Automotive Camera Market Analysis

The Automotive Camera Market is expected to register a CAGR of greater than 12% during the forecast period.

The COVID-19 pandemic hindered the growth of the market as suspension of vehicle production, and supply disruptions brought the automotive industry to a halt. However, the automotive camera market started gaining momentum owing to the mandates by different countries. Furthermore, the development of new technologies like night vision systems, cruise control systems, etc., and growing e-mobility drive demand in the market.

In addition, factors such as increasing penetration of safety systems in vehicles and a high degree of competition among vendors for providing value-added services and products that cater to customer needs are likely to contribute to enhanced development in the market. However, high installation costs and malfunctioning camera components like sensors, modules, etc., are projected to act as potential challenges over the forecast period.

North America is expected to dominate the automotive camera market, owing to the increasing demand for luxury vehicles in the United States and Canada. The increasing installation of advanced driver-assistance systems (ADAS) is estimated to further boost the demand for automotive cameras in the coming years. Europe and the Asia-Pacific region are likely to hold a prominent share in the market due to the presence of many automobile manufacturers in the region.

Automotive Camera Market Trends

Innovations to Lead the Development of the Automotive Camera Market

Sensing cameras are gradually becoming an integral part of an active safety system in vehicles. The growth can be attributed to the increase in safety concerns of the passengers and strict government initiatives. Sensing cameras also provide a higher level of performance than general-purpose driving cameras by maintaining quality standards as cost-effective solutions.

These are intelligent safety systems with two key components: A remote sensor is a device that collects data about real-world conditions through sensors, such as radar, ultrasonic sensors, and cameras. The processing computer receives data from these cameras, and then the sensor makes the decision and sends commands to the vehicle subsystems.

- In March 2019, Garmin Ltd announced a fresh iteration to its backup camera solution with the all-new BC 40, the company's first wireless backup camera with a compatible Wi-Fi-enabled Garmin GPS navigator that allows drivers to confidently see a wide and clear view from the backup camera on the navigation display to help encourage a safer driving experience.

With the increasing adoption of ADAS features in vehicles, the demand for cameras is increasing significantly.

- In March 2020, BMW launched plug-in hybrid 330e and 330e xDrive. Its ADAS includes active cruise control with stop and go, which can accelerate and slow automatically to maintain the desired speed set by the driver. It also has standard features such as active guard, frontal collision warning, city collision mitigation, and lane departure warning.

Sensing cameras provide a higher level of performance than general-purpose driving cameras while also meeting the required automotive quality standards as cost-effective solutions. With the increasing adoption of ADAS features in vehicles, the demand for cameras has been increasing.

Expected to Experience the Fastest Growth

North America is expected to hold a dominant share in the market, followed by Europe and Asia-pacific region during the forecast period. Growing demand for luxury vehicles in the United States, Canada, and Mexico, coupled with increasing installation of ADAS in commercial vehicles and passenger cars likely to drive demand in the region during the forecast period.

In addition, the rising penetration of camera-based convenience features in luxury vehicles and the active engagement of players in the market is also largely influencing the growth of the automotive camera market. Also, the rising consumer demand for active safety systems is another driver flourishing the growth of the automotive camera market, which in turn is raising the growth of the target market across the region. For instance, In August 2019, Magna opened a new USD 50 million manufacturing center near Flint, Michigan, to cater to the increased demand for digital cameras from customers.

Europe is also likely to hold a prominent share in the market owing to the high installation of ADAS and legislation mandating the installation of safety technologies in passenger cars in Germany, the UK, France, and Italy. The growing influence of the new car assessment program (NCAP) is one of the drivers of the global automotive camera market. The Asia Pacific is expected to witness significant growth, mainly in China, India, Japan, Thailand, Malaysia, and South Korea, in light of rapid industrialization along with an increasing automobile production.

