| Study Period | 2019 - 2030 |

| Market Size (2025) | USD 222.29 Billion |

| Market Size (2030) | USD 367.05 Billion |

| CAGR (2025 - 2030) | 10.55 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Europe |

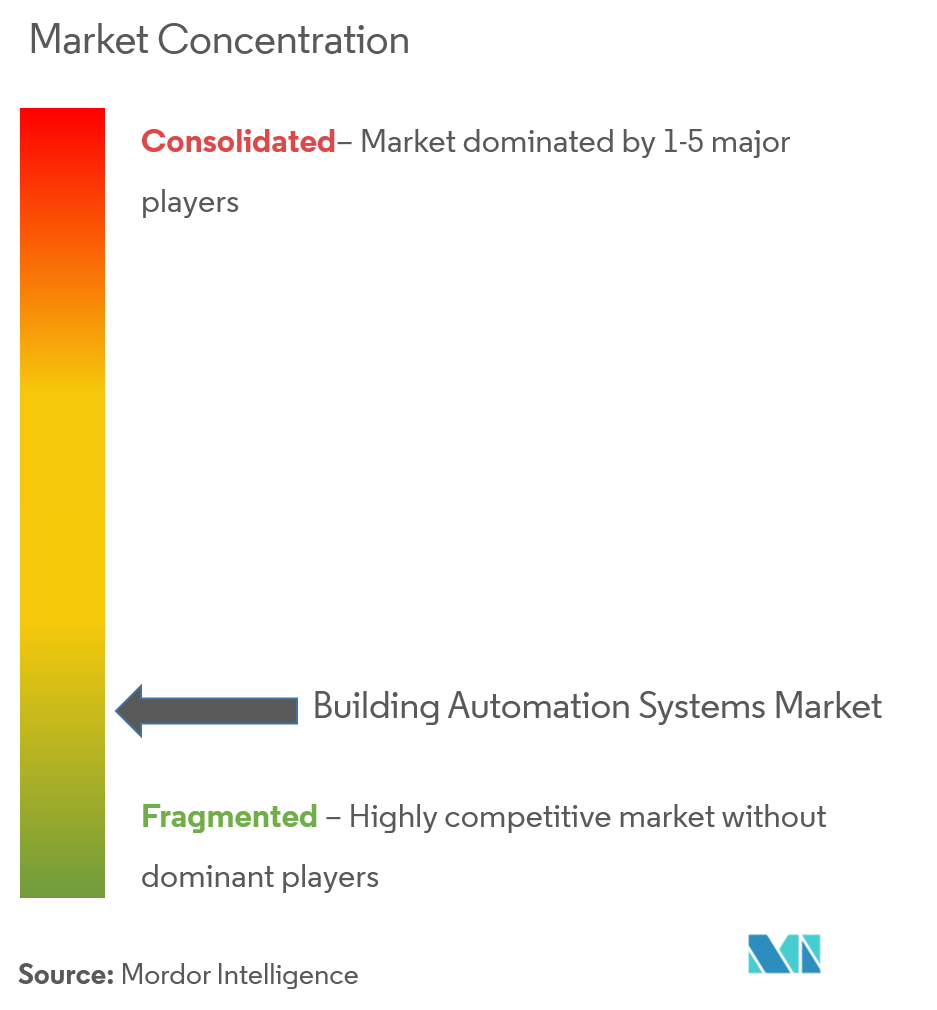

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Building Automation Systems Market Analysis

The Building Automation Systems Market size is estimated at USD 222.29 billion in 2025, and is expected to reach USD 367.05 billion by 2030, at a CAGR of 10.55% during the forecast period (2025-2030).

The building automation system industry is experiencing a profound transformation driven by the rapid advancement of Internet of Things (IoT) technology and increasing digitalization. According to Cisco's Annual Internet Report, nearly 30 billion network-connected devices and connections are expected to exist by next year, with IoT devices accounting for 50% (14.7 billion) of all networked devices. This widespread adoption of connected devices is revolutionizing how buildings operate, enabling seamless integration of various systems and promoting more efficient resource utilization. The integration of artificial intelligence and machine learning capabilities is further enhancing the sophistication of building automation system solutions, enabling predictive maintenance and optimized performance across building systems.

The industry is witnessing a significant shift toward sustainable and energy-efficient building solutions, driven by growing environmental concerns and regulatory pressures. According to the US Department of Energy, buildings represent the largest energy-consuming sector in the US economy, accounting for approximately 75% of the nation's electricity use and 40% of its total energy demand. This has led to increased adoption of smart building management system technologies that can monitor and optimize energy consumption in real-time. Building automation systems are becoming increasingly sophisticated in their ability to manage and reduce energy consumption through advanced analytics and intelligent control mechanisms.

