MI Company Positioning Matrix: Azerbaijan Oil And Gas Upstream Market

Evaluation Parameters

MI Company Positioning Matrix

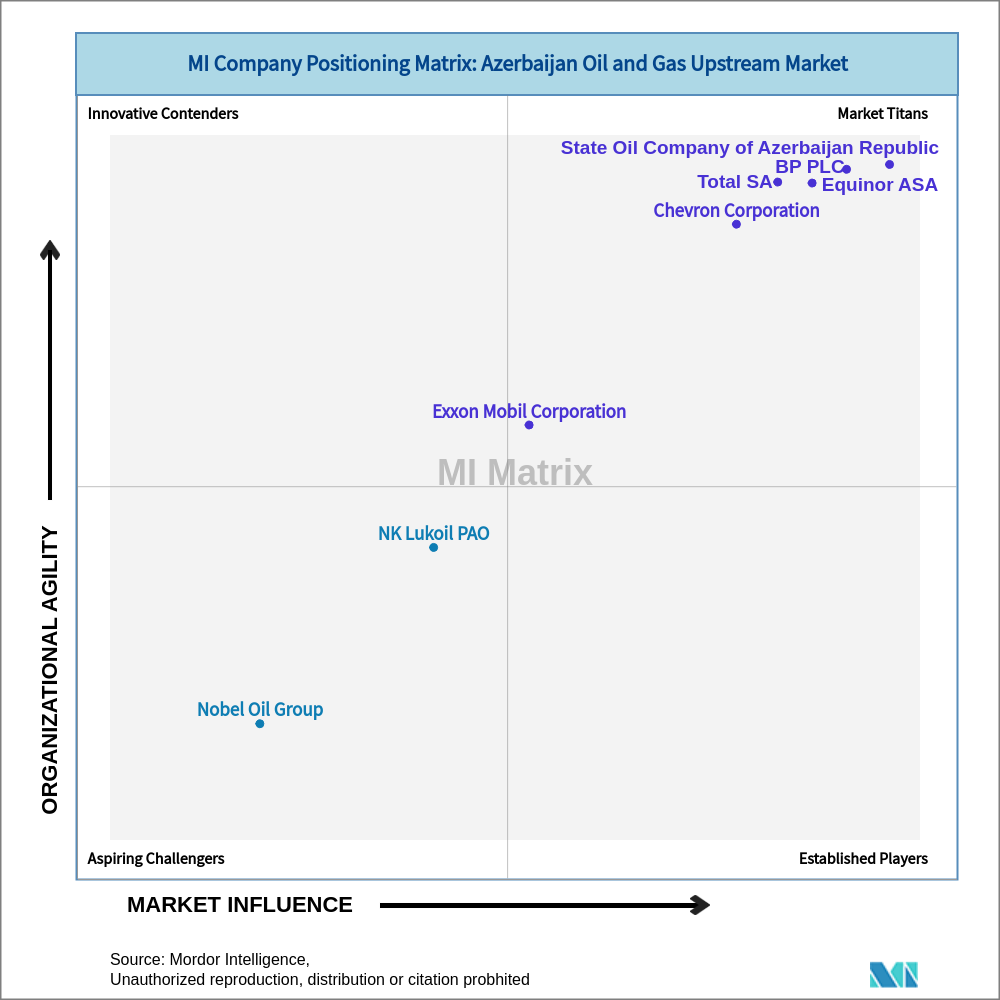

The MI Company Positioning Matrix is a comprehensive framework designed to evaluate and position companies within a specific market segment based on two main dimensions: Market Influence and Organizational Agility. This framework helps stakeholders understand the relative positioning of companies based on their current market impact and their ability to adapt and thrive in a dynamic environment.

The Matrix is divided into four quadrants that illustrate different strategic positions:

- Market Titans (Upper Right Quadrant): Companies positioned here indicate robust market presence and strong adaptability to future trends.

- Established Players (Lower Right Quadrant): These companies have strong current performance and potential for strategic adjustments to enhance flexibility.

- Innovative Contenders (Upper Left Quadrant): Positioned with high agility, these companies are innovative and well-prepared for future opportunities, focusing on growth and expansion.

- Aspiring Challengers (Lower Left Quadrant): Companies in this quadrant offer specialized products or services, emphasizing targeted strategies and unique market segments.

MI Company Positioning Matrix: Azerbaijan Oil And Gas Upstream Market

Want to use this image? See our sharing and referencing guidelines

Want to use this image? See our sharing and referencing guidelinesCompany Profiles

| Company | Market Influence Summary | Organizational Agility Summary |

|---|---|---|

| Market Titans | ||

| Equinor ASA | Pioneering initiatives across renewable integration, comprehensive offerings in various upstream markets, and a robust brand identity sustain its appeal in Azerbaijan's energy sector. | Proven capacity for swift strategic pivots, with decentralized decision-making enhancing responsiveness and operational fluidity in a dynamic context. |

| Exxon Mobil Corporation | Significant reach with varied services, yet potential to strengthen regional engagement and brand depth to capture rising demand effectively in Azerbaijan. | Democratic internal processes support gradual adjustments and align resources with evolving priorities, optimizing operations for current market landscapes. |

| Total SA | Strong market adaptability, aligning innovative energy solutions with customer needs, underpins steadfast connections within Azerbaijan, leveraging expansive project portfolios. | Extensive, well-coordinated teams prioritize rapid resource allocation and cross-functional initiatives, ensuring strategic alignment with market shifts. |

| State Oil Company of Azerbaijan Republic | Dominant regional player with finely-tuned offerings, responsive to local energy demands and regulatory environments, showcasing unmatched industry expertise. | Streamlined operational frameworks allow for seamless integration of novel approaches and adaptation to fluctuating market conditions. |

