Ceramic Coatings Market Analysis by Mordor Intelligence

The Ceramic Coatings Market is expected to register a CAGR of greater than 7.5% during the forecast period.

- The aerospace and defense segment dominated the market and is likely to grow during the forecast period, owing to the increasing demand and production of commercial and military aircraft.

- The alternatives to cadmium and PTFE coatings and the development of new applications and spray processes are likely to provide opportunities for the market studied during the forecast period.

Global Ceramic Coatings Market Trends and Insights

Aerospace and Defense Segment to Dominate the Market Demand

- Aerospace and defense is the end-user industry that has the largest application of thermal sprayed ceramic coatings. Ceramic coatings are being preferred, owing to their properties, such as corrosion protection and friction reduction.

- These are extensively used as protective coatings, in order to protect the aircraft components and repair the old ones. The various airplane components, like engines, rotors, and other mechanical parts, require hard and wear-resistant coatings that can withstand high temperatures, therefore, they use ceramic coatings.

- They are used for coating the aerospace turbine components, engine components, and actuation systems, in order to provide high thermal, wear, and corrosion resistance, and longevity.

- With the increasing security concerns and increasing commercial use of aircraft as a medium of conveyance, the demand for aircraft has been increasing across the world. With this, various aircraft production orders have been lined up for delivery in the coming years.

- For instance, according to Boeing, by 2038,the deliverables of commercial aircraftare expected to reach about17,390 units in the Asia Pacific,9,130 units in North America and about8,990 units in Europe.

- Hence, with the production of aircraft to deliver the aircraft orders from the defense as well as the aviation industry, the demand for ceramic coatings is projected to increase worldwide, during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region dominated the global market share. The increasing investments and production in the end-user industries, such as aerospace and defense, electronics, automotive, etc., are driving the demand for ceramic coatings in the region.

- The Asia-Pacific region consists of 4 of the top 10 countries in terms of defense spending. The spending is increasing in recent years with the rise in terrorism and rising security concerns in the region. China is just behind the United States in terms of defense spending.

- China is the largest producer of aircraft in the region and invests heavily in R&D and innovation in the field of aerospace and defense.

- China holds the world's largest industrial manufacturing base and is the largest automotive and electronic producer in the world. The country not only supports the domestic demand but also caters to the demand in international markets. Thus, with the growing demand for electronic products, and automobiles worldwide, there is an increase in the industrial output in China.

- Besides, countries, like India and South Korea, are also witnessing a substantial increase in the demand for ceramic coatings.

- In India and South Korea, increasing investments and production in the electronics industry, and increased defense spending are driving the demand for ceramic coatings.

- Besides, countries, such as India, Indonesia, Malaysia, and Thailand, have been witnessing an increase in investment and production in the automotive industry, which is further likely to increase the consumption of ceramic coatings in these countries.

- Thus, all such factors are expected to drive the demand for the market for ceramic coatings in the region, during the forecast period.

