Colombia Food Ingredients Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

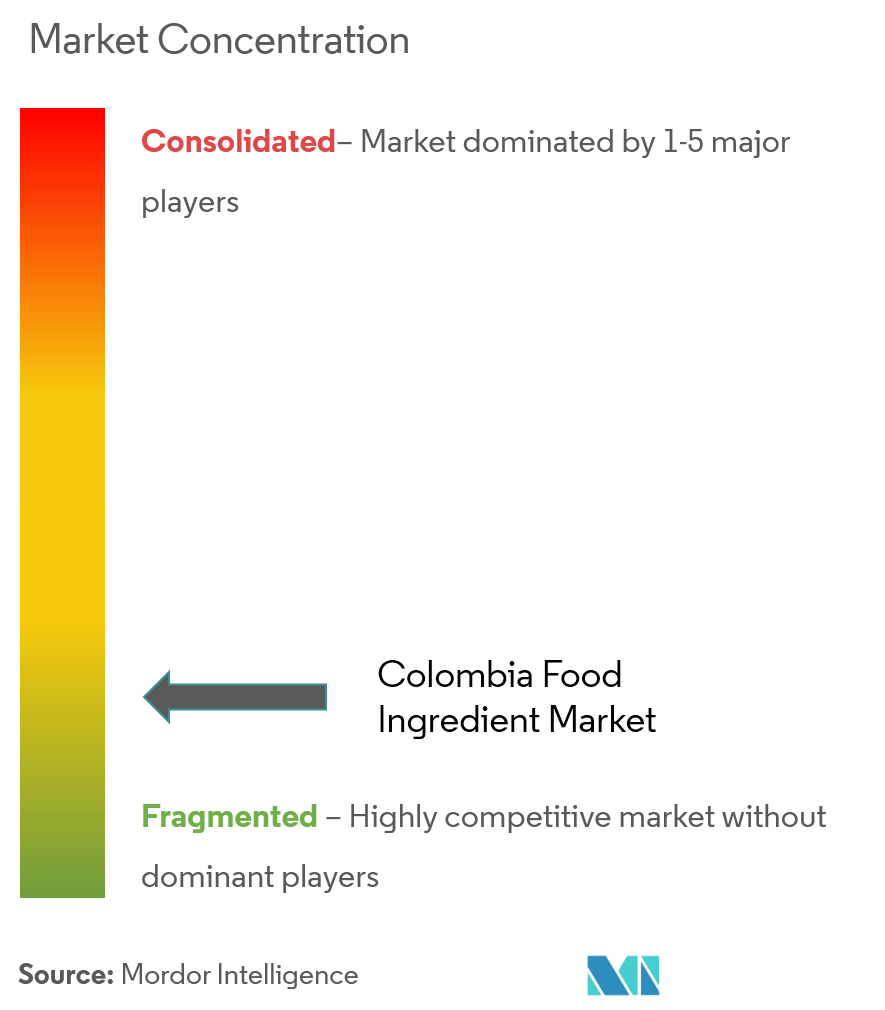

| CAGR | 6.09 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Colombia Food Ingredients Market Analysis

The Colombia food ingredient market is forecasted to reach USD 1.3 billion by 2025growing at a CAGR of 6.09% during the forecast period.

- The market is directly proportional to the growing demand for animal feed market and animal nutrition.

- Obtained from livestock producers, owing to the rising awareness about food quality and safety, along with the growing emphasis on the importance of quality meat and animal by-products by population.

- The thriving poultry industry in the country is not only increasing its production capacity, but also serving exports tocountries such as China, Vietnam, and Thailand, thus, adding an impetus to the market.

