Commercial Robotics Market Analysis

The Commercial Robotics Market is expected to register a CAGR of 33.65% during the forecast period.

- Commercial robots are widely used in the field as autonomous guided drones and medical applications. Commercial robots' exceptional service over conventional methods will likely boost investment and utilization.

- Drones are becoming popular and are being integrated into diverse applications, including commercial space. Also, various startups and tech giants are rigorously investing in this technology to capture a higher market share at an early stage. Further, the market is witnessing various partnerships and collaborations by public and private organizations. For instance, in August 2022, The Drone Federation of India signed an MoU with the Indian Army Design Bureau to accelerate drone technology development and indigenization in the drone ecosystem.

- Moreover, the medical robotics sector has developed at a rapid rate due to the growing acknowledgment of its benefits in the healthcare sector. The healthcare industry strongly leans toward technological innovation the IoT industry and investments in robotics have been the major contributors to the growth of the market.

- For instance, in September 2022, The Care and Equity Healthcare Logistics UAS Scotland project secured EUR 10.1 million (USD 10.7 million) in funding from the future flight challenge at UK Research and Innovation. Led by AGS Airports in partnership with NHS Scotland, CAELUS brings together 16 partners, including the University of Strathclyde, NATS, and NHS Scotland.

- The market is witnessing the adoption of robots for protecting the border. For instance, recently, an Israeli defense contractor unveiled a remote-controlled armed robot to patrol battle zones, track infiltrations, and open fire. It is operated by an electronic tablet and can be equipped with two machine guns, cameras, and sensors.

Commercial Robotics Market Trends

Drones in Military and Defense to Present Significant Opportunities for the Commercial Robotics Market

- Military robot automation of the defense process is the next wave of military evolution. As automated systems and networking complement the Internet, communication is facilitated on a global basis. Over the past decade, there have been increasing levels of investment in surveillance and security in the defense sector.

- The increasing government spending on the defense industry is further creating an opportunity for market growth. For instance, in August 2022, the Ministry of Defense in Tokyo asked for a JPY 5.59 trillion (USD 40.4 billion) budget for the fiscal year 2023.

- Moreover, the increasing tensions among the countries are further creating a demand for automation in the defense industry. For instance, amid the war with Ukraine, Russia increased defense spending by 43% and the police budget by 40%.

- The UAVs and drones are increasingly being adopted in the defense and military sector worldwide due to their benefits, such as enemy tracking, use in war zones in reconnaissance of unknown areas or buildings, force protection, and to assist in the search for lost or injured soldiers, as well as a real-time view of various missions.

- The industry is also witnessing various partnerships among developing nations for the development of unmanned aerial vehicles. For instance, recently, India and United States signed an MoU for cooperation in the production of Air-launched unmanned aerial vehicles. The partnership is aimed to promote collaborative technology exchange and create opportunities for the co-production and co-development of future technologies for Indian and US military forces.

North America to Dominate the Market

- The North American region is set to lead the market for commercial robotics due to the widespread acceptance of the infrastructure required for the adoption of commercial robotic systems.

- The steady technological advancements in the healthcare sector in North America are a major driver for the commercial robotics market in the region. The United States is home to some of the largest players in the market. It is a pioneer in adopting surgical robots, which has been a primary factor influencing the market's growth during the past decade.

- In January 2022, Wingcopter announced its commercial partnership with Spright to use drones to deliver medical supplies to improve healthcare access for customers across the United States. This agreement will see Spright acquire a large fleet of Wingcopter's new flagship delivery drones to create a drone-based, healthcare-specific delivery network.

- The defense and security sector also accounts for a significant portion of the demand, for robotics, in the region, as developed countries in these regions have focused on military modernization in the recent past. However, airborne drones have seen a phenomenal increase in their application because of their heavy usage in security and surveillance.

