Cloud Security In Banking Market Analysis

The Cloud Security in Banking Market is expected to register a CAGR of 33.1% during the forecast period.

- An increase in cybersecurity threat is driving the market as for banks. This threat is particularly imposing, as breached data exposes the opportunity for immediate and future theft. Cloud computing provides a very high level of data protection, especially for sensitive data that includes customer information.

- Cost reduction, scalability, and efficiency by cloud computing are driving the market. Due to the constant decline in the absolute cost of IT equipment, many financial institutions have changed other production factors with IT. The essential idea of cloud computing is to deliver IT services, such as computer infrastructure or storage in a utility, thus, making these services ultimately more flexible and cost-efficient.

- Additionally, meeting the customer demands immediately and the scalability of computer resources save the time of IT specialist and business users from engineering the system for peak load. Banks can handle the issues associated with security and privacy of data by building a hybrid cloud where important data keeps on private cloud and computing power resides in the public cloud.

- However, vulnerability to attack is still a challenge as in cloud computing, every component is online, which exposes potential vulnerabilities. Even the best teams suffer severe attacks and security breaches from time to time in a bank, which is a restraint to the market.

Cloud Security In Banking Market Trends

Cloud Email Security Software to Grow Significantly Over the Forecast Period

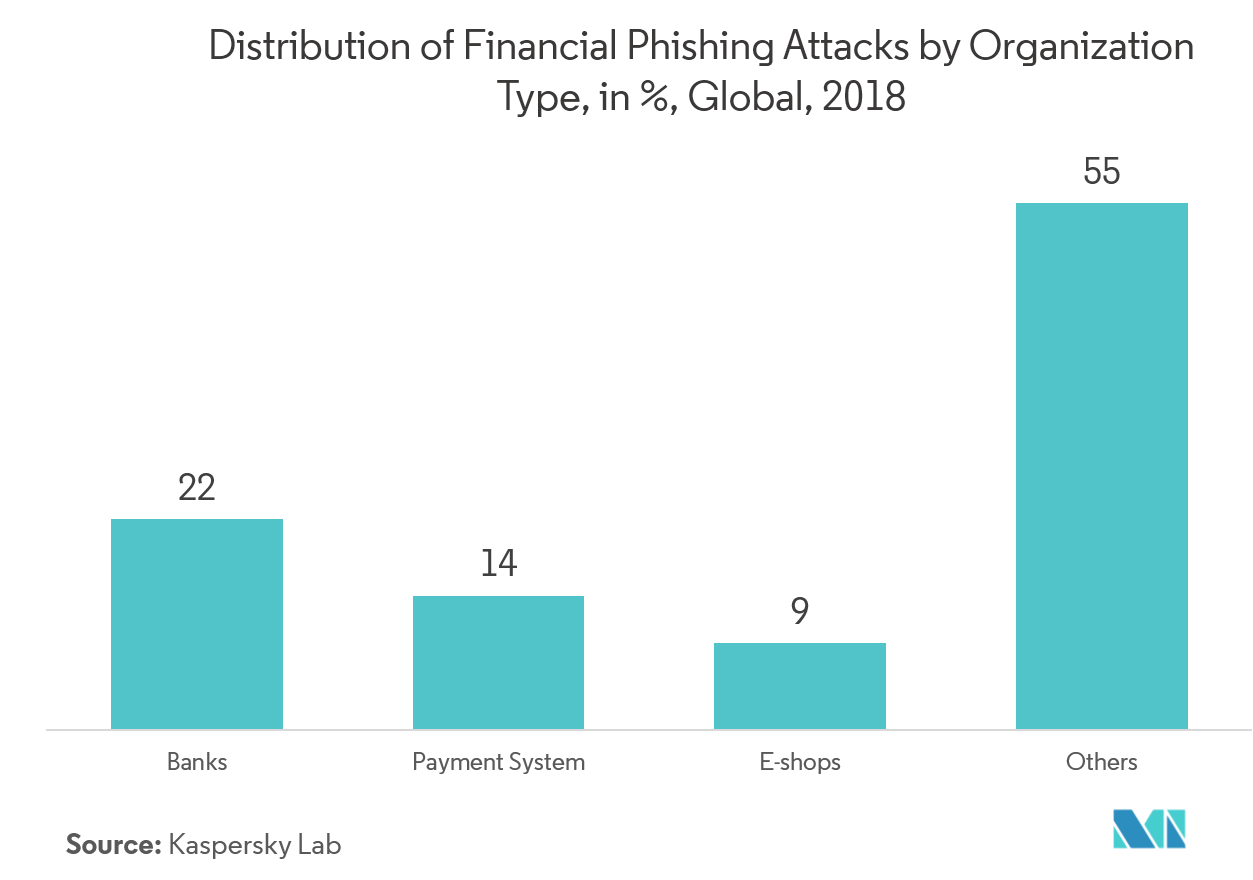

- The banking industry is one of the top targets of hackers using phishing attacks to breach security. According to Kaspersky Lab, in 2018, the number of users attacked with banking Trojans was 889,452, which was an increase of 15.9% in comparison with 767,072 in 2017, globally.

- Recently, in May 2019, the UK banking giant, TSB, experienced one of these phishing-related emergencies. The messages were crafted to resemble authentic communications and informed recipients that TSB Bank accounts had been suspended due to “recent technical and security issues” and account verification is needed by which 1,300 customers reported their bank accounts had been robbed of everything they owned.

- Owing to this rise in mail phishing in banking, where fraudulent e-mails can look like they come from a real bank e-mail address, the need for security has gained significant importance. Cisco Advanced Phishing Protection deploys as a lightweight sensor via the cloud or on-premise, where the sensor receives all messages considered clean by the secure email gateway and determines if the message is malicious or not in the banking.

