Bio Vanillin Market Analysis

The Global Bio Vanillin Market size is estimated at USD 297.96 million in 2025, and is expected to reach USD 423.80 million by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

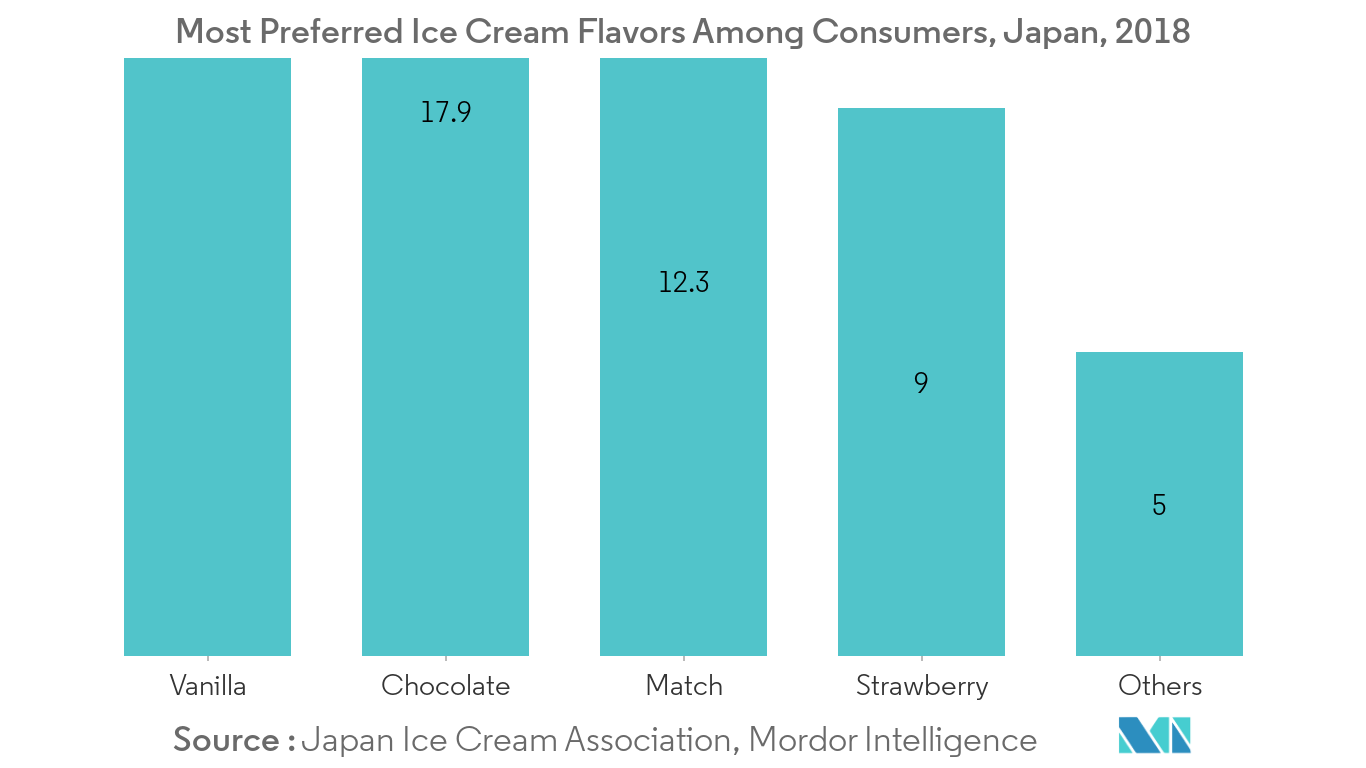

- Vanilla has been one of the most popular flavors in various applications. The market's growth is driven by its diversified applications in end-user industries, ranging from food and beverage to pharmaceuticals.

- It is extensively used as a flavoring agent in the food and beverage sector, which is the major application augmenting the market growth. The ice-cream and chocolate industries cover a large portion of the market.

Bio Vanillin Market Trends

Growing Demand for Bio Vanillin in the Food and Beverage Industry

Bio vanillin enhances the aroma, flavor, shelf life, and taste of various food and beverage products, keeping the nutritional value of foods unaltered. Thus, it can favorably be used for food and beverage processing applications, especially for manufacturing dairy products. The growing consumer preference toward the utilization of highly nutritional and biobased food products, especially in developed economies. such as the United States, is expected to create a significant demand for bio vanillin over the forecast period.

Asia-Pacific Remains the Dominant Region

In 2019, emerging regions, like Asia-Pacific, dominated the global bio vanillin market, in terms of market revenue. Moreover, Asia-Pacific is expected to expand at a substantial rate. Strategically, one of the leading vanillin producers, Camlin Fine Sciences Ltd, acquired 51% stake in Ningbo Wanglong Flavors and Fragrances Company Limited (China) and gained a leading position among the vanillin producers in the global market. Europe held the second-largest share, followed by North America, owing to the increasing chemical and pharmaceutical units in the region. In addition, Brazil is expected to witness significant gains in the vanillin market share. The Middle-East, led by the confectionaries and ice cream industry's growth in the GCC region, is expected to witness an above-average industry gain.

