Thailand Crop Protection Chemicals Market Analysis

The Thailand Crop Protection Chemicals Market size is estimated at USD 0.72 billion in 2025, and is expected to reach USD 1.00 billion by 2030, at a CAGR of 6.8% during the forecast period (2025-2030).

- The crop protection chemical industry has been transforming over the years, with robust growth coupled with changing crop mix trends and environmental regulations. According to World Bank data, Thailand’s population rose to 71.6 million in 2021 from 71.12 million in 2019. The rising population in Thailand resulted in an increased demand for food, creating the need for higher food production with constant arable land. The use of crop protection chemicals helps in increasing crop production per unit of land. Hence, to increase agricultural productivity, there is an increased consumption of crop protection chemicals in the country.

- The rapid increase in pesticide use in Thailand is likely to account for an increase in cash crops. Most pesticide-intensive crops, vegetables, and fruits are the highest cash value-added crops in Thailand. As farmers have gradually switched from low-value-added to high-value-added crop production, the overall consumption rate of pesticides has naturally increased. According to the Office of Agricultural Economics (OAE) and the Office of Agriculture Regulations (OAR), the usage of pesticides has increased significantly in recent years. The import value of pesticides increased from USD 649.8 million in 2020 to USD 885.1 million in 2021. Thailand's prominent position as a top exporter of food and agricultural products has been the primary driver behind the surge in pesticide imports and usage over the past decade.

- The Thai government has initiated projects and imparted knowledge on sustainable farming practices to bolster agricultural production in the nation. In 2021, CropLife International, a private sector collaborator, joined forces on the Market-Oriented Smallholder Value Chain (MSVC) project located in Thailand's Central Plains. This initiative emphasizes Integrated Pest Management (IPM), educating farmers on the responsible use of pesticides and promoting alternatives such as biocontrol agents.

Thailand Crop Protection Chemicals Market Trends

Herbicides are a Significant Segment by Product

Herbicides are chemical agents that are used to kill or inhibit the growth of unwanted plants, such as residential or agricultural weeds and other invasive species. The ease of application is a big advantage of chemical herbicides over mechanical weed control methods. This also helps save labor costs. The most widely used synthetic herbicides include 2,4-D, glyphosate, and glufosinate. However, the growth of the market is mostly driven by glyphosate. Glyphosate, sold under the Roundup brand name of Bayer, is the largest-selling herbicide in the country.

Thailand's agricultural sector grapples with labor shortages, a consequence of urban migration and an aging farming demographic. For instance, according to World Bank data, in 2022, the labor force numbered 40.91 million but saw a decline to 40.81 million in 2023. As a result, herbicides have become increasingly vital, minimizing the reliance on manual weeding. This not only conserves time and labor costs but also allows farmers to manage larger areas with reduced manpower. Such advantages propel the adoption of herbicides as a financially savvy choice for weed management.

Weeds compete with crops for essential resources like water, nutrients, and sunlight, often diminishing yields. By employing herbicides, farmers can safeguard their crops from such competition, resulting in enhanced yields and profitability. For key crops such as corn, cassava, and soybeans, herbicides play a pivotal role in curbing yield losses from weed pressure. Furthermore, in Thailand's expansive rubber and oil palm plantations, herbicides are crucial for controlling weeds, particularly in younger plantations where competition can stunt growth. Effective weed management in these sectors not only boosts crop quality but also enhances the production of latex and palm oil.

Fruit and vegetables Dominate the Market

The Thai horticultural sector is crucial in crop protection chemical markets. Fresh and processed tropical fruits are important contributors to the booming Thai agriculture sector, complementing the crop protection industry. In 2022, Thai farmers cultivated 57 tropical fruits on around 1.2 million hectares of land with approximately 11 million metric tons of volume. Thailand's tropical fruit business is well-known due to variables such as geography and tropical environment.

