Market Trends of Cosmetic & Toiletry Containers Industry

This section covers the major market trends shaping the Cosmetic & Toiletry Containers Market according to our research experts:

Plastic Container Holds the Significant Share in The Market

- Toiletries which are consumer products are used for personal hygiene and also for beautification. The largest segments in the toiletries market contain Lotions (including sunscreens), Hair preparations, Face creams and Perfumes where the demand for plastic usage for the container is higher due to superior resistance to breakage, in both production and transportation.

- Some types of plastic bottles are incompatible with specific kind of toiletries. GoToobs are a desired choice for travel toiletry bottles for their soft silicone material, flip caps and suction cups that one can stick onto the wall of the shower. It’s BPA free and easy to clean. Also, Pitotubes are best for things that won’t clot and won’t be difficult at high pressures. These bottles are in a number of sizes but are typically in 0.5 ounces or 1-ounce bottles.

- Moreover, Nalgene bottles are finest for slightly runny liquids like shampoo and lotion. Anything firmer, like gels and creams, perform best in the Nalgene tubs. These are highly preferred in the United kingdom.

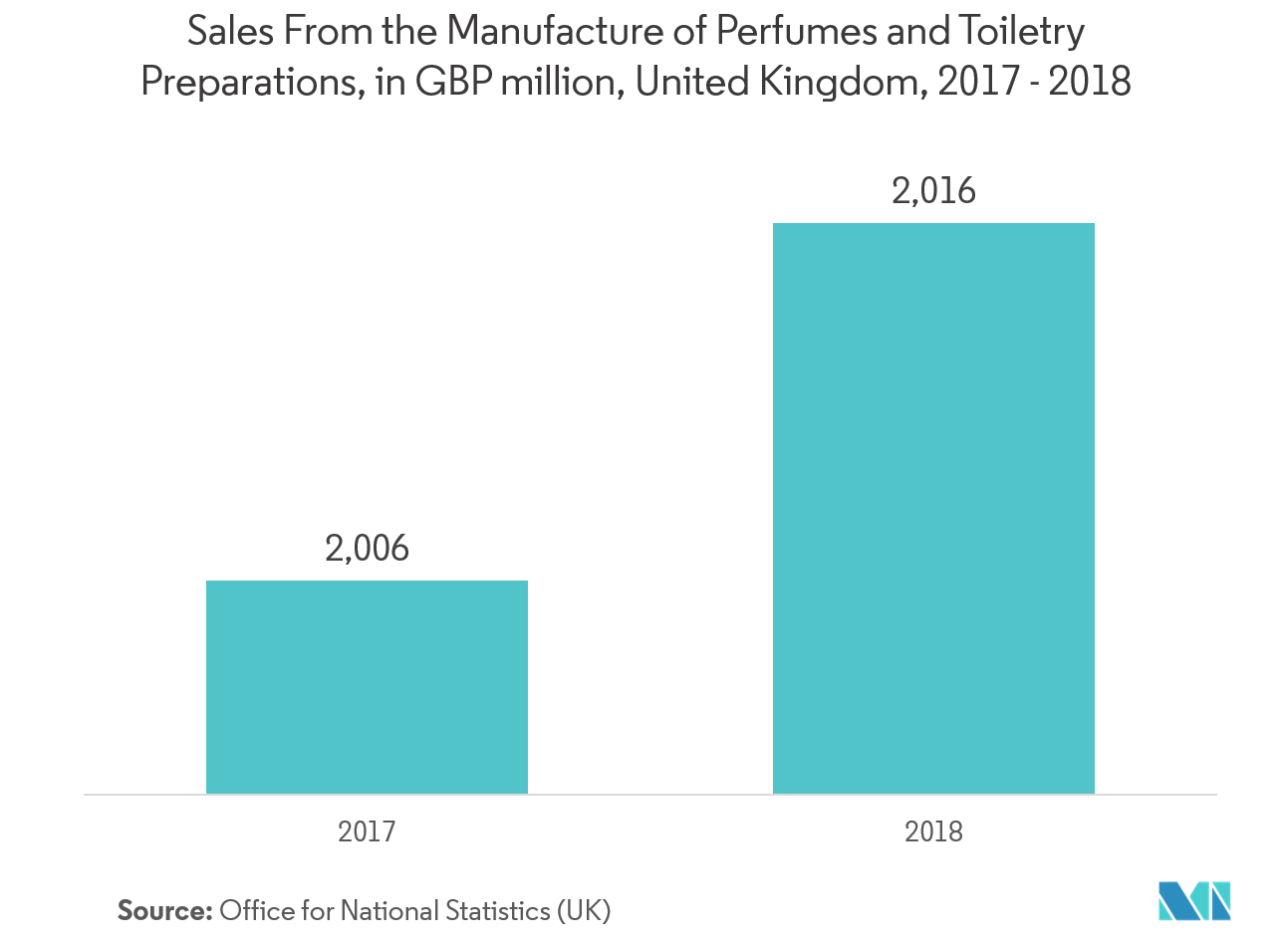

- According to UK's Office for National Statistics, the median disposable household income in the U.K. was about USD 33,787 in the fiscal year 2017. This suggested an increase of 2.3% from the previous year and the sales of perfume and toiletries increases on a yearly basis.