Bio Vanillin Industry Overview

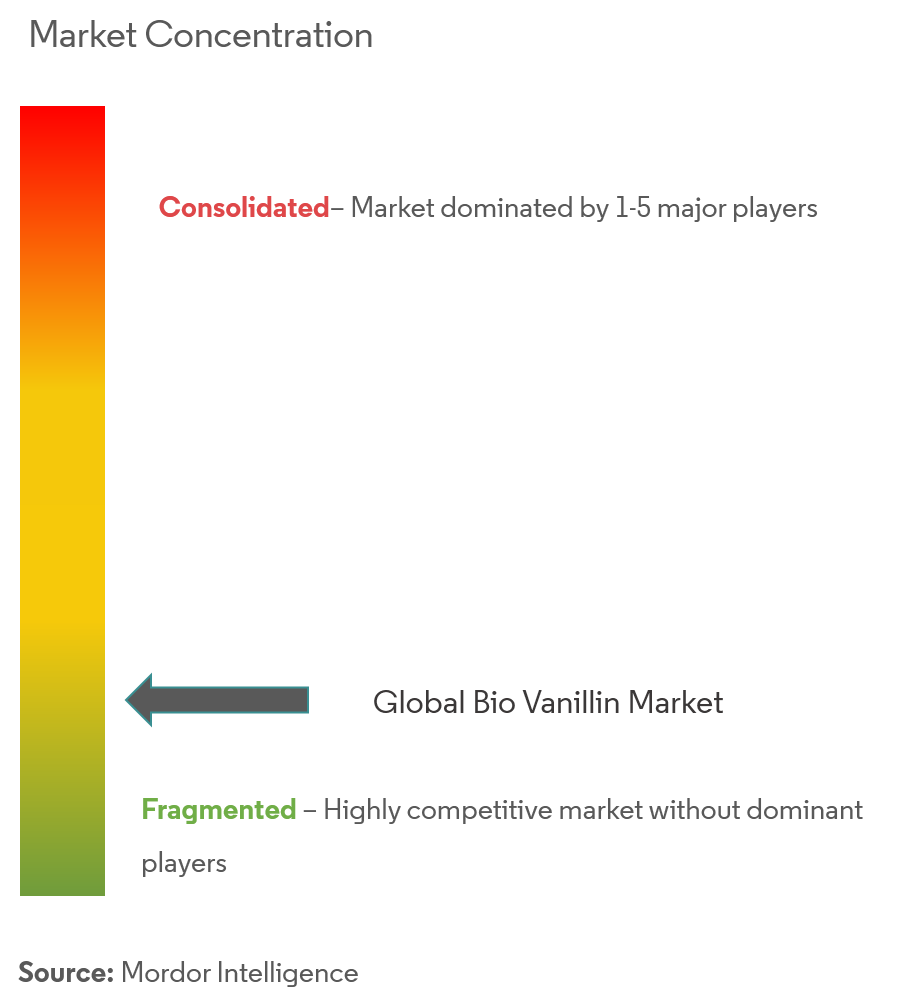

Some of the major key players in bio vanillin market, globally, include Firmenich SA, Givaudan, Apple Flavor & Fragrance Group Co. Ltd, Archer Daniels Midland Company, and Advanced Biotech.

Bio Vanillin Market Leaders

-

Firmenich SA

-

Givaudan

-

Advanced Biotech

-

Evolva Holding SA

-

Lesaffre

- *Disclaimer: Major Players sorted in no particular order

Bio Vanillin Industry Segmentation

The global bio vanillin market is segmented by application and geography. On the basis of application, the market is segmented into food, beverage, pharmaceutical, and fragrance. The food segment is further classified into ice cream, baked goods, chocolate, and other foods. On the basis of geography, the study provides an analysis of the bio vanillin market in the emerging and established markets across the world, including North America, Europe, Asia-Pacific, South America, and Middle-East & Africa.

| By Application | Food | Ice Cream | |

| Baked Goods | |||

| Chocolate | |||

| Other Foods | |||

| Beverage | |||

| Pharmaceutical | |||

| Fragrance | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Russia | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Rest of the World | South America | ||

| Middle-East & Africa | |||

Bio Vanillin Market Research FAQs

How big is the Global Bio Vanillin Market?

The Global Bio Vanillin Market size is expected to reach USD 297.96 million in 2025 and grow at a CAGR of 7.30% to reach USD 423.80 million by 2030.

What is the current Global Bio Vanillin Market size?

In 2025, the Global Bio Vanillin Market size is expected to reach USD 297.96 million.

Who are the key players in Global Bio Vanillin Market?

Firmenich SA, Givaudan, Advanced Biotech, Evolva Holding SA and Lesaffre are the major companies operating in the Global Bio Vanillin Market.

Which is the fastest growing region in Global Bio Vanillin Market?

Middle East and Africa is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Global Bio Vanillin Market?

In 2025, the Asia Pacific accounts for the largest market share in Global Bio Vanillin Market.

What years does this Global Bio Vanillin Market cover, and what was the market size in 2024?

In 2024, the Global Bio Vanillin Market size was estimated at USD 276.21 million. The report covers the Global Bio Vanillin Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Bio Vanillin Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Bio Vanillin Industry Report

Statistics for the 2025 Global Bio Vanillin market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Bio Vanillin analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.