APAC Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 1.67 % |

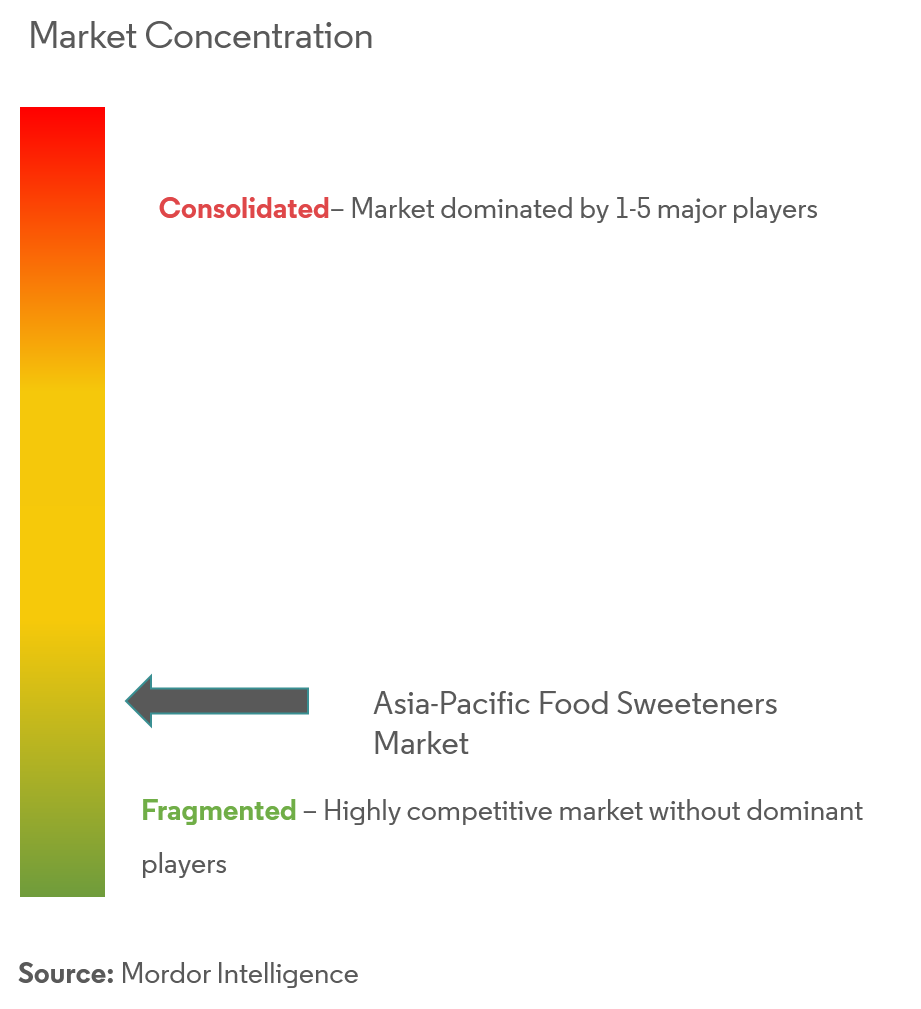

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

APAC Food Sweetener Market Analysis

The Asia-Pacific Food Sweetener Market is growing at a very slow pace, registering a CAGR of 1.67% during the forecast period (2020-2025).

- China is the largest bulk sweetener consuming country in the Asia-Pacific region, accounting for a major share of the bulk sweeteners market.Moreover, the country is the primary source of sugar substitutes.

- The remarkable growth in the Food and Beverage market is also driving the food sweetener market.There is a rising prevalence of diabetes, obesity, and cardiac diseases, due to the high consumption of sugar-based products. This, in turn, is augmenting the demand for sweeteners.

- With the changing regulatory environment and permission for using sweeteners in dairy products, biscuits, and confectionery, the artificial sweeteners segment is witnessing high growth.

