Assistive Robotics Market Analysis

The Assistive Robotics Market is expected to register a CAGR of 21% during the forecast period.

- A rise in the geriatric population drives the Assistive Robotics market. According to United Nations, data from the world population says that by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%). Considering this data, at the age of 65 or above, it shows higher symptoms of mild cognitive impairment (MCI) or early dementia. This says that the demand for assistive robotics will increase in the future.

- The adoption of robot-assisted surgery is driving the Assistive Robotics market. Surgeons who use the robotic system find that for many procedures it enhances precision, flexibility and control during the operation and allows them to better see the site, compared with traditional techniques. According to the Accenture survey in the United States in 2018, the random base surveys for more than 2000 respondents say that 46% of those aged 18-34 prefer robot-assisted surgery and the market penetration is high in the United States, where Spinal surgery is a common symptom. This enhances the demand for robot-assisted surgery and will show high growth in coming years globally.

- Lack of social awareness about the benefits of adopting assistive robotic systems is restraining the market to grow. This can challenge the Assistive Robotics market especially for elderly assistance where their uneven perceptions regarding robot machines may hinder them to take its service advantages.

Assistive Robotics Market Trends

Socially Assistive Robots (SAR) Holds the Significant Share in the Market

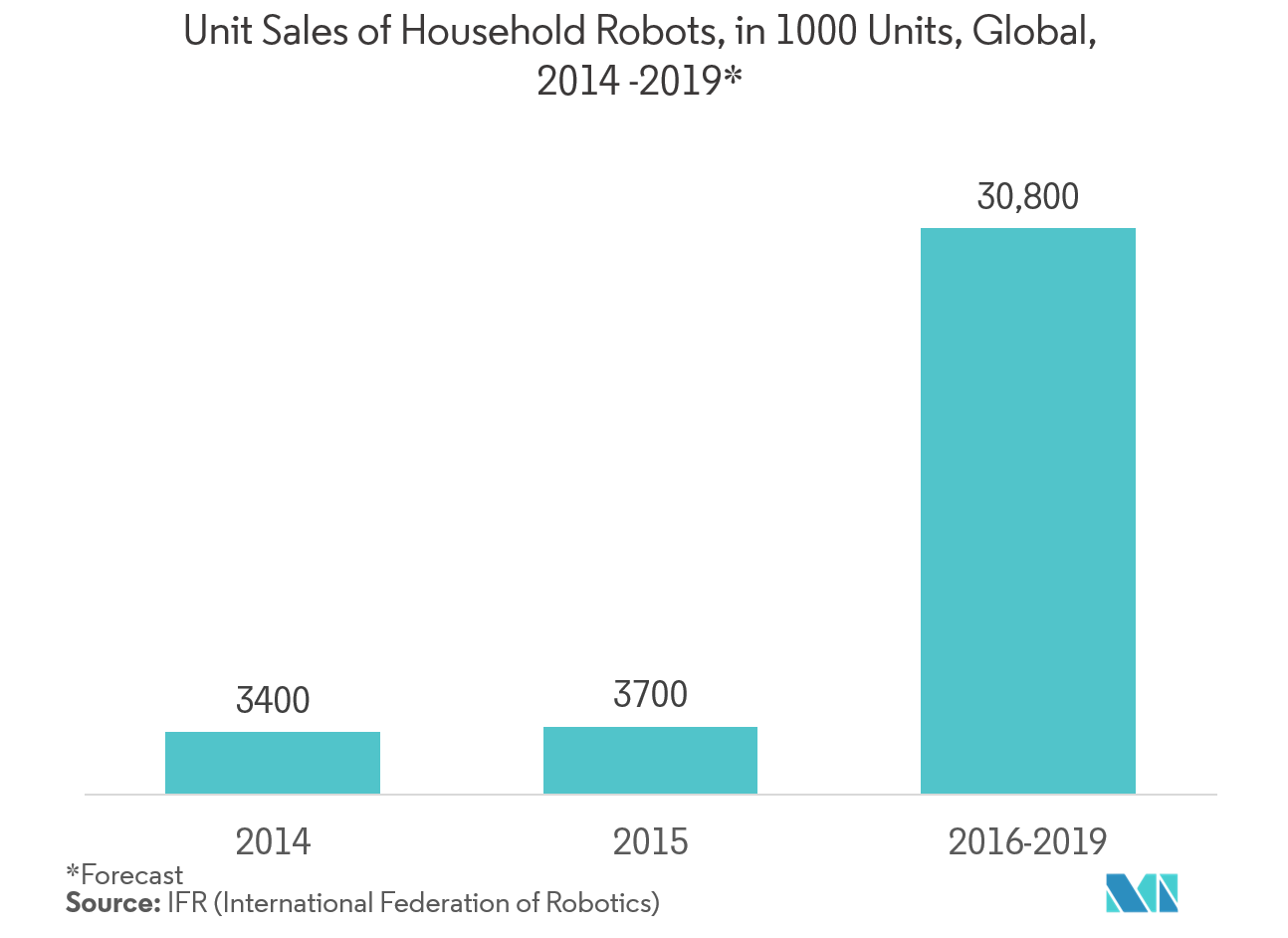

- Physical activities have tremendous benefits to older adults. A report from the World Health Organization has mentioned that lack of physical activity contributed to around 3.2 million premature deaths annually worldwide. With the rise in the population of older adults, which is expected to triple by 2050, this SAR will aim to improve the quality of life for a significant proportion of the population for household segment.

- Socially assistive robots, if properly utilized, would assist older people in their daily routines and increase their quality of life by performing some much-needed functions such as reminders to take meals and medication, offer suggestions for activities and encourage social interactions.

- The University of Pittsburgh & Carnegie Mellon University developed the Pearl nurse robot. It is a personal and social robot that helps the elderly go about their daily routines. Other robotic technologies used to assist older adults as well as the disabled are exoskeletons, electric wheelchairs, and other similar devices.

- Various research and developments are ongoing to improve the performance and activities of robots. Companies like Waypoint Robotics and sister R&D company Stanley Innovation are working on optimizing the mobility part of autonomous eldercare robotics by creating mobile robotic platforms that are adaptable and scalable.

- Also in Mar 2019, ChartaCloud ROBOTTECA announced the launch of specialized socially assistive robot-based behaviors for daily living engagement in eldercare which will also show the properties of behavior intervention for autism, assisted pediatric medical care in hospitals,etc. Hence with increasing innovation, the Assistive Robotics market shows potential growth in the future.

