Commercial Pumps Market Size and Share

Commercial Pumps Market Analysis by Mordor Intelligence

The Commercial Pumps Market is expected to register a CAGR of 5.75% during the forecast period.

- The recent introduction of the green buildings concept has transformed the production strategies of many top commercial pump vendors in the market. There have been high research and development activities in the market to produce highly energy efficient and smart commercial pumps.

- Moreover, the increased adaption of IoT will be a major opportunity for a commercial pump market as pumps are going to have more embedded technology and be able to use advanced analytics to optimize themselves for the systems. This requires the modern commercial pumps market to cope up with the requirements. Hence, the commercial pumps market is on the verge of transformation providing an edge over the competitors to those vendors who have the capabilities to manufacture smart and energy efficient commercial pumps.

- However, the high cost of energy- efficient system pumps and fluctuation in the price of raw materials are hindering the growth of the commercial pump market.

Global Commercial Pumps Market Trends and Insights

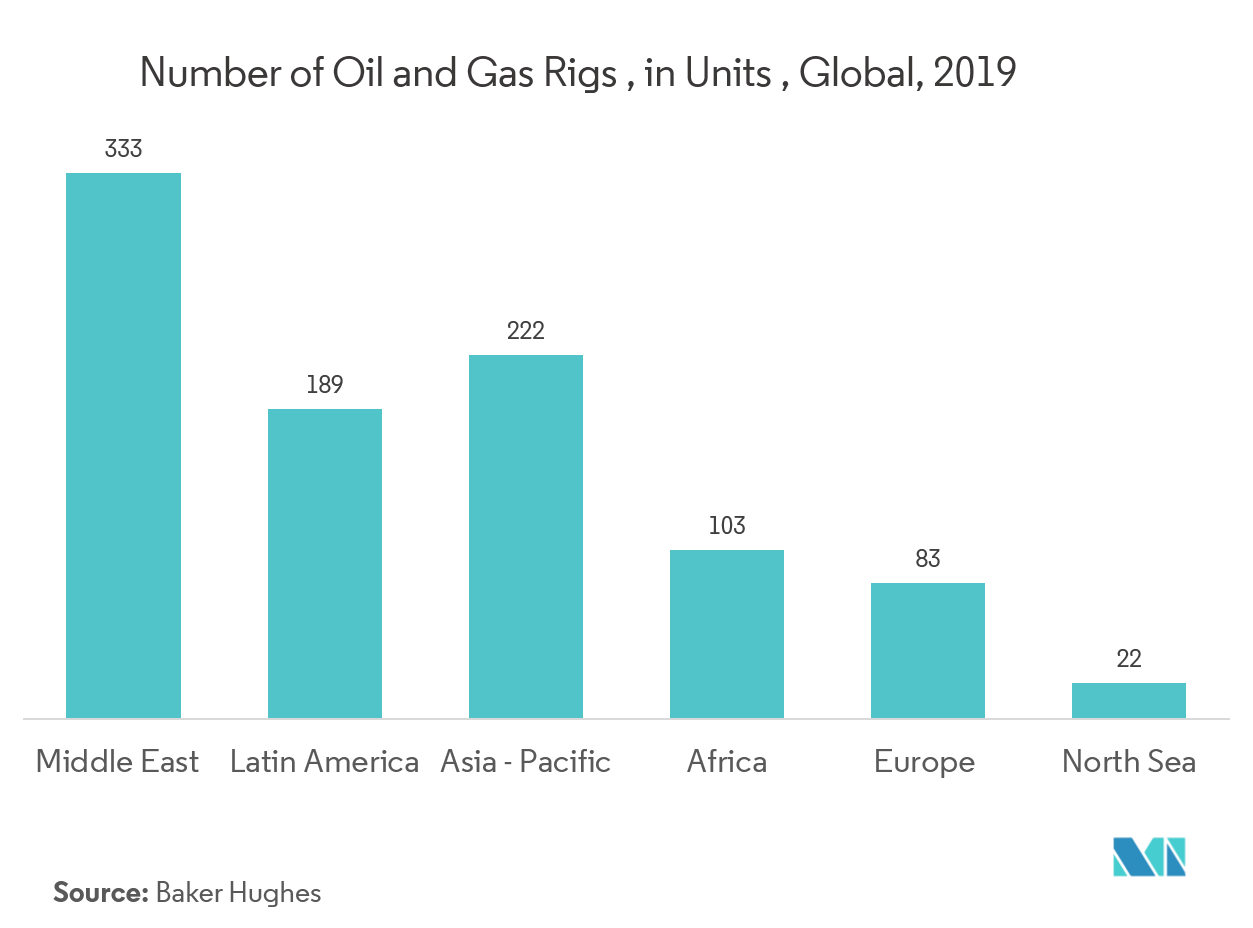

Increasing Activities in Oil and Gas Sector to Create New Opportunities

- Oil & gas sector is the most prominent source of demand for the commercial pumps industry. The intensive work of drilling and extracting requires reliable and powerful pumps to draw resource from great depths of the ocean and land.

- Commercial pumps are installed in almost every vertical of the oil & gas sector. Commercial pumps are used in regulating the transport operations via pipelines, they installed in several refineries to feed the machines treating crude oil with the raw product, they are used at the outlets or gas station to provide the end product to the customer, etc.

