APAC On-Demand Color Labels Market Analysis

The APAC On-Demand Color Labels Market is expected to register a CAGR of 4.07% during the forecast period.

- Pre-printed labels have a chance of ascended risk of errors, owing to printing over the improper stock, which is, in turn, projected to fuel the market growth in the region over the forecast period.

- Color labels are becoming an integral part of an organization's success, owing to the rising importance of branding, which offers a competitive edge to the product.

- In Asia-Pacific, the growth in grocery retailers is at the most prominent phase, which is likely to drive the on-demand color label market growth.

APAC On-Demand Color Labels Market Trends

Secondary to Hold Major Share

Secondary labeling is placed outside the primary packaging and is placed in a less prominent position, such as at the bottom, back, or side of a product.

A secondary label provides information about the product, such as health and safety warnings, its ingredients and nutritional values, manufacturer or supplier details, instructions for use, contact information, or detailed tracking and product information in a barcode format.

With the upsurge in the e-commerce industry in Asia-Pacific, the market for secondary packaging is on the rise, which subsequently generates the demand for secondary labeling.

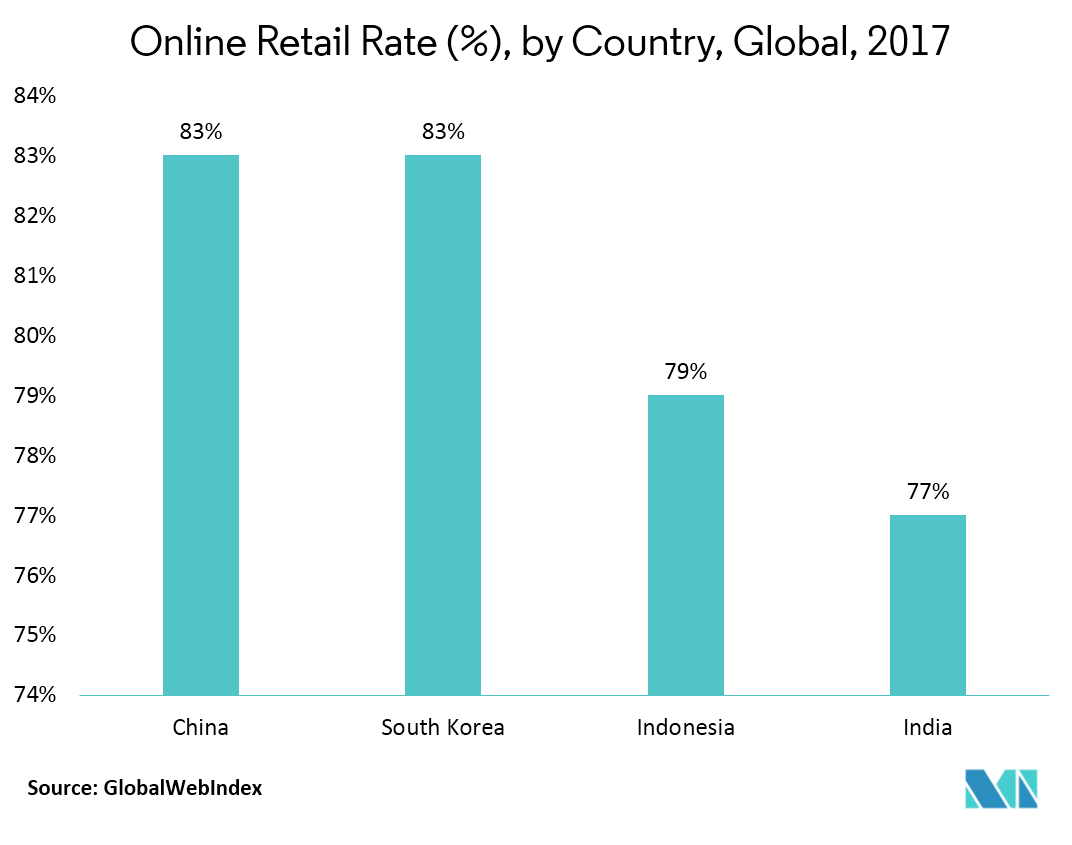

With the Asian countries acquiring leading positions, with the highest online shopping penetration, the region experiences significant demand for secondary packaging.

