Canada Oil & Gas Pipeline Services Market Analysis

The Canada Oil and Gas Pipeline Services Market is expected to register a CAGR of less than 1% during the forecast period.

- The repair services are expected to the fastest-growing segment during the forecast period owing to aging pipelines in the country and increasing demand for energy.

- The upcoming oil and gas projects, such as Trans Mountain Expansion Project, TransCanada Keystone XL and Enbridge Line 3 Replacement Project (part of Enbridge Mainline) are expected to create tremendous market opportunities in years to come.

- Western Canada is the largest market mainly due to the presence of an extensive network of oil and gas pipeline across the region and beyond the borders to the US refineries.

Canada Oil & Gas Pipeline Services Market Trends

Increasing Demand for Repair Services

- Among the service type, repair services account for the largest market share, followed by drying and inspection services. The presence of a significant network of aging pipelines has been driving the demand for repair services, such as corrosion prevention.

- The repair and maintenance services include hot tapping, repair clamp, strap clamp, leak repair, and pipe lifting and handling services.

- Canada is witnessing an increasing demand for natural gas, particularly in the power sector. Any disruption in the gas supply can cause disruption in power generation, which, in turn, can affect gas suppliers, power industry, along with the manufacturing sector, in a region. Therefore, with a rising share of gas consumption, the demand for hot tapping from the gas pipeline operators in the region, is expected to grow substantially during the forecast period.

- Other repair and maintenance services are mainly used for repairing or replacing the damaged pipelines. The requirement of these services is generally unplanned. Moreover, the major consumer for these services is the aging pipeline network as the aging pipelines are more prone to unplanned damages.

- Moreover, as a significant fraction of the Canadian pipeline infrastructure is quite old, the probability of unplanned servicing requirement is pretty high, which is a positive indicator for the segment of the market being studied.

Western Canada to Dominate the Market

- Western Canada is the largest market mainly due to the presence of an extensive network of oil and gas pipeline across the region and beyond the borders to the US refineries. Due to strict government regulations and lack of social acceptance in the region toward crude oil pipeline the market is shifting toward the natural gas pipeline.

- Alberta and Quebec are in talks to develop a 750 km pipeline, which will carry natural gas from Alberta, across northern Ontario, and through the Abitibi region to a natural gas liquefaction complex at Port Saguenay.

- The aim is to export 11 million metric ton of LNG per year from Western Canada. The project is worth USD 13 billion and is expected to create ample opportunity for pipeline services, such as pre-commissioning and commissioning, and pigging services in the coming years.

- Surging crude oil production and limited space for export pipelines have encouraged the producers to sell the crude oil at a record low relative to world benchmark. The Government of Alberta has announced a mandatory province-wide 8.7% production cut to keep the prices from falling further.

- This is expected to allow the WCS prices to recover and encourage the investors in the long run to invest in new projects, and drive the demand for pipeline services in the coming years.

- Furthermore, the Government of Alberta is planning to build a new refinery to process the discounted crude oil, and sell the high value refined product to the international market. This is expected result in demand for the new pipeline project, and in turn, pipeline services.

