Cable Tags Market Size and Share

Cable Tags Market Analysis by Mordor Intelligence

The Cable Tags Market is expected to register a CAGR of 5.77% during the forecast period.

- The market for automation is increasing at a significant rate, owing to its adoption in industrial and urban use. Automation uses a large number of components, such as switchgear, relays, HVAC systems, human-machine interface (HMI,) and IT systems, which are connected through wires or cables.

- These cables may be small in size, ranging from 0.5 sq. mm to 35 sq. mm. Tracking the exact wire connection in an automation system is a challenging task for any skilled professional. Thus, the use of a cable tag has become an important component in the cable management process.

- Moreover, recently, data centers are growing drastically. With the rise in cloud computing, social media, big data, online gaming, and other online applications, there is a constant need for enhanced IT infrastructure that caters to the ever-increasing demand for resources; a factor that further supplements the demand for hyperscale data centers.

Global Cable Tags Market Trends and Insights

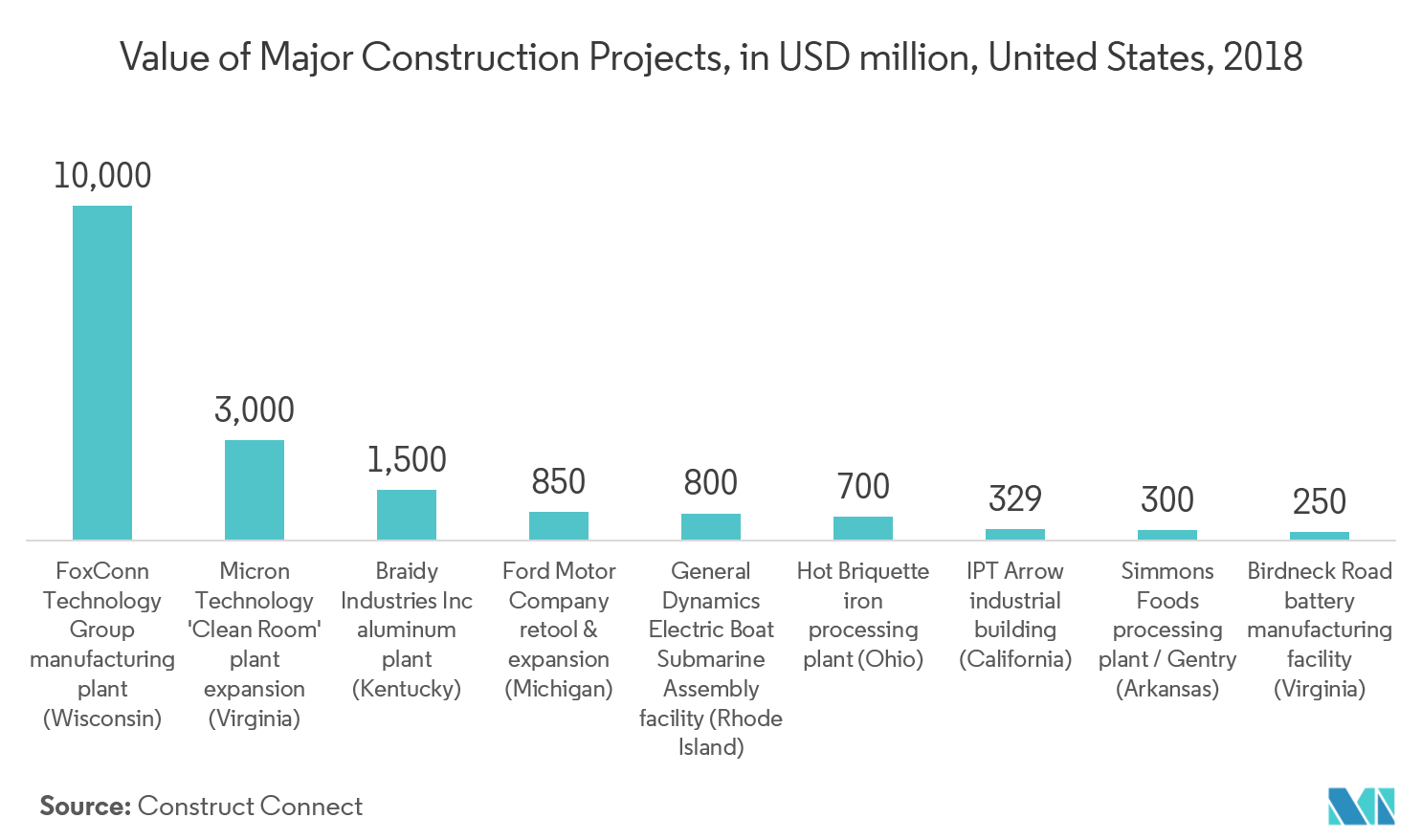

Manufacturing Occupies Major Share in the Cable Tag End-user Industry

- Manufacturers across various industries must identify parts, cartons, pallets, and shipments. This requires labeling, coding, and marking on a wide range of products and packaging systems, without sacrificing line speed.

- Cable tags are able to withstand high temperature and harsh weather condition so that the printing on the tag does not fade away, which is necessary for the manufacturing sector. Cable tag companies are now finding innovative ways to resolve this problem.

- Furthermore, continuous self-adhesive label stocks are ideal for warehouse and pipe marking. Self-adhesive labels are being used for asset labeling, removable asset tracking, temporary tracking labels, warehouse labeling, pipe marking, wire and cable identification, and secure identification of component parts and circuit boards.