APAC Food Sweetener Market Trends

This section covers the major market trends shaping the APAC Food Sweetener Market according to our research experts:

Rise in Applications of Sweeteners in Processed Foods

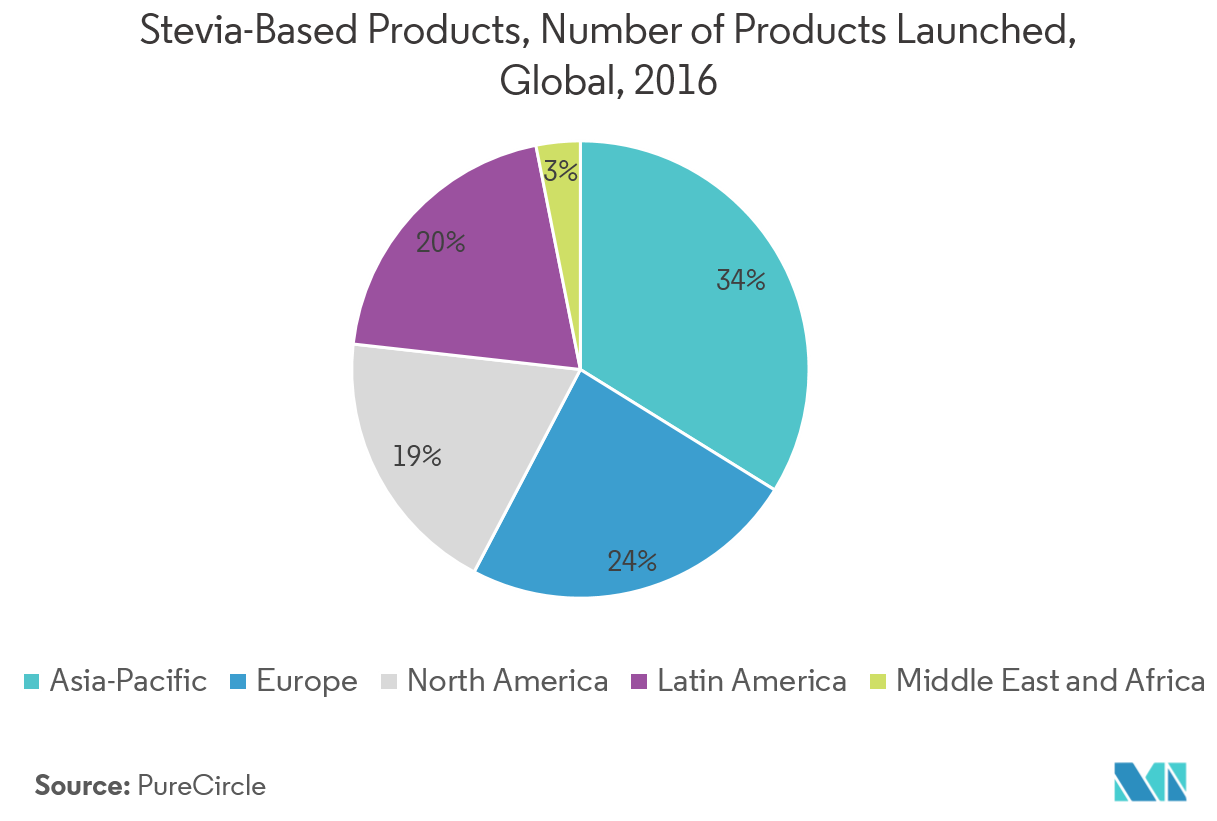

The quest to reduce calories has made food manufacturers look for sucrose replacement with a variety of substitutes. Presently, a majority of their product offerings are sweetened with bulk sweeteners or sugar substitutes. Sweeteners are now becoming a ubiquitous part of products, like ketchup, whole-wheat bread, salad dressing, yogurt, and even breakfast cereals. As the global obesity epidemic and its significant impact on health, consumers are looking for ways to curb their sugar intake and protect themselves from the negative health effects of weight gain. This has led the Asia-Pacific region to record the highest number of new product launches with low-calorie sweeteners such as Stevia which would provide subtle taste to the food. Manufacturers choose the low-calorie sweetener, either on its own or as a blend, based on taste considerations, stability, and cost.

