Bahrain Paints and Coatings Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | > 4.50 % |

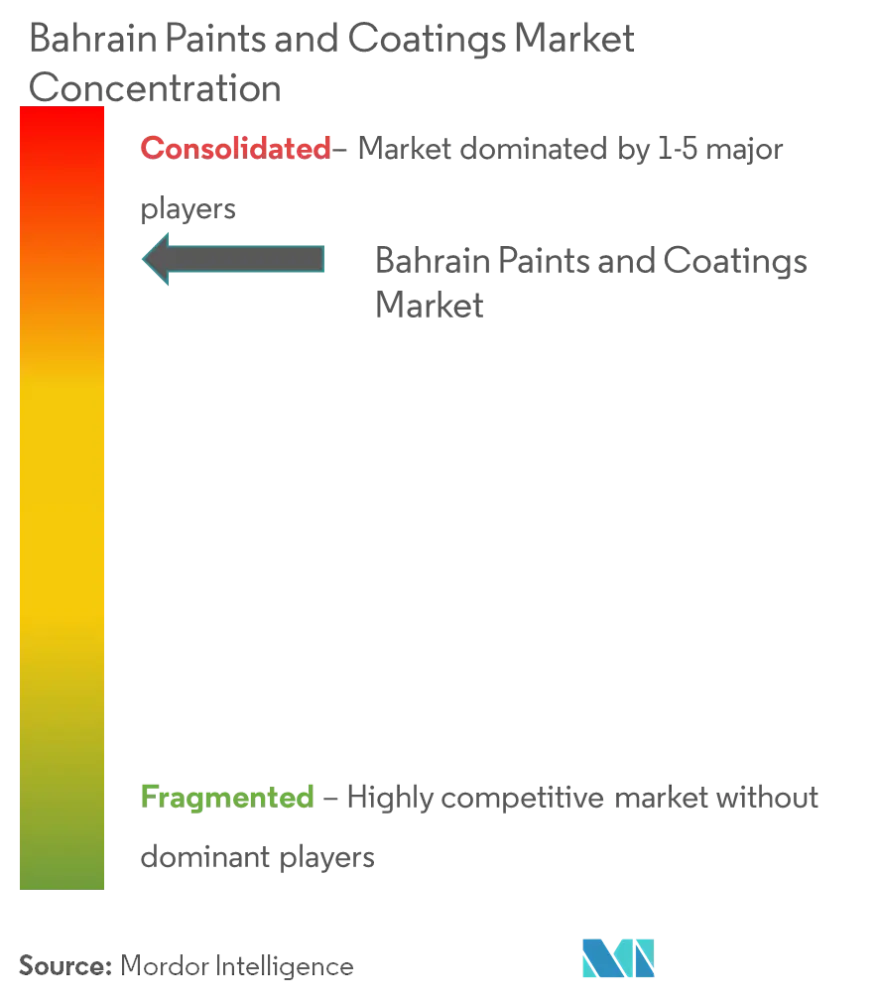

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Bahrain Paints and Coatings Market Analysis

The Bahrain paints and coatings market is estimated to witness a significant growth, at an estimated CAGR of over 4.5%, over the forecast period. One of the major factors driving the market studied is the rapidly increasing housing construction activity in the country. The rise in the prices of raw materials is expected to hinder the growth of the market studied.

- Architectural coatings dominated the market, and it is expected to grow during the forecast period due to the increasing construction activities.

- Growing oil & gas exploration and production activities in Bahrain are likely to act as an opportunity in the future.

Bahrain Paints and Coatings Market Trends

This section covers the major market trends shaping the Bahrain Paints & Coatings Market according to our research experts:

Acrylic Resin Dominating the Market

- Acrylic resins are the most widely used polymers in the paint and coatings industry. Most of the acrylic paints are water-based or solvent-based and are available as emulsions (latices), lacquers (lower volume solids), enamels (higher volume solids), and powders (100% solids).

- The common acrylic polymers come in a wide variety of types and combinations, such as methyl and butyl methacrylate. In the case of inexpensive paints, polyvinyl acetate is used primarily.

- The two principal forms of acrylic used are thermoplastic and thermoset. Thermoplastics acrylic resins are synthetic resins achieved by polymerization of different acrylic monomers. Thermosets are cured at elevated temperatures by reacting them with other polymers. Thermoplastic acrylic resins are of two types, namely solution acrylics and acrylic latex coatings.

- Furthermore, the acrylic resins develop properties, such as transparency, high colorability, and UV resistance in coating solutions. They are used in waterborne systems very often, which result in low VOC emission. The application of acrylic coatings leads to high surface hardness. In certain applications, such as walls, decks, and roofing, the acrylic coatings provide elastomeric finishes to improve the UV resistance of the surface, if employed with some fluids.

- The application of acrylic coatings is primarily found in the construction industry for high-end finishing in roofs, decks, bridges, floors, and other applications. The water-based acrylic coatings are high in demand, owing to the environmental concerns, as the negative impact of VOCs affecting the air quality in the environment.