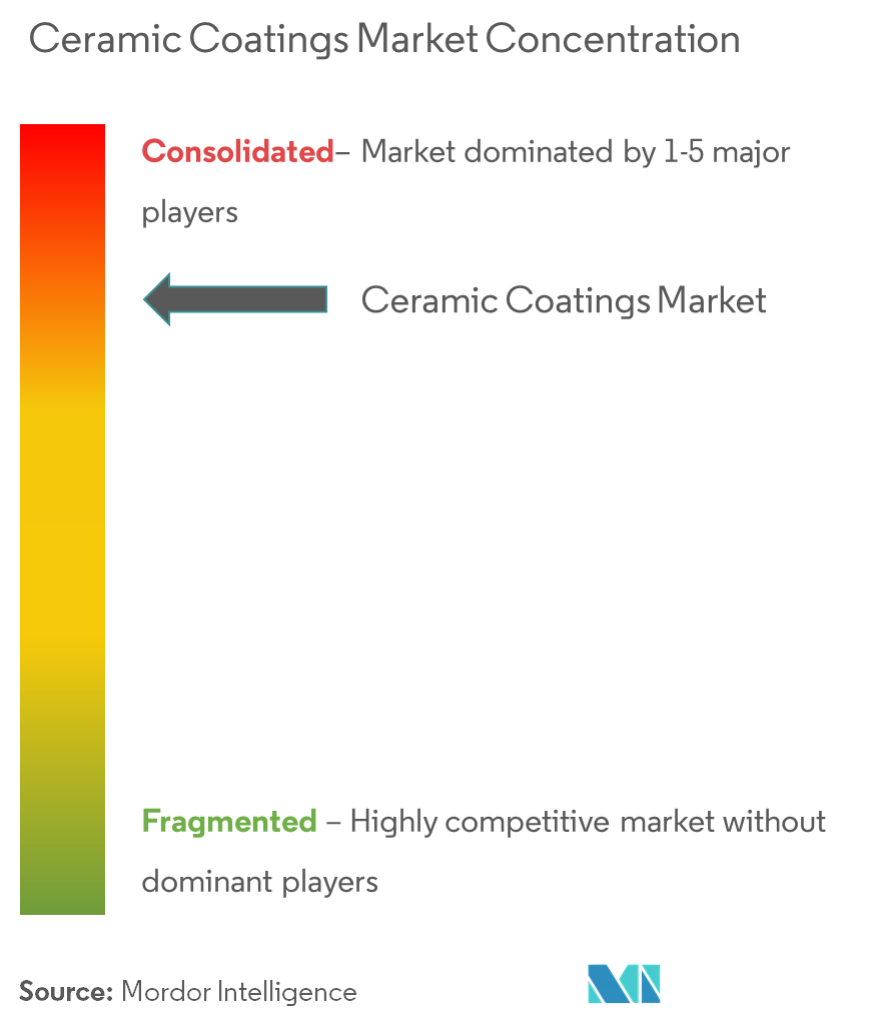

Competitive Landscape

The ceramic coatings market is a moderately consolidated market, where few players account for a significant share of the market demand. Some of the major players in the market include A&A Thermal Spray Coatings, APS Materials Inc., DuPont, Saint-Gobain, and Praxair S.T. Technology Inc., among others.

Ceramic Coatings Industry Leaders

-

A&A Thermal Spray Coatings

-

APS Materials Inc.

-

DuPont

-

Saint-Gobain

-

Praxair S.T. Technology Inc.

- *Disclaimer: Major Players sorted in no particular order

Global Ceramic Coatings Market Report Scope

The ceramic coatings market report includes:

| Carbide |

| Nitride |

| Oxide |

| Other Types |

| Thermal Spray |

| Physical Vapor Deposition |

| Chemical Vapor Deposition |

| Atmospheric Outer Spray |

| Other Technologies |

| Aerospace and Defense |

| Transportation |

| Healthcare |

| Energy and Power |

| Industrial |

| Other End-user Industries |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East & Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle East & Africa |

| Type | Carbide | |

| Nitride | ||

| Oxide | ||

| Other Types | ||

| Technology | Thermal Spray | |

| Physical Vapor Deposition | ||

| Chemical Vapor Deposition | ||

| Atmospheric Outer Spray | ||

| Other Technologies | ||

| End-user Industry | Aerospace and Defense | |

| Transportation | ||

| Healthcare | ||

| Energy and Power | ||

| Industrial | ||

| Other End-user Industries | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| North America | United States | |

| Canada | ||

| Mexico | ||

| Europe | Germany | |

| United Kingdom | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| South America | Brazil | |

| Argentina | ||

| Rest of South America | ||

| Middle East & Africa | Saudi Arabia | |

| South Africa | ||

| Rest of Middle East & Africa | ||

Key Questions Answered in the Report

What is the current Ceramic Coatings Market size?

The Ceramic Coatings Market is projected to register a CAGR of greater than 7.5% during the forecast period (2025-2030)

Who are the key players in Ceramic Coatings Market?

A&A Thermal Spray Coatings, APS Materials Inc., DuPont, Saint-Gobain and Praxair S.T. Technology Inc. are the major companies operating in the Ceramic Coatings Market.

Which is the fastest growing region in Ceramic Coatings Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Ceramic Coatings Market?

In 2025, the Asia Pacific accounts for the largest market share in Ceramic Coatings Market.

What years does this Ceramic Coatings Market cover?

The report covers the Ceramic Coatings Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Ceramic Coatings Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Ceramic Coatings Market Report

Statistics for the 2025 Ceramic Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Ceramic Coatings analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.