Certificate Testing Market Analysis

The Certificate Testing Market is expected to register a CAGR of 3.2% during the forecast period.

- International imports and exports of products belonging to different industries apart from the high demand, food and medical products have increased significantly over the years. In fact, according to The World Bank Group, global exports has increased from USD 6.24 trillion in 1995 to USD 22.99 trillion in 2018. Food and beverages, consumer electronics, agriculture, and automotive (electrical vehicles) markets are expected to provide more scope for the Certificate Testing market. So as to adapt to the diverse quality and safety standards of the import destinations, the need for effective testing, inspection, and certification has become critical for product manufacturers.

With significant certification work being outsourced, the independent TIC companies benefit from the high growth rates, operating margins, and reliable revenue streams. In addition to imports and exports, rapid technological advancement, which led to product diversity, and in some cases shorter life-cycles, is expected to increase the usage of certificate testing services. Going forward, as these technologies become mainstream, the dependency on certificate testing services is only going to increase, thus increasing the scope for Certificate Testing companies.

Certificate Testing Market Trends

Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period

The growing adoption of smart and wireless devices in the sector is also attracting many vendors to offer a range of product certification programs, for smart and wireless devices to help customers meet industry standards. These programs address a variety of technologies, including Bluetooth SIG, NFC Forum, LoRa Alliance, Sigfox, and GCF and PTCRB for cellular. These certifications are required if products leverage cellular and wireless technologies.

Products and Retail are expected to remain the fastest-growing segment, mainly due to the global expansion of online retail platforms. Personal care and beauty products, softlines and accessories, electrical and electronics, hard goods, toys, and juvenile products are significant fields, which TIC vendors are targeting.

The expanding scope of online payment services with standards, like EMV Co/ Visa, are also driving the need for TIC services. Mobile and wearables, point of sales terminals, cards and payment vendors, banks, and ICTK Payment & Finetech offer scopes of these services. According to the industry expert, about 25% of all product returns in the online retail market are mainly due to poor or unexpected quality. These factors are attracting market vendors to cater to innovative services for these cases.

