Automatic Mounter Wafer Equipment Market Analysis

The Automatic Mounter Wafer Equipment Market is expected to register a CAGR of 11.5% during the forecast period.

- >

- Further, the rising penetration of consumer electronics in the high growth regions of the world and rising capital investment by several automatic wafer manufacturing companies to meet the increasing demand for defect-free chips will drive the growth of this market. According to the GSMA Mobile Economy Report 2019, 71% of the global population will be Unique Mobile Subscribers by 2025.

- A recent report by SEMICON EUROPA stated that there would be an increase of 25% in Semiconductor Fabrications Investment in China from 2018 to 2019. It shall be followed by the USA at 24% and Taiwan at 15% for the same period.

- The adoption of Automatic Wafer Equipment will be due to the multiple benefits they offer like increase in handling throughput, reliability, and frequency.

Automatic Mounter Wafer Equipment Market Trends

Proliferation of IoT will be Significant Driver of the Market

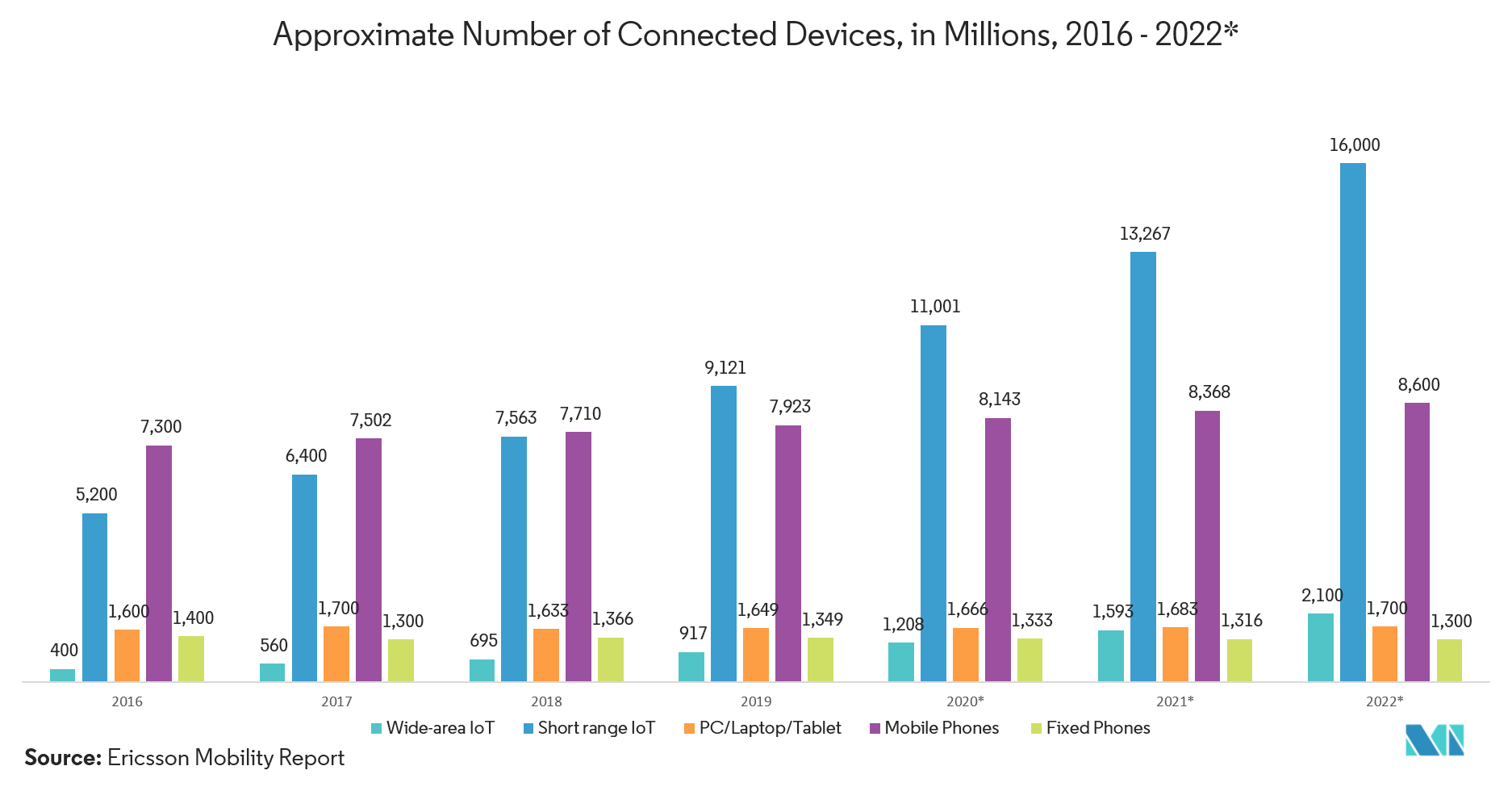

- The IoT market is growing at a significant rate. A rise in the number of interconnected smart devices over the Internet, coupled with advances in critical sensor technologies is fueling the adoption of IoT for faster data communication.

- According to Ericsson’s recently published Mobility Report, Cellular IoT connections are projected to increase from 1 billion in 2018 to 4.1 billion in 2024. It is predicted that by the end of 2024, nearly 35 percent of Cellular IoT connections will be broadband IoT, with 4G connecting the majority. The report further adds that first modules supporting Critical IoT use cases are expected to be deployed in 2020.

- Favorable support from governments for the proliferation of IoT in major industries coupled with the mass adoption of the Internet is driving the adoption of IoT, thereby increasing the growth of Semiconductor Foundry market.

- For instance, the Government of India is investing USD 1 billion in developing 100 smart cities which are expected to be a key enabler for the proliferation of IoT in this region.