- With more than 1.8 million barrels of crude oil held back every day from the global supply due to OPEC regulations, the crude oil prices are stabilizing slowly. The newly found shale gas resources in North America and increasing investments in the Middle East region towards exploration and drilling activities are reviving all the secondary industries that are highly dependent on the oil & gas industry, including the commercial pumps market.

- Moreover, an increasing number of oil and gas rigs around the world will boost the commercial pumps market.

North America to be the Largest Market

- Commercial pumps have significant applications in the construction sector. They are majorly used for water circulation systems and waste management. Generally, buildings are responsible for an enormous amount of global energy use, resource consumption, and greenhouse gas emissions. As the demand for more sustainable building options increases, green construction is becoming increasingly profitable and desirable within the international construction market.

- Green buildings are known for the usage of low energy consuming appliances, especially pumps, which are the prime contributors to the energy consumption of a building. More energy efficient variants of commercial pumps are installed in green buildings to reduce the carbon footprint of the North America region.

- For instance, in the United States alone, buildings account for almost 40% of national CO2 emissions out-consuming both the industrial and transportation sectors. To keep this situation under control, the construction companies in the region adopted Leadership in Energy and Environmental Design(LEED) standards to construct green buildings.

- According to US Green Building Council (USGBC), currently, in the US, LEED-certified buildings have 34% lower CO2 emissions, consume 25% less energy and 11% less water, and have diverted more than 80 million tons of waste from landfills. USGBC estimates that by 2018, green construction will directly contribute a million jobs and USD 75.6 billion in wages. The industry’s direct contribution to U.S. Gross Domestic Product (GDP) is also expected to reach USD 303.5 billion by the end of 2018.

