Anti-Static Agents Market Analysis

The Anti-static Agents Market is expected to register a CAGR of less than 5% during the forecast period.

- Issues of static build-up in plastics and the growing demand for plastics from various end-user industries such as packaging, automotive, electronics, and medical is expected to be the driving factor in the market studied.

- Stringent government regulations by the FDA revoking the use of certain anti-static agents in food containers is expected to significantly hinder the growth of the market studied.

- Ethoxylated fatty acid amines is the majorly used anti-static agent and is expected to dominate the global market through the forecast period.

Anti-Static Agents Market Trends

Growing Usage in Packaging Industry

- Build-up of electric charges is common in low conductivity and high surface resistance material such as plastics. Such static buildup not only has a detrimental effect on the end-users of plastics but also interfere with the processing and production of polymers by reducing the speed of the technological process, generating material losses, causing contamination of the product, and accelerating the decomposition of plastics. Hence, it is crucial to add anti-static agents into plastics.

- Packaging being the major end-user industry of plastics, accounting for a significant position in the market, is the major user end-user industry of anti-static agents accounting for more than 30% share in the global market.

- Packaging production is expanding at a decent rate across the world driven largely by the fast-moving consumer goods (FMCG) sector and the booming e-market sites.

- In most countries of Asia-Pacific region, the packaging industry plays a crucial role, adding value to various manufacturing sectors including agriculture, pharmaceutical, retail, and FMCG, to name a few. Strong demand from food and pharmaceutical industries is expected to drive the packaging production in the region.

- Even in matured markets such as in Europe and North America, the packaging industry is registering decent growth influenced by economic growth and the level of real personal disposable income.

- All such factors are expected to drive the market for anti-static agents in the packaging industry through the forecast period.

Asia-Pacific to Dominate the Demand in Global Region

- The demand for anti-static agents in the Asia-Pacific region is expected to rise at a significant pace due to the increasing demand for plastics from various end-user industries such as packaging, automotive, electronics, and medical amongst others.

- China is one of the fastest-growing economies, globally, and almost all the end-user industries have been growing owing to the rising population, living standards, and per capita income. However, owing to the international trade turbulences and unfavorable geopolitical affairs, the growth rate is expected to slow down in the initial years of the forecast period. But the growth is expected to take up the pace in the later part of the forecast period, considering the favorable conditions and relations in the future.

- Additionally, rising disposable income among individuals has increased their purchasing power which overall has increased the per capita consumption of plastics, which in turn has contributed to positive growth in plastic production in the region.

- Packaging industry accounts for more than 40% of the country’s total GDP. Packaging companies are continuously expanding their production capacity in the country.

- Many international foreign packaging companies are investing in the Chinese market, as the country is increasingly turning into the world’s largest consumer of luxury goods. The industry has attracted many specialized firms that are expertise in packaging a range of products, including cosmetics, fragrances, tobacco, confectionary, alcoholic drinks, gourmet food and drinks, watches, etc.

- Overall, all such factors are expected to drive the Asia-Pacific market, making them the leading consumer of plastics, and in turn anti-static agents through 2024.