Thailand’s warm, humid climate creates ideal conditions for the proliferation of pests, diseases, and fungi that can damage crops. The increased production of fruits and vegetables exposes more farmland to these risks, requiring the use of more comprehensive pest control and crop protection measures. For instance, according to FAOSTAT, Thailand's production of fruits was 10.0 million metric tons in 2021, which increased to 10.9 million metric tons in 2022. Also, as the area under fruit and vegetable cultivation expands, the diversity of crops increases. This brings new challenges, such as the emergence of pests that target specific crops. Farmers must use targeted insecticides and biological controls to manage these pests and protect their investments.

A research study undertaken by the Biodiversity Sustainable Agriculture Food Sovereignty Action Thailand (Biothai) found that the highest levels of pesticide residues were present in fruits and vegetables. Also, around 62.0% of such fruits and vegetables included more than one pesticide as residue. However, the intensity of pesticide use in Thailand is still lower than that of Vietnam but also higher than in Laos and Cambodia. The application of pesticides in fruits and vegetables has been the highest over the past several years, and this trend is likely to continue.

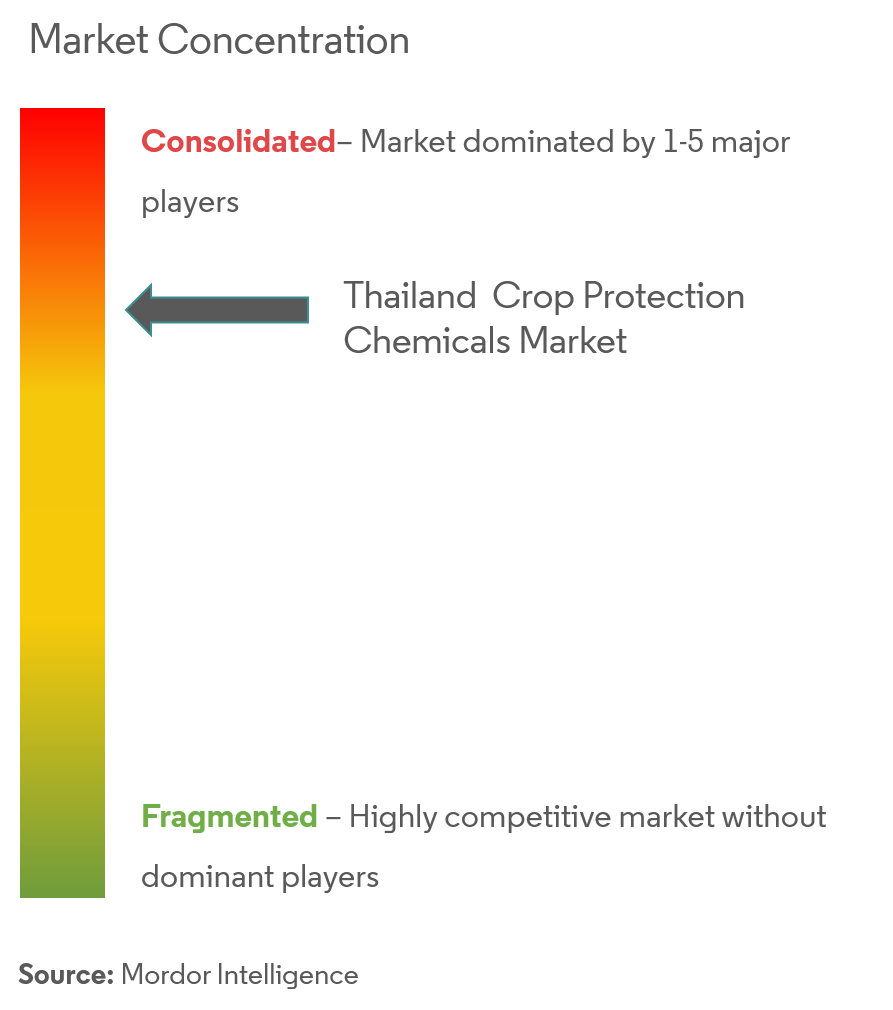

Thailand Crop Protection Chemicals Industry Overview

The Thai crop protection chemicals market is consolidated with a few major players. Thailand's top major global pesticide players are Corteva Agriscience, Syngenta, ADAMA Agriculture Solutions, BASF SE, and Bayer Crop Science AG. The market is also dominated by local traders. Companies in the market are mainly focusing on developing new and qualitative products and new technologies to improve product quality. New product launches, partnerships, and mergers and acquisitions are the main strategies followed by the major players in the market.

Thailand Crop Protection Chemicals Market Leaders

-

Bayer Crop Science AG

-

BASF SE

-

Corteva Agriscience

-

Syngenta International AG

-

ADAMA Agriculture Solutions

- *Disclaimer: Major Players sorted in no particular order

Thailand Crop Protection Chemicals Market News

- March 2023: Bayer introduced its cutting-edge rice fungicide, Etiage, in Thailand. Formulated with Trifloxystrobin and Tebuconazole SC300, Etiage adeptly protects rice crops from fungal threats, including Leaf Spot, Blast, and Dirty Panicle.

- June 2022: Best Agrolife, one of the leading agrochemical companies in Thailand, launched its agro-products basket of insecticide, fungicide, and pesticide products, Ronfen, AxeMan, Warden, and Tombo.

