Cattle Feed Market Analysis

The Cattle Feed Market size is estimated at USD 90.52 billion in 2025, and is expected to reach USD 107.51 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

The global cattle feed market plays a crucial role in the agricultural sector, supporting the production of beef and dairy products that are integral to the global food system. This market encompasses a wide range of feed products and additives designed to optimize cattle health, growth, and productivity. This market is driven majorly due to the rising demand for cattle-based products in the world. According to the USDA Foreign Agricultural Service, the consumption of milk in India grew from 202.4 million metric tons in 2022 to 207.4 million metric tons in 2023. As the demand for meat and dairy continues to rise, the cattle feed market is also expanding supporting the market growth.

Government subsidies and financial assistance have contributed to the increased availability and affordability of cattle feed. Similarly, the Indian government provides subsidies on certain feed ingredients and feed formulations. For instance, an amount of Rs 500 lakh (USD 60 thousand) was allocated under the Cattle Feed Subsidy Programme 2022-2023 scheme. This is used for the distribution of natural feed components i.e. distributing green grass and dried fodder at a subsidized rate. Further cattle feed mineral supplements are being distributed at subsidized rates and adoption of calves for rearing. This has enabled more farmers to access high-quality feed, thereby improving cattle health and productivity further boosting the market.

Along with this, the feed sector is rapidly advancing, driven by technological innovations. Innovations in feed technology, such as precision feeding and advanced nutritional formulations, contribute to better feed efficiency and cattle performance. For instance, in 2024, Precision Livestock Technologies (PLT), a leading provider of software and hardware solutions related to livestock feeding and health, introduced the first system that uses artificial intelligence (AI) to predict cattle feed intake and make feeding recommendations. These advancements help optimize the nutritional value of feed and reduce waste thereby supporting the market growth. Therefore, the growing demand for meat and milk coupled with government support and the advancement of feeding technologies are driving the market growth.

Cattle Feed Market Trends

Cereals Segment Leads the Market

Cereal grains have long been essential in livestock nutrition, particularly for cattle feed. These grains are used both as whole plant forage and as feed grains. Their high energy content makes them crucial, especially in systems aimed at maximizing growth rates or milk production. Corn is a primary choice due to its high starch content, providing readily available energy. Additionally, barley and oats offer a more balanced energy profile and are often combined with other feeds to optimize nutritional intake.

Along with this, corn, barley, wheat, oats, and rye, are majorly used in cattle feeds as they provide essential nutrients that support growth, reproduction, and overall health in cattle, aiding segment growth. The growing area under these crops fuels the market growth. As per FAOSTAT, the production of barley in the world grew from 145 million metric tons to 154 million metric tons from 2021 to 2022. Similarly, Cereal grains serve as concentrated energy sources in the cattle feeding sector, especially in finishing rations, where they can constitute up to 90% of the nation's dry matter. This significant dependence on cereals for energy stems largely from their cost-effectiveness as they usually offer a lower cost per unit of dietary energy compared to other readily available feed sources.

Furthermore, the rise of cereal-based feed mills serving cattle is driving the market's growth. For example, in 2023, a new feed mill commenced operations in Kidapawan City, located on Mindanao's southern main island in the Philippines. This facility processes corn and rice, creating diets for various livestock, including cattle. Additionally, the European Union (EU) contributed USD 119 thousand towards the feed mill's construction. Therefore, the high nutritional value, competitive pricing and the expansions of the cereal grains feeding mills make cereals attractive feed sources for cattle.

North America Dominates the Market

The cattle feed market in North America, including the United States and Canada, is substantial due to high cattle inventories and advanced farming practices. The market has shown steady growth driven by increasing demand for beef and dairy products in the countries. The per capita consumption of beef in Canada is observed to be growing from 26.2 kgs to 26.8 kgs from 2021 to 2022, according to Statistics Canada. Despite the growing consumption, the production of beef is reducing in the country. As per Statistics Canada, beef production dropped from 1.38 million metric tons to 1.29 million metric tons in 2022. This shortfall amplifies the need for imports and underscores the urgency to boost local production, subsequently bolstering the cattle feed market.

The United States cattle feed market is vast, driven by extensive beef and dairy cattle farming, technological advancements in feed production, and a heightened emphasis on sustainable, eco-friendly feeding practices. For example, data from the United States Department of Agriculture indicates that the United States milk cow population increased from 9.33 million in 2019 to 9.38 million in 2023. This growing dairy cattle population underscores the demand for high-quality feed, essential for boosting milk production and, consequently, propelling market growth.

Moreover, companies in the animal nutrition sector are strategizing to broaden their reach and ensure high-quality feed for animals, including cattle. For example, in 2022, the Buhler Group formed a joint venture with IMDHER S.A. de C.V., a prominent player in Mexico's animal nutrition market. This move focuses on enhancing process efficiency, quality, and sustainability in the feed industry, particularly for cattle. Consequently, the surging demand for cattle-based products, combined with escalating farming activities and proactive measures by key industry players, is propelling the market's growth during the forecast period.