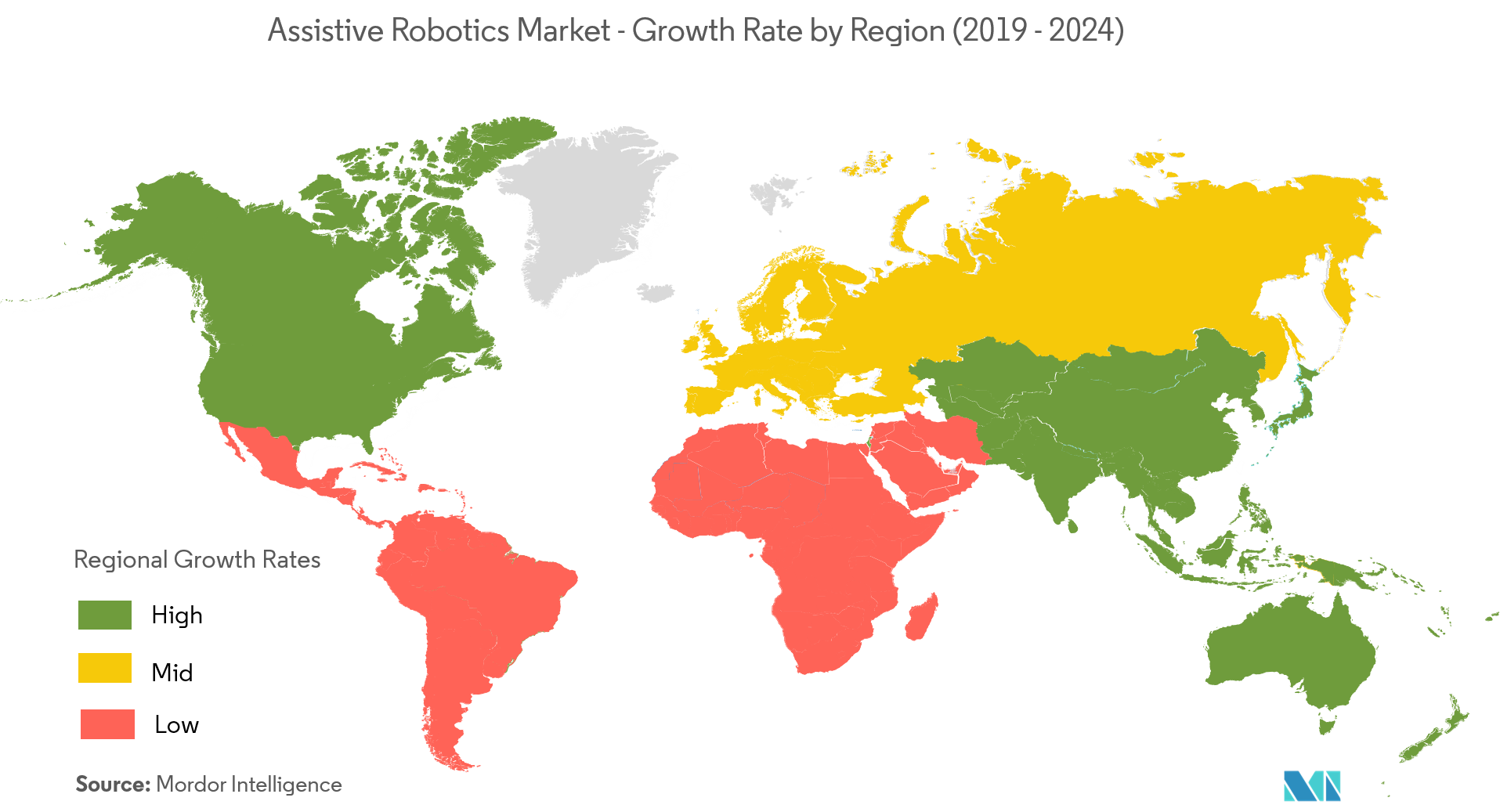

North America Account for Significant Market Share

- North America holds the significant share due to growing demand from the healthcare sector for rehabilitation and a favorable funding scenario for research on assistive technologies.

- In the United States, the government agency is taking the initiative to fund the Assistive Robotics market. For instance, the National Science Foundation is investing in the development of service robots, particularly in eldercare robotics projects that help to increase mobility in elder patients.

- Moreover, players are also investing to improve the market growth. For Instance, in Oct, 2019, Labrador Systems, an early-stage technology company developing a new generation of assistive robots, announced that it has closed a USD 2 million Pre-Seed round led by SOSV's hardware accelerator HAX, in partnership with Centrica Hive, with participation from Amazon’s Alexa Fund, iRobot Ventures and iD Ventures America. The company is pioneering a new version generation of assistive robots to empower seniors and others to live more independently and provide a new platform for supporting home health in the United States. The investment will be used to expand development of Labrador’s platform and conduct pilot studies with partners in 2020.

Assistive Robotics Industry Overview

The assistive robotics marketis highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. Key players are Kinova, Ekso Bionics Holdings Inc.,Cyberdyne Inc., etc. Recent developments in the market are -

- Oct 2019 - The scientists from University of Texas at Dallas announced a groundbreaking new approach for improving control of prosthetics with the use of artificial intelligence (AI) at the 2019 IEEE International Symposium on Measurement and Control in Robotics Symposium this month. The research findings show a huge leap forward in the goal of fully end-to-end optimization of electromyography (EMG) controlled prosthetic hands.