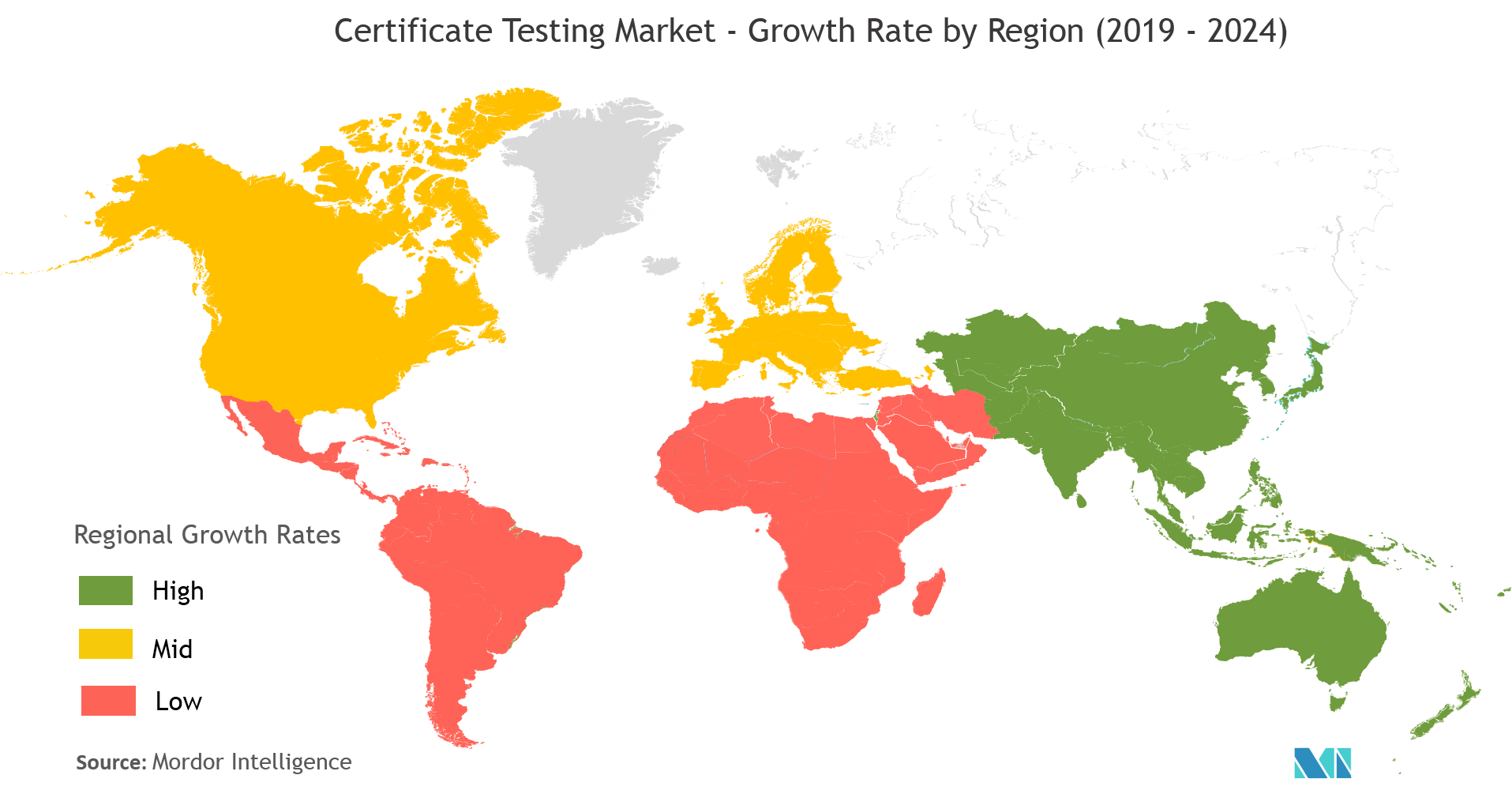

APAC is Expected to Account for the Largest Market Share During the Forecast Period

- The growth of the certification market in APAC is driven by a combination of regulatory and economic determinants. Furthermore, investments in new technologies are sizeable and are likely to continue growing on the back of the rising global competition. Moreover, the governments of several countries in APAC are boosting investments by private actors in the technology area, which would lead to the enhanced application of independent certification services.

- Emerging markets, such as China, have become attractive, through the development of indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization. Additionally, the rise of the middle class has led to an increase in private consumption and demand for both safety and product quality. This, in turn, offers growth opportunities in areas, such as food and consumer goods testing. One such example is the acquisition of TUV Rheinland’s food analysis laboratories in China.

- Similar to many Asia-Pacific countries, South Korea has very limited domestic oil and gas resources. Every year, more than 98% of the fossil needs in the country is met by imported fuels. Sustainability in architecture is one of the critical factors among Korean design and engineering firms. Rising awareness about global warming and the limitation of resources pushed the government to adopt building codes, demanding high energy-efficient buildings for new constructions as well as existing infrastructure, thus fueling the growth of the Certificate Testing market.

Certificate Testing Industry Overview

Certificate Testing Market is moderately competitive and consists of several prominent players. In terms of market share, few of these major players currently dominate the market.Moreover, the level of engagement among the vendors will strengthen in the following years to come, due to limited product differentiation and underpricing strategy of the local and the regional vendors. The companies operating in the market are leveraging on strategic collaborative initiatives, to offer specialized products, increase their market share and increase their profitability.

- Feb 2019 -Intertek opened a 70,000 sq.ft. building and construction laboratory in Fridley, Minnesota. Through this, the company aims to offer customers systemic assurance, testing, inspection, and certification (ATIC) solutions which include full-scale, indoor mockup capabilities, air/water/structural testing, impact and pressure cycle testing, field testing, and acoustical field testing among others.

- May 2018 -SGS launched a new approach to certification utilization through which it utilizes data to develop custom business enhancement solutions. This enhancement meets the needs of organizations to overcome a variety of operational and business challenges.

Certificate Testing Market Leaders

-

Intertek Group plc

-

Bureau Veritas S.A.

-

Underwriters Laboratories (UL)

-

SGS S.A.

-

Eurofins Scientific SE

- *Disclaimer: Major Players sorted in no particular order

Certificate Testing Industry Segmentation

Certificate testing is the regular procedure by which an accredited or approved person or agency evaluates and verifies (and attests in writing by issuing a certificate) the properties, features, quality, requirement, or status of individuals or corporations, procedures or processes, goods or services, or events or situations, in accordance with authorized requirements or standards.

| By Sourcing Type | In-house | ||

| Outsourced | |||

| By End-user Vertical | Construction and Engineering | ||

| Chemicals | |||

| Food and Healthcare | |||

| Energy and Commodities | |||

| Transportation | |||

| Products and Retail | |||

| Industrial | |||

| Other End-user Vertical | |||

| Geography | North America | US | |

| Canada | |||

| Europe | UK | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| South Korea | |||

| India | |||

| Rest of Asia-Pacific | |||

| Rest of the World | |||

Certificate Testing Market Research FAQs

What is the current Certificate Testing Market size?

The Certificate Testing Market is projected to register a CAGR of 3.2% during the forecast period (2025-2030)

Who are the key players in Certificate Testing Market?

Intertek Group plc, Bureau Veritas S.A., Underwriters Laboratories (UL), SGS S.A. and Eurofins Scientific SE are the major companies operating in the Certificate Testing Market.

Which is the fastest growing region in Certificate Testing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Certificate Testing Market?

In 2025, the Asia Pacific accounts for the largest market share in Certificate Testing Market.

What years does this Certificate Testing Market cover?

The report covers the Certificate Testing Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Certificate Testing Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Certificate of Testing Industry Report

Statistics for the 2025 Certificate Testing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Certificate Testing analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.