Market Trends of Automotive Inertial Systems Industry

This section covers the major market trends shaping the Automotive Inertial Systems Market according to our research experts:

Inertial Measurement Unit is Gaining Traction Due to Emergence of Automotive Inertial Systems

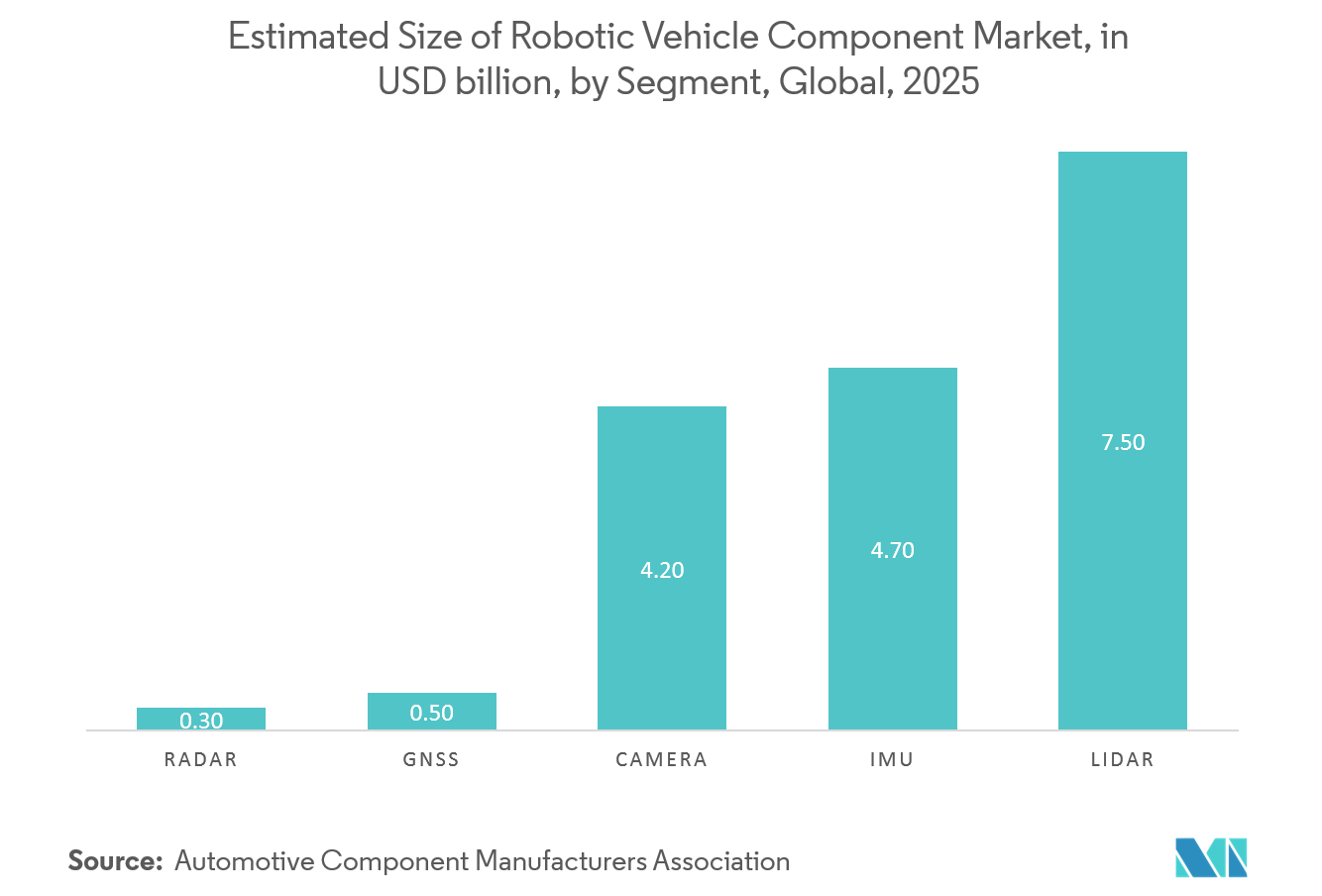

- Inertial Measurement Unit (IMU) allows the measurement of transitional as well as rotational accelerations by combining several inertial sensors including, accelerometer, gyroscope, and sometimes magnetometer to enable reading of six dimensions (yaw, roll and pitch rate as well as lateral, longitudinal and vertical accelerations) around the three axes while driving.

- The IMUs are used at a multitude of automotive applications as well as for the latest ADAS functioning for autonomous driving. It helps to fill the gap in GPS while the vehicle moving towards the blind spot and when LiDAR functionality struggles in a snowstorm.

- Owing to the high resonance frequency of over 25 kHz in IMU along with closed driving and evaluation unit, it provides high barrier to mechanical interference. The inertial measuring unit (IMU) has gained popularity for the application on contributing to active and passive safety systems such as ESP (Electronic Stability Control Program), airbag control unit, and driver assistance systems like the adaptive cruise control. This enhances the offset performance with an integrated microcontroller.

