Cable Duct Market Size and Share

Cable Duct Market Analysis by Mordor Intelligence

The Cable Duct Market is expected to register a CAGR of 4.55% during the forecast period.

- Cable ducts are mainly used as raceways for cables and wires within electrical enclosures. Cable ducts, along with conduit, wiring ducts, wire ways, and cable carriers, are frequently used as essential components of a cable management system. Growing investments in infrastructure expansion activities, huge demand from IT facilities and data centers, and rising urbanization are propelling the market for wire and cable management, as well as cable duct market growth.

- The development of frequently changed wiring systems in constructions acts as a driving force of the global cable duct market. Owing to the smooth replacement of conductors with a very low disruption, regular wiring changes are made safer and simpler. Thus, the cable ducts guard the wiring replacements against chemical vapors, flammable gases, moisture, electromagnetic interruption, and other external discrepancies. The rise in the development of the construction industry is driving the growth of the cable duct market.

Global Cable Duct Market Trends and Insights

Growing Construction Industry is to Play a Dominant Role

- The construction industry grew at a steady rate of 3.7%, in 2018, and is expected to gain momentum, over the next five years. As per consensus forecast, in 2018, the US construction industry is expected to grow at 4%, with the residential sector poised to record the highest growth of 6%, whereas, the non-residential and non-building sectors are expected to record growth rates of 2% and 4%, respectively.

- Rising investments in real estate and infrastructure development activities is a major factor responsible for the steadfast growth of the global cable duct market. Besides this, surging demand from data centers and IT facilities and rapid urbanization are also propelling expansion in the global cable duct market. Foreign Direct Investment (FDI) received in Construction Development sector (townships, housing, built-up infrastructure, and construction development projects) from April 2000 to March 2019 stood at USD 25.05 billion in India, according to the Department of Industrial Policy and Promotion (DIPP).

- Besides, during the first five months of this year, construction spending amounted to USD 498.8 billion, 0.3 percent (±1.3 percent) below the USD 500.3 billion for the same period in 2018. The highest growth rate is observed in the US hotel construction industry. With the expansion in the construction industry, a rise in the demand for cable ducts is expected, thus leading to the growth of the market studied.