Colombia Food Ingredients Market Trends

This section covers the major market trends shaping the Colombia Food Ingredient Market according to our research experts:

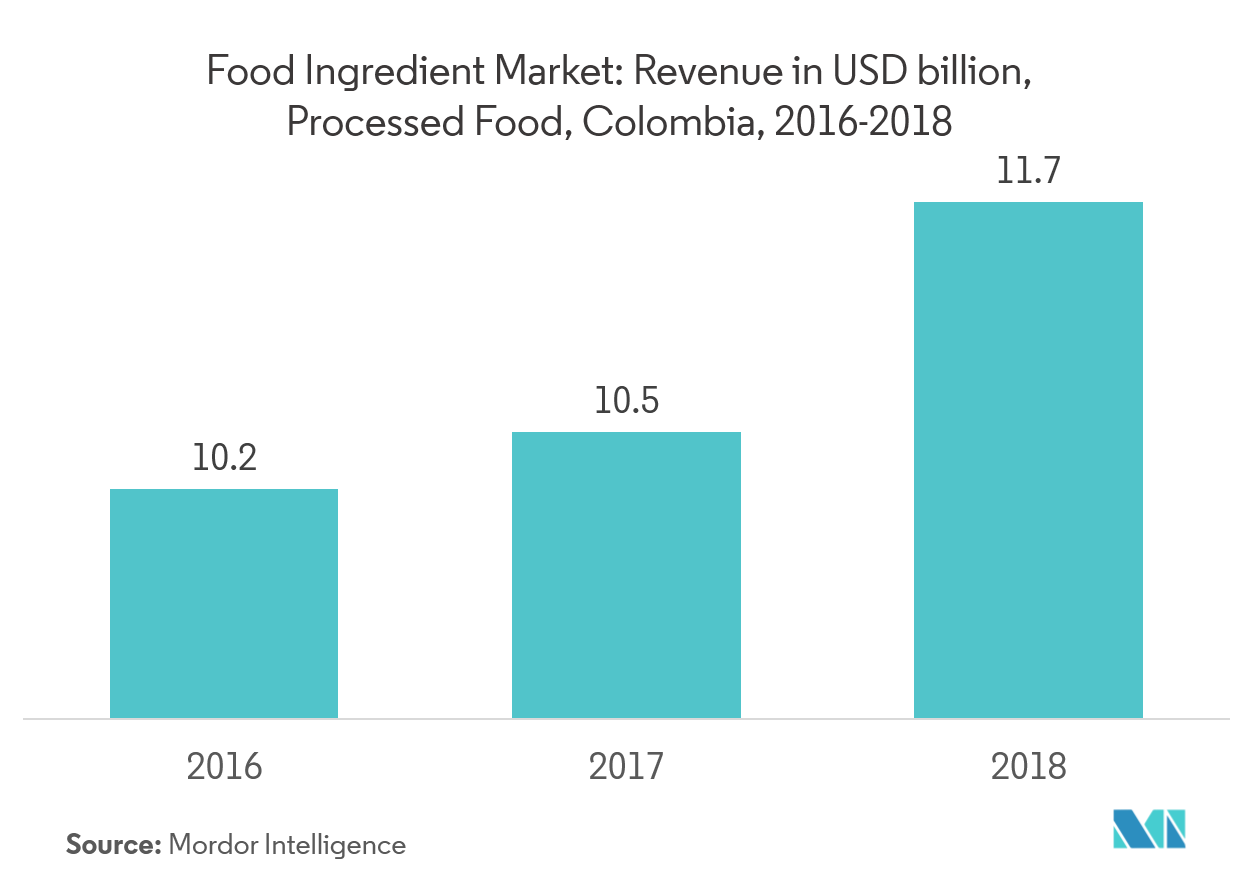

Emerging Of Processed Foods Market in Colombia

Colombia is an emerging economy with a rapidly growing processed food industry. The Colombian processed food industry is expected to project a double-digit growth rate. As per the Colombian statistical data, the Colombian consumer spent almost USD 337 worth of processed food per capita per year. Consumption at this scale is significantly supported by the growth in the Colombian household disposable income. Therefore, the food ingredient market is also witnessing growth along with the processed food market. As the food industry in the developed regions is mature enough, food manufacturers are forced to explore some other market with better growth potential. In this scenario, South America and Asia-Pacific are the most preferred market.

