Algae Omega-3 Ingredients Market Analysis

The Algae Omega-3 Ingredients Market size is estimated at USD 1.26 billion in 2025, and is expected to reach USD 2.36 billion by 2030, at a CAGR of 13.36% during the forecast period (2025-2030).

The omega-3 ingredients market is experiencing a significant shift toward higher concentration products, with manufacturers now offering concentrates ranging from 50% to 85% purity levels. This trend is driven by increasing consumer awareness and demand for more potent formulations, leading companies like DSM Nutritional Products and BASF to develop ultra-high concentrate products exceeding 85% purity. The evolution of processing technologies has enabled manufacturers to achieve these higher concentrations while maintaining product stability and bioavailability, resulting in more effective and convenient dosage forms for consumers.

The market is witnessing a transformative shift toward sustainable and plant-based alternatives, particularly in response to growing environmental concerns and changing consumer preferences. In June 2021, Polaris launched Omegavie DHA 800 algae oil market, sourced from microalgae rich in vitamins, proteins, pigments, and enzymes, offering a minimum of 800 mg/g of DHA. This innovation exemplifies the industry's response to the rising demand for sustainable alternatives to traditional fish-based omega-3 sources, while simultaneously addressing the growing vegan and vegetarian consumer segments.

Product innovation and formulation development have become central to market growth, with manufacturers focusing on improving absorption rates and bioavailability of algae-based ingredients market. Companies are investing in research and development to create new delivery systems and application formats, from microencapsulated powders to stable oil emulsions. The industry has seen particular advancement in the development of taste-masked formulations and oxidation-resistant products, making these ingredients more versatile for use in various food and beverage applications.

The application landscape for omega-3 ingredients continues to expand beyond traditional supplements into diverse sectors including functional foods, infant nutrition, and animal feed. According to recent market surveys in the United Kingdom, there has been a 19% increase in daily supplement consumers compared to previous years, highlighting the growing acceptance of omega-3 supplementation. This expansion is further supported by innovative product launches in new categories, such as omega-3 enriched beverages and functional snacks, demonstrating the versatility and market potential of algae-based omega-3 market.

Algae Omega-3 Ingredients Market Trends

Growing Demand in Infant Formula Applications

The increasing incorporation of omega-3 ingredients in infant formula products has emerged as a primary market driver, supported by extensive research validating their developmental benefits. According to recent Norwegian studies, omega-3 supplementation demonstrates significant positive effects on children's brain development and problem-solving abilities. The research particularly emphasizes how higher doses of DHA in baby formula can enhance the growth metrics of pre-term infants, including notable improvements in height development. These scientific validations have prompted leading infant nutrition manufacturers to incorporate algae-derived DHA as a standard ingredient in their formulations.

The growing parental awareness regarding the essential role of DHA and EPA in infant brain development and immunity strengthening has further catalyzed market growth. This trend is particularly pronounced among urban parents with busy lifestyles who seek convenient yet nutritionally optimal feeding solutions for their infants. Major brands have responded to this demand by launching premium infant formula products enriched with algae-based omega-3 ingredients. For instance, leading nutrition companies like Enfamil have introduced advanced formula products incorporating DHA along with other essential prebiotics and micronutrients, demonstrating the industry's commitment to meeting evolving nutritional requirements.

Immense Growth in Concentrated Forms of Algae Omega-3 Ingredients

The market is experiencing substantial growth driven by increasing demand for highly concentrated forms of algae omega-3 ingredients, particularly in dietary supplements and pharmaceutical applications. Major companies are now offering high-concentrate fish oils, high-purity krill oils, and purified algal oils with concentration levels ranging from 50% to over 85%. This trend is supported by supplement consumers' growing preference for higher omega-3 dosages in convenient, smaller delivery formats. For instance, in June 2023, Polaris launched Omegavie DHA 800 algae oil, offering a minimum of 800 mg/g of DHA, demonstrating the industry's push toward higher concentration products.