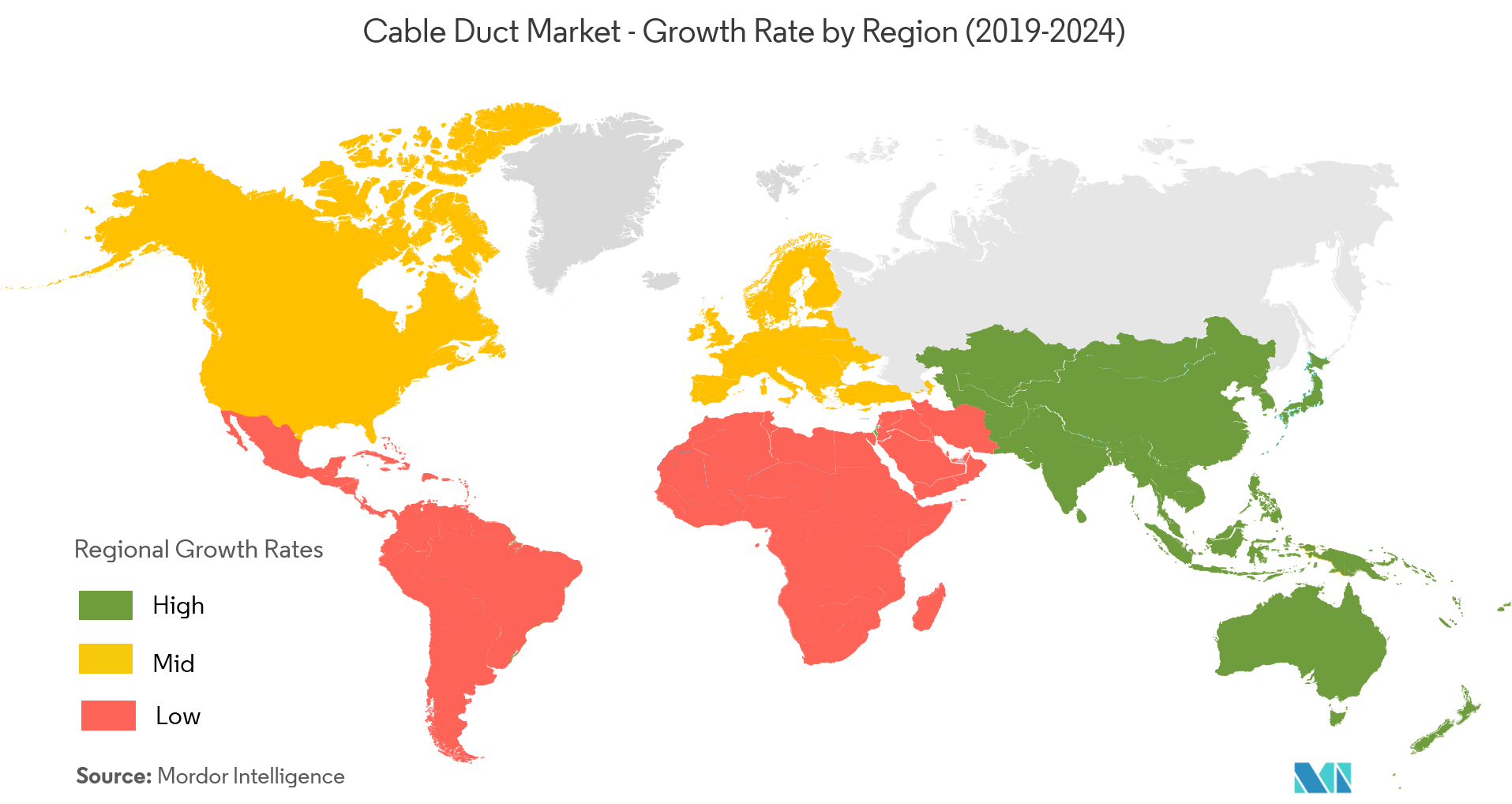

Asia-Pacific to Witness Fastest Growth

- The growth in Asia-Pacific is attributed to the rapid infrastructure building activities being undertaken in the region, mainly in China and India. In these countries, rural areas are being converted into urban areas and these countries will collectively be responsible for more than a 50% share of the growth in the construction industry by the end of 2020.

- Moreover, the increasing projects in the field of electrification and power supply in these regions also provide ample opportunity for the growth of the electrical conduit pipe market.

- Additionally, in India, the initiatives (such as excise duty exemption for Ferro-silicon-magnesium and pig iron used for manufacturing components for wind-operated electric power generators as well as the target set by the Jawaharlal Nehru National Solar Mission to generate more than 1,00,000 MW of solar power by the end of 2022) are expected to boost the demand for electrical wires and cables.

- With this continuous growth in the building and construction industry, along with the increase in demand for renewable sources of energy, the demand for electrical conduit pipes is expected to increase over the forecast period.

