Crime Risk Report Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 16.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Crime Risk Report Market Analysis

The crime risk report market is anticipated to witness a CAGR of 16.0% over the forecast period 2021 - 2026. Factors, such as increased digitalization in the banking system, and concern for data security and fraud detection issues are anticipated to fuel the market growth. The surge in banking-related fraud and risk management are influencing the financial institutes across the globe to implement crime risk management solutions. With the growth in web-based banking and payment system, the risk of fraud and spams have increased over the last few years. Currently, crime risk management solutions are being implemented for various applications such as banking, insurance, real estate, and others.

- Financial crime costs around USD 2.5 trillion per year which is equivalent to 3-4% of global GDP. Internet banking is expected to hold more than 70% share in the financial crime cost value, followed by mobile banking with more than 12%.

- According to UK Finance Limited, fraud and scams have cost GBP 1.2 billion to the UK government in 2018, which is 75% of the spending on finance security systems by the country.

Crime Risk Report Market Trends

This section covers the major market trends shaping the Crime Risk Report Market according to our research experts:

Growth in Digitalization and Cloud Adoption is Influencing the Market Demand

- Financial institutes across regions are implementing IT solutions to augment business operations. Cloud-based crime risk solution providers are gaining significant returns, by maintaining competitive costs, rapid innovation, and portfolio expansions. Recently, in 2019, Oracle Corporation expanded its cloud-based Anti-Money Laundering (AML) solution for smaller banks to enhance their capability in crime risk management.

