Australia Food Sweetener Market Analysis by Mordor Intelligence

The Australia Food Sweetener Market is expected to register a CAGR of 1.77% during the forecast period.

- The market’s growth can be primarily attributed to the increasing demand from the beverage industry. This accounts for a prominent share in the various applications of sweeteners.

- The diet-soft drink sector is highly dominant in the sugar substitute market, with aspartame emerging as the leading sweetener. However, stringent regulations in the region are expected to hinder the growth of the market studied.

- The Australian sugar industry is focusing on developing alternatives for sugars, primarily to cater to the increasing demand for natural sweeteners.

Australia Food Sweetener Market Trends and Insights

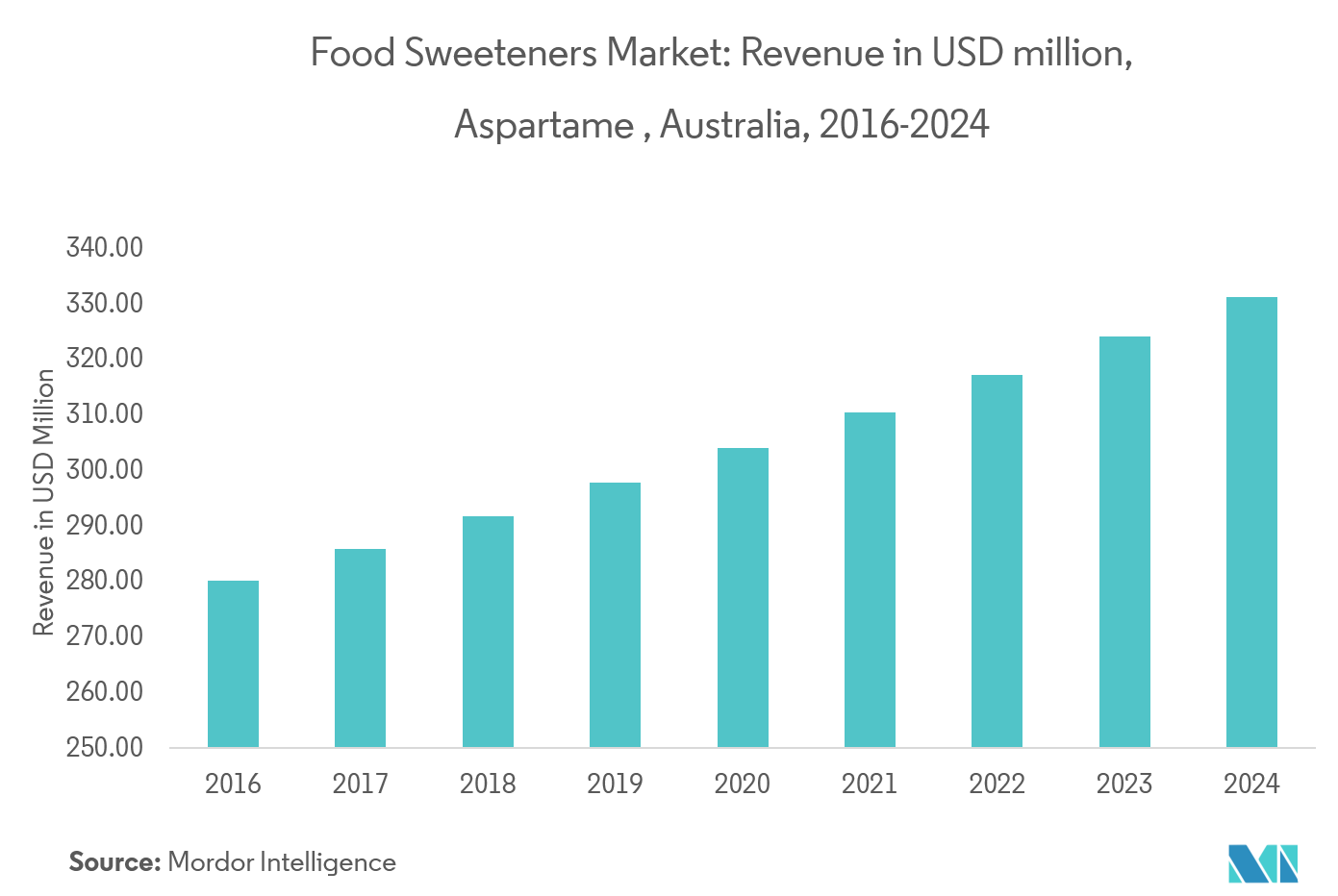

Aspartame Is The Leading Sweetener

Aspartame is a low-calorie, high-intensity sweetener used as a sugar substitute in some foods and beverages. It is 160 to 220 times sweeter than table sugar, so it provides negligible calories. Drinks that were formerly sweetened entirely with aspartame are now sweetened in many countries by blends of aspartame with other sweeteners; and the loss of aspartame sales is compounded by the potency gains and synergies from blending. In the future, we can expect to see increased quantities of aspartame destined for the confectionery and dairy industries, and we may even see lower priced aspartame making gains from saccharin in certain pharmaceutical applications.