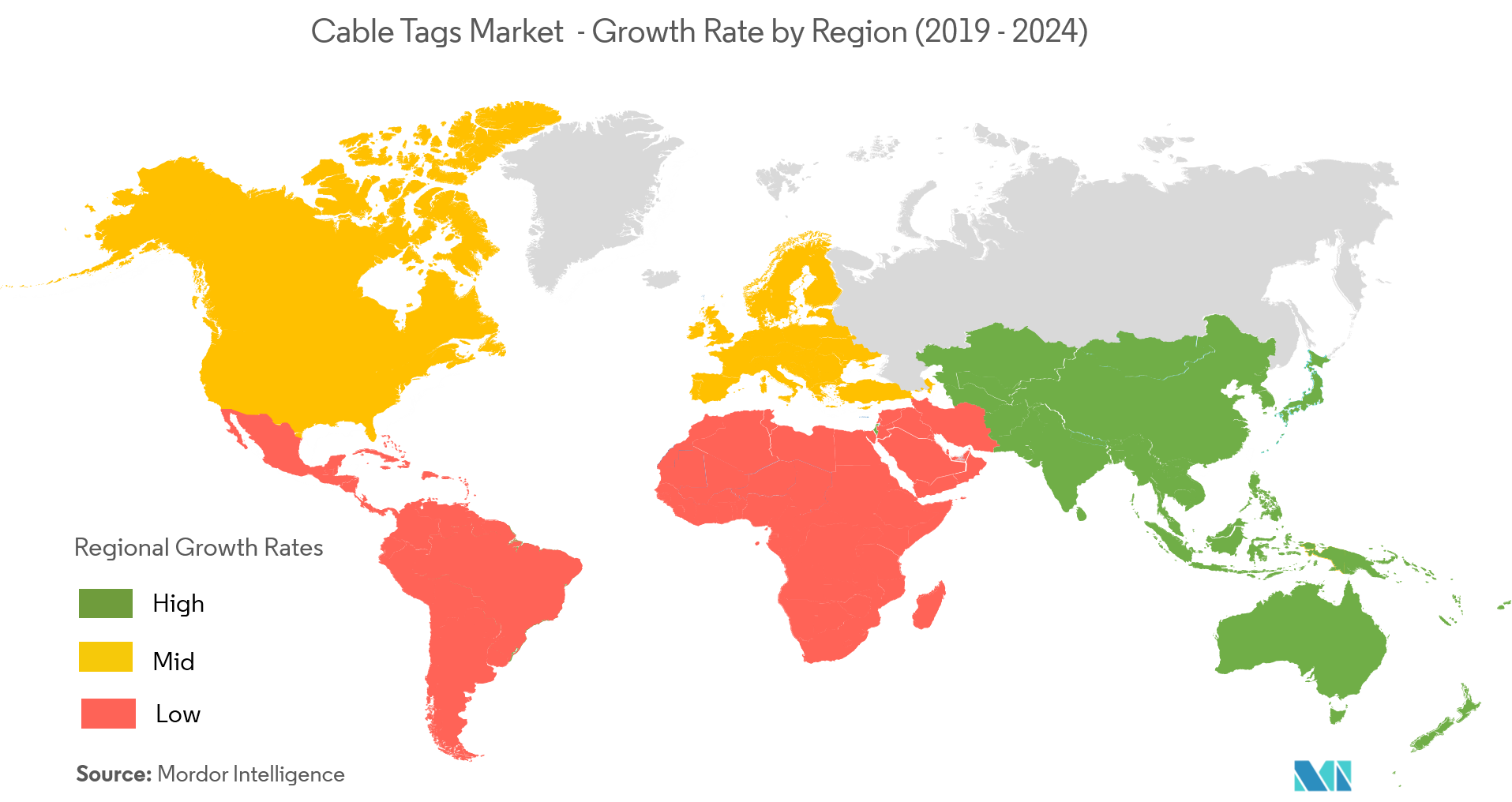

Asia-Pacific is Expected to Witness Highest Growth Rate

- China is one of the major players in the global cable tags market, mainly due to a high rate of investment in industrial automation and also due to growing local manufacturing production. The need to track the exact wire connection in an automation system is boosting the demand for cable tags.

- According to the National Bureau of statistics, China’s industrial output grew by 6.1% in 2018. The growth is expected to sustain as a result of the increase in retail sales of industrial products by about 10.4%. These factors are also acting as a significant driver for automation in the country.

- The Indian manufacturing sector is one of the highest growth sectors, registering a 7.9% year-on-year growth. The Make in India initiative plans to make India equally attractive for domestic and foreign players, and give global recognition to the Indian economy. By the end of 2020, the Indian manufacturing sector is expected to touch USD 1 trillion.

- Japan is becoming an automated industrial economy, and the advancement in Industrial version 4.0 is taking up at a faster pace in the country. The country has emerged as the manufacturing hub for the factory automation products, supplying them to another regional market in the Asia-Pacific region.

- The Olympic games that are to be held in Japan in 2020 has accelerated the pace of public and private sector investment in construction projects. Even the government efforts to revitalize the economy by focusing on infrastructure development are expected to provide momentum to the construction industry's growth. As the adoption of cable tags are vital in infrastructure, this is expected to impact the market for cable tags.

Competitive Landscape

- August 2017 - TE Connectivity acquired Hirschmann Car Communication, a company that provides antennas, antenna systems, and broadcast tuners for automotive and commercial vehicle applications. The acquisition expands TE Connectivity’s product portfolio as well as the integrated and highly engineered solutions provided for connected and autonomous vehicles, worldwide. Hirschmann Car Communication’s strong R&D and engineering capabilities in electronics and software development allow the company to further strengthen its global leadership position in automotive sensing and connectivity.