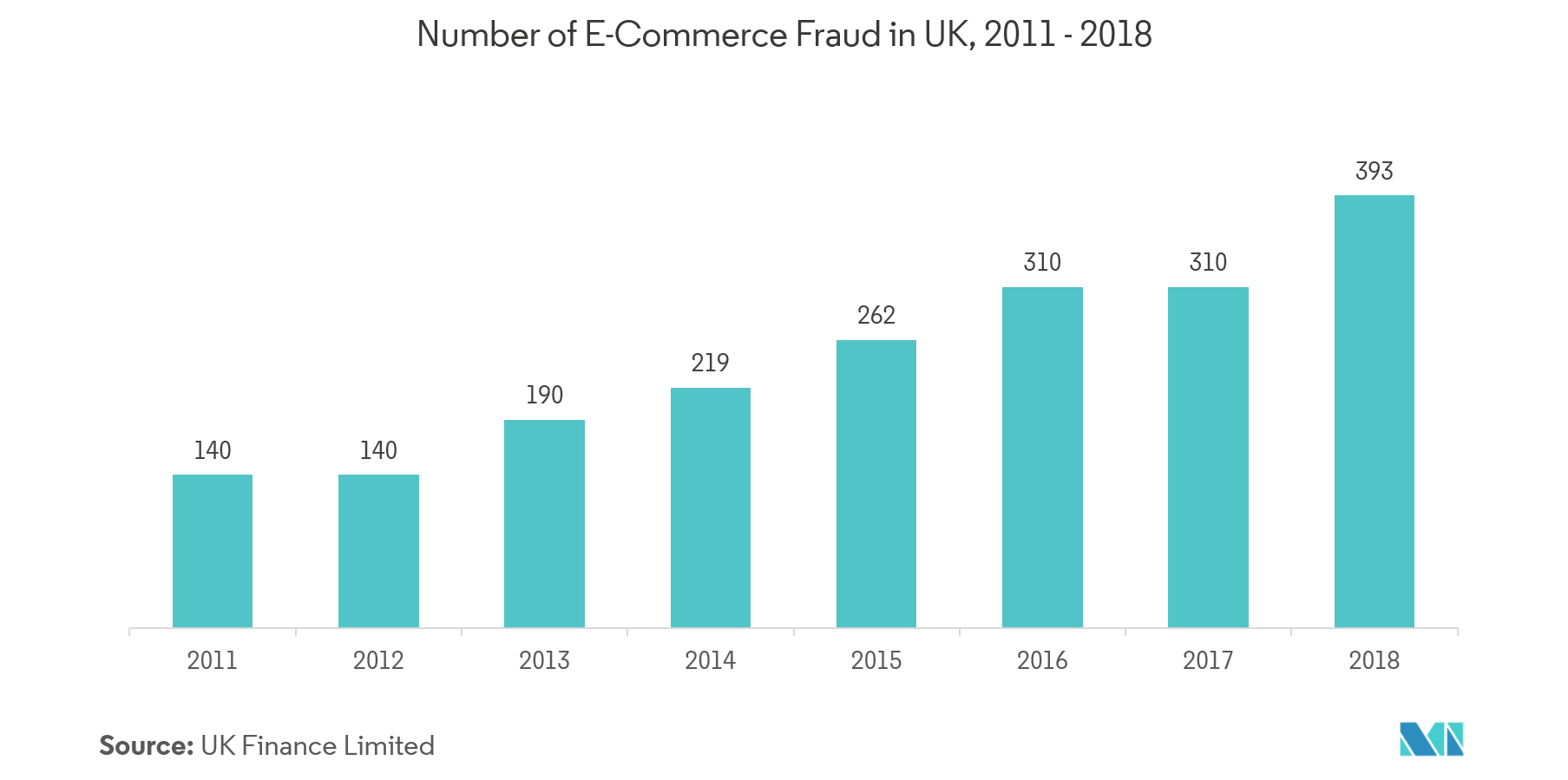

- Due to rapid digitization and emergence of mobile apps, industrial processes have become virtual, which in turn has given rise to online security risks and fraudulent behaviors in recent years. Online payment modes and digital transactions are some of the most affected areas in crime risk portfolio. According to UK Finance Limited, the number of e-commerce fraud has shown a growth of 26% in 2018 than in previous years.

- According to the Reserve Bank of India, financial transactions volume of the second populated country in the World (India) increased by 5% in the FY 2018 than previous FY 2017, which is anticipated to provide a great opportunity to vendors in the crime risk report market in the coming years.

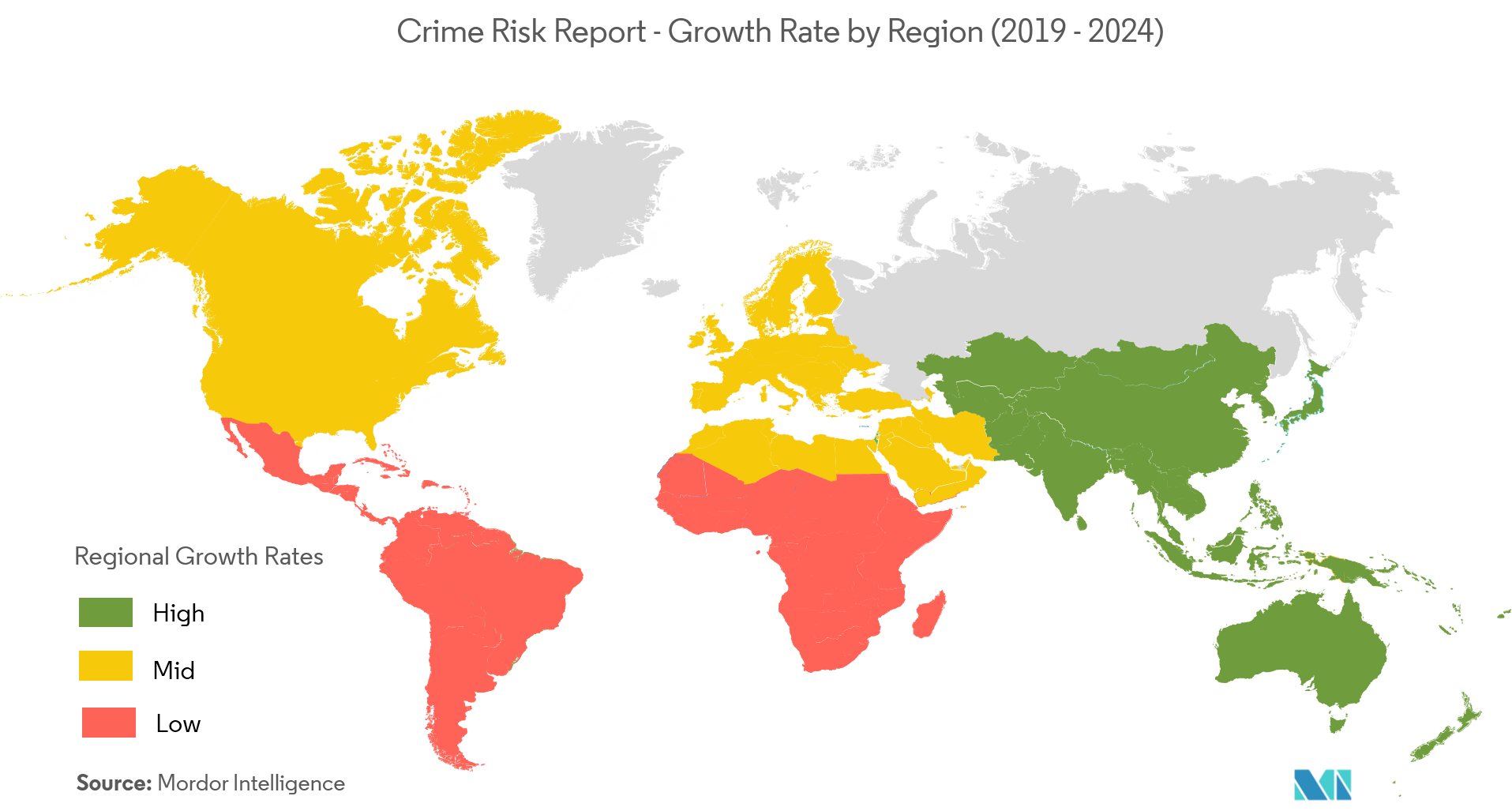

Asia-Pacific is the Fastest Growing Region

- The region's strong presence in the finance sector, rapid growth in internet banking users and cloud platform deployment for the various finance-related solution is some of the factors influencing the market growth in the Asia-Pacific region.