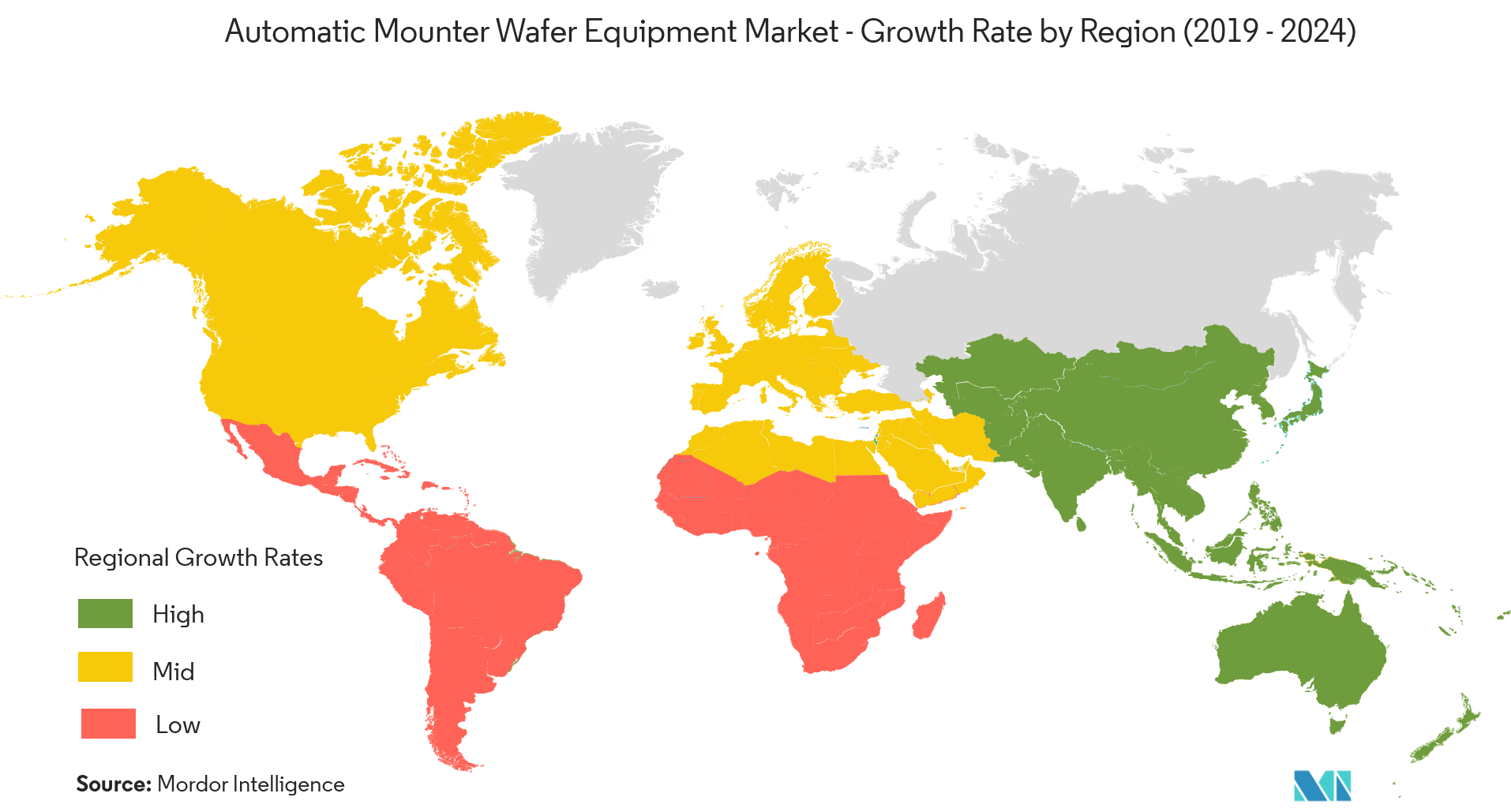

Asia-Pacific to Occupy Significant Market Share

- The low cost of production along with the increasing number of production facilities in the electronics sector are the two major factors that will drive the growth of Automatic Mounter Wafer Equipment Market in the Asia-Pacific.

- According to IMF, World Economic Outlook and IMF Staff Estimates Report Asia’s contribution to the global growth of consumer electronics was 63% in 2018, much higher than any other region which highlights the importance of the Consumer Electronics Industry to this region.

- Moreover, the thriving semiconductor fabrication industry in this region is the primary reason why Asia-pacific will continue to dominate this market.

- For example, Taiwan remains the leading country in the semiconductor foundry business. Taiwan Semiconductor Manufacturing Co. remains, by some distance, the world’s largest foundry, with 2017 revenue going up to USD 32.2 billion. Moreover, Taiwan is also home to the world’s third-largest foundry, United Microelectronics Corp., and the sixth-largest company in foundry, by sales, Powerchip Technology Corp. TSMC, UMC, and Powerchip combined make Taiwan the largest market for this industry closely followed by another emerging Asian giant in this space, China.

