Bottled Water Packaging Market Analysis

The Bottled Water Packaging Market size is worth USD 54.15 Billion in 2025, growing at an 5.22% CAGR and is forecast to hit USD 69.83 Billion by 2030.

The packaged water industry, and by extension, the bottled water packaging industry, is growing quickly as public awareness of the importance of clean drinking water rises. Additionally, the use of recyclable polymers in the production of bottles is making a good impact on consumers.

- The beverage industry is one of the pioneers with considerable expansion and technology modernization investments. Packaging water is a complex technical area of the industry. The packaged and bottled water packaging industries are experiencing rapid growth as public awareness of the need for pure drinking water increases.

- Bottled water is considered one of the most consumed beverages due to its convenience. The bottle packaging is also suitable for long-distance transportation of water. Boiling water at home is time-consuming and energy inefficient. It is anticipated to contribute significantly to the growth of the bottled water packaging market. In emerging markets, it became a symbol of a healthy lifestyle. The rise in awareness about consuming safe water for a healthy life and contaminated tap water is creating a huge market opportunity for bottled water. It, in turn, will create a positive outlook on the bottled water packaging market.

- Moreover, bottled mineral water is purified and fortified with dissolved minerals, providing added health benefits to consumers. The innovative designs and new packaging solutions contributed to packaging and weight reduction improvements. Hence, acting as the driver for the bottled water packaging market.

- However, environmental regulations imposed by the government due to improper disposal of plastic bottles will likely curb the bottled water packaging market size during the forecast period.

- Moreover, the Russia-Ukraine war significantly impacted the bottled water packaging market. Businesses operating in the area with close financial ties to the region are considering the war into account as they examine how it may affect their operations over the long run.

Bottled Water Packaging Market Trends

Plastic Packaging to Dominate the Market

- Plastics are the most popular materials for manufacturing water bottles. They occupy 97.3 % of the global bottled packaging market, and glass occupies the rest. Plastic containers are inexpensive, lightweight, and durable materials for manufacturing containers. Polyethylene terephthalate (PET) is the most commonly used type of plastic and is also 100% recyclable.

- Innovative packaging technologies developed lightweight and durable plastic water pack bottles that positively impact the market. Furthermore, packaging containers with a low carbon footprint and recyclable material will further drive the growth of the global bottled water packaging market.

- Further, manufacturing advancements and lowering operational costs, resins, and packaging are pacing the industry's growth. Low feedstock costs are encouraging the utilization and adoption of plastic bottle packaging.

- Moreover, by focusing on customers, brand owners are pushing design innovations in plastic bottling that are unparalleled in the rest of the packaging sector, such as weight savings in transport and manufacturing. This factor is fueling the bottled water plastic packaging market.

- PET is used to make plastic bottles for beverages and other frequently used things, according to Indorama Ventures. The demand for PET reached 27 million metric tonnes in 2020. The demand for PET is anticipated to reach 42 metric tonnes by 2030. The rise in PET demand shows an increase in plastic bottle production capacity. Producers will spend money extending their production capacities to satisfy the rising demand, increasing the availability of plastic bottles for use in bottled water and other uses.

North America to Hold Prominent Share

- According to the International Bottled Water Association (IBWA) and the Beverage Marketing Corporation (BMC), Americans drink more bottled water than any other packaged beverage. Health awareness, a higher standard of living, and rising demand and consumption of bottled water are major driving factors of bottled water packaging in North America.

- In developed economies like the United States and Canada, available water is becoming a major commercial and popular beverage category, as it is an appealing option for health-conscious consumers. Hence, the factor is augmenting the bottled water market.

- The single-serve sparkling water products, bulk water, and produced ice are the primary products of the Canadian bottled water production sector. Due to a rise in customer interest in buying bottled water, industry income grew throughout the study period. It is due to customers' increased health consciousness and desires to consume fewer sugary beverage items like sodas and juices. The demand for at-home alternatives to bottled water, such as tap water filters, which are not often included in the industry, surged due to this shift in views toward health.

- Moreover, according to a recent nationwide study of more than 2,000 United States adults 18 and older conducted online by The Harris Poll on behalf of the International Bottled Water Association (IBWA), 88% of Americans say they include a favorable impression of bottled water as a beverage option.