The development of ultra-high concentrated omega-3 supplements has created a premium market segment, with consumers willing to pay higher prices for superior products. These concentrates offer manufacturers significant advantages in product formulation, enabling the development of smaller capsules and soft gels while delivering equivalent or higher doses of omega-3. Additionally, high concentration algae omega-3-based ingredients allow manufacturers to optimize space in their products and create formulations incorporating other active ingredients. This has led to increased investment in research and development focused on improving absorption and utilization of omega-3 concentrates, particularly in applications such as dietary supplements and pharmaceuticals. The DHA algae oil for dietary supplements market is poised to benefit significantly from these advancements.

Segment Analysis: By Type

DHA Segment in Algae Omega-3 Ingredients Market

The Docosahexaenoic Acid (DHA) segment dominates the algae omega-3 ingredients market, commanding approximately 64% of the total market share in 2024. This significant market position is primarily driven by the rising demand in infant formulae and nutritional products targeting children's health, as DHA is an essential building block for the growth and maturation of an infant's brain and retina. The segment's growth is further bolstered by its extensive use in fortified foods and dietary supplements, where it is predominantly used for treating Type 2 diabetes, coronary artery disease (CAD), dementia, and attention deficit-hyperactivity disorder (ADHD). The healthy aging-related benefits of DHA have also led to their successful utilization in geriatric nutrition products, expanding its application scope.

EPA/DHA Segment in Algae Omega-3 Ingredients Market

The EPA/DHA omega-3 ingredients market combination segment is emerging as the fastest-growing segment in the algae omega-3 ingredients market, projected to grow at approximately 15% during 2024-2029. This robust growth is attributed to the increasing recognition of the combined benefits of EPA and DHA in maintaining cardiovascular health and reducing hypertension risk in the general population. The segment's growth is particularly driven by the rising demand from vegan consumers who are more likely to be deficient in DHA and EPA, as these are essential omega-3 fatty acids that the body cannot synthesize. End-user producers are capitalizing on this trend by developing innovative algal omega-3 supplements specifically targeted at the growing vegan consumer base.

Remaining Segments in Algae Omega-3 Ingredients Market

The Eicosapentaenoic Acid (EPA) segment represents a significant portion of the algae omega-3 ingredients market, offering unique benefits and applications. This segment is particularly notable for its role in reducing symptoms of menopause and supporting infant growth. EPA has shown promising results in immune function modulation and maintaining the balance of pro- and anti-inflammatory proteins. The segment's growth is supported by manufacturers actively developing standalone EPA concentrates for incorporation in nutraceuticals and pharmaceutical formulations, predominantly for cardiovascular prevention and animal feed applications.

Segment Analysis: By Application

Dietary Supplements Segment in Algae Omega-3 Ingredients Market

The dietary supplements segment dominates the omega-3 ingredients market, accounting for approximately 44% of the total market share in 2024. This significant market position is driven by the increasing consumer awareness about the benefits of omega-3 supplements and a growing preference for plant-based alternatives to fish oil supplements. The segment's growth is further supported by the rising adoption of preventive healthcare practices and an increasing focus on maintaining overall wellness through supplementation. Manufacturers are actively developing innovative formulations and delivery formats to cater to diverse consumer preferences, including vegetarian and vegan populations. The segment also benefits from the expanding distribution channels, including online retail platforms, making these supplements more accessible to consumers worldwide.

Clinical Nutrition Segment in Algae Omega-3 Ingredients Market

The clinical nutrition segment is emerging as the fastest-growing application area in the algae omega-3 ingredients market. This rapid growth is attributed to the increasing recognition of omega-3's role in patient recovery and overall health management in clinical settings. Healthcare providers are increasingly incorporating algae-based omega-3 supplements in their treatment protocols, particularly for patients with specific nutritional requirements or those unable to consume traditional fish-based omega-3 sources. The segment's expansion is also driven by growing research supporting the benefits of omega-3 supplementation in various clinical conditions, including cardiovascular health, cognitive function, and inflammatory responses. The development of specialized formulations for clinical applications and increasing healthcare expenditure worldwide are further propelling this segment's growth.

Remaining Segments in Algae Omega-3 Ingredients Market by Application

The other significant segments in the algae omega-3 ingredients market include pharmaceuticals, infant formula, functional food and beverage, and animal nutrition. The pharmaceuticals segment maintains a strong position due to the increasing development of omega-3-based pharmaceutical products. The infant formula segment continues to grow as manufacturers recognize the importance of DHA in early childhood development. The functional food and beverage segment is expanding through innovative product launches and increasing consumer demand for fortified products. The animal nutrition segment serves an important niche in the market, particularly in aquaculture and pet food applications, where sustainable omega-3 sources are increasingly sought after.