APAC On-Demand Color Labels Industry Overview

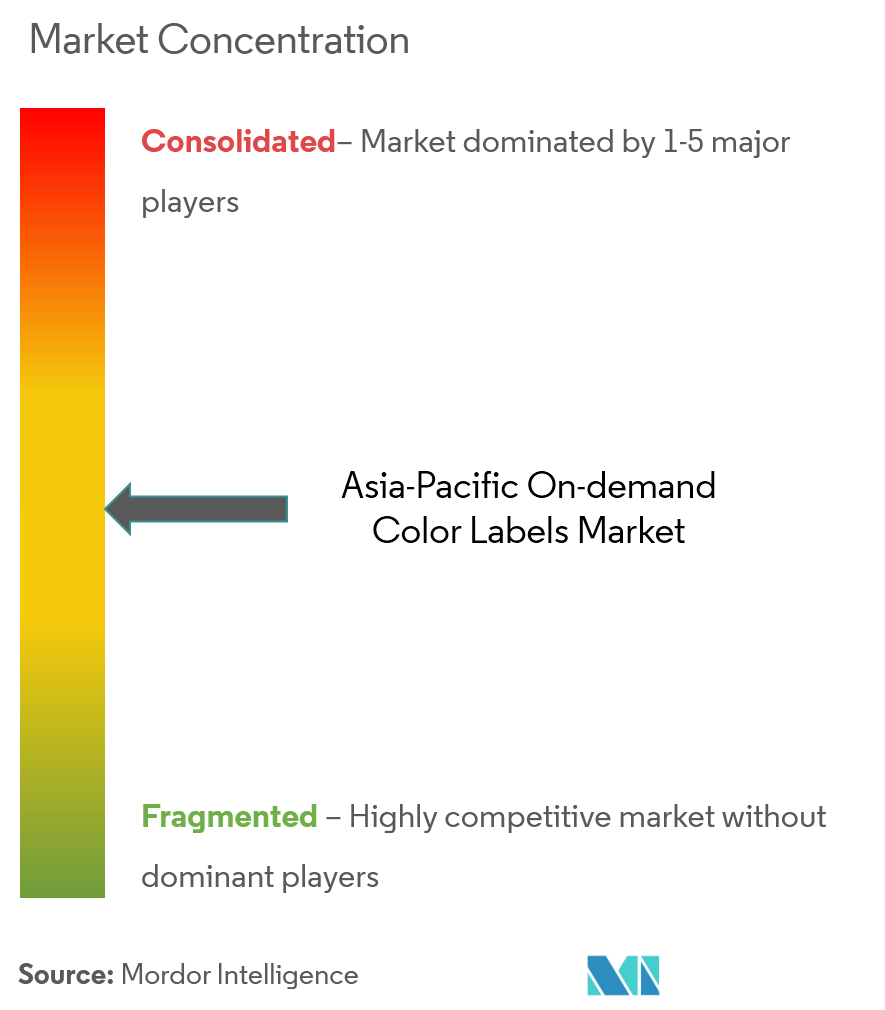

The Asia-Pacific on-demand color labels market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market shares and profitability. In March 2018, Lexmark International Inc. announced Lexmark Pharmacy Order Assistant, a solution that fills the paper-based gaps in pharmacy order workflows, allowing users to process complex, paper-based pharmacy orders from its existing Lexmark smart multi-function printer (MFP) for increased accuracy, speed, and safety.

APAC On-Demand Color Labels Market Leaders

-

Avery Dennison Corporation

-

Brady Corporation

-

Lexmark International Inc.

-

Fuji Seal International Inc

-

CCL Industries Inc.

- *Disclaimer: Major Players sorted in no particular order

APAC On-Demand Color Labels Industry Segmentation

On-demand color labels have diverse benefits over pre-demand. However, the cost per label is much higher than the conventional forms of labeling. The total cost of the color label is characteristically lower than the 2-step label, owing to mitigation in transportation and storage expenditure.

| By Type of Labelling | Primary |

| Secondary | |

| By End-user Industry | Chemical |

| Retail | |

| Manufacturing | |

| Other End-user Industries |

APAC On-Demand Color Labels Market Research FAQs

What is the current APAC On-Demand Color Labels Market size?

The APAC On-Demand Color Labels Market is projected to register a CAGR of 4.07% during the forecast period (2025-2030)

Who are the key players in APAC On-Demand Color Labels Market?

Avery Dennison Corporation, Brady Corporation, Lexmark International Inc., Fuji Seal International Inc and CCL Industries Inc. are the major companies operating in the APAC On-Demand Color Labels Market.

What years does this APAC On-Demand Color Labels Market cover?

The report covers the APAC On-Demand Color Labels Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the APAC On-Demand Color Labels Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

APAC On-Demand Color Labels Industry Report

Statistics for the 2025 APAC On-Demand Color Labels market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. APAC On-Demand Color Labels analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.