Automotive Exhaust Aftertreatment Systems Market Analysis

The Automotive Exhaust Aftertreatment Systems Market is expected to register a CAGR of greater than 18.5% during the forecast period.

The COVID-19 pandemic had a severe impact on the market. With the record low sales of passenger and commercial vehicles worldwide, the demand for exhaust after-treatment systems was almost significantly affected. The lockdown and social distancing norms worldwide caused the aftermarket business of the after-treatment systems to plummet. However, with the restrictions gradually being relaxed, the growing need for lesser emissions from vehicles of all sizes, and strict emission norms levied by governments of different nations, the future market for this industry looks hopeful.

Technical difficulties, such as high pressure to force the exhaust through the filtering system, unavailability of these systems for biodiesel, passive regeneration system requiring highway driving to clean the accumulated soot, and complicated set-up for urea injection have acted as barricades for the market growth. However, the recovering global automotive industry and increasing production sites in developing nations, such as Mexico and India, are opening up new opportunities for market growth by 2027.

Automotive Exhaust Aftertreatment Systems Market Trends

Stringent Emission Regulations Driving the Market

The demand for diesel engines is expected to witness positive growth due to the surge in commercial vehicle sales, owing to the growing construction industry and developing logistics market (primarily due to a rise in the e-commerce business).

Emission standards for diesel engines are becoming more stringent gradually. Adhering to such standards has forced manufacturers to develop advanced exhaust after-treatment systems.

For instance, the Government of India announced to skip BS-V and leapfrog to BS-VI emission norms in April 2020, opening new opportunities for the exhaust after-treatment systems market. Strong economic growth in Asia-Pacific increased the purchasing power of consumers in the region.

The majority of diesel engines can convert between 40% to 46% of the fuel to propulsion energy, while the remaining is lost in the environment as heat through exhaust emissions and cooling systems.

With the enactment of Euro VI emission for heavy-duty engines, the burden on commercial vehicle manufacturers has increased. Manufacturers are looking at the most efficient type of filter that can be installed in the exhaust aftertreatment systems for diesel vehicles, with an aim to provide least or zero particulate emissions and meet the emission standards set by different governments.

Asia-Pacific Market Growing at a Faster Pace

In 2021, Asia-Pacific dominated the global market. China emerged as the largest automotive destination, with major OEMs setting up manufacturing plants in the country. The government is playing a pivotal role in the shift toward electric vehicles. To cut carbon emissions and reduce dependence on non-renewable sources, governments of various countries have implemented programs to boost the electric vehicle infrastructure. They are supporting manufacturers with funds to set up new factories and to encourage customers to purchase. Despite many efforts, the need for diesel-powered vehicles is especially observed in commercial vehicles used for mass transport or mining purposes.

China is the world's largest automotive market, accounting for more than 35% of the global passenger vehicle sales and 15% of the global commercial market sales. With numerous active vehicles in the country, the government is coming up with various strategies to reduce emissions. For instance,

China targets a reduction of 50% for hydrocarbons, 40% for nitrogen oxides (NOx), and 33% for particulate matter in terms of the China 6 emission standards. New gasoline vehicles in China are made mandatory to meet the regulations. For instance, from January 2021, China 5 emission standard vehicles are not permitted for sales due to the oncoming of China 6 standards.

India also introduced strict emission standards, due to which the aftertreatment systems market is expected to grow in the country. The huge market for the automobile industry in the country is an added advantage.

With such stringent emission standards in the region, the market for exhaust aftertreatment systems is looking at a good growth potential in the coming years up to the forecast period.