Algae Omega-3 Ingredients Market Geography Segment Analysis

Algae Omega-3 Ingredients Market in North America

North America represents a mature and sophisticated omega-3 ingredients market for algae omega-3 ingredients, driven by increasing consumer awareness about plant-based alternatives and sustainable sourcing. The region benefits from advanced research capabilities, a strong regulatory framework, and established distribution networks. The United States leads the regional market, followed by Canada and Mexico, with manufacturers focusing on product innovation and clean-label offerings. The presence of major players and growing demand for plant-based nutrition has created a robust ecosystem for algae-based omega-3 products across various applications, including dietary supplements, functional foods, and infant nutrition.

Algae Omega-3 Ingredients Market in the United States

The United States dominates the North American algae omega-3 ingredients market, holding approximately 83% of the regional market share in 2024. The country's market leadership is supported by a strong research and development infrastructure, innovative product launches, and increasing consumer preference for plant-based alternatives. The US market is characterized by robust demand from the pharmaceutical and nutraceutical sectors, with manufacturers actively investing in technological advancements. The presence of leading companies and growing health consciousness among consumers has created a favorable environment for market expansion, particularly in segments like functional foods and dietary supplements.

Algae Omega-3 Ingredients Market in Mexico

Mexico emerges as the fastest-growing market in North America, with a projected CAGR of approximately 13% during 2024-2029. The country's growth is driven by increasing awareness of nutritional supplements, rising disposable income, and growing demand for premium health products. Mexican consumers are increasingly adopting preventive healthcare approaches, leading to higher consumption of omega-3 supplements. The country's potential as a production hub for microalgae, supported by favorable climatic conditions and government initiatives, further strengthens its market position. The expanding middle class and growing health consciousness among consumers continue to drive market growth.

Algae Omega-3 Ingredients Market in Europe

Europe represents a significant market for algae omega-3 ingredients, characterized by strong research initiatives and increasing consumer preference for sustainable and plant-based products. The region's market is driven by robust demand from countries including Germany, the United Kingdom, France, Spain, Russia, and Italy. The European market benefits from advanced technological capabilities, stringent quality standards, and growing awareness about the health benefits of omega-3 supplements. The region's focus on sustainable sourcing and environmental consciousness has created favorable conditions for algae-based alternatives to traditional fish-derived omega-3 products.

Algae Omega-3 Ingredients Market in Germany

Germany leads the European market, commanding approximately 19% of the regional market share in 2024. The country's market leadership is attributed to its strong manufacturing base, technological expertise, and robust research and development infrastructure. German consumers show high awareness of nutritional supplements and an increasing preference for plant-based alternatives. The presence of major manufacturers and research institutions, coupled with growing demand for sustainable products, has established Germany as a key market for algae omega-3 ingredients in Europe.

Algae Omega-3 Ingredients Market in Italy

Italy demonstrates the highest growth potential in Europe, with an expected CAGR of approximately 12% during 2024-2029. The Italian market is driven by increasing health consciousness and growing adoption of dietary supplements. The country's strong tradition in nutraceuticals and high supplement consumption rates create favorable conditions for market growth. The aging population and rising awareness about preventive healthcare continue to drive demand for algae-based omega-3 products, particularly in the dietary supplements and functional foods segments.

Algae Omega-3 Ingredients Market in Asia-Pacific

The Asia-Pacific region represents a dynamic and rapidly evolving omega market for algae omega-3 ingredients, characterized by diverse consumer preferences and varying levels of market maturity across countries. The region encompasses major markets including China, Japan, Australia, and India, each with distinct market characteristics and growth drivers. Increasing health consciousness, rising disposable income, and growing awareness about preventive healthcare contribute to market expansion across the region.

Algae Omega-3 Ingredients Market in China

China dominates the Asia-Pacific market, driven by its large consumer base, strong manufacturing capabilities, and growing health awareness. The country's market leadership is supported by increasing investments in research and development, growing demand for premium health products, and strong government support for the algae industry. The presence of domestic manufacturers and rising consumer preference for plant-based alternatives continue to strengthen China's position in the regional market. Notably, China omega-3 powder manufacturers play a significant role in meeting the regional demand for algae-based ingredients.