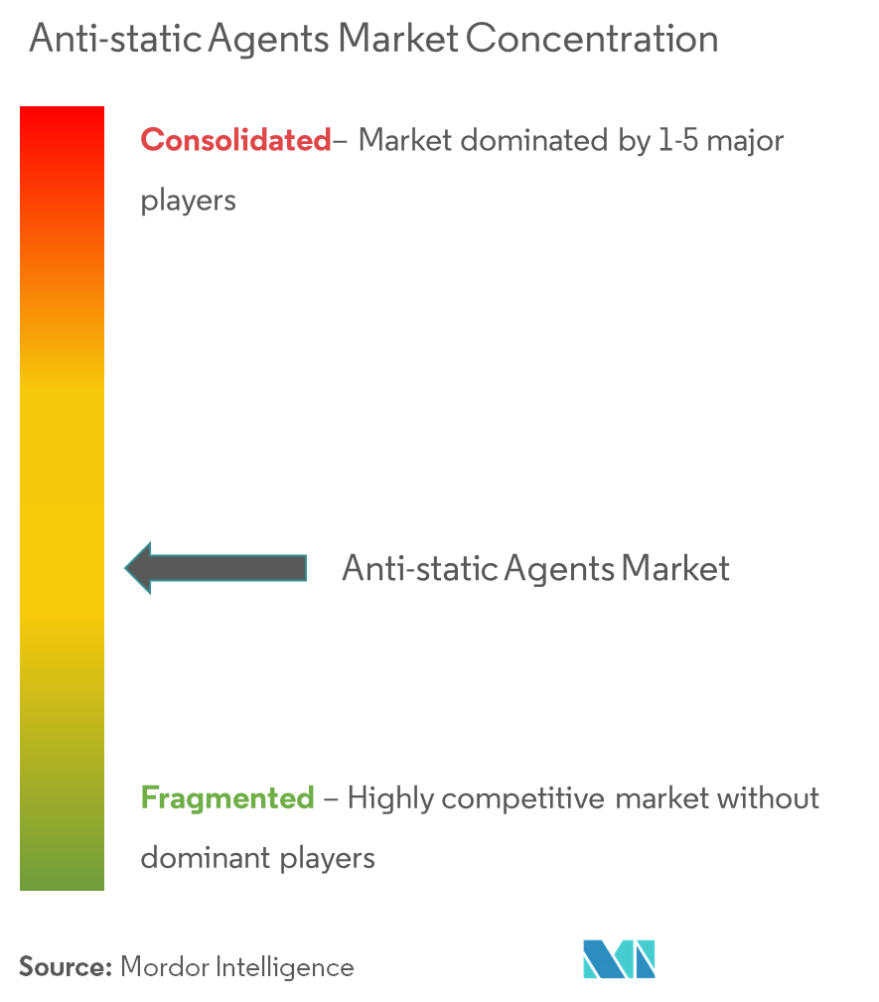

Anti-Static Agents Industry Overview

The global anti-static agents market is partially fragmented with the presence of various international and local players in the global market. Some of the major players of the market studied include, 3M, Nouryon, BASF SE, Solvay, and Mitsubishi Chemical Corporation, among others.

Anti-Static Agents Market Leaders

-

3M

-

Nouryon

-

BASF SE

-

Mitsubishi Chemical Corporation

-

Solvay

- *Disclaimer: Major Players sorted in no particular order

Anti-Static Agents Industry Segmentation

The global anti-static agents market includes:

| Type | Monoglycerides | ||

| Polyglycerol Esters | |||

| Diethanolamides | |||

| Ethoxylated Fatty Acid Amines | |||

| Polymer | Polypropylene (PP) | ||

| Polyethylene (PE) | |||

| Polyvinyl Chloride (PVC) | |||

| Others (ABS, polystyrene, etc.) | |||

| End-user Industry | Automotive & Transportation | ||

| Packaging | |||

| Electronics | |||

| Other End-User Industries (Medical, etc.) | |||

| Geography | Asia-Pacific | China | |

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| Italy | |||

| France | |||

| Rest of Europe | |||

| Rest of the World | |||

Anti-Static Agents Market Research FAQs

What is the current Anti-static Agents Market size?

The Anti-static Agents Market is projected to register a CAGR of less than 5% during the forecast period (2025-2030)

Who are the key players in Anti-static Agents Market?

3M, Nouryon, BASF SE, Mitsubishi Chemical Corporation and Solvay are the major companies operating in the Anti-static Agents Market.

Which is the fastest growing region in Anti-static Agents Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Anti-static Agents Market?

In 2025, the Asia Pacific accounts for the largest market share in Anti-static Agents Market.

What years does this Anti-static Agents Market cover?

The report covers the Anti-static Agents Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Anti-static Agents Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Anti-Static Agents Industry Report

Statistics for the 2025 Anti-static Agents market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Anti-static Agents analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.