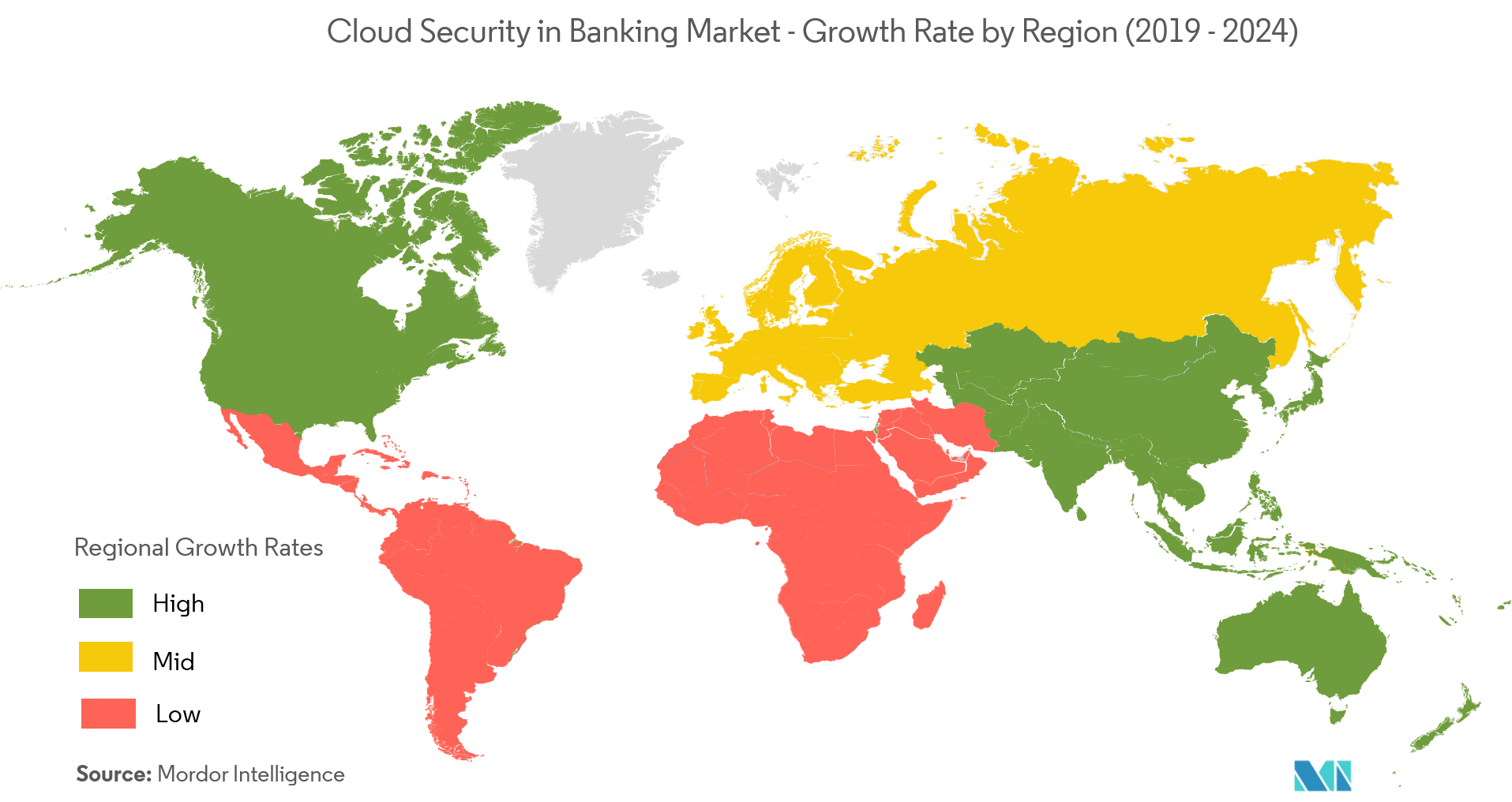

North America to Account for Significant Share

- North America is holding the highest share as the most number of data breaches in banks occur in this region. In July 2018, hackers used phishing emails to break into a Virginia bank in two separate cyber intrusions over eight months, making off with more than USD 2.4 million total. With rising cyberthreat, the need for cloud security software in North American banks is increasing which is driving the market.

- Most banks have begun to explore the cloud’s potential as a business building asset for transforming their operating and delivery models, clarifying requirements and governance issues and addressing regulatory and security issues in this region.

- Retail banks have been quick to explore cloud options. Accenture worked with a large bank in the United States to create a cloud architecture that would automate the conversion of data from multiple sources into useful insights for making business decisions and providing more security.

- Bank of America chooses the Microsoft Cloud to support digital transformation and help deliver new business efficiencies, support digital culture change, and meeting customer needs. Additionally, Bank of America is one such institution that won the best cloud initiative category at 2019 AFTAs for project Greenfield. The bank is aiming to host around 80 percent of its applications in its private cloud to secure all the customer data and give high cybersecurity.