Algae Omega-3 Ingredients Market in India

India emerges as the fastest-growing market in the Asia-Pacific region, driven by increasing health consciousness, rising disposable income, and growing demand for plant-based products. The country's large vegetarian population creates a natural market for algae-based alternatives to fish-derived omega-3 products. The expanding middle class, growing awareness about nutritional supplements, and increasing investments in research and development contribute to India's rapid market growth.

Algae Omega-3 Ingredients Market in South America

The South American market for algae omega-3 ingredients shows promising growth potential, with Brazil and Argentina emerging as key markets in the region. Brazil leads the regional market, while Argentina demonstrates the fastest growth rate. The region's market is characterized by increasing health consciousness, a growing middle-class population, and rising demand for nutritional supplements. The favorable climate conditions for algae cultivation and growing awareness about sustainable alternatives contribute to market expansion across South America.

Algae Omega-3 Ingredients Market in the Middle East & Africa

The Middle East & Africa region presents an emerging market for algae omega-3 ingredients, with South Africa and Saudi Arabia as key markets. Saudi Arabia leads the regional market, while South Africa shows the fastest growth potential. The region's market is driven by increasing health awareness, growing disposable income, and rising demand for premium nutritional products. Government initiatives supporting sustainable production and increasing investments in research and development contribute to market growth across the region.

Algae Omega-3 Ingredients Industry Overview

Top Companies in Algae Omega-3 Ingredients Market

The market is characterized by the strong presence of established players like Archer Daniels Midland, DSM, Corbion, BASF, and Lonza, who have demonstrated consistent leadership through various strategic initiatives. These companies have prioritized product innovation through significant R&D investments, particularly in developing high-concentrate formulations and sustainable production methods. Operational agility is evident in their approach to expanding production capacities and optimizing supply chains across key regions. Strategic partnerships, especially with aquaculture companies and research institutions, have become increasingly common to enhance technical capabilities and market reach. Geographic expansion has focused on high-growth markets in the Asia-Pacific region, while portfolio diversification has targeted emerging applications in functional foods, dietary supplements, and animal nutrition. This focus on innovation positions them as leading suppliers of algae omega-3 in the omega-3 ingredients market.