Climate change considerations are dramatically influencing the evolution of building automation systems, with a growing focus on adaptive technologies. According to research published in the Proceedings of the National Academy of Sciences, by 2070, approximately 30% of the world's population is expected to reside in regions where average temperatures exceed 29°C, highlighting the critical need for advanced climate control solutions. This demographic shift is driving innovation in HVAC automation and intelligent building system technologies that can automatically adjust to extreme weather conditions while maintaining optimal energy efficiency.

The convergence of IT and operational technology is reshaping the building automation market, with an increasing emphasis on cybersecurity and system integration. Building automation systems are becoming more interconnected, incorporating advanced security protocols and real-time monitoring capabilities. The industry is witnessing a surge in the development of cloud-based building management system platforms that offer enhanced flexibility and remote monitoring capabilities. These platforms are enabling building managers to optimize operations, reduce maintenance costs, and improve occupant comfort through data-driven decision-making and automated response systems.

Building Automation Systems Market Trends

Increasing Initiatives and Directives for Energy and Operational Efficiency Across the World and Europe

Government bodies worldwide are implementing stringent regulations and directives to improve building energy efficiency and reduce carbon emissions. The European Union has been particularly proactive, with its Energy Performance of Buildings Directive setting ambitious targets for member states. For instance, the German Buildings Energy Act, published in the Federal Law Gazette, implements comprehensive measures outlined in the Climate Action Programme 2030 concerning laws governing energy efficiency in buildings. These initiatives are compelling building owners and operators to adopt automated systems that can optimize energy consumption and operational efficiency through intelligent monitoring and control mechanisms. This trend is a significant driver in the building automation industry, where the adoption of building automation services is becoming increasingly essential.

The drive toward operational efficiency is further evidenced by significant corporate investments in energy-saving technologies and solutions. For example, in June 2022, Honeywell International launched its Carbon and Energy Management system as part of the Honeywell Forge platform, providing building owners with sophisticated tools to optimize energy use and reduce carbon emissions through data analytics and IoT capabilities. Similarly, Trane Technologies and Nexii Building Solutions Inc. formed a strategic partnership to construct sustainable commercial buildings with significantly reduced carbon footprints, incorporating digitally enabled EcoWise high-efficiency climate comfort systems to minimize energy usage and emissions. These developments highlight key building automation trends that are shaping the future of the building automation industry.

Surge in Demand for HVAC Housing Owing to Rapid Population Growth

The global population growth trajectory is creating unprecedented demand for HVAC systems in residential and commercial buildings. According to United Nations projections, the world population is expected to reach 10.4 billion by the end of the century, up from approximately 8 billion in 2022. This population expansion, coupled with rising temperatures and urbanization, is driving the need for efficient HVAC solutions. The International Energy Agency estimates that by 2050, up to 2.5 billion individuals in hot countries are expected to own an air conditioner, with air conditioners potentially being used by 75% of people in hot nations.

The Asia-Pacific region exemplifies this trend, with Asia's population expected to reach 5.3 billion inhabitants by 2055, representing an increase of 620 million people from current levels. This rapid population growth, combined with rising temperatures and increasing urbanization, is creating substantial demand for HVAC systems. Manufacturers are responding to this demand with innovative solutions, as evidenced by Johnson Controls-Hitachi's introduction of their new Wall Mount indoor mini-split unit in 2022, specifically designed for small to medium-sized spaces. The system features enhanced installation flexibility and precise sizing capabilities to meet diverse application requirements, demonstrating how manufacturers are adapting to the growing demand for efficient HVAC solutions in both residential and commercial sectors. This adaptation is supported by the integration of smart building systems and building automation and control systems, which are essential for optimizing HVAC performance and energy efficiency.

Segment Analysis: By Component

Security Systems Segment in Building Automation Systems Market

The Security Systems segment dominates the building automation systems market, holding approximately 48% market share in 2024, with a market value of USD 97.98 billion. This segment encompasses security cameras, video surveillance systems, video analytics, and VSaaS services, excluding fire and smoke detection systems. The segment's leadership position is driven by increasing security concerns in smart buildings, growing adoption of face recognition systems, thermal camera body temperature screening, and mask detection algorithms. The integration of IoT-enabled security solutions, including presence simulation, motion detection, and remote video access capabilities, has further strengthened this segment's market position. Additionally, the rising implementation of advanced security measures in commercial spaces, such as keyless entry systems and integrated access control solutions, continues to fuel the segment's growth.

