Ampoules & Blister Packaging Market Analysis

The Ampoules and Blister Packaging Market is expected to register a CAGR of 7.49% during the forecast period.

- The rising need for product safety through tamper-evident packaging from manufacturers, consumer, and regulatory organizations, have been instrumental in the adoption of ampoules and blister packaging across the pharmaceutical and food industry.

- Also, the rising geriatric ages are increasing the consumption of medicines across the world. According to the Energy Source Outlook 2018, the proportion of the population above 65 years of age is expected to cross 14% by the year 2025 from over 10% in 2016.

- The cases of pharmaceutical counterfeits have been increasing year on year globally. The protection of pharmaceuticals is necessary for any company to retain its client, revenue growth, and brand reputation. WHO estimated 116 thousand deaths occurred due to pharmaceutical counterfeits in sub-Saharan Africa. Ampoules and blister packaging allow prevention from counterfeit tamper-evident incidences, driving the market growth for these packaging solutions.

- The use of innovative technologies in ampoules and blisters, such as radio frequency identification (RFID) tags, deployed with a seal applied outside the packaging, are growing, owing to the potential to provide individual security throughout supply chains. Also, the expansion of rural healthcare infrastructure is expected to drive the ampoules and blister packaging market over the forecast period.

- However, due to volatile raw material prices and stringent government regulations in certain end-user industries are limiting the adoption of ampoules and blister packaging market.

Ampoules & Blister Packaging Market Trends

Pharmaceutical and Healthcare Segment to Hold the Largest Share

- Strengthening compliance rates is a goal of the pharmaceutical industry, and ampoules and blister packaging have been shown to have a positive effect on patient compliance and medication adherence. Moreover, ampoules and blisters are highly valued for protective properties, adaptability, and cost-effectiveness, and requirements of the pharmaceutical & healthcare packaging industry.

- In the USA, 90% of the prescription have generic drugs but only generates 28% of the revenue of the pharmaceutical revenue resulting in increasing demand for protective packaging solutions.