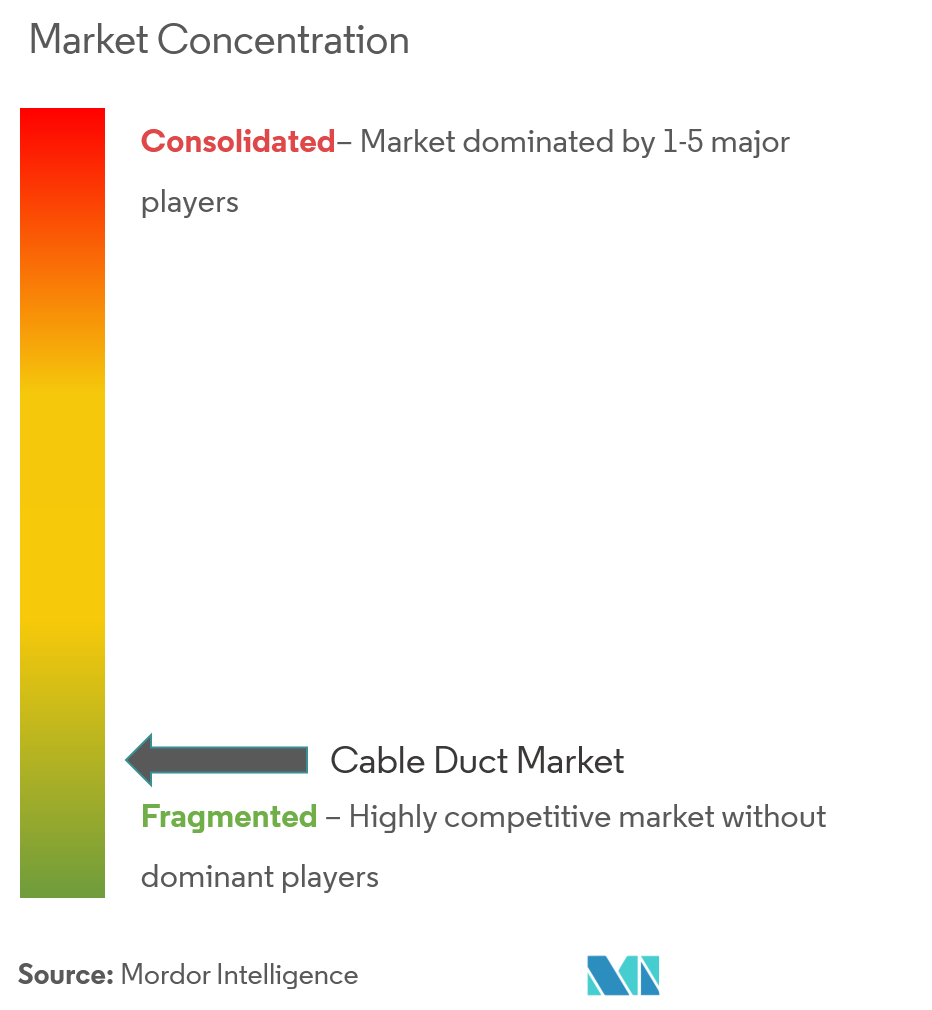

Competitive Landscape

The overall cable duct market is fragmented in nature, with a large number of players operating in the market globally.In addition to innovative product offerings, cable andwire manufacturersare also following strategies, such as mergers and acquisitions to acquire new technologies and expand their customer reach. Companies are now adopting efficient techniques in an effort to provide consumers with innovated and cost-efficient products.

- January 2019 -Electrical and digital building products company, Legrand,opened its first voice-enabled experience center- Innoval - in Bengaluru, said it plans to open two more in Dehradun and New Delhi. By the end of next year, it wantsto have 10 Innoval centers.

- August 2018 -ABB announced its expansion of the Thomas andBetts facility on Dennis Street in Athens. The addition to the plant is expected to boost production for their 21 product lines.

Cable Duct Industry Leaders

-

Legrand

-

Schneider Electric

-

ABB Ltd.

-

Eaton Corporation PLC

-

Barton Engineers Ltd

- *Disclaimer: Major Players sorted in no particular order

Global Cable Duct Market Report Scope

Cable ducts are manufactured from uniquely compounded high impact rigid polyvinyl chloride. These ducts don't peel, chip or crack. It resists salt solution, oil, and fungus. It is non-flammable confirming to UL 94 V0 standards, non-brittle and warp-proof. It has huge dielectric strength and endures temperature up to 60 degrees Celcius. It magnifies aesthetics and clarity, allows faster connections, addition and error tracing of wires.

| Flexible Cable Duct |

| Rigid Cable Duct |

| Concrete Cable Duct |

| Plastic Cable Duct |

| Metal Cable Duct |

| IT & Telecom |

| Construction |

| Energy & Utility |

| Manufacturing |

| Other End Users |

| North America |

| Europe |

| Asia Pacific |

| Latin America |

| Middle East & Africa |

| By Product Type | Flexible Cable Duct |

| Rigid Cable Duct | |

| By Material | Concrete Cable Duct |

| Plastic Cable Duct | |

| Metal Cable Duct | |

| By End-user Industry | IT & Telecom |

| Construction | |

| Energy & Utility | |

| Manufacturing | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Cable Duct Market size?

The Cable Duct Market is projected to register a CAGR of 4.55% during the forecast period (2025-2030)

Who are the key players in Cable Duct Market?

Legrand, Schneider Electric, ABB Ltd., Eaton Corporation PLC and Barton Engineers Ltd are the major companies operating in the Cable Duct Market.

Which is the fastest growing region in Cable Duct Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Cable Duct Market?

In 2025, the North America accounts for the largest market share in Cable Duct Market.

What years does this Cable Duct Market cover?

The report covers the Cable Duct Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Cable Duct Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Cable Duct Market Report

Statistics for the 2025 Cable Duct market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cable Duct analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.