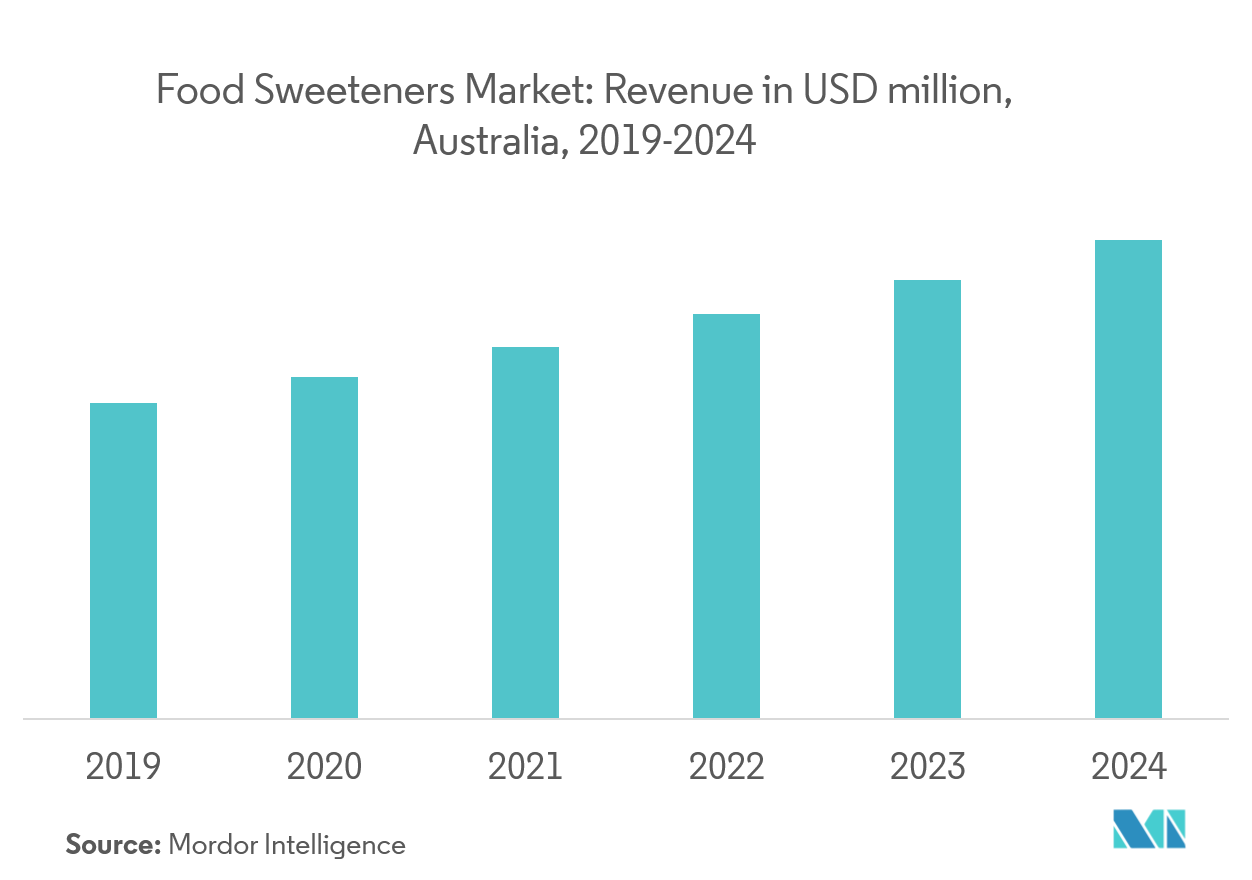

Australia is the Fastest Growing Market

Australia Food Sweetener Market is growing at a comparatively higher growth rate. The market’s growth can be primarily attributed to increasing demand. This accounts for a 30% share in the various applications of sweeteners. The diet-soft drink sector is highly dominant in the sugar substitute market, with aspartame emerging as the leading sweetener. However, stringent regulations in the region are expected to hinder the growth of the market studied. The Australian sugar industry is focusing on developing alternatives for sugars, primarily to cater to the increasing demand for natural sweeteners. Furthermore, stevia is gaining immense popularity in the country with the increasing demand for natural and clean ingredients. Powder stevia holds the majority market share.