| BP PLC | Extensive product lines and strategic partnerships underlie its solid foothold, maintaining significant appeal and reaching diverse upstream interests in Azerbaijan. | Integrated team collaboration fosters proactive adjustments to strategic goals, ensuring continuity and sector leadership through timely innovation. |

| Chevron Corporation | Diverse service offerings enrich its standing, yet opportunities for deeper market engagement remain, enhancing long-term customer alignment. | Adaptive frameworks support operational enhancements, facilitating efficient shifts in company strategies to leverage sector trends. |

| Aspiring Challengers | ||

| NK Lukoil PAO | Emerging capabilities yet to fully harness regional market dynamics, suggesting capacity for expanded strategic outreach and increased presence overhead. | Established foundational systems open to iterative refinements; potential for heightened cohesion in strategic approaches to streamline processes and goals. |

| Nobel Oil Group | Regional operations and niche services offer tangible prospects. Enhanced innovation and regional alignment could increase market capital. | Strategic consolidation focal point; refined management systems enhance response speed and knowledge transfer within operational tiers. |

Get hard to find intelligence on your customers, suppliers, partners and competitors-backed with on-the-gorund-data.

- In-depth company profiles

- Segment level market shares

- Strategy assessment and SWOT analysis

- Product portfolio and pricing details

- Identification and shortlisting of potential partners

- Need analysis and unmet needs

- Purchase and usage behavior

- Partner/customer feedback and satisfaction

Market Overview

Strategic Importance of the Azerbaijan Energy Sector

Positioned at the crossroads of Europe and Asia, the Azerbaijan oil and gas upstream market is a pivotal player in global energy dynamics. With its substantial petroleum reserves in the Caspian Sea, the market commands significant international attention. SOCAR leads Azerbaijan's oil production efforts, collaborating with other major entities like BP, Total, and Chevron, particularly in the prolific Shah Deniz field, which fuels Azerbaijan gas exports. These partnerships leverage advanced exploration techniques within the Baku oil industry, driving efficiency and expanding Azerbaijan's energy sector.

Key Players and Their Operational Dynamics

SOCAR's operations dominate the market, supported by a strong alliance with BP Azerbaijan projects in the Caspian basin resources. Equinor and Total are investing in upstream oil exploration, capitalizing on Azerbaijan petroleum reserves. Chevron and NK Lukoil, while not market leaders, maintain a presence through strategic stakes in ongoing projects. Such global collaborations bring advanced technology and funding, enhancing the market's output efficiency and impacting industry statistics positively.

Market Forces Shaping Upstream Activities

The Azerbaijan oil investments landscape is influenced by the Trans-Anatolian Pipeline, which establishes a direct route for natural gas production from Azerbaijan to Europe. This infrastructure is crucial for sustaining market growth and meeting the increasing European energy demand, aligning with market predictions and forecasts. The international partnerships contribute to industry research, reinforcing market competitiveness and driving regulatory changes that support more sustainable and lucrative industry outcomes.

Regulatory and Local Dynamics

Regulatory impacts from local governments focus on boosting the Baku oil industry, aiming for a balanced approach towards environmental policies while maximizing economic benefits. Industry trends suggest an increasing inclination towards sustainable practices, fostering a favorable environment for innovation in upstream exploration.

Market Leaders and Competitive Advantage

While SOCAR stands as a significant regional force, BP PLC emerges as a technological leader, progressively integrating cutting-edge solutions in exploration and production, thus enhancing market value through collaborative mechanisms. Total and Equinor are notable for their segment-specific strategies, prioritizing targeted development plans tailored to specific geographic needs within the region.

Advisory for Potential Investors

Stakeholders contemplating new ventures should consider market segmentation and the competitive dynamics within the Caspian Sea oil exploration activities. Partnerships with established market leaders like BP and SOCAR can access strategic advantages and insights specific to Shah Deniz operations. Staying abreast of local regulatory transitions and fostering adaptability to market reviews and disruptions can augment long-term benefits. Embracing emerging technologies and responding to fluctuating global oil demands will be pivotal in optimizing the market outlook. Investors are advised to monitor the evolving landscape closely to leverage industry sales to the maximum extent possible.

Methodology and Assessment Criteria

The MI Company Positioning Matrix is constructed through a rigorous methodology that includes detailed analysis and scoring based on a range of carefully selected criteria. Each company is evaluated on ten parameters: five under Market Influence and five under Organizational Agility.

- Market Influence

The horizontal axis of the MI Company Positioning Matrix represents a company's current market influence. This dimension assesses how well the company is performing in terms of its existing market share, product portfolio, competitive positioning, customer leadership, and geographic reach. Companies positioned higher on this axis demonstrate a strong influence in the market, which indicates a robust presence, a well-established product lineup, a significant share of the market, and effective leadership in customer satisfaction and retention. - Organizational Agility

The vertical axis measures a company’s organizational agility, which reflects its capability to innovate, adapt, and optimize its operations in response to changing market conditions and future customer needs. This dimension evaluates a company’s strengths in new product development, sales excellence, marketing excellence, operational efficiency, and financial health. Companies positioned further to the right on this axis are better equipped to adapt their strategies and operations to meet future challenges and opportunities, thus ensuring long-term sustainability and growth.

The scores for these parameters are assigned based on a comprehensive evaluation of publicly available information, industry reports, company financials, and expert insights. Weighted averages for each dimension are then calculated to determine the overall positioning of each company on the matrix.

Contact us in case

- You want an image without MI Matrix watermark

- You are unable to refer to this page via a hyperlink

- You have other suggestions or comments

- You want detailed insights on the competitive landscape market estimates for this industry