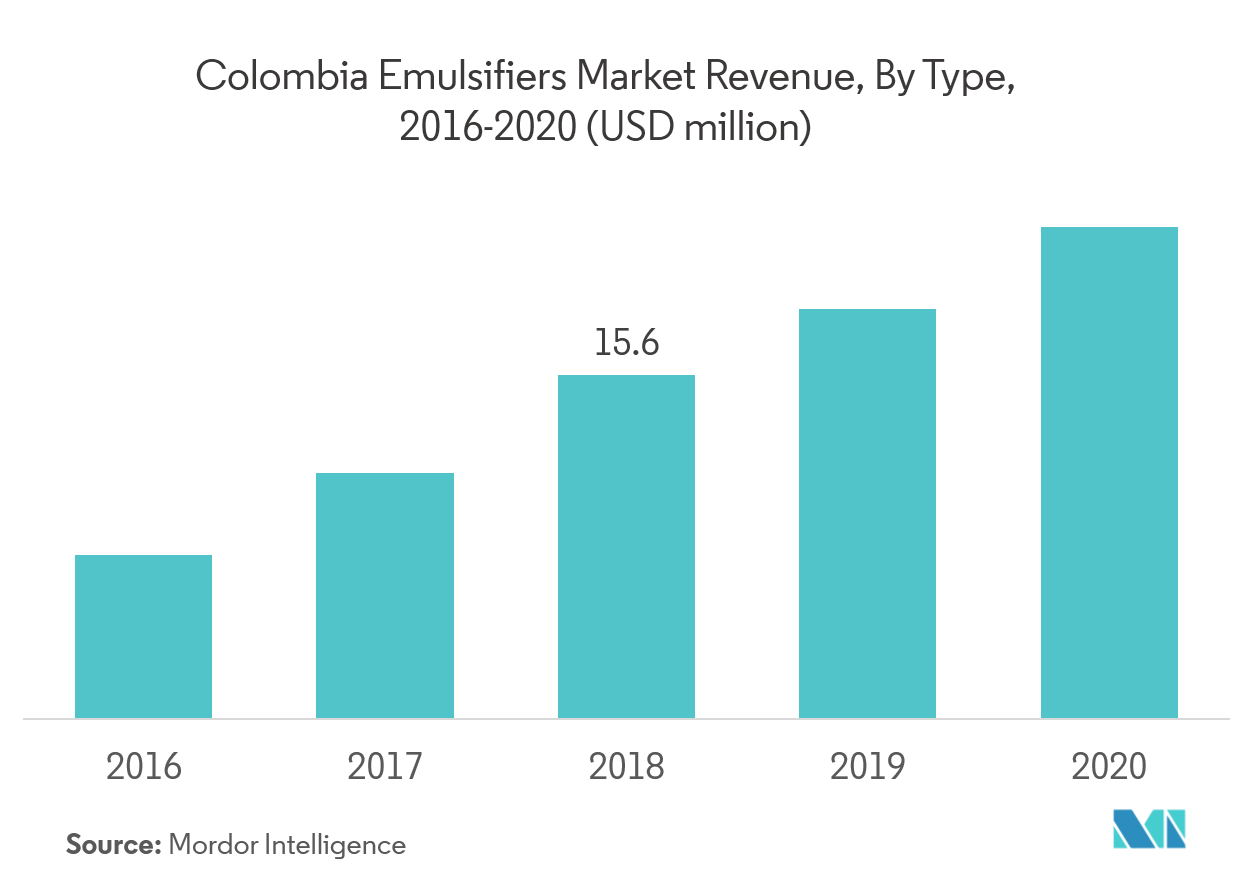

Increase in Import and Export Trade of Enulsifiers

Colombia has a major production of emulsifiers based on palm oil, glycerin and castor oil or castor oil. There is an abundance of raw materials required, given to the existence of government policies for the production of biodiesel for blending with petrochemical diesel. The technology of production of emulsifiers, which will dominate the Colombian market in the future, will be the one that uses enzymatic catalysis. Aceitalis SA and Aceites y Grasas Vegetales S.A. are some of the major producers of emulsifiers in Colombia, mainly dealing in lecithin, which has a significant market in the country. Mono-, Di-Glycerides & Derivatives are the dominant emulsifier in Colombia, followed by lecithin and polyglycerol poliricinoleate. The emulsifiers, which are classified in the others category are mainly stearoyl lactylates, alkoxylated fatty esters, ethoxylated fatty acids, ethoxylated glyceryl esters, ethoxylated sorbital esters.