Usage In Beverage Industry Has Grown In The Past Decade

The intake of beverages has changed dramatically over the past few decades, coinciding with an increased prevalence of obesity. Intakes of soft drinks, colas, other sweetened carbonated beverages, and fruit drinks with added sugar have increased dramatically, especially among youth, whereas the intake of milk has declined. Detrimental effect linked with consumption of excess sugar or artificial sweeteners, have led consumers to shift interests toward functional beverages. Incorporating botanical herbs, along with therapeutic properties has laid down a better roadmap for manufacturers to target the “desire for natural products” among consumers.

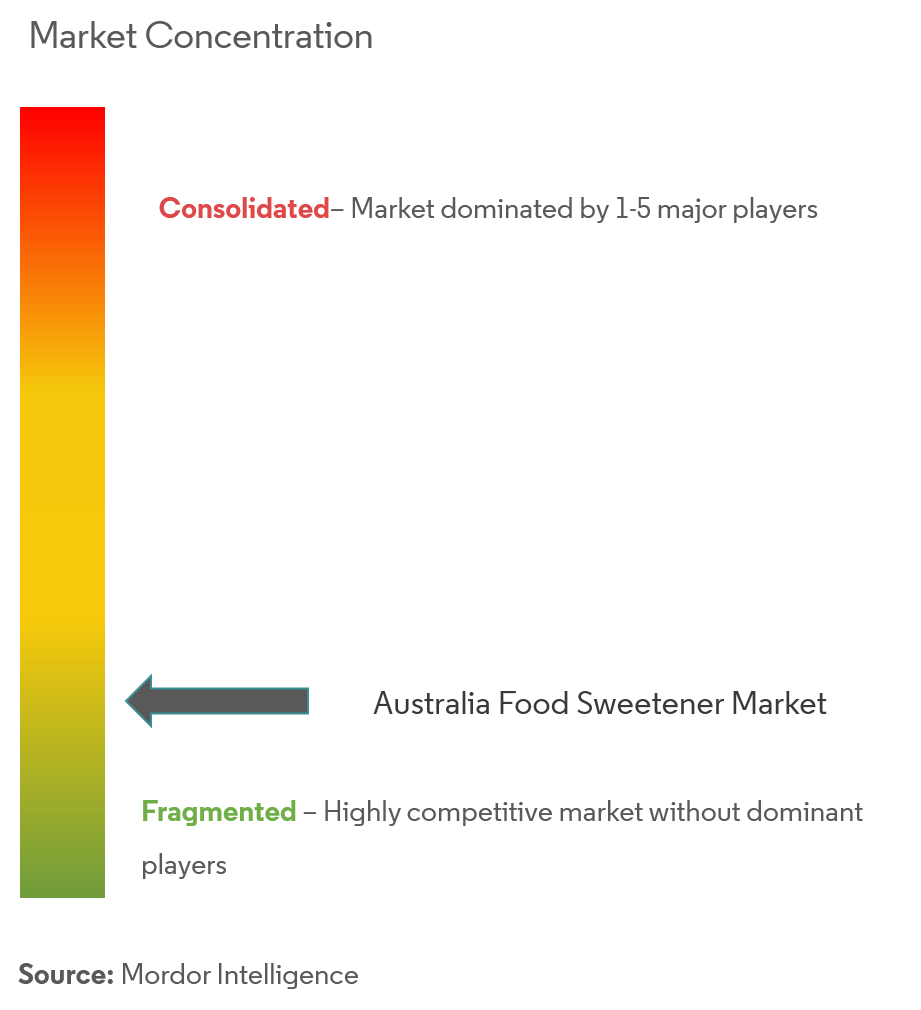

Competitive Landscape

The Australia Food Sweetener Market is a fragmented market with the presence of various players. Major players are bringing innovatoions in their products and are expanding their product portfolio to maintain the position in the market. Players are also focusing on natural and clean label products since consumers are becoming more health conscious.

Australia Food Sweetener Industry Leaders

-

Tate & Lyle

-

Cargill

-

ADM

-

Ingredion

- *Disclaimer: Major Players sorted in no particular order

Australia Food Sweetener Market Report Scope

Australia Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High Intensity Sweeteners. The market is segmented based on Application into Dairy, Bakery, Beverages, Confectionery, Soups, Sauces and Dressings and Others.

| Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose |

| High Fructose Corn Syrup (HFCS) | |

| Maltodextrin | |

| Sorbitol | |

| Xylitol | |

| Others | |

| High Intensity Sweeteners (HIS) | Sucralose |

| Aspartame | |

| Saccharin | |

| Cyclamate | |

| Ace-K | |

| Neotame | |

| Stevia | |

| Others |

| Dairy |

| Bakery |

| Soups, Sauces and Dressings |

| Confectionery |

| Beverages |

| Others |

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others | ||

Key Questions Answered in the Report

What is the current Australia Food Sweetener Market size?

The Australia Food Sweetener Market is projected to register a CAGR of 1.77% during the forecast period (2025-2030)

Who are the key players in Australia Food Sweetener Market?

Tate & Lyle, Cargill, ADM and Ingredion are the major companies operating in the Australia Food Sweetener Market.

What years does this Australia Food Sweetener Market cover?

The report covers the Australia Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Australia Food Sweetener Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Australia Food Sweetener Market Report

Statistics for the 2025 Australia Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Australia Food Sweetener analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.