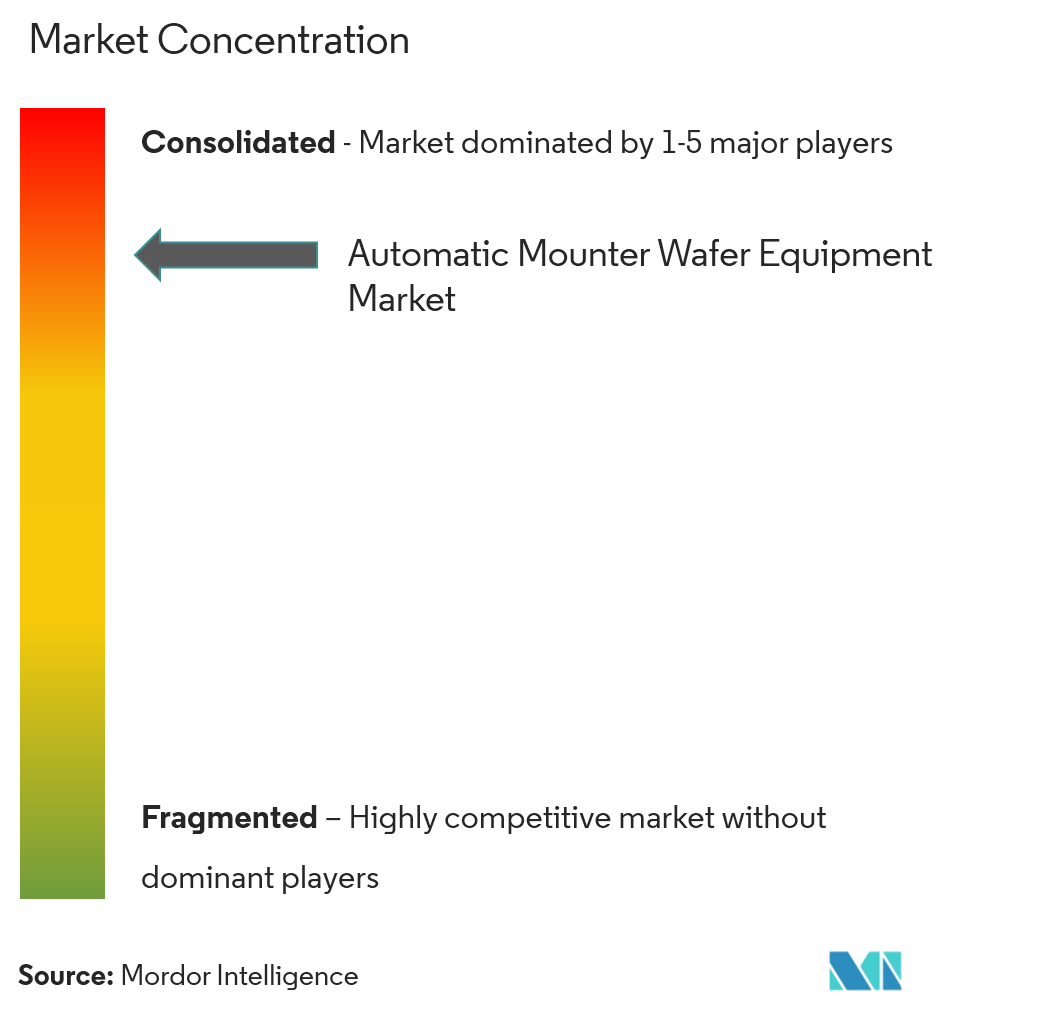

Automatic Mounter Wafer Equipment Industry Overview

The competitive landscape of the Automatic Mounter Wafer Equipment Market is highly consolidated as there are only a few players who produce fully Automatic Wafer Equipment. Moreover, the widespread adoption of manual mounter wafer equipment has made the transition process slow, which in turn has made the process of entry of players in this market leisurely.

- June 2019 - Norwegian monocrystalline wafer maker NorSun announced a partnership New York-based mounting system producer GameChange Solar to more than double the production capacity of its n-type high-efficiency operation at Årdal to join the solar gold rush and counter the Chinese competitors present in the same space.

Automatic Mounter Wafer Equipment Market Leaders

-

Longhill Industries Limited

-

LINTEC Corporation

-

Nitto Denko Corporation

-

Takatori Corporation

-

Disco Corporation

- *Disclaimer: Major Players sorted in no particular order

Automatic Mounter Wafer Equipment Industry Segmentation

Wafer mounting is the step performed during the die preparation of a wafer as part of semiconductor fabrication. During this, the wafer is mounted on a plastic tape that is attached to a ring and is done right before the wafer is cut into separate dies.

| By Wafer Size | 300 mm |

| 200 mm | |

| 150 mm | |

| By End-User | Foundries |

| Inter-level Dielectric Material | |

| Memory | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Automatic Mounter Wafer Equipment Market Research FAQs

What is the current Automatic Mounter Wafer Equipment Market size?

The Automatic Mounter Wafer Equipment Market is projected to register a CAGR of 11.5% during the forecast period (2025-2030)

Who are the key players in Automatic Mounter Wafer Equipment Market?

Longhill Industries Limited, LINTEC Corporation, Nitto Denko Corporation, Takatori Corporation and Disco Corporation are the major companies operating in the Automatic Mounter Wafer Equipment Market.

Which is the fastest growing region in Automatic Mounter Wafer Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Automatic Mounter Wafer Equipment Market?

In 2025, the North America accounts for the largest market share in Automatic Mounter Wafer Equipment Market.

What years does this Automatic Mounter Wafer Equipment Market cover?

The report covers the Automatic Mounter Wafer Equipment Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Automatic Mounter Wafer Equipment Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Automatic Mounter Wafer Equipment Industry Report

Statistics for the 2025 Automatic Mounter Wafer Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automatic Mounter Wafer Equipment analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.