- The primary binder type in the Bahrain paints and coatings market is acrylic, with a total share of more than 70% of all the waterborne coatings. Acrylic is widely used in architectural coatings.

- Such positive factors are likely to increase demand over the forecast period.

Protective Coatings Demand to Expand at a Fastest Rate

- The oil and gas industry use protective coatings for both upstream and downstream segments, for the transportation of oil and gas toward refineries.

- The industry has been trying to find ways to cut capital charges. This, along with the need to adhere to strict environmental regulations, has led to the demand for a coating system (with a long life), which may be effective in the protection of the assets.

- The oil and gas industry use various types of protective coatings, such as anti-corrosion, heat-resistant, abrasion-resistance, fire-resistance, and others.

- The offshore oil and gas production have some of the most demanding conditions. Therefore, the coating systems used must be equipped likewise.

- Apart from oil and gas, infrastructure has been the major backbone for the country’s growth.

- Roads, bridges, public parks, etc., are all subjected to continuously extreme conditions. Paints and coatings in infrastructure can be used as varnishes and inorganic binders that provide protection against harsh environmental conditions. The key drivers of this growth are a USD 32 billion infrastructure investment, a pipeline comprised of USD 10 billion in government funding, USD 7.5 billion from the GCC Development Fund, and USD 15 billion from the private sector.

- With the substantial growth, especially in the oil and gas and infrastructural projects, the protective coatings market is expected to witness rapid growth during the forecast period.

Bahrain Paints and Coatings Industry Overview

The Bahrain paints and coatings market is consolidated and the top five players account for more than 65% of the market share. The major companies include Jotun, Asian Paints Berger, Hempel A/S, Omega Paints & Chemical Industries, and PPG Industries, Inc. among others.

Bahrain Paints and Coatings Market Leaders

-

Jotun

-

Asian Paints Berger

-

Hempel A/S

-

Omega Paints & Chemical Industries

-

PPG Industries, Inc.

*Disclaimer: Major Players sorted in no particular order

Bahrain Paints and Coatings Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Assumptions

-

1.2 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Drivers

-

4.2 Restraints

-

4.3 Industry Value Chain Analysis

-

4.4 Porter's Five Forces Analysis

-

4.4.1 Bargaining Power of Suppliers

-

4.4.2 Bargaining Power of Consumers

-

4.4.3 Threat of New Entrants

-

4.4.4 Threat of Substitute Products and Services

-

4.4.5 Degree of Competition

-

-

-

5. MARKET SEGMENTATION

-

5.1 Resin Type

-

5.1.1 Acrylic

-

5.1.2 Alkyd

-

5.1.3 Polyurethane

-

5.1.4 Epoxy

-

5.1.5 Polyester

-

5.1.6 Other Resin Types

-

-

5.2 End-user

-

5.2.1 Architectural

-

5.2.2 Automotive

-

5.2.3 Protective Coating

-

5.2.4 Transportation

-

5.2.4.1 Marine

-

5.2.4.2 Other Transportation Types

-

-

5.2.5 Other End-users

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

-

6.2 Market Share Analysis**

-

6.3 Strategies Adopted by Leading Players

-

6.4 Company Profiles

-

6.4.1 Akzo Nobel N.V.

-

6.4.2 Asian Paints Berger

-

6.4.3 Basic System

-

6.4.4 Caparol

-

6.4.5 GMCI BAHRAIN

-

6.4.6 Hempel A/S

-

6.4.7 Jotun

-

6.4.8 Legend Paints Company W.L.L.

-

6.4.9 Omega Paints & Chemical Industries

-

6.4.10 Prisma Paints

-

6.4.11 The Sherwin-Williams Company

-

6.4.12 PPG Industries, Inc.

-

6.4.13 Sika AG

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Bahrain Paints and Coatings Industry Segmentation

The Bahrain paints and coatings market report includes:

| Resin Type | |

| Acrylic | |

| Alkyd | |

| Polyurethane | |

| Epoxy | |

| Polyester | |

| Other Resin Types |

| End-user | ||||

| Architectural | ||||

| Automotive | ||||

| Protective Coating | ||||

| ||||

| Other End-users |

Bahrain Paints and Coatings Market Research FAQs

What is the current Bahrain Paints and Coatings Market size?

The Bahrain Paints and Coatings Market is projected to register a CAGR of greater than 4.5% during the forecast period (2024-2029)

Who are the key players in Bahrain Paints and Coatings Market?

Jotun, Asian Paints Berger, Hempel A/S, Omega Paints & Chemical Industries and PPG Industries, Inc. are the major companies operating in the Bahrain Paints and Coatings Market.

What years does this Bahrain Paints and Coatings Market cover?

The report covers the Bahrain Paints and Coatings Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Bahrain Paints and Coatings Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Bahrain Paints Industry Report

Statistics for the 2024 Bahrain Paints market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Bahrain Paints analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.