- June 2022: BASF Agriculture Solutions launched Basta - x with new applications on cassava and rubber in Thailand. With Basta - x, BASF provides a non-selective, non-residual herbicide with limited translocation potential, effectively controlling over 80 weed species of rice, mango, cassava, palm oil, and rubber farms.

Thailand Crop Protection Chemicals Industry Segmentation

Crop protection chemicals are a class of agrochemicals used to prevent the destruction of crops by insect pests, diseases, weeds, and other pests. The Thai crop protection chemicals market is segmented by product (herbicides, insecticides, fungicides, molluscicide, and nematicide), crop (commercial crops, fruits and vegetables, grains and cereals, pulses and oil seeds, and turf and ornamental crops), and application (chemigation, foliar, fumigation, seed treatment, and soil treatment). The report offers market size and forecasts in terms of value (USD) for all the above segments.

| Product | Herbicides |

| Insecticides | |

| Fungicides | |

| Molluscicide | |

| Nematicide | |

| Crop | Commercial Crops |

| Fruits and Vegetables | |

| Grains and Cereals | |

| Pulses and Oil seeds | |

| Turf and Ornamental Crops | |

| Application | Chemigation |

| Foliar | |

| Fumigation | |

| Seed Treatment | |

| Soil Treatment |

Thailand Crop Protection Chemicals Market Research FAQs

How big is the Thailand Crop Protection Chemicals Market?

The Thailand Crop Protection Chemicals Market size is expected to reach USD 0.72 billion in 2025 and grow at a CAGR of 6.80% to reach USD 1.00 billion by 2030.

What is the current Thailand Crop Protection Chemicals Market size?

In 2025, the Thailand Crop Protection Chemicals Market size is expected to reach USD 0.72 billion.

Who are the key players in Thailand Crop Protection Chemicals Market?

Bayer Crop Science AG, BASF SE, Corteva Agriscience, Syngenta International AG and ADAMA Agriculture Solutions are the major companies operating in the Thailand Crop Protection Chemicals Market.

What years does this Thailand Crop Protection Chemicals Market cover, and what was the market size in 2024?

In 2024, the Thailand Crop Protection Chemicals Market size was estimated at USD 0.67 billion. The report covers the Thailand Crop Protection Chemicals Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Thailand Crop Protection Chemicals Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Thailand Crop Protection Chemicals Industry Report

Statistics for the 2025 Thailand Crop Protection Chemicals market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thailand Crop Protection Chemicals analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.