Growth Trajectory of Security Systems in BAS Market

The Security Systems segment is projected to maintain its strong growth momentum between 2024-2029, with an expected growth rate of approximately 13% annually. This robust growth is attributed to several factors, including the increasing integration of artificial intelligence and machine learning in security systems, rising demand for smart surveillance solutions in residential and commercial buildings, and the growing adoption of cloud-based security services. The segment's growth is further supported by technological advancements in video analytics, the emergence of 5G technology enabling faster and more reliable security communications, and the increasing focus on cybersecurity in building automation and controls market. The trend toward integrated security solutions that can seamlessly connect with other building automation system components is also expected to drive significant growth in this segment.

Remaining Segments in Building Automation Systems Market

The remaining segments in the building automation systems market include HVAC Controls, Fire Detection, Lighting Controls, and building management systems, each serving crucial functions in modern building automation. HVAC Controls represent a significant portion of the market, focusing on energy efficiency and climate control optimization. Fire Detection systems continue to evolve with advanced sensing technologies and integration capabilities with other building systems. Lighting Controls are gaining prominence with the increasing adoption of smart lighting solutions and energy-efficient systems. Building management systems serve as the backbone for integration and centralized control of various building automation components, enabling seamless operation and monitoring of building functions.

Segment Analysis: By End User

Commercial Segment in Building Automation Systems Market

The commercial segment dominates the building automation systems market, commanding approximately 63% market share in 2024. This segment encompasses offices, hospitals, retail spaces, infrastructures, warehouses, and industrial buildings. The strong market position is driven by increasing adoption of IoT, integration of artificial intelligence (AI), machine learning (ML), and smart sensors across commercial buildings. Commercial buildings are increasingly implementing sophisticated automation systems that rely on numerous IoT sensors and computers synchronized with local servers and the Internet to automate functionalities such as lighting control, interior climate management, elevator operations, fire detection, and video surveillance. The segment's growth is further supported by stringent energy efficiency regulations, rising focus on occupant comfort, and the need for enhanced building security measures.

Residential Segment in Building Automation Systems Market

The residential segment, which includes houses, hostels, apartments, flats, and private garages, is projected to grow at approximately 12% CAGR from 2024 to 2029. This accelerated growth is primarily driven by increasing consumer awareness about energy efficiency benefits and the growing demand for smart home solutions. The segment is witnessing significant technological advancements in areas such as lighting controls, emergency lighting, and automated security systems. The rise in urban population and increasing preference for connected living environments are further catalyzing the adoption of residential automation solutions. Additionally, the integration of voice-controlled systems, mobile applications, and IoT-enabled devices is making home automation more accessible and user-friendly for residential consumers.

Building Automation Systems Market Geography Segment Analysis

Building Automation Systems Market in Germany

Germany stands as the powerhouse of Europe's building automation market, commanding approximately 20% of the regional market share in 2024. The country's leadership position is driven by its robust industrial infrastructure and stringent energy efficiency regulations, particularly through the Buildings Energy Act. The nation's commitment to sustainable building practices and technological innovation has created a fertile ground for advanced building automation solutions. German building automation system manufacturers and solution providers are at the forefront of developing cutting-edge technologies, including smart HVAC systems, intelligent lighting controls, and integrated security solutions. The country's focus on Industry 4.0 initiatives has further accelerated the adoption of automated building systems, particularly in commercial and industrial sectors. The market is characterized by strong domestic demand, supported by the government's ambitious climate protection goals and energy efficiency targets. The presence of major industry players and a well-established network of system integrators has created a sophisticated ecosystem that continues to drive innovation and market growth.

Building Automation Systems Market in France

France's building automation control systems market demonstrates remarkable dynamism, driven by the country's aggressive push toward building energy efficiency and sustainability. The French government's implementation of stringent building automation and control system regulations has created a strong foundation for market growth. The country's emphasis on smart building technologies is particularly evident in its commercial sector, where the integration of advanced automation systems has become increasingly prevalent. French businesses are actively embracing digital transformation in building management, with a particular focus on energy optimization and occupant comfort. The market is characterized by a strong presence of both domestic and international building automation companies, contributing to a competitive landscape that fosters innovation. The country's commitment to reducing building energy consumption has led to increased adoption of sophisticated building management systems, particularly in urban centers. The renovation of existing buildings with smart technologies and the implementation of automation solutions in new construction projects continue to drive market expansion.

