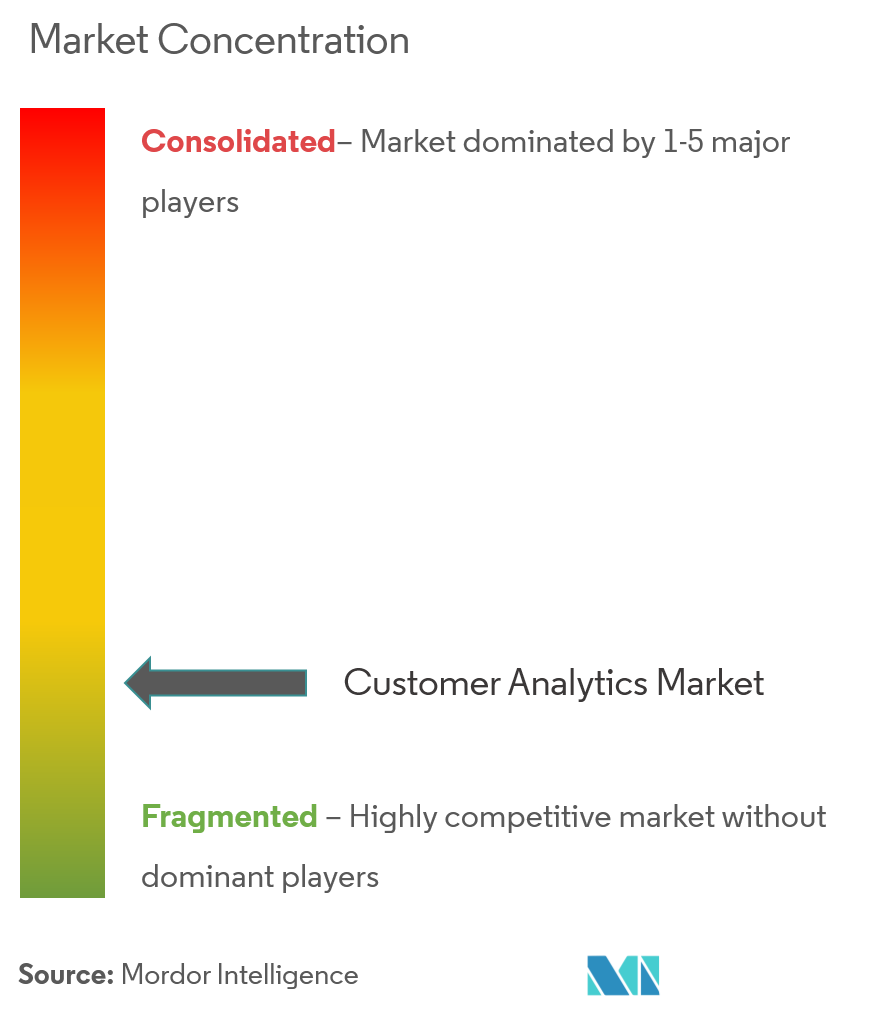

The market for consumer analytics is highly fragmented, with fierce competition from established and developing businesses. By spending on R&D and player acquisitions, these players hope to acquire an advantage over their competitors through new product development. Adobe Systems Inc., IBM Corporation, and Oracle Corporation are critical participants in the industry under consideration.

- March 2022 - Adobe introduced a new Customer Journey Analytics for Adobe's Experience Cloud. Adobe launched a new experimentation tool in experience analytics that allows organizations to test real-world scenarios and evaluate the results to understand how little changes can affect the overall customer experience across their various products. Adobe Customer Data Platform (CDP) and Customer Journey Analytics have also been combined to improve Adobe's capacity to uncover customer segments.

- June 2022 - Salesforce introduced new Customer 360 technologies that combine marketing, commerce, and service data on a single platform, allowing businesses to connect, automate, and customize every encounter and develop trusted relationships at scale.