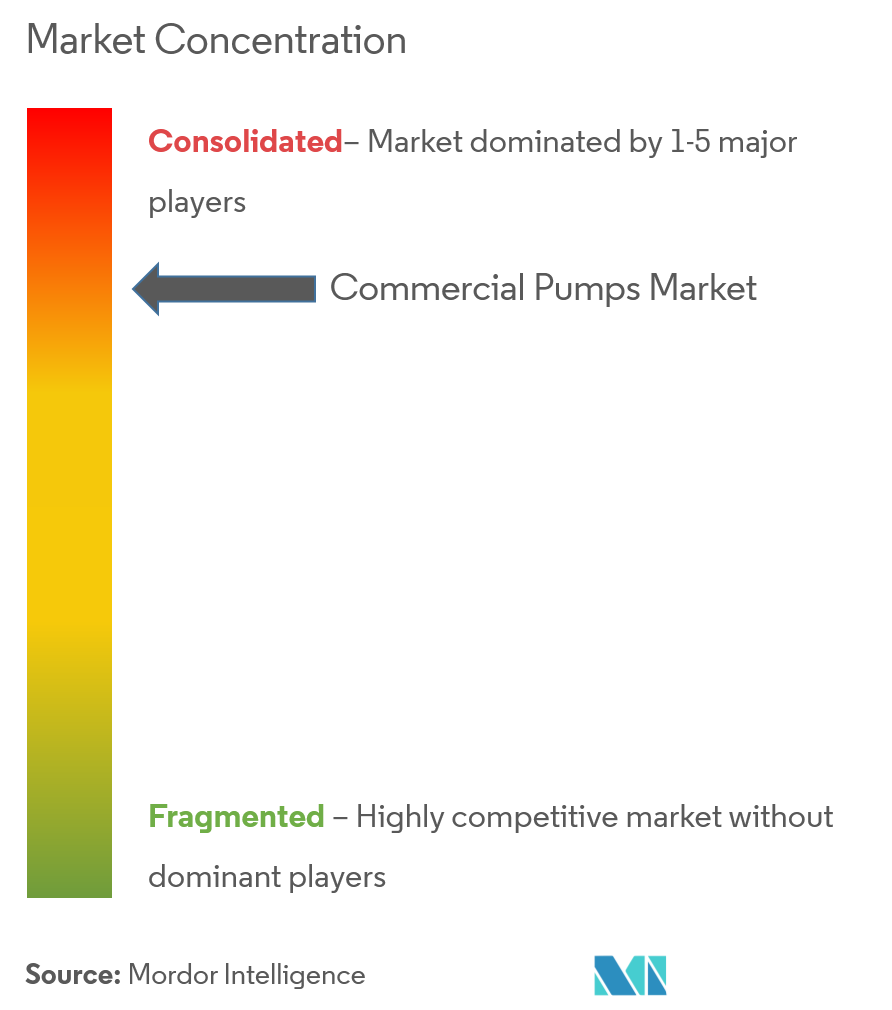

Competitive Landscape

The commercial pumps market is consolidated due to a major share of the market is occupied by top players. Moreover, due to fluctuating raw material cost and high set up cost, it is difficult for a new player to enter the market. Some of the key players in the market arePentair Inc.,Xylem Inc., Grundfos GmbH,Armstrong Fluid Technology,Franklin Electric,Patterson Pumps,Parker Hannifin Corp.,IDEX Corporation,CG Power and Industrial Solutions Limited, among others.

- April 2019 - Parker Hannifin Corporation, the global leader in motion and control technologies,announced that it has entered into a definitive agreement to acquire LORD Corporation for approximately $3.675 billion in cash.LORD, headquartered in Cary, North Carolina, is a privately-held company founded in 1924 offering a broad array of advanced adhesives, coatings and specialty materials as well as vibration and motion control technologies. LORD’s products are used in mission-critical applications in the aerospace, automotive and industrial markets. LORD has annual sales of approximately $1.1 billion and employs 3,100 team members across 17 manufacturing and 15 research and development facilities globally.

- February 2018 - Xylem Inc. announced the acquisition of EmNet, LLC, a prominent US company known for its smart solutions that are specialized in systems for managing the urban water cycle and wastewater and stormwater. This acquisition is expected to expand Xylem’s growing portfolio of advanced infrastructure analytics solutions and capabilities.

Commercial Pumps Industry Leaders

-

Pentair Inc.

-

Xylem Inc.

-

Parker Hannifin Corp.

-

CG Power and Industrial Solutions Limited

-

Patterson Pumps

- *Disclaimer: Major Players sorted in no particular order

Global Commercial Pumps Market Report Scope

The commercial pumps are devices that moves liquid, gases or slurries by mechanical action that are specifically used for commercial purposes such as agriculture, construction, mining, many other activities. The commercial pump is classified into different types depending upon its end-user usage.

| Single Stage Pumps |

| Seal-less and Circulator Pumps |

| Multi Stage Pumps |

| Submersible Pumps |

| Other Types |

| Agriculture and Irrigation |

| Oil & Gas Industry |

| Construction |

| Water Treatment |

| Mining Industry |

| Energy & Power Generation |

| Chemical Industry |

| Other End-users |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Type | Single Stage Pumps |

| Seal-less and Circulator Pumps | |

| Multi Stage Pumps | |

| Submersible Pumps | |

| Other Types | |

| By End-user | Agriculture and Irrigation |

| Oil & Gas Industry | |

| Construction | |

| Water Treatment | |

| Mining Industry | |

| Energy & Power Generation | |

| Chemical Industry | |

| Other End-users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Commercial Pumps Market size?

The Commercial Pumps Market is projected to register a CAGR of 5.75% during the forecast period (2025-2030)

Who are the key players in Commercial Pumps Market?

Pentair Inc., Xylem Inc., Parker Hannifin Corp., CG Power and Industrial Solutions Limited and Patterson Pumps are the major companies operating in the Commercial Pumps Market.