- Also, according to UK's Office for National Statistics, average weekly household expenditure on toiletries and soap in the United Kingdom under age 50 - 64 is GBP 2.8 and under the age of 30 - 49 is GBP 2.7 in 2018. This rate is increasing with the increasing demand for toiletry products by which the raise of plastic container in this region is increasing.

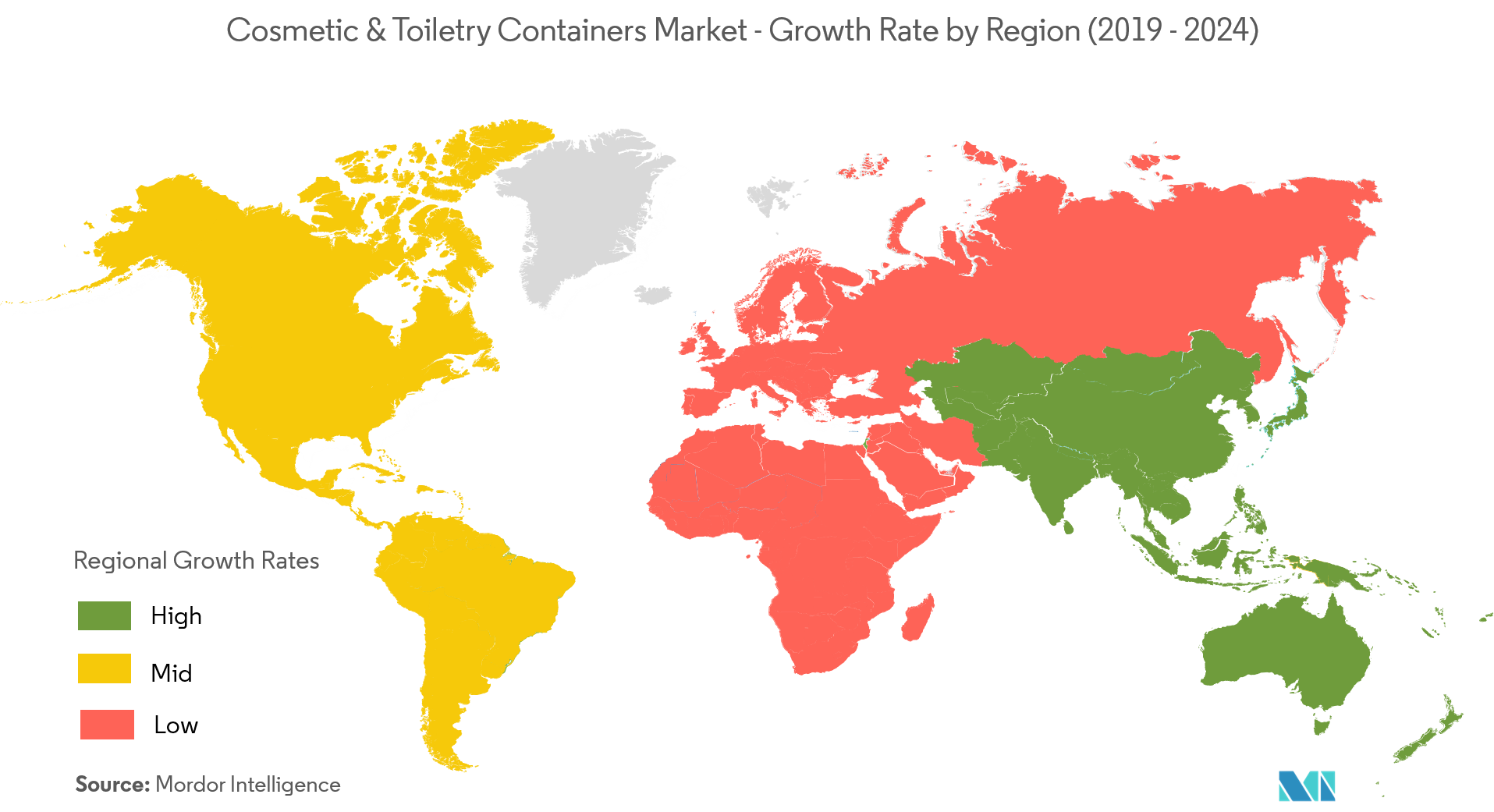

Asia-Pacific Account for Significant Market Growth

- Asia-Pacific is accounted for significant growth in the coming years. The growing trend of various home-based skincare products developed mainly by young beauty supporter is one of the significant factors for driving the market of cosmetic and toiletry containers in the region.

- According to the National Bureau of Statistics of China, China’s skincare-products market is becoming more high-end. Though the retail sales value of high - end skincare products was however below that of mass-market alternatives in the year 2018, the market share of the skincare products has risen gradually to 32% in 2018 from 25.3% in 2013. Consumers are favoring major international brand skincare products and this factor is rising the demand for cosmetic containers at the production site to export the finished goods in this region.

- Moreover, according to statistics from NMPA (National Medical Products Administration), which is now under SAMR (State Administration for Market Regulation), there were 4,933 enterprises licensed to manufacture cosmetics in China at the end of June 2019. Domestic brands are mostly concentrated in the mid- to low-end market segments, while joint ventures and enterprises with foreign investment dominate the high-end segment.

- Moreover, according to the Indian Brand Equity Foundation in 2017, India’s rural per capita disposable income was estimated to increase and reach USD 631 by 2020 with a CAGR of 4.4%. This rate of increment shows a high growth of demand of cosmetics and toiletries product in future which will increase the growth of the market.