Building Automation Systems Market in United Kingdom

The United Kingdom's building management system market exhibits strong growth potential, supported by the country's ambitious net-zero carbon emissions targets and smart building initiatives. The market is characterized by increasing adoption of integrated building management systems, particularly in commercial and residential sectors. British businesses are increasingly recognizing the value of automated building solutions in reducing operational costs and improving energy efficiency. The country's focus on sustainable building practices has led to the implementation of advanced automation technologies in both new construction and retrofit projects. The market benefits from a well-developed technological infrastructure and a strong emphasis on innovation in building management solutions. The UK's commercial real estate sector, particularly in major cities, has been a key driver of automation system adoption. The integration of IoT-enabled devices and smart building technologies has become increasingly prevalent, supported by government initiatives and industry partnerships.

Building Automation Systems Market in Other European Countries

The building management system vendors across other European countries, including Italy, Spain, the Netherlands, and Poland, demonstrate varying degrees of market maturity and adoption rates. These markets are characterized by distinct regulatory environments and different levels of technological readiness. Southern European countries are showing increased interest in building automation solutions, particularly for energy management and comfort control. The Scandinavian region leads in terms of technological adoption and sustainable building practices. Eastern European countries are experiencing growing demand for building automation systems, driven by rapid urbanization and increasing awareness of energy efficiency benefits. The market in these regions is supported by EU-wide initiatives promoting smart building technologies and energy efficiency. Local preferences and climate conditions influence the type of automation solutions being adopted, with some regions focusing more on heating control systems while others prioritize cooling and ventilation solutions. The presence of both regional specialists and international building automation companies creates a dynamic market environment that caters to diverse customer needs and requirements.

Building Automation Systems Industry Overview

Top Companies in Building Automation Systems Market

The building automation systems companies market features prominent players like Honeywell International, Cisco Systems, Trane Technologies, Johnson Controls, ABB, and Siemens leading the innovation curve. These top building automation companies are increasingly focusing on developing sophisticated IoT-enabled solutions and AI-powered building management platforms to enhance operational efficiency and sustainability. Strategic partnerships with technology providers and cloud service companies have become a common trend to accelerate digital transformation initiatives. Companies are investing heavily in R&D to develop integrated solutions that combine HVAC, lighting, security, and energy management functionalities. The market is witnessing a strong push towards developing open-protocol solutions that enable seamless integration across different building systems and third-party applications. Additionally, manufacturers are expanding their service offerings to include predictive maintenance, remote monitoring, and energy optimization services, creating comprehensive building management ecosystems.

Consolidated Market with Strong Regional Players

The building automation systems market exhibits a moderately consolidated structure, dominated by large multinational conglomerates with diverse product portfolios and strong technological capabilities. These major players leverage their extensive distribution networks, brand reputation, and comprehensive service offerings to maintain their market positions. Regional specialists have carved out strong niches in specific geographic markets or technological segments, particularly in emerging economies. The market has witnessed significant merger and acquisition activity, with larger players acquiring specialized technology companies to enhance their digital capabilities and expand their geographic presence.

The competitive dynamics are characterized by a mix of global system integrators and local solution providers, creating a complex ecosystem of partnerships and collaborations. Major players are increasingly focusing on vertical integration strategies, developing end-to-end solutions from hardware components to software platforms. The market has seen a trend of strategic alliances between building automation system companies and IT firms to develop more sophisticated, cloud-based solutions. Companies are also investing in developing region-specific products and solutions to address local market requirements and regulations, particularly in emerging markets.

Innovation and Integration Drive Market Success

Success in the building automation systems market increasingly depends on companies' ability to deliver integrated, scalable solutions that address evolving customer needs for energy efficiency and smart building capabilities. Incumbent players are focusing on expanding their digital service offerings, developing more sophisticated analytics capabilities, and creating user-friendly interfaces to maintain their competitive edge. Companies are also investing in strengthening their cybersecurity capabilities and ensuring compliance with evolving building regulations and energy efficiency standards. The ability to provide comprehensive after-sales support and maintenance services has become crucial for maintaining market share.

For new entrants and challenger companies, success lies in identifying and exploiting specific market niches or technological gaps in the current offerings. Companies are focusing on developing specialized solutions for specific building types or applications, particularly in emerging segments like smart homes and green buildings. The market shows relatively low substitution risk due to high switching costs and the critical nature of building automation systems. However, companies must navigate complex regulatory environments, particularly regarding energy efficiency standards and data privacy requirements. Building strong relationships with system integrators and maintaining close engagement with end-users for feedback and continuous improvement have become essential strategies for market success. The largest building automation companies continue to lead in innovation and integration, setting benchmarks for others to follow.

Building Automation Systems Market Leaders

-

Honeywell International Inc.

-

Cisco Systems Inc.

-

Trane Technologies

-

Lutron Electronics Co. Ltd

-

Hubbell Inc.