APAC Food Sweetener Industry Overview

Asia Pacific food sweeteners market is currently dominated by Cargill, Tate & Lyle PLC, Stevia First Corp, Ingredion, Pure circle, Sudzucker, AB Sugar.Rising disposable incomes have increased the consumer expenditure on healthy and nutritious foods, and in turn, is helping the sweetener market to progress exponentially.

APAC Food Sweetener Market Leaders

-

Tate & Lyle

-

Ingredion

-

Dupont

-

ADM

-

Cargill

*Disclaimer: Major Players sorted in no particular order

APAC Food Sweetener Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

3.1 Market Overview

-

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Product Type

-

5.1.1 Sucrose (Common Sugar)

-

5.1.2 Starch Sweeteners and Sugar Alcohols

-

5.1.2.1 Dextrose

-

5.1.2.2 High Fructose Corn Syrup (HFCS)

-

5.1.2.3 Maltodextrin

-

5.1.2.4 Sorbitol

-

5.1.2.5 Xylitol

-

5.1.2.6 Others

-

-

5.1.3 High Intensity Sweeteners (HIS)

-

5.1.3.1 Sucralose

-

5.1.3.2 Aspartame

-

5.1.3.3 Saccharin

-

5.1.3.4 Cyclamate

-

5.1.3.5 Ace-K

-

5.1.3.6 Neotame

-

5.1.3.7 Stevia

-

5.1.3.8 Others

-

-

-

5.2 By Application

-

5.2.1 Dairy

-

5.2.2 Bakery

-

5.2.3 Soups, Sauces and Dressings

-

5.2.4 Confectionery

-

5.2.5 Beverages

-

5.2.6 Others

-

-

5.3 Asia Pacific

-

5.3.1 China

-

5.3.2 Japan

-

5.3.3 India

-

5.3.4 Australia

-

5.3.5 Rest of Asia-Pacific

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 Tate & Lyle PLC

-

6.4.2 Cargill Incorporated

-

6.4.3 Archer Daniels Midland Company

-

6.4.4 DuPont

-

6.4.5 Ingredion Incorporated

-

6.4.6 Ajinomoto Co., Inc.

-

6.4.7 PureCircle Limited

-

6.4.8 Tereos S.A.

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

APAC Food Sweetener Industry Segmentation

Asia pacific Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High Intensity Sweeteners. By Application into Dairy, bakery, Beverages and Confectionery, Soups, Sauces and Dressings and Others. Regional Analysis of the market is also included.

| By Product Type | ||||||||||

| Sucrose (Common Sugar) | ||||||||||

| ||||||||||

|

| By Application | |

| Dairy | |

| Bakery | |

| Soups, Sauces and Dressings | |

| Confectionery | |

| Beverages | |

| Others |

| Asia Pacific | |

| China | |

| Japan | |

| India | |

| Australia | |

| Rest of Asia-Pacific |

APAC Food Sweetener Market Research FAQs

What is the current Asia Pacific Food Sweetener Market size?

The Asia Pacific Food Sweetener Market is projected to register a CAGR of 1.67% during the forecast period (2024-2029)

Who are the key players in Asia Pacific Food Sweetener Market?

Tate & Lyle, Ingredion, Dupont, ADM and Cargill are the major companies operating in the Asia Pacific Food Sweetener Market.

What years does this Asia Pacific Food Sweetener Market cover?

The report covers the Asia Pacific Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Asia Pacific Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Asia Pacific Food Sweetener Industry Report

Statistics for the 2024 Asia Pacific Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Asia Pacific Food Sweetener analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.