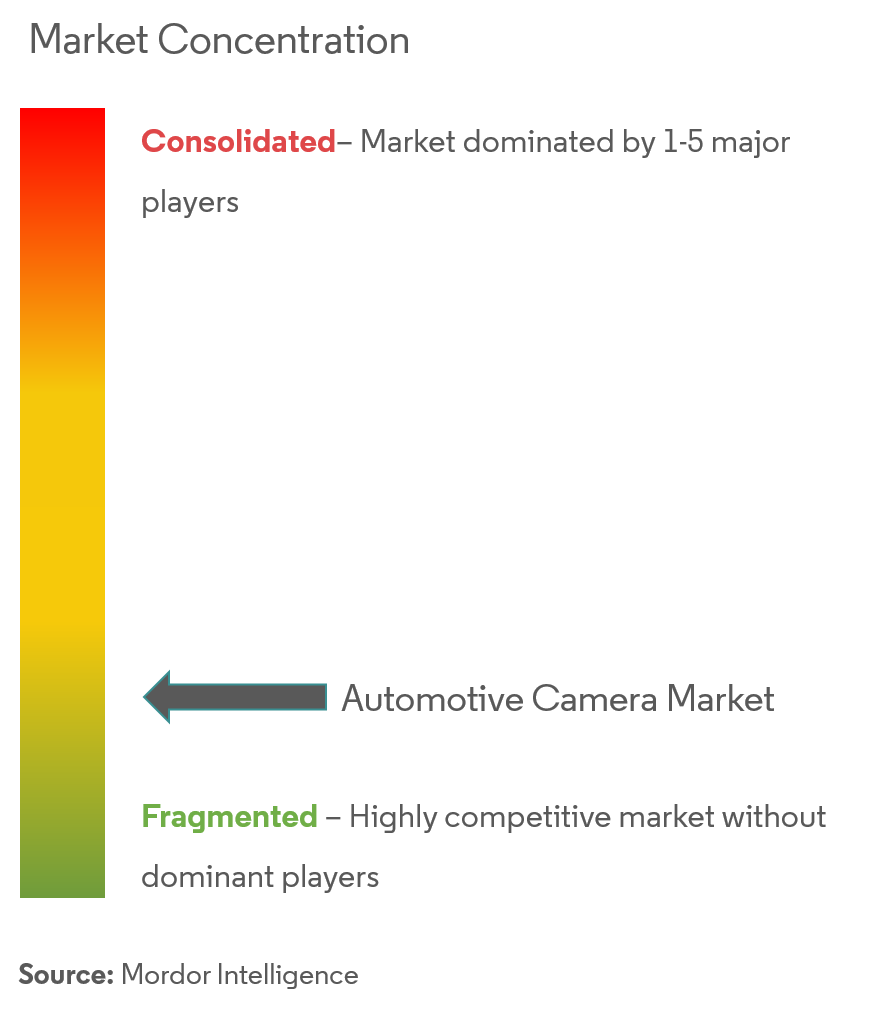

Automotive Camera Industry Overview

The automotive camera market is highly fragmented due to the presence of many regional players. However, some major players, like Garmin Ltd, Panasonic Corporation, Continental AG, Autoliv Inc., Bosch Mobility Solutions, and Magna International, captured significant shares in the market. These companies are focusing on strategic collaborative initiatives to expand their market shares and profitability. For instance,

- In September 2020, OMNIVISION Technologies, Inc. and GEO Semiconductor Inc. announced a joint solution optimized to provide the industry's highest quality images for rear-view cameras (RVCs) and surround-view systems (SVS) and e-mirrors. This solution includes OmniVision's OXO3C10, the world's only automotive image sensor that combines a large 3.0-micron pixel, high dynamic range of 140 dB for minimized motion artifacts, and the highest LED flicker mitigation (LFM) performance.