- *Disclaimer: Major Players sorted in no particular order

Building Automation Systems Market News

- September 2022: Honeywell International announced the Australian launch of Fire-lite, a suite of fire protection systems designed to meet the need of small and medium businesses. Mid-rise residential, warehouses, and retail spaces across Australia. Fire-Lite'scustomizable and intelligent addressable fire panels are designed to meet a range of building requirements by providing flexible solutions to support a variety of installations.

- March 2022: Trane Technologies announced its plans to expand its operations in Greenville country with an investment of USD 30 million. The company will add around 3,00,000 sq. ft of manufacturing capacity designed to enable and sustain the company's future growth.

Building Automation Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy and Operational Efficiency, Supported by Government Initiatives

-

5.2 Market Challenges

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6. MARKET SEGMENTATION

-

6.1 By Component (Market Sizing and Forecast, Trends, and Dynamics)

- 6.1.1 Hardware (Controllers and Field Devices)

- 6.1.2 Software

- 6.1.3 Services

-

6.2 By End User (Market Sizing and Forecast, Trends, and Dynamics)

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

-

6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Trane Technologies

- 7.1.4 Lutron Electronics Co. Ltd

- 7.1.5 Hubbell Inc

- 7.1.6 United Technologies Corporation

- 7.1.7 Hitachi Ltd

- 7.1.8 Huawei Technologies Corporation

- 7.1.9 Emerson Electric Co.

- 7.1.10 Mitsubishi Electric Corporation

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. FUTURE OF THE MARKET

Building Automation Systems Industry Segmentation

Building automation systems exhibit functions such as control of the building's environment, operating systems depending on the energy demand, and monitoring the system performance, based on which the systems produce sound alerts as required. Moreover, it centrally controls the building's heating, ventilation, and air conditioning (HVAC), electrical, lighting, shading, access control, security systems, and other interrelated systems.

Building automation systems (BASs) or building automation control systems exhibit functions such as control of the building's environment and operating systems (depending on the energy demand) and monitor the system performance, based on which the systems produce sound alerts as required. A BAS has related hardware and software for controlling and monitoring electrical systems, heating, ventilation, air-conditioning (HVAC), lighting control, security, and surveillance in buildings.

The report on the building automation systems market is segmented by component (hardware, software, services), end-user (residential, commercial, industrial), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The market sizing and forecasts are provided in terms of value (USD billion) for all the above segments.

| By Component (Market Sizing and Forecast, Trends, and Dynamics) | Hardware (Controllers and Field Devices) |

| Software | |

| Services | |

| By End User (Market Sizing and Forecast, Trends, and Dynamics) | Residential |

| Commercial | |

| Industrial | |

| By Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Building Automation Systems Market Research FAQs

How big is the Building Automation Systems Market?

The Building Automation Systems Market size is expected to reach USD 222.29 billion in 2025 and grow at a CAGR of 10.55% to reach USD 367.05 billion by 2030.

What is the current Building Automation Systems Market size?

In 2025, the Building Automation Systems Market size is expected to reach USD 222.29 billion.

Who are the key players in Building Automation Systems Market?

Honeywell International Inc., Cisco Systems Inc., Trane Technologies, Lutron Electronics Co. Ltd and Hubbell Inc. are the major companies operating in the Building Automation Systems Market.

Which is the fastest growing region in Building Automation Systems Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Building Automation Systems Market?

In 2025, the Europe accounts for the largest market share in Building Automation Systems Market.

What years does this Building Automation Systems Market cover, and what was the market size in 2024?

In 2024, the Building Automation Systems Market size was estimated at USD 198.84 billion. The report covers the Building Automation Systems Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Building Automation Systems Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Building Automation Systems Market Research

Mordor Intelligence provides a comprehensive analysis of the building automation system market. We leverage our extensive expertise in the building automation industry to deliver detailed research. Our report examines the evolving landscape of building automation and control systems, including technologies like BMS (Building Management Systems) and BACS (Building Automation and Control Systems). The analysis covers leading building automation system manufacturers, building automation companies, and emerging building automation services providers. This information is available in an easy-to-read report PDF format for immediate download.

The report offers invaluable insights for building automation system companies and stakeholders across the value chain. It includes a detailed examination of building management system industry growth trends and building automation trends. Our analysis explores the implementation of intelligent building automation technologies and features comprehensive profiles of top building automation companies and building management system vendors. The research provides a detailed assessment of building automation market size projections and examines how building automation manufacturers are adapting to evolving industry demands. The report is particularly beneficial for building management system companies seeking to understand market dynamics and competitive positioning in the global BAS industry.