Assistive Robotics Market Leaders

-

Kinova

-

Ekso Bionics Holdings Inc.

-

Cyberdyne Inc.

-

ReWalk Robotics, Inc.

-

Focal Meditech BV

- *Disclaimer: Major Players sorted in no particular order

Assistive Robotics Market News

Assistive Robotics Industry Segmentation

The assistive robotics engage individuals in social human-robot interactions (HRI) in order to maintain or even improve residual social, cognitive and affective functioning. The market has largely referred to robots that assisted people with physical disabilities through physical interaction along with increasing use of socially assistive robots for elderly people.

| By Types | Socially Assistive Robots | ||

| Physically Assistive Robots | |||

| Other Types | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | Japan | ||

| China | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Latin America | ||

| Middle-East & Africa | |||

Assistive Robotics Market Research FAQs

What is the current Assistive Robotics Market size?

The Assistive Robotics Market is projected to register a CAGR of 21% during the forecast period (2025-2030)

Who are the key players in Assistive Robotics Market?

Kinova, Ekso Bionics Holdings Inc., Cyberdyne Inc., ReWalk Robotics, Inc. and Focal Meditech BV are the major companies operating in the Assistive Robotics Market.

Which is the fastest growing region in Assistive Robotics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Assistive Robotics Market?

In 2025, the North America accounts for the largest market share in Assistive Robotics Market.

What years does this Assistive Robotics Market cover?

The report covers the Assistive Robotics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Assistive Robotics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Assistive Robotics Industry Report

Statistics for the 2025 Assistive Robotics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Assistive Robotics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.