Cattle Feed Industry Overview

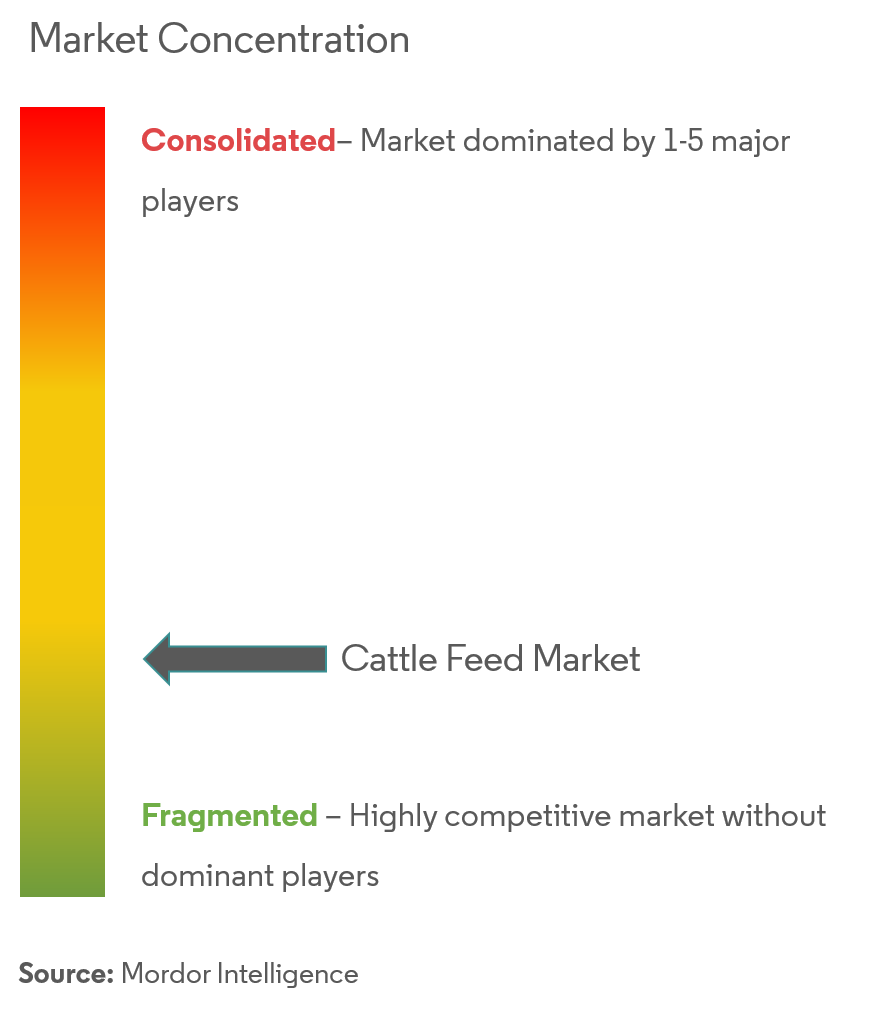

The cattle feed market is highly fragmented, with numerous local and regional players vying for increasing market shares in a market that has a strong presence of multinational players. Archer Daniels Midland, Cargill Inc., Land O' Lakes Inc., De Heus, and ForFarmers are some of the major players in the market. The fragmented supply of raw materials and the geographically dispersed consumer group in developing markets provide significant opportunities for local feed manufacturers to maintain a niche group of customers.

Cattle Feed Market Leaders

-

Cargill Inc.

-

Archer Daniels Midland Company

-

ForFarmers Inc.

-

De Heus

-

Land O'Lakes, Inc.

- *Disclaimer: Major Players sorted in no particular order

Cattle Feed Market News

- April 2024: M Marks & Spencer has launched a novel feed supplement aimed at pasture-grazed dairy cows, to reduce the carbon footprint of the retailer's fresh milk. This innovative feed additive, derived from corn fermentation and mineral salts, inhibits the formation of methane by digestive enzymes and is naturally metabolized in the cows' stomachs.

- January 2024: DSM, the leading innovator in nutrition, health and beauty received market authorization for Bovaer in Canada for use with dairy and beef cattle. This feed ingredient enables dairy and beef farmers to substantially lower their carbon footprint.

- August 2023: Gramik, India's pioneering Peer Commerce platform in AgriTech, has unveiled three innovative cattle food supplements: 'Doodh Sagar', 'Heifer Mix', and 'Urja Pashu PoshakAahar'. These products empower Indian livestock farmers, making high-quality cattle food supplements both accessible and affordable.

Cattle Feed Industry Segmentation

Cattle feed contains protein, energy, minerals, and vitamins required for the growth, maintenance, and milk production of animals. For this report, only commercial cattle feed has been considered. The Cattle Feed Market is Segmented by Animal Type (Dairy Cattle, Beef Cattle, and Other Cattle), Ingredient (Cereals, Cakes and Mixes, Food Wastages, Feed Additives, and Other Ingredients), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers market size and forecasts for cattle feed in terms of value (USD) for all the above segments.

| Animal Type | Dairy Cattle | ||

| Beef Cattle | |||

| Other Cattle Types | |||

| Ingredient | Cereals | ||

| Cakes and Mixes | |||

| Food Wastages | |||

| Feed Additives | |||

| Other Ingredients | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Spain | |||

| Russia | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| Australia | |||

| Rest of the Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Africa | South Africa | ||

| Rest of Africa | |||

Cattle Feed Market Research FAQs

How big is the Cattle Feed Market?

The Cattle Feed Market size is expected to reach USD 90.52 billion in 2025 and grow at a CAGR of 3.5% to reach USD 107.51 billion by 2030.

What is the current Cattle Feed Market size?

In 2025, the Cattle Feed Market size is expected to reach USD 90.52 billion.

Who are the key players in Cattle Feed Market?

Cargill Inc., Archer Daniels Midland Company, ForFarmers Inc., De Heus and Land O'Lakes, Inc. are the major companies operating in the Cattle Feed Market.

Which is the fastest growing region in Cattle Feed Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Cattle Feed Market?

In 2025, the North America accounts for the largest market share in Cattle Feed Market.

What years does this Cattle Feed Market cover, and what was the market size in 2024?

In 2024, the Cattle Feed Market size was estimated at USD 87.35 billion. The report covers the Cattle Feed Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Cattle Feed Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Cattle Feed Industry Report

Statistics for the 2025 Cattle Feed market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cattle Feed analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.