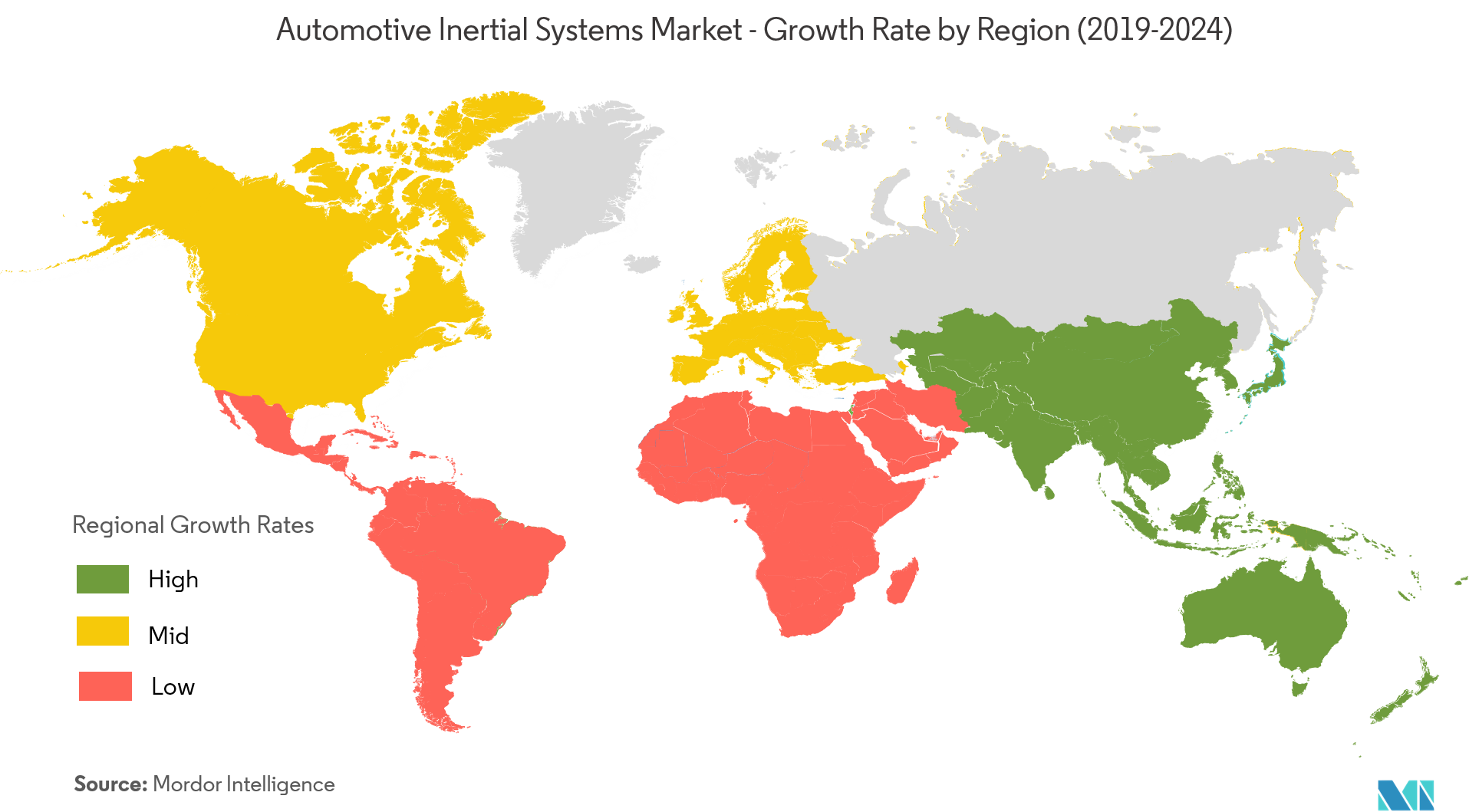

Asia-Pacific to Register a Significant Growth During the Forecast Period

- Asia-Pacific is a significant market for automotive inertial systems in the current market scenario. Huge volume production in countries such as China, Japan, and India keeps a constant demand for automotive inertial systems in the region. However, in recent times, sales of the new vehicle in certain parts of the region have been sluggish. The witnessed a decrease in car sales across various economies. For instance, according to the Japan Automotive Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, 2,895,454 cars were sold in Japan in 2018 which decreased by 1.6% compared to 2017.

- Further, Electric vehicles (EVs) are projected to gain popularity with Chinese car owners this year, as new designs with improved performance offset a government cut in price subsidies. According to the International Energy Agency forecasts, In 2017, China had the largest EV market, where EVs accounted for 2.2% of new cars sold in the country. The Chinese government sees EVs as an opportunity for China to compete and become a major car manufacturer.

- Furthermore, the electric vehicle market is gaining momentum in India owing to the ambitious plans and initiatives of the government. Public authorities in India have made a number of electric vehicle-related policy announcements over the past few years showing strong commitment, concrete action, and significant ambition for the deployment of electric vehicles in the country.