Commercial Robotics Industry Overview

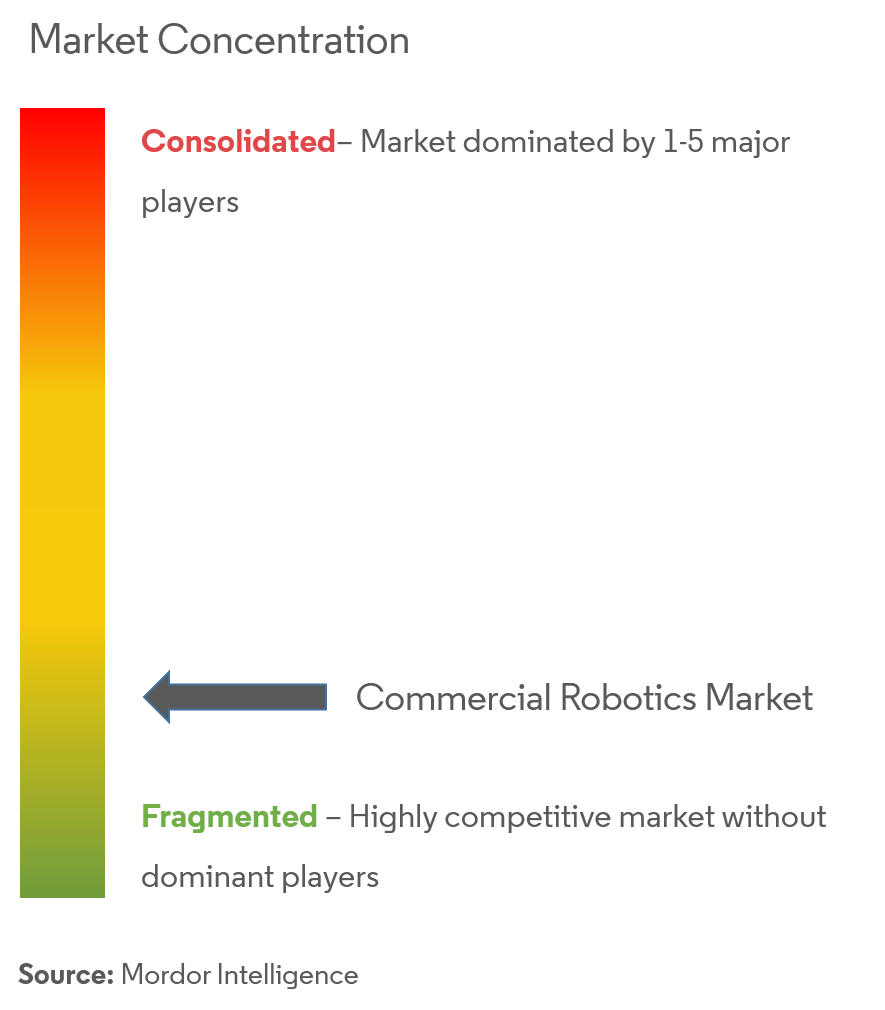

The commercial robotics market is highly fragmented, as expenditure on commercial robots is rapidly increasing due to their superior benefits. The increasing investments, especially in the medical robotics segment, coupled with technological innovations and product launches by the industry players, are expected to drive the commercial robotics market. Some key players in the market are Northrop Grumman Corp., Yaskawa Electric Corporation, Kuka AG, iRobot Corporation, Honda Motor Company Limited, Omron Adept Technologies Inc., and 3D Robotics Inc., among others.

- November 2022 - Brain Corporation launched a next-generation autonomy platform for commercial robotics. The third-generation platform represents the evolution of Brain Corp's BrainOS autonomous robotic operating system, which currently powers over 20,000 autonomous robots operating in public spaces and has been developed to underpin a future generation of intelligent robotic solutions to be used across multiple commercial sectors.

- July 2022 - Leidos announced the development of a medium-sized unmanned underwater vehicle (UUV) for marine environmental sensing and counter-mine warfare under terms of a USD 12 million contract with U.S. Naval Sea Systems Command in Washington.

Commercial Robotics Market Leaders

-

Yaskawa Electric Corporation

-

Northrop Grumman Corporation

-

Kuka AG

-

iRobot Corporation

-

Omron Adept Technologies Inc.

- *Disclaimer: Major Players sorted in no particular order

Commercial Robotics Market News

- July 2022 - Ganymed Robotics announced that the company had received funding of EUR 21 million in the series B funding round to complete the development of its next-generation surgical robot and prepare for a commercial launch.

- January 2022 - LG announced the launch of a CLOi service robot in the United States after gaining a UL certification. The LDLIM21 is a commercial robot developed for safe operation in complex commercial environments like restaurants, retail stores, and hotels. The robot will offer an operation of 11 hours on a single charge.

Commercial Robotics Industry Segmentation

Robotics play a crucial role in commercial applications, with many core operations being managed by robots. The commercial robotics market has witnessed a surge in demand in the past decade. This is due to the rising convergence of robotics and artificial intelligence, including planning and search, probabilistic inference, localization, tracking, and control.

The Commercial Robotics Market is Segmented by Type of Robot (Drones, Field Robots, Medical Robots, Autonomous Guided Robotics), Application (Medical and Healthcare, Defense and Security, Agriculture and Forestry, Marine), and Geography (North America, Europe, Asia Pacific, Latin America, MEA). The market sizes and forecasts are provided in terms of value (USD million) for all the above segments. The report also covers the trends in the market and the assessment of the impact of COVID-19 on the market.

| By Type of Robot | Drones | ||

| Field Robots | |||

| Medical Robots | |||

| Autonomous Guided Robotics | |||

| Other Types of Robots | |||

| By Application | Medical and Healthcare | ||

| Defense and Security | |||

| Agriculture and Forestry | |||

| Marine | |||

| Other Applications | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| Singapore | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Latin America | Brazil | ||

| Mexico | |||

| Argentina | |||

| Rest of Latin America | |||

| Middle East & Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Rest of Middle East & Africa | |||

Commercial Robotics Market Research FAQs

What is the current Commercial Robotics Market size?

The Commercial Robotics Market is projected to register a CAGR of 33.65% during the forecast period (2025-2030)

Who are the key players in Commercial Robotics Market?

Yaskawa Electric Corporation, Northrop Grumman Corporation, Kuka AG, iRobot Corporation and Omron Adept Technologies Inc. are the major companies operating in the Commercial Robotics Market.

Which is the fastest growing region in Commercial Robotics Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Commercial Robotics Market?

In 2025, the North America accounts for the largest market share in Commercial Robotics Market.

What years does this Commercial Robotics Market cover?

The report covers the Commercial Robotics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Commercial Robotics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Commercial Robots Industry Report

Statistics for the 2025 Commercial Robotics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Commercial Robotics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.