Broaching Machines Market Analysis

The Broaching Machines Market is expected to register a CAGR of greater than 4% during the forecast period.

The broaching machines market is expected to register moderate growth during the forecast period (2019-24). The growth of the market is majorly driven by the increasing demand from several end-user industries such as automotive, aerospace and others, across the world. Broaching remains one of the fastest methods of cutting production parts, which is primarily intended for high-volume production runs. The rising demand for high speed and accurate finishing process in the end-use sector is putting pressures on broaching machine manufacturers. To meet this demand, manufacturers are increasingly adopting advanced technology and automation. The automation of the production and related fabrication process help companies in gaining a competitive edge in the market and reduce their operational costs. CNC, servo, and software technology continue to improve and provide additional impact on power savings, high efficiencies, and high precision mechanical systems. The CNC broaching machines offer benefits such as energy savings and high precision during metal cutting, key formation, and gear making. There has been an improvement in the production of broach tools, which play a key role in the quality of the finished product.

According to industrial sources, in term of the overall equipment effectiveness, especially with the achievable qualities and profile areas of energy efficiency, electro-mechanical actuators are increasingly replacing the hydraulic drives. In recent times, CNC controls have paved the way to the elimination of hydraulics and replacing them with servo drives and ball screws for many applications. About half of the customer base considers an electro-mechanical machine for small to-mid-range applications. Furthermore, the market is also driven by the growing demand for the fabricated metal products, development of heavy industrial equipment, and advancement in the manufacturing processes. The metal fabrication market may be less prone to wild fluctuations than other industries, which will allow these conventional machining processes to grow moderately. For instance, in India, the annual growth rate of fabricated metal products production followed negative trend during the period 2013-15. Whereas, after 2015, the production rate witnessed positive trend with lesser growth rates. Worldwide, the machine tool cutting sector represented a major share in terms of production volume when compared to forming technology. The machine tool cutting sector comprises of lathes, drilling machines, broaching machines, boring machines, milling machines, etc.

Broaching Machines Market Trends

Growing Demand from the Automotive Industry

Major factor boosting the growth of broaching machines is the increasing demand from the automotive industry. Broaching machines have a significant share in the automotive industry and are used for several operations to manufacture gears, transmission shafts, steering wheel hubs, steering yokes, etc. Automotive gear manufacturers implemented significant improvements in external planetary gear manufacturing. As hybrid and electric vehicles are developing and bringing to the market, the demand for quieter gears continues to rise. Broaching is widely used method for cutting internal gear. Internal helical broaching is regarded as an economical choice for the highest volume mass production with minimal product mix. The advent of electromechanical broach machines allows helical broaching without the need for the specific mechanical guides.