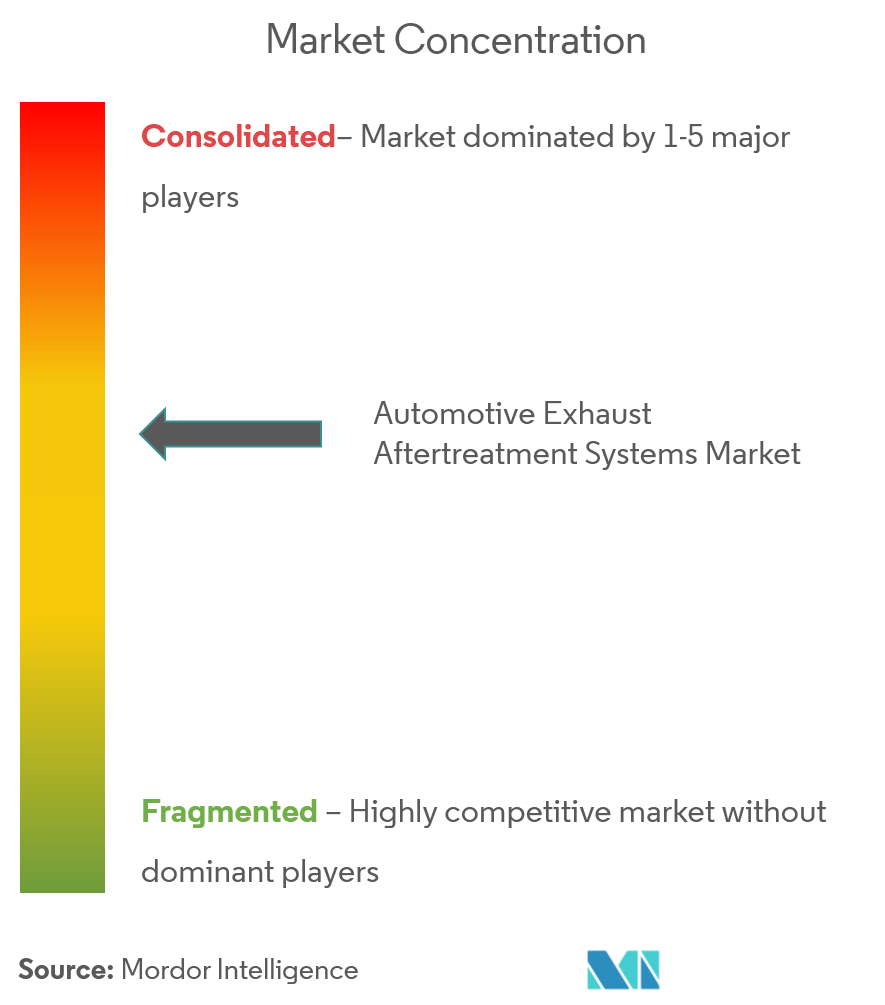

Automotive Exhaust Aftertreatment Systems Industry Overview

Some of the major players dominating the market are CDTi Advanced Materials Inc., Delphi Technologies PLC, Continental Reifen Deutschland GmbH, Tenneco Inc., and Donaldson Company Inc., among others. The companies are planning to tap the market by introducing or expanding their product portfolio. Increasing pressure from emission regulation authorities has forced manufacturers to come up with new technologies, which reduce the emission of polluting gases from the exhaust. This has compelled the manufacturers to increase R&D spending, to manufacture better exhaust aftertreatment technologies. For instance,

- In March 2021, Eaton and Tenneco partnered to build an integrated thermal management system that will enable commercial vehicles to meet stringent emission regulations. This system provides heat directly to the aftertreatment systems that can reduce harmful exhaust emissions.

The increasing number of suppliers of exhaust aftertreatment systems and their joint ventures with local suppliers putting emphasis on expanding their presence resulted in improving production capacity.

Automotive Exhaust Aftertreatment Systems Market Leaders

-

Continental Reifen Deutschland GmbH

-

Delphi Technologies PLC

-

Tenneco Inc.

-

Donaldson Company Inc.

-

CDTi Advanced Materials Inc.

- *Disclaimer: Major Players sorted in no particular order

Automotive Exhaust Aftertreatment Systems Market News

- In May 2022, Engineers at Southwest Research Institute demonstrated the effectiveness of new technologies for reducing diesel emissions. The breakthrough successfully lowered heavy-duty diesel engine nitrogen oxide (NOx) emissions to satisfy CARB 2027 criteria.

- In October 2020, Bosch announced that it is developing an efficient drive technology for commercial vehicles with internal combustion engines with diesel fuel. This product portfolio includes engine and air control, fuel supply, and exhaust gas aftertreatment systems.

Automotive Exhaust Aftertreatment Systems Industry Segmentation

The automotive exhaust aftertreatment system market is segmented by fuel type (gasoline and diesel), vehicle type (passenger cars and commercial vehicles), and geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers market size and forecasts for automotive exhaust aftertreatment systems in volume and value (in USD billion), for all the above segments.

| Fuel Type | Gasoline | ||

| Diesel | |||

| Vehicle Type | Passenger Cars | ||

| Commercial Vehicles | |||

| Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | South America | ||

| Middle-East and Africa | |||

Automotive Exhaust Aftertreatment Systems Market Research FAQs

What is the current Automotive Exhaust Aftertreatment Systems Market size?

The Automotive Exhaust Aftertreatment Systems Market is projected to register a CAGR of greater than 18.5% during the forecast period (2025-2030)

Who are the key players in Automotive Exhaust Aftertreatment Systems Market?

Continental Reifen Deutschland GmbH, Delphi Technologies PLC, Tenneco Inc., Donaldson Company Inc. and CDTi Advanced Materials Inc. are the major companies operating in the Automotive Exhaust Aftertreatment Systems Market.

Which is the fastest growing region in Automotive Exhaust Aftertreatment Systems Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Automotive Exhaust Aftertreatment Systems Market?

In 2025, the North America accounts for the largest market share in Automotive Exhaust Aftertreatment Systems Market.

What years does this Automotive Exhaust Aftertreatment Systems Market cover?

The report covers the Automotive Exhaust Aftertreatment Systems Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Automotive Exhaust Aftertreatment Systems Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Automotive Exhaust Aftertreatment Systems Industry Report

Statistics for the 2025 Automotive Exhaust Aftertreatment Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Exhaust Aftertreatment Systems analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.