- In July 2020, ZF, the world's leading supplier of automotive cameras, announced that it had launched its S-Cam4.8 with enhanced vision technology from Mobileye, an Intel Company, on the new Nissan Rogue in the U.S. For light passenger vehicles in the near term, ZF is focusing on Level 2/2+ systems that utilize advanced camera technologies like the S-Cam4.8 and Tri-Cam4 for leading global automakers and plans to its coAssist Level2+ system, the most affordable Level2+ system available at well under USD 1,000, with a major Asian automaker by the end of 2022.

- In September 2019, Bosch developed an MPC3 mono video camera for applications such as advanced driver assistance systems (ADAS) and autonomous driving. The new camera utilizes a multi-path approach and artificial intelligence (AI) for more efficient recognition.

- In August 2019, Continental unveiled new system solutions for safer automated driving. It developed a combined camera system comprising an inward-looking infra-red camera and an outward-looking camera. The system can simultaneously monitor the driver and the surrounding vehicles.

Automotive Camera Market Leaders

-

Garmin Ltd

-

Continental AG

-

Panasonic Corporation

-

Magna International Inc.

-

Bosch Mobility Solutions

- *Disclaimer: Major Players sorted in no particular order

Automotive Camera Market News

- In January 2022, DTS a global leader in developing extraordinary next-generation audio, imaging and sensing technology and a wholly owned subsidiary of Xperi Holding Corporation announced that, at CES 2022, the launch of its revolutionary single camera DTS AutoSense driver and occupancy monitoring solution.

- In July 2021, Continental, has acquired a minority stake in the German-U.S start-up Recogni. The company is working on a new chip architecture for object recognition on AI that can perform rapid processing of sensor data for autonomous driving.

- In February 2020, Continental announced the construction of a new plant in New Braunfels in Texas, United States. The purpose of the new building is to expand its capacity to produce radar sensors in advanced driver assistance systems (ADAS).

- In June 2020, Omnivision launched the world's first image sensor for vehicle cameras. It offers a combination of STEREO flicker mitigation (LFM) and a 3 micron pixel size camera integrated with 140db HDR accomodating features such as lens correction and defect pixel correction.

Automotive Camera Industry Segmentation

An automotive camera is installed on the front side, rear side, or inside a vehicle for safety purposes. Camera modules contain image sensors that are coupled with electronic components in vehicles. The automotive camera market report covers the latest trends, COVID-19 impact, and technological developments in the market.

The scope of the report covers segmentation based on vehicle type, type, technology, applications, and geography. By vehicle type, the market is segmented into passenger vehicles and commercial vehicles. By type, the market is segmented into viewing cameras and sensing cameras. By technology, the market is segmented into digital cameras, infrared, and thermal.

By application, the market is segmented into ADAS, parking assist, and other applications. By geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the world. For each segment, the market sizing and forecast are based on value (USD billion).

| Vehicle Type | Passenger Vehicles | ||

| Commercial Vehicles | |||

| Type | Viewing Camera | ||

| Sensing Camera | |||

| Technology | Digital Camera | ||

| Infrared | |||

| Thermal | |||

| Application | ADAS | ||

| Parking Assist | |||

| Other Applications | |||

| Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| France | |||

| United Kingdom | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | South America | ||

| Middle-East and Africa | |||

Automotive Camera Market Research FAQs

What is the current Automotive Camera Market size?

The Automotive Camera Market is projected to register a CAGR of greater than 12% during the forecast period (2025-2030)

Who are the key players in Automotive Camera Market?

Garmin Ltd, Continental AG, Panasonic Corporation, Magna International Inc. and Bosch Mobility Solutions are the major companies operating in the Automotive Camera Market.

Which is the fastest growing region in Automotive Camera Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Automotive Camera Market?

In 2025, the North America accounts for the largest market share in Automotive Camera Market.

What years does this Automotive Camera Market cover?

The report covers the Automotive Camera Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Automotive Camera Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Automotive Camera Industry Report

Statistics for the 2025 Automotive Camera market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Camera analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.