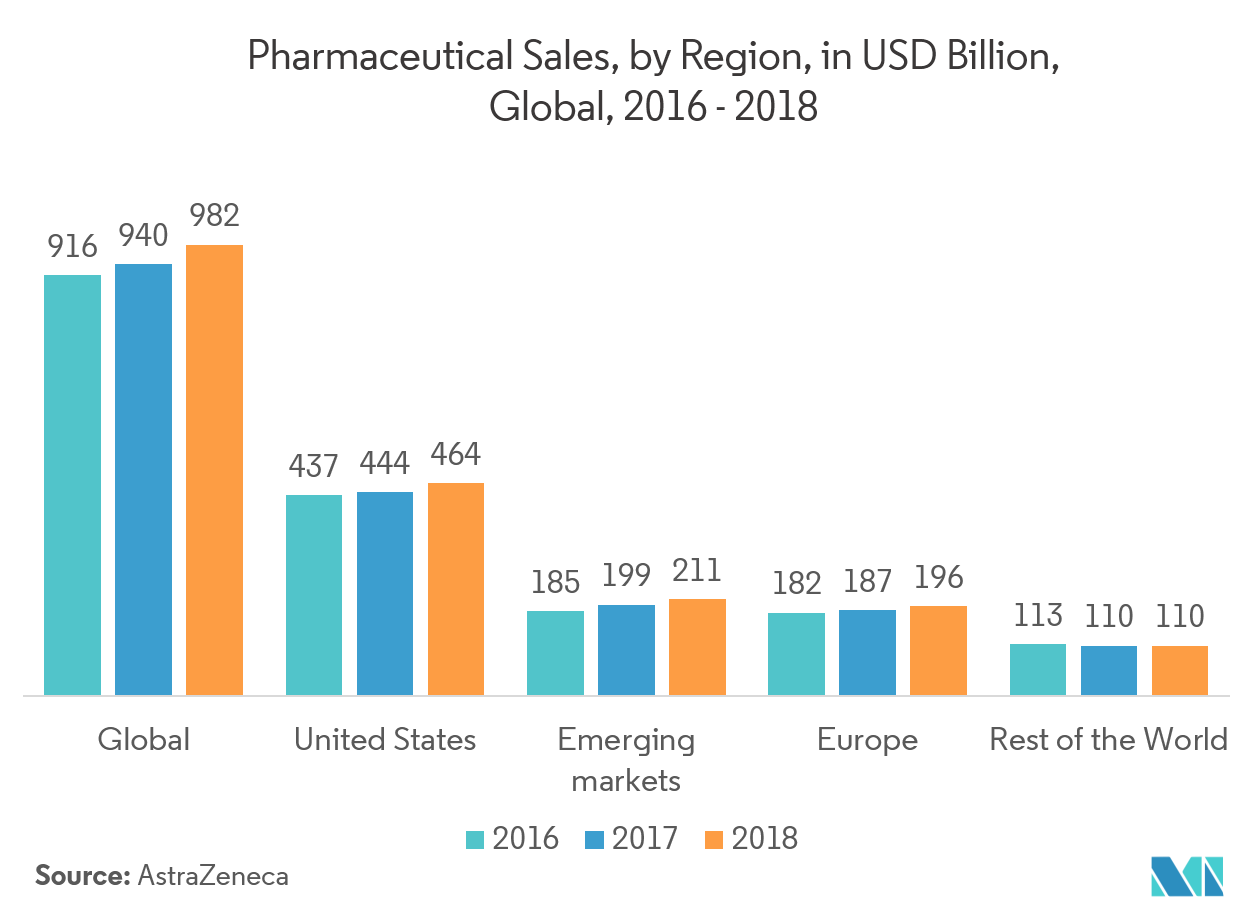

- The global pharmaceutical sales have reached USD 982 billion in the year 2018 in which the united states lead with USD 464 billion followed by emerging markets like Asia-Pacific region.

- However, owing to increase diseases and infections, the demand for ampoules and blisters are compelling the manufacturers, to venture into new machinery to increase the production of the ampoules and blisters, thus, creating a significant investment challenge for them.

Europe Expected to Grow Significantly

- The increasing incorporation of sustainable materials, like green plastics and other biodegradable materials in the manufacturing of ampoules and blisters, is likely to provide significant momentum to the European ampoules and blisters market in the forecast period.

- This ready-to-use packaging solution facilitates pharmaceutical companies to react faster to new industry trends without building specific manufacturing capabilities. To serve the growing demand, major companies like SCHOTT invested EUR 12 million in a newly established manufacturing plant in Russia, which approximately serves 500 million vials and ampoules every year.

- The European community has stronger environmental incentives to use ampoules and blister packaging, because of the stringent regulations over the manufactures in using excess material in the packaging system. The use of ampoules and blister packaging allows manufacturers to reduce packages to a minimal size. In Europe, the UK pharmaceutical industry is one of the major engines of innovation and research.

- The industry spends billions on R&D and employs vast numbers for highly skilled R&D roles. These massive investments and the proportion of skilled workers employed show how the United Kingdom is building up the pipeline of medicines and future drugs. These active investments can be seen as an excellent opportunity for the growth of ampoules and blister packaging market in the country.

Ampoules & Blister Packaging Industry Overview

The availability of several players providing ampoules and blister packagingsolutionshas intensified the competition in the market. Therefore, the market is moderately fragmented with many companies developing expansion strategies.

- Mar 2019 - Amcor Limited plannedto acquire its rival Bemis CompanyInc. By combining these two market leaders, Amcor aims tocreate a stronger value proposition for shareholders, customers, employees, and the environment.

- August 2018 - Keystone launched customizable blister packaging solution, amodified version of its Ecosite-RX prescription blister package to address the opioid epidemic in the United States.In an effort to combat dependency and overdoses, the design of the Ecoslide-RX allows doctors to prescribe smaller quantities of opioid medication via limited days of dosing presented in blister packs.

Ampoules & Blister Packaging Market Leaders

-

Amcor Limited

-

WestRock Company

-

Constantia Flexibles International Gmbh

-

Sonoco Products Company

-

Klockner Pentaplast Group

- *Disclaimer: Major Players sorted in no particular order

Ampoules & Blister Packaging Industry Segmentation

The scope of the study for ampoules and blister packaging market is limited to the solutions offered by vendors made of different materials and their respective applications in a wide range vertical globally.

| By Packaging Type | Ampoules |

| Blisters | |

| By Material | Plastic |

| Glass | |

| Aluminium | |

| Other Materials | |

| By End-user Vertical | Consumer Goods |

| Pharmaceuticals and Healthcare | |

| Personal care | |

| Industrial | |

| Other End-user Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Ampoules & Blister Packaging Market Research FAQs

What is the current Ampoules and Blister Packaging Market size?

The Ampoules and Blister Packaging Market is projected to register a CAGR of 7.49% during the forecast period (2025-2030)

Who are the key players in Ampoules and Blister Packaging Market?