- According to Fair Isaac Corporation, 75% of the bank in the region is estimating a rise in fraud-related activities in the coming years. Also, the Asia-Pacific region with 50% of global online retail transactions will provide potential space for market development of risk-related solutions in the forecast period.

- Specifically, China, Japan, South Korea, India, Singapore, and Australia are expected to create huge potential for crime risk report solutions in the coming years. A number of Chinese banks have surged their IT spending in 2018. China Merchants Bank and China Construction Bank (CCB) have increased their IT spending by 35.2% and 22% respectively in 2018 than the previous year, which will eventually create potential space for vendors offering crime risk solutions in the country for the years to come.

Crime Risk Report Industry Overview

With the presence of many regional as well as the global player present in the market, the global market for crime risk report is expected to be fragmented in nature. ACI Worldwide, Inc., Capco, CoreLogic, Inc., Fenergo Ltd, Fiserv, Inc., IBM Corp., Mphasis Limited, NICE Ltd., Oracle Corporation, Refinitiv US Holdings Inc., and RiskScreen (KYC Global Technologies) are some of the major players present in the current market. All these players are involved in competitive strategic developments such as partnerships, new product innovation and market expansion to gain leadership positions in the global crime risk report market.

- March 2019 - Fenergo launched next generation Fenergo Hierarchy Manager (FHM) solution to mitigate financial risks related to money laundering and other financial threats in the banking and insurance sector.

- June 2019 - One of the leading insurance service providers in Asia, implemented Fiserv's "The Automated Suspicious Transaction Monitoring and Reporting (STR)" system to monitor transactions and detecting suspicious activities. This strategic development will help Fiserv expanding business in the Asia-Pacific region.

Crime Risk Report Market Leaders

-

ACI Worldwide, Inc.

-

Fenergo Ltd

-

Fiserv, Inc.

-

IBM Corp.

-

Oracle Corporation

*Disclaimer: Major Players sorted in no particular order

Crime Risk Report Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.3.1 Increased Digitalization in Banking Sector

-

4.3.2 Concern for Data Security and Fraud Detection

-

-

4.4 Market Restraints

-

4.4.1 Sceptical View on Data Privacy

-

-

4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

-

4.6.1 Threat of New Entrants

-

4.6.2 Bargaining Power of Buyers/Consumers

-

4.6.3 Bargaining Power of Suppliers

-

4.6.4 Threat of Substitute Products

-

4.6.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Deployment

-

5.1.1 On-Premise

-

5.1.2 Cloud

-

-

5.2 By Application

-

5.2.1 Banking

-

5.2.2 Insurance

-

5.2.3 Real Estate

-

5.2.4 Other Applications

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

-

5.3.2 Europe

-

5.3.2.1 Germany

-

5.3.2.2 United Kingdom

-

5.3.2.3 Rest of Europe

-

-

5.3.3 Asia-Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Rest of Asia-Pacific

-

-

5.3.4 Rest of the World

-

5.3.4.1 Latin America

-

5.3.4.2 Middle-East & Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 ACI Worldwide, Inc.

-

6.1.2 Capco

-

6.1.3 CoreLogic, Inc.

-

6.1.4 Fenergo Ltd

-

6.1.5 Fiserv, Inc.

-

6.1.6 IBM Corp.

-

6.1.7 Mphasis Limited

-

6.1.8 NICE Ltd.

-

6.1.9 Oracle Corporation

-

6.1.10 Refinitiv US Holdings Inc.

-

6.1.11 RiskScreen (KYC Global Technologies)

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANALYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Crime Risk Report Industry Segmentation

Crime risk report includes various software solutions for several fraud and risk related applications such as merchant fraud detection, card relayed fraud assessment, money laundering detection, risk protection, and many others. All these solutions can be deployed in on-premise environment as well as on hosted cloud platform.

| By Deployment | |

| On-Premise | |

| Cloud |

| By Application | |

| Banking | |

| Insurance | |

| Real Estate | |

| Other Applications |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

|

Crime Risk Report Market Research FAQs

What is the current Crime Risk Report Market size?

The Crime Risk Report Market is projected to register a CAGR of 16% during the forecast period (2024-2029)

Who are the key players in Crime Risk Report Market?

ACI Worldwide, Inc., Fenergo Ltd, Fiserv, Inc., IBM Corp. and Oracle Corporation are the major companies operating in the Crime Risk Report Market.

Which is the fastest growing region in Crime Risk Report Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Crime Risk Report Market?

In 2024, the North America accounts for the largest market share in Crime Risk Report Market.

What years does this Crime Risk Report Market cover?

The report covers the Crime Risk Report Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Crime Risk Report Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Crime Risk Report Industry Report

Statistics for the 2024 Crime Risk Report market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Crime Risk Report analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.