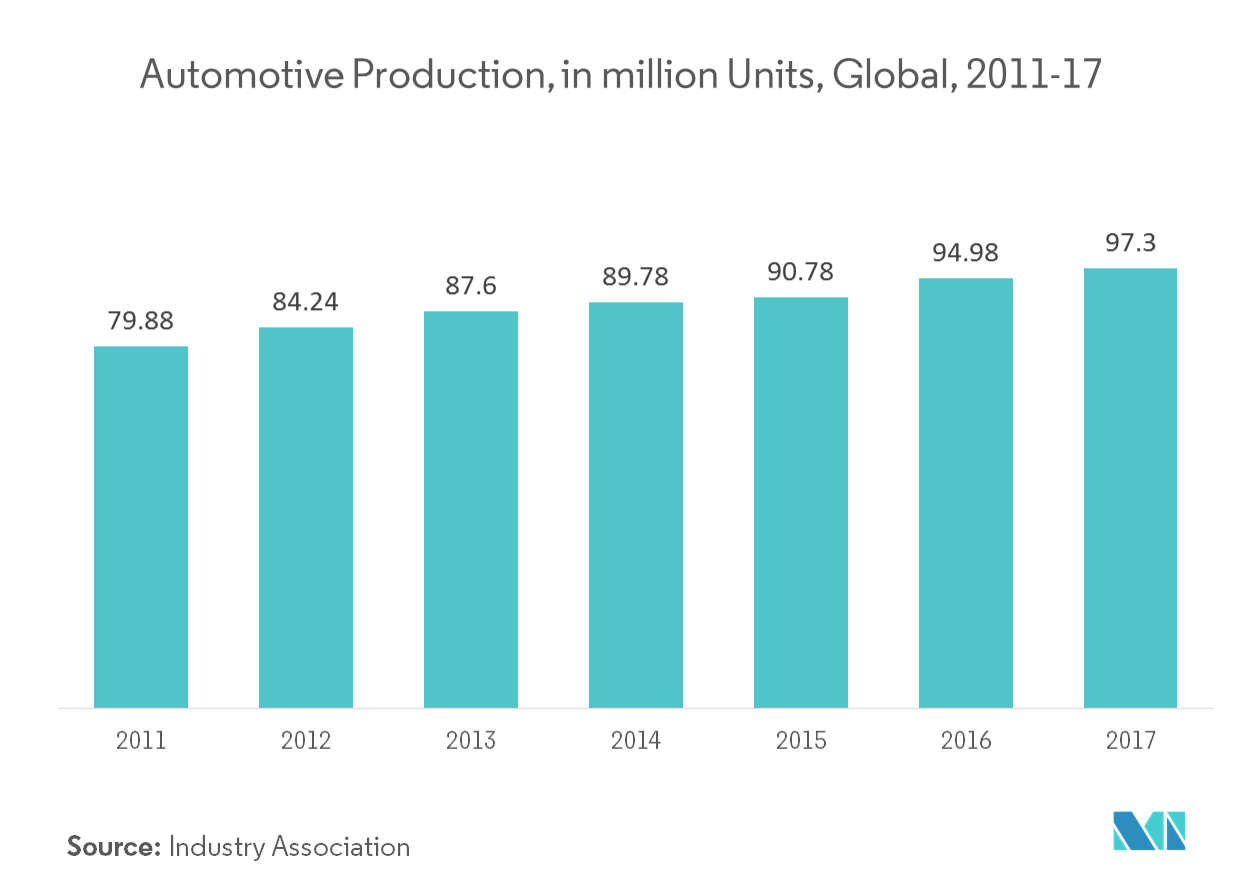

Despite some headwinds, automotive industry is look bright globally. U.S. light vehicle sales figures peaked in 2016 with 17.46 million and 2018 marked the fourth straight year with over 17 million unit sales. According to industry sources, global light vehicle production units have been remarkable and it is only continue to grow. APAC is expected to register the highest growth rates in terms of production volumes followed by North America. This scenario is expected to create demand for the broaching machines and other related machines associated with manufacturing process.