Cable Tags Industry Leaders

-

TE Connectivity Ltd

-

Brady Corporation

-

ZipTape Label ID Systems

-

Novoflex Marketing Ltd

-

Panduit Corporation

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

X

Global Cable Tags Market Report Scope

A cable tag is a label representing the information or a serial number on a particular wire to which, a component is connected. A cable tag can be pasted or inserted as a ferrule on the cable. Cable tags come in various types, such as ferrule tags, sleeveless-based tag, sleeve-based tag, tie-based tag, wrap-around label tag, and heat shrinkable tag. A ferrule tag is a small and medium plastic bracelet, which is inserted at the end of the cable. Ferrules are available in the form of numbers and alphabets, separately.

| Metallic |

| Non-metallic |

| IT and Telecom |

| Construction |

| Power and Utilities |

| Manufacturing |

| Other End Users |

| North America |

| Europe |

| Asia Pacific |

| Rest of the World |

| By Type | Metallic |

| Non-metallic | |

| By End User | IT and Telecom |

| Construction | |

| Power and Utilities | |

| Manufacturing | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Key Questions Answered in the Report

What is the current Cable Tags Market size?

The Cable Tags Market is projected to register a CAGR of 5.77% during the forecast period (2025-2030)

Who are the key players in Cable Tags Market?

TE Connectivity Ltd, Brady Corporation, ZipTape Label ID Systems, Novoflex Marketing Ltd and Panduit Corporation are the major companies operating in the Cable Tags Market.

Which is the fastest growing region in Cable Tags Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Cable Tags Market?

In 2025, the Asia Pacific accounts for the largest market share in Cable Tags Market.

What years does this Cable Tags Market cover?

The report covers the Cable Tags Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Cable Tags Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Cable Tags Market Report

Statistics for the 2025 Cable Tags market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cable Tags analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.