- December 2022 - Acquia, the open digital experience provider, announced changes to its customer data platform (CDP) that expand support for business marketing teams. The additional features broaden how marketers and data scientists can engage with information managed by Acquia CDP and reinforce the product's important position in composable customer data initiatives. Acquia CDP is a component of Acquia Digital Experience Platform (DXP), the industry's first open platform for combining content and data to create world-class digital consumer experiences.

Customer Analytics Market Leaders

-

Adobe Systems Inc.

-

IBM Corporation

-

Oracle Corporation

-

Salesforce.Com Inc.

-

SAS Institute Inc.

- *Disclaimer: Major Players sorted in no particular order

Customer Analytics Market News

- February 2024: Accenture has reached an agreement to acquire GemSeek, a provider of customer experience analytics. GemSeek aids global businesses in comprehending their customers through insights, analytics, and AI-driven predictive models. This acquisition highlights Accenture Song's continued investment in data and AI capabilities. Accenture Song, recognized as the world's largest tech-powered creative group, aims to leverage these capabilities to assist clients in expanding their businesses and maintaining relevance with their customers.

- January 2024: MX Technologies, Inc. unveiled its new Customer Analytics tool, tailored for financial service providers. This tool harnesses advanced transaction data and insightful consumer analytics. With these capabilities, financial institutions can boost deposits and engagement, pinpoint cross-sell opportunities, optimize ROI on marketing endeavors, and foresee and mitigate customer churn.

Customer Analytics Industry Segmentation

The consumer analytics market is gaining traction as more firms migrate from on-premise to cloud-based services to promote company development. Client analytics are being utilized by insurance firms, banks, and many other businesses to analyze client lifetime value better and increase cross-selling, among other things. In contrast to telecom, which focuses on reducing churn, industries such as e-commerce and retail strongly emphasize client purchase behavior.

The Customer analytics market is segmented by deployment type (on-premise and cloud-based), solution (social media analytical tools, web analytical tools, dashboard and reporting tools, voice of customer, ETL, and analytical modules/tools), organization size (small and medium enterprises and large enterprises), service (managed service and professional service), end-user industry (telecommunications and IT, travel and hospitality, and retail), and geography.

| By Deployment Type | On-premise |

| Cloud-based | |

| By Solution | Social Media Analytical Tools |

| Web Analytical Tools | |

| Dashboard and Reporting Tools | |

| Voice of Customer (VOC) | |

| ETL (Extract, Transform, and Load) | |

| Analytical Modules/Tools | |

| By Organization Size | Small and Medium Enterprises |

| Large Enterprises | |

| By Service | Managed Service |

| Professional Service | |

| By End-user Industry | Telecommunications and IT |

| Travel and Hospitality | |

| Retail | |

| BFSI | |

| Media and Entertainment | |

| Healthcare | |

| Transportation and Logistics | |

| Manufacturing | |

| Other End-user Industries | |

| By Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |

Customer Analytics Market Research FAQs

How big is the Customer Analytics Market?

The Customer Analytics Market size is expected to reach USD 14.82 billion in 2025 and grow at a CAGR of 19.01% to reach USD 35.37 billion by 2030.

What is the current Customer Analytics Market size?

In 2025, the Customer Analytics Market size is expected to reach USD 14.82 billion.

Who are the key players in Customer Analytics Market?

Adobe Systems Inc., IBM Corporation, Oracle Corporation, Salesforce.Com Inc. and SAS Institute Inc. are the major companies operating in the Customer Analytics Market.

Which is the fastest growing region in Customer Analytics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Customer Analytics Market?

In 2025, the North America accounts for the largest market share in Customer Analytics Market.

What years does this Customer Analytics Market cover, and what was the market size in 2024?

In 2024, the Customer Analytics Market size was estimated at USD 12.00 billion. The report covers the Customer Analytics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Customer Analytics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Customer Analytics Industry Report

Statistics for the 2025 Customer Analytics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Customer Analytics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.