Spotlight on Asia-Pacific Market

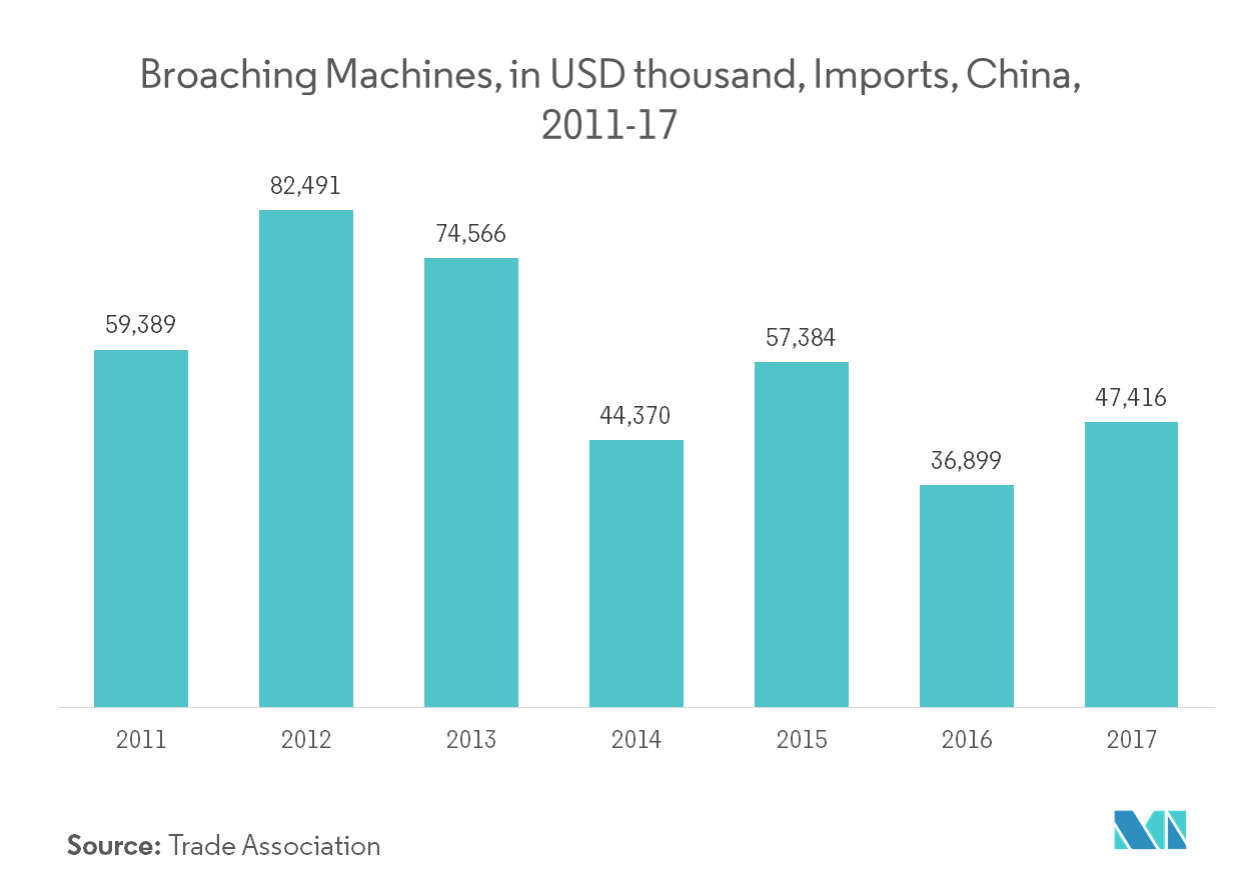

According to analysis, Asia-Pacific (APAC) is estimated to register a significant growth rate in the current market studied. The region has the highest number of manufacturing plants where adoption of broaching machines is substantial. China is expected to be the major country in the region owing to its vast manufacturing sector. Additionally, automotive is one of China's pillar industries, and it continues to be the largest vehicles market in the world. The country’s total automotive production reached 27.8 million units in 2018, which is far ahead of major markets like the United States (11.3 million units), Japan (9.7 million units), and Germany (5.1 million units).

Coming to ASEAN, the manufacturing sector has been one of ASEAN’s key economic growth drivers. Economies in this region have low operating costs, which attract many businesses from larger manufacturing bases. In the recent times, China has seen rising wages and tighter regulations, which has led to an increase in operating costs as it shifts towards the higher value manufacturing. In order to replace the role that PRC once played, companies are looking to the ASEAN region for lower-value production networks which have also been largely integrated into global manufacturing value chains. As per the analysis, broaching machine manufacturers should align their distribution channels to focus on the growing markets by serving the emerging manufacturing sectors to increase their sales.

Broaching Machines Industry Overview

The broaching machines market is fairly fragmented in nature with the presence of large global players and small and medium sized local players with quite a few players who occupy the market share. When analyzing major countries’ manufacturing establishments, it is revealed that many of the global companies have footprint in the major countries. Detailed analysis of major companies, which include company overview, financials, products offerings, recent developments, etc. are covered in the report. A large number of companies are working to change the way broaching is perceived. Over the past 10 years, manufacturers have been incorporating significant technological changes to make the process more flexible, productive and accurate.

Broaching Machines Market Leaders

-

American Broach & Machine Co

-

Axisco Precision Machinery Co., Ltd

-

Forst Technologie GmbH & Co. KG

-

Nachi-Fujikoshi Corp

-

Mitsubishi Heavy Industries, Ltd

- *Disclaimer: Major Players sorted in no particular order

Broaching Machines Industry Segmentation

A complete background analysis of the broaching machines market, which includes an assessment of the sector and contribution of sector in the economy, market overview, market size estimation for key segments, key regions and emerging trends in the market segments, market dynamics, and key production and consumption statistics are covered in the report.

| By Prodcut Type | Vertical Broaching Machine |

| Horizontal Broaching Machine | |

| Others | |

| By End-user | Automotive |

| Fabrication and Industrial Machinery Manufacturing | |

| Aerospace & Defense | |

| Oil and Gas, and Energy | |

| Others | |

| Geography | Asia-Pacific |

| North America | |

| Europe | |

| Latin America | |

| Middle East and Africa |

Broaching Machines Market Research FAQs

What is the current Broaching Machines Market size?

The Broaching Machines Market is projected to register a CAGR of greater than 4% during the forecast period (2025-2030)

Who are the key players in Broaching Machines Market?

American Broach & Machine Co, Axisco Precision Machinery Co., Ltd, Forst Technologie GmbH & Co. KG, Nachi-Fujikoshi Corp and Mitsubishi Heavy Industries, Ltd are the major companies operating in the Broaching Machines Market.

What years does this Broaching Machines Market cover?

The report covers the Broaching Machines Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Broaching Machines Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Broaching Machines Industry Report

Statistics for the 2025 Broaching Machines market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Broaching Machines analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.