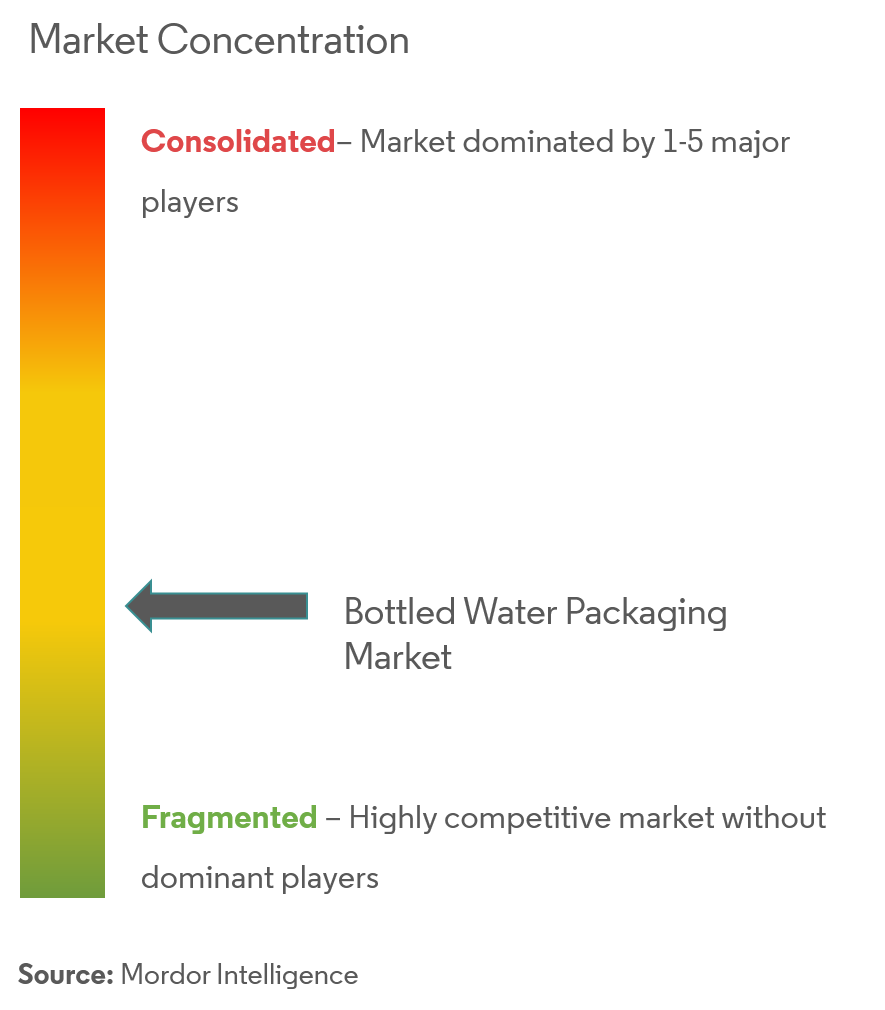

Bottled Water Packaging Industry Overview

The bottled water packaging market is fragmented and competitive because of major players. The key bottled water packaging market players are Amcor Ltd, Plastipak Holdings, Ball Corporation, and Sidel International. The bottle manufacturers also invest in advertising and marketing campaigns to capture a larger customer base and a high industry share.

- October 2022- Sidel introduces their 1SKIN bottle, the future of environmentally friendly packaging for delicate beverages. Sidel developed a one-of-a-kind recycled PET bottle with no labels. It was created to assist Sidel's customers in achieving their sustainability goals and boost sales of high-end items by fusing exceptional shelf appeal with the best eco credentials.

- July 2022- Amcor Limited launched samples of spirits bottles made of recyclable polyethylene terephthalate (PET) that meet the newly approved US Tax and Trade Bureau (TTB) sizes. Amcor's new offering is developed to give customers the freedom and flexibility to explore new markets.

Bottled Water Packaging Market Leaders

-

Plastipak Holdings

-

Amcor Limited

-

Ball Corporation

-

Alpack Plastics

-

Sidel International

- *Disclaimer: Major Players sorted in no particular order

Bottled Water Packaging Market News

- June 2023: Coca-Cola India introduced a new bottle in Andhra Pradesh that is 100% recycled PET (rPET), with the assistance of ALPLA. It is an important milestone as the first time a 100% rPET bottle is used in India for food or beverages. ALPLA's initiatives are intended to promote Coca-Cola's global objective of using at least 50% recycled material in all packaging by 2030 by providing the rPET preforms. The new rPET bottle, now offered in 1 l bottles, was introduced for the packaged drinking water company Kinley.

- May 2022: Amcor Limited announced next-generation technology enabling bottles to be produced 30% lighter and with 100% recycled material. Furthermore, innovation will improve the consumer experience while addressing widespread commitments to reduce material use and lower greenhouse gas emissions.

- January 2022: Plastipak manufacturing and recycling plastic bottles and containers expanded its PET recycling capacity at its manufacturing site in Bascharage, Luxembourg. It converts washed rPET flakes from post-consumer bottles into food-grade recycled PET (rPET) pellets.

Bottled Water Packaging Industry Segmentation

Bottled water is considered among the highest consumed beverage owing to its convenience. Bottle packaging also makes transportation of water over greater distances convenient. It is expected to contribute significantly toward the growth of the bottled water packaging market. It became an icon of a healthy lifestyle in emerging countries.

The Bottled Water Packaging Market is segmented by material (plastic, metal, glass, and other materials), product (still bottled water, carbonated bottled water, flavored bottled water, and functional bottled water), and geography (North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa). The market sizes and forecasts are provided in value (USD) for all the above segments.

| By Material | Plastic |

| Metal | |

| Glass | |

| Other Materials | |

| By Product | Still Bottled Water |

| Carbonated Bottled Water | |

| Flavored Bottled Water | |

| Functional Bottled Water | |

| By Geography | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |

Bottled Water Packaging Market Research FAQs

How big is the Bottled Water Packaging Market?

The Bottled Water Packaging Market size is worth USD 54.15 billion in 2025, growing at an 5.22% CAGR and is forecast to hit USD 69.83 billion by 2030.

What is the current Bottled Water Packaging Market size?

In 2025, the Bottled Water Packaging Market size is expected to reach USD 54.15 billion.

Who are the key players in Bottled Water Packaging Market?

Plastipak Holdings, Amcor Limited, Ball Corporation, Alpack Plastics and Sidel International are the major companies operating in the Bottled Water Packaging Market.

Which is the fastest growing region in Bottled Water Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Bottled Water Packaging Market?

In 2025, the North America accounts for the largest market share in Bottled Water Packaging Market.

What years does this Bottled Water Packaging Market cover, and what was the market size in 2024?

In 2024, the Bottled Water Packaging Market size was estimated at USD 51.32 billion. The report covers the Bottled Water Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Bottled Water Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Bottled Water Packaging Industry Report

Statistics for the 2025 Bottled Water Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Bottled Water Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.