Amcor Limited, WestRock Company, Constantia Flexibles International Gmbh, Sonoco Products Company and Klockner Pentaplast Group are the major companies operating in the Ampoules and Blister Packaging Market.

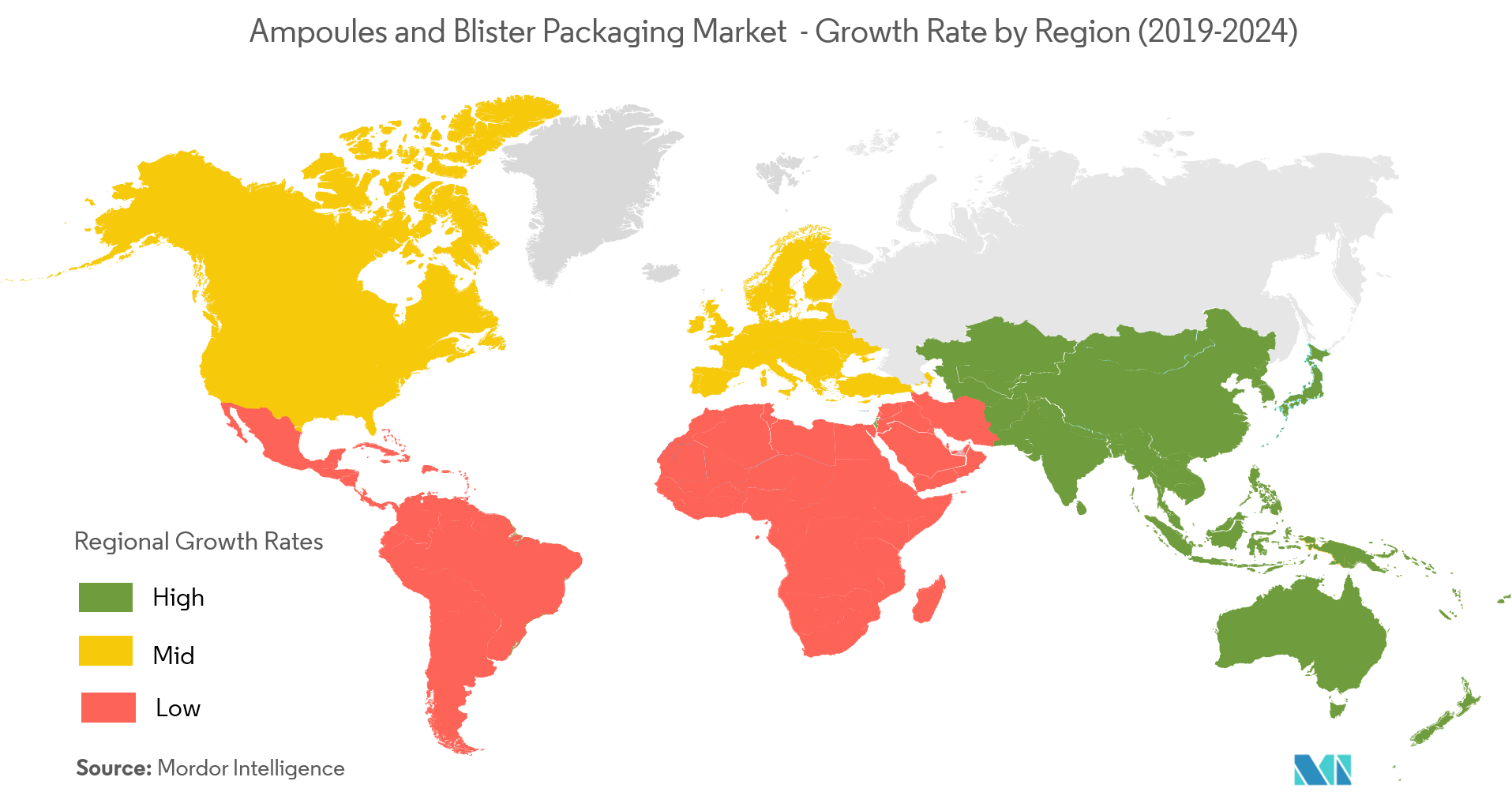

Which is the fastest growing region in Ampoules and Blister Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Ampoules and Blister Packaging Market?

In 2025, the North America accounts for the largest market share in Ampoules and Blister Packaging Market.

What years does this Ampoules and Blister Packaging Market cover?

The report covers the Ampoules and Blister Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Ampoules and Blister Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Ampoules and Blister Packaging Industry Report

Statistics for the 2025 Ampoules and Blister Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Ampoules and Blister Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.