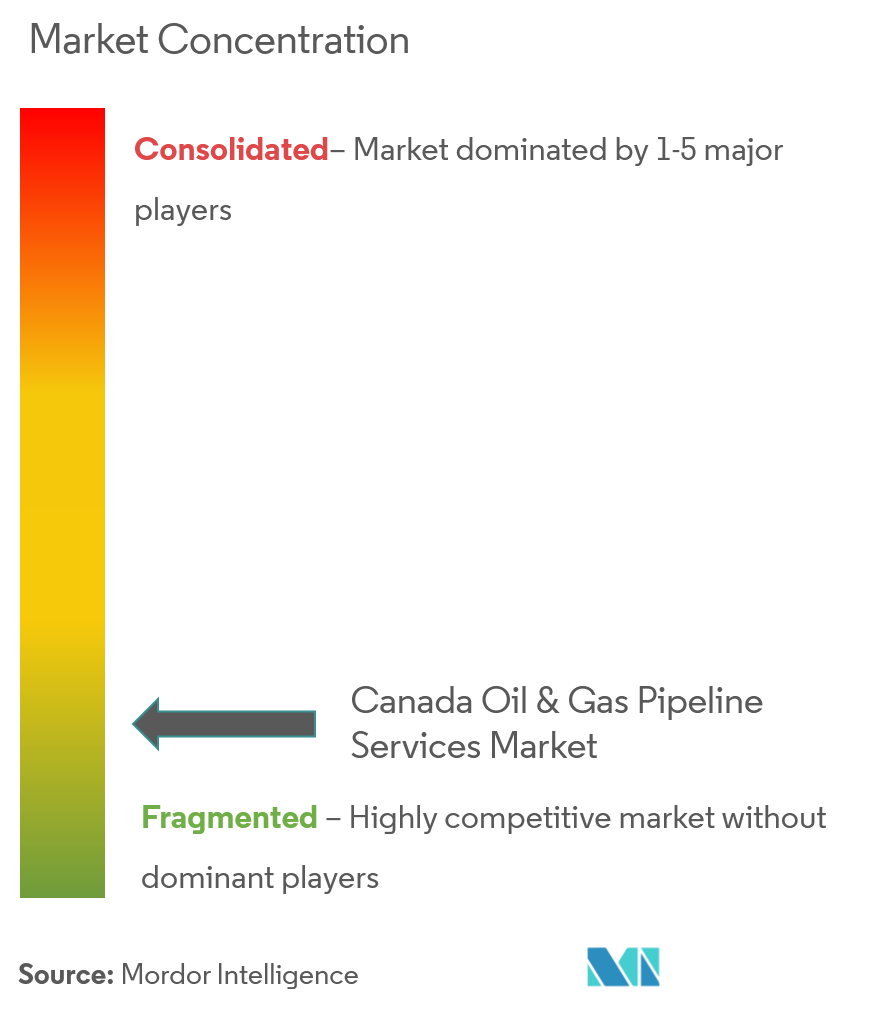

Canada Oil & Gas Pipeline Services Industry Overview

The Canada oil and gas pipeline services market is partially fragmented and the key oil & gas pipeline service providers in the market include Baker Hughes a GE Co., Tenaris SA, Tetra Tech Inc., Mistras Group Inc., and Trican Well Services Ltd.

Canada Oil & Gas Pipeline Services Market Leaders

-

Tenaris SA

-

Tetra Tech Inc.

-

Mistras Group Inc.

-

Trican Well Services Ltd

-

Baker Hughes Co.

- *Disclaimer: Major Players sorted in no particular order

Canada Oil & Gas Pipeline Services Industry Segmentation

The Canada oil and gas pipeline services market report include:

| Service Type | Pre-commissioning and Commissioning Services | ||

| Pigging and Cleaning Services | Intelligent Pigging | ||

| Caliper Pigging | |||

| Mechanical Cleaning | |||

| Inspection Services (Excluding Pigging) | Hydro Testing | ||

| Other Inspection Services | |||

| Flushing and Chemical Cleaning Services | Chemical Cleaning | ||

| Chemical Inhibitors | |||

| Other Flushing and Chemical Cleaning Services | |||

| Drying Services | Air Drying | ||

| Nitrogen Drying (Nitrogen Purging and Nitrogen Fill) | |||

| Vacuum Drying | |||

| Repair Services | Hot Tapping | ||

| Other Repair Services | |||

| Decommissioning Services | |||

| Sector | Upstream | ||

| Midstream | |||

| Downstream | |||

| Geography | Western Canada | ||

| Eastern Canada | |||

Canada Oil & Gas Pipeline Services Market Research FAQs

What is the current Canada Oil and Gas Pipeline Services Market size?

The Canada Oil and Gas Pipeline Services Market is projected to register a CAGR of less than 1% during the forecast period (2025-2030)

Who are the key players in Canada Oil and Gas Pipeline Services Market?

Tenaris SA, Tetra Tech Inc., Mistras Group Inc., Trican Well Services Ltd and Baker Hughes Co. are the major companies operating in the Canada Oil and Gas Pipeline Services Market.

What years does this Canada Oil and Gas Pipeline Services Market cover?

The report covers the Canada Oil and Gas Pipeline Services Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Canada Oil and Gas Pipeline Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Canada Oil and Gas Pipeline Services Industry Report

Statistics for the 2025 Canada Oil and Gas Pipeline Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Canada Oil and Gas Pipeline Services analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.