Colombia Food Ingredients Industry Overview

Colombia, followed by Brazil and Venezuela, are the largest consumer of the United States’ food and agricultural products, in South America. Leading global players in Colombia have a focus on investing in infrastructure to establish manufacturing sites for food additives. Many companies from Europe, Mexico and Canada have strong ties with local distributors and traders which help them in selling their products to local sellers.

Colombia Food Ingredients Market Leaders

Cargill, Incorporated

Ingredion Incorporated

DSM

Archer Daniels Midland Company

Dupont Danisco

*Disclaimer: Major Players sorted in no particular order

Colombia Food Ingredients Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

3.1 Market Overview

-

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porters 5 Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Type

-

5.1.1 Starch and Texturants

-

5.1.2 Sweetener

-

5.1.3 Flavors

-

5.1.4 Acidulants

-

5.1.5 Preservative

-

5.1.6 Emulsifier

-

5.1.7 Color

-

5.1.8 Enzymes

-

5.1.9 Others

-

-

5.2 By Application

-

5.2.1 Beverages

-

5.2.2 Sauces, Dressings, and Condiments

-

5.2.3 Bakery

-

5.2.4 Dairy

-

5.2.5 Confectionery

-

5.2.6 Dried Processed Food

-

5.2.7 Frozen/Chilled Processed Food

-

5.2.8 Sweet and Savory Snacks

-

5.2.9 Others

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Market Share Analysis

-

6.2 Most Active Companies

-

6.3 Most Adopted Strategy

-

6.4 Company Profiles

-

6.4.1 Cargill Incorporated

-

6.4.2 DSM

-

6.4.3 Ingredion Incorporated

-

6.4.4 Archer Daniels Midland Company

-

6.4.5 Dupont

-

6.4.6 Firmenich SA

-

6.4.7 BASF SE

-

6.4.8 Associated British Foods PLC

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Colombia Food Ingredients Industry Segmentation

The studied market of Colombia food ingredient is available as functional food ingredient, starch and texturants, sweetener, flavors, acidulants, preservative, emulsifier, color, enzyme, culture, proteins, oil and yeast. By application, the market is segmented as beverages, sauces, dressings, and condiments, bakery, dairy, confectionery, dried processed food, frozen/chilled processed food, sweet and savory snacks and other applications.

| By Type | |

| Starch and Texturants | |

| Sweetener | |

| Flavors | |

| Acidulants | |

| Preservative | |

| Emulsifier | |

| Color | |

| Enzymes | |

| Others |

| By Application | |

| Beverages | |

| Sauces, Dressings, and Condiments | |

| Bakery | |

| Dairy | |

| Confectionery | |

| Dried Processed Food | |

| Frozen/Chilled Processed Food | |

| Sweet and Savory Snacks | |

| Others |

Colombia Food Ingredients Market Research FAQs

What is the current Colombia Food Ingredients Market size?

The Colombia Food Ingredients Market is projected to register a CAGR of 6.09% during the forecast period (2024-2029)

Who are the key players in Colombia Food Ingredients Market?

Cargill, Incorporated, Ingredion Incorporated, DSM, Archer Daniels Midland Company and Dupont Danisco are the major companies operating in the Colombia Food Ingredients Market.

What years does this Colombia Food Ingredients Market cover?

The report covers the Colombia Food Ingredients Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Colombia Food Ingredients Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Colombia Food Ingredients Industry Report

Statistics for the 2024 Colombia Food Ingredients market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Colombia Food Ingredients analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.