Cloud Security In Banking Industry Overview

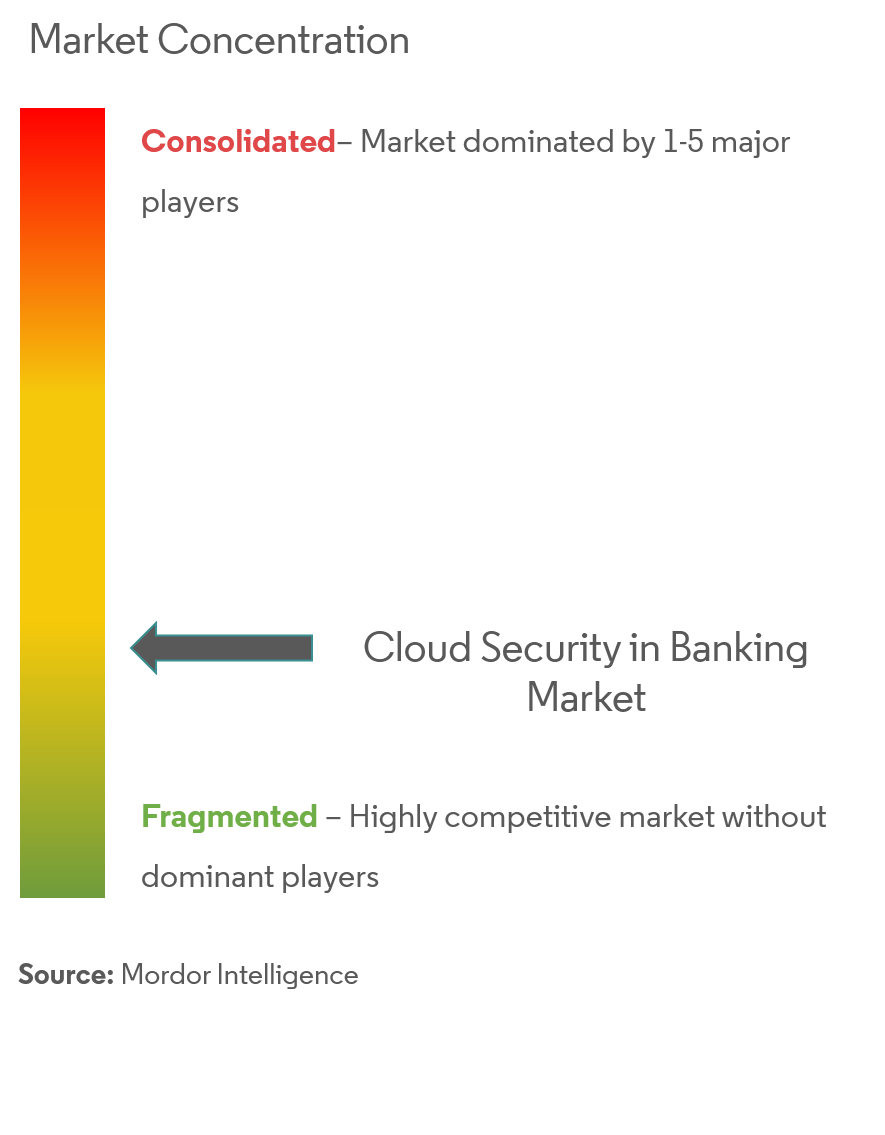

The cloud security in the banking market is moving toward the fragmented stage as the banking industry is experiencing a massive transformation, due to technological advancement, and the players are competing in providing the best solution to the banking and financial institutions. Key players are Google Cloud Platform, Salesforce, Vormetric, etc. The recent developments in the market are -

- April 2019 - Scotiabank’s platform VP shared Google's cloud-native approach for protecting personally identifiable information (PII) in Google Cloud Platform (GCP). The session will cover their considerations around access and bank application reidentification.

Cloud Security In Banking Market Leaders

-

Google Cloud Platform

-

Salesforce

-

Vormetric, Inc.

-

Boxcryptor

-

Trend Micro

- *Disclaimer: Major Players sorted in no particular order

Cloud Security In Banking Industry Segmentation

The cloud security in banking is required as the customers are now the driving force behind this sector and are forcing banks to try new business models. Banks can be benefited by deploying private cloud in the system with various cloud software such as cloud identity and access management software, cloud email security, etc.

| By Type of Software | Cloud Identity and Access Management Software |

| Cloud Email Security Software | |

| Cloud Intrusion Detection and Prevention System | |

| Cloud Encryption Software | |

| Cloud Network Security Software | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Cloud Security In Banking Market Research FAQs

What is the current Cloud Security in Banking Market size?

The Cloud Security in Banking Market is projected to register a CAGR of 33.1% during the forecast period (2025-2030)

Who are the key players in Cloud Security in Banking Market?

Google Cloud Platform, Salesforce, Vormetric, Inc., Boxcryptor and Trend Micro are the major companies operating in the Cloud Security in Banking Market.

Which is the fastest growing region in Cloud Security in Banking Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Cloud Security in Banking Market?

In 2025, the North America accounts for the largest market share in Cloud Security in Banking Market.

What years does this Cloud Security in Banking Market cover?

The report covers the Cloud Security in Banking Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Cloud Security in Banking Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Cloud Security In Banking Industry Report

Statistics for the 2025 Cloud Security in Banking market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cloud Security in Banking analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.