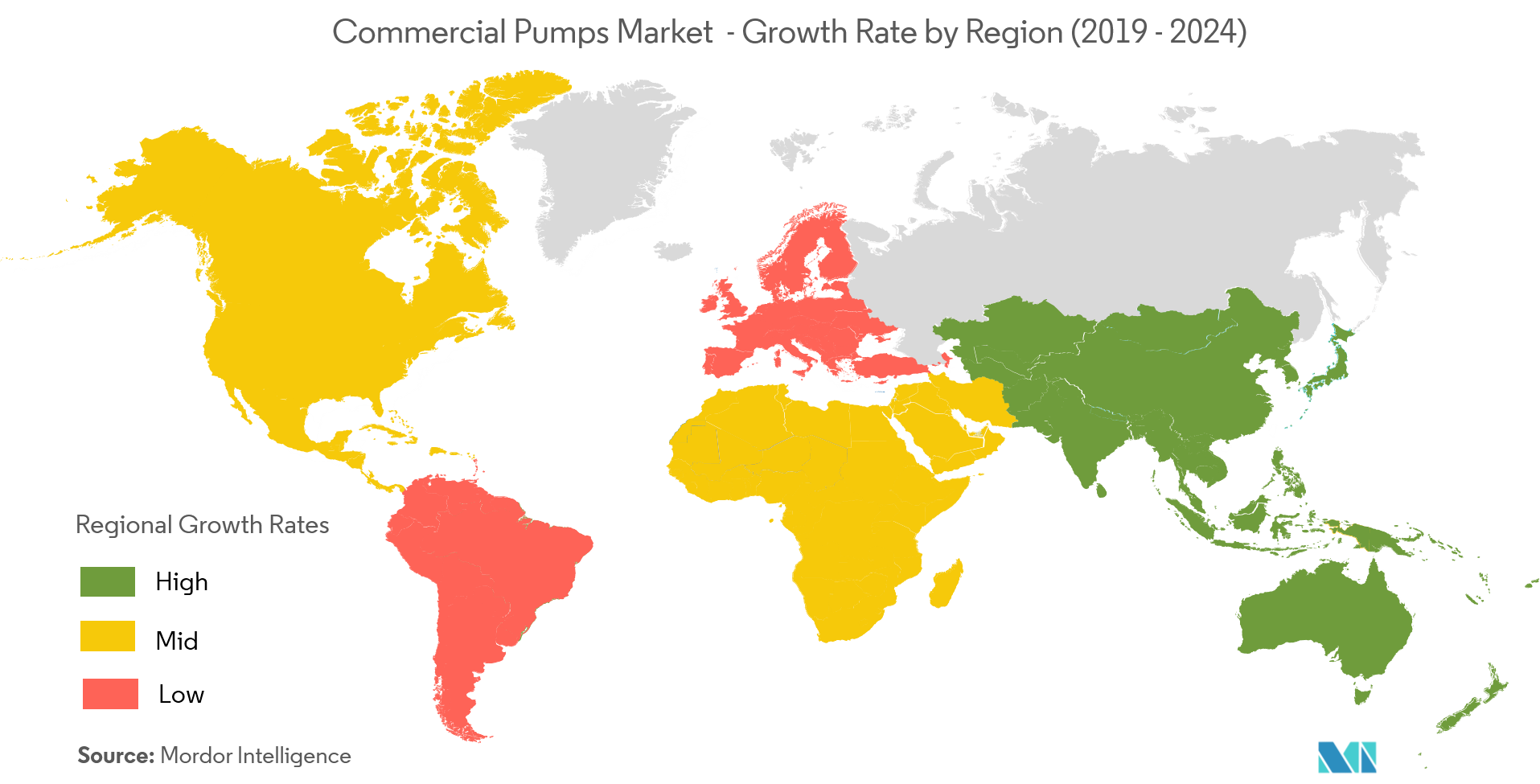

Which is the fastest growing region in Commercial Pumps Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Commercial Pumps Market?

In 2025, the North America accounts for the largest market share in Commercial Pumps Market.

What years does this Commercial Pumps Market cover?

The report covers the Commercial Pumps Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Commercial Pumps Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Commercial Pumps Market Report

Statistics for the 2025 Commercial Pumps market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Commercial Pumps analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.