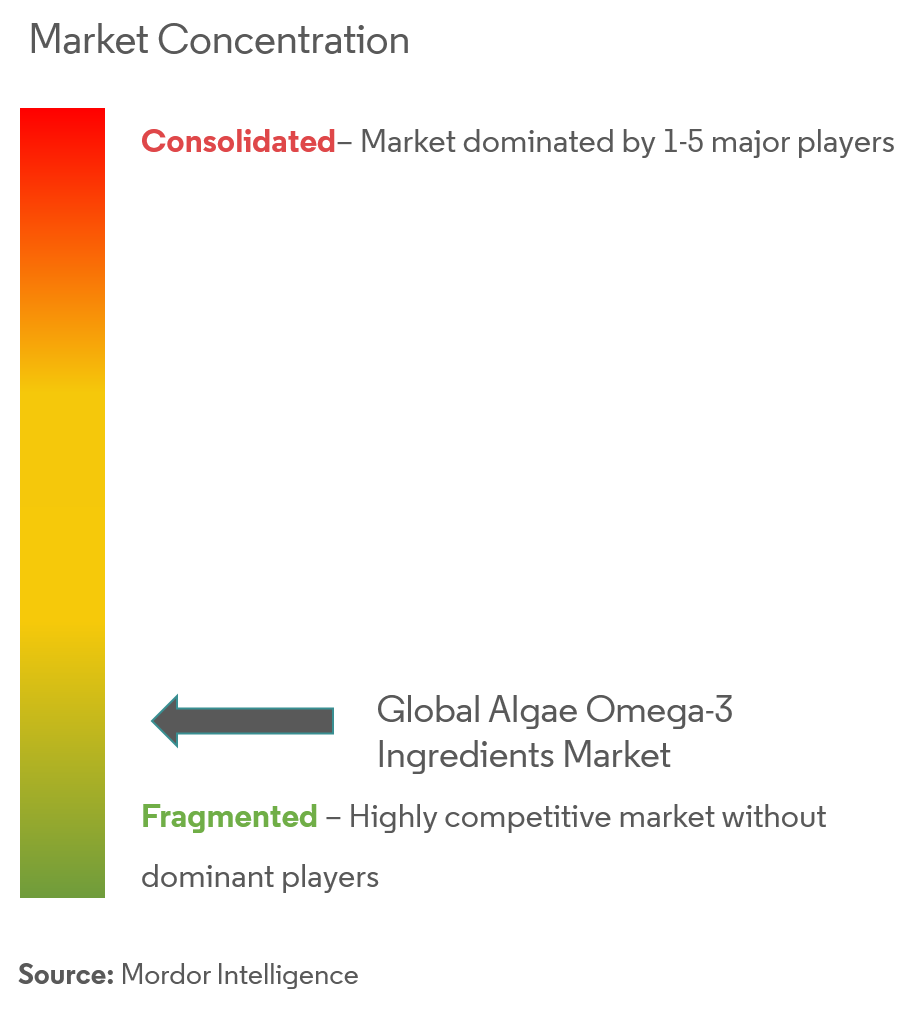

Dynamic Market Structure with Strong Consolidation Trends

The competitive landscape exhibits a mix of global conglomerates and specialized manufacturers, with large multinationals holding dominant positions through their extensive research capabilities and established distribution networks. These major players have strengthened their market presence through vertical integration strategies, controlling everything from algae cultivation to final product formulation. The market structure is relatively consolidated at the global level, though regional markets often feature local players with strong distribution networks and customer relationships. Merger and acquisition activity has been particularly robust, with larger companies acquiring specialized algae technology firms and regional players to expand their technical capabilities and geographic footprint.

The industry demonstrates high barriers to entry due to significant capital requirements, sophisticated extraction technologies, and stringent regulatory compliance needs. Competition intensity is further shaped by the need for sustainable competitive advantages through innovation in terms of source, processability, bioavailability, and purity. Market leaders have established strong relationships with key customer segments through comprehensive product portfolios and technical support services, while also maintaining strategic control over raw material sources through long-term supplier agreements and proprietary cultivation technologies. This strategic control is critical in the omega market, where innovation and sustainability are key.

Innovation and Sustainability Drive Future Success

Success in this market increasingly depends on companies' ability to develop sustainable production methods and innovative product formulations that meet evolving consumer preferences. Incumbents must focus on expanding their research and development capabilities, particularly in areas such as high-concentrate products and novel extraction technologies. Building strong relationships with end-users through customized solutions and technical support services has become crucial for maintaining market position. Companies must also address the growing demand for transparency in sourcing and production methods, while maintaining cost competitiveness through operational efficiency improvements.

For contenders looking to gain market share, differentiation through specialized product offerings and focus on underserved market segments presents significant opportunities. The increasing emphasis on sustainable and plant-based alternatives creates openings for new entrants with innovative technologies or unique value propositions. Success factors include developing strong intellectual property portfolios, establishing reliable supply chains, and building credibility through third-party certifications and quality assurance programs. Companies must also carefully navigate regulatory requirements across different regions while maintaining flexibility to adapt to changing market conditions and customer preferences. The market for algae-based ingredients offers potential for growth through these strategic initiatives.

Algae Omega-3 Ingredients Market Leaders

-

Archer Daniels Midland Company

-

Koninklijke DSM N.V.

-

Corbion N.V.

-

Neptune Wellness Solutions

-

Polaris

- *Disclaimer: Major Players sorted in no particular order

Algae Omega-3 Ingredients Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porters Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Eicosapentanoic Acid (EPA)

- 5.1.2 Docosahexaenoic Acid (DHA)

- 5.1.3 EPA/DHA

-

5.2 By Application

- 5.2.1 Food and Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Pharmaceuticals

- 5.2.4 Animal Nutrition

-

5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Positioning Analysis

-

6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Koninklijke DSM N.V.

- 6.3.3 Corbion N.V.

- 6.3.4 Neptune Wellness Solutions

- 6.3.5 Source Omega LLC

- 6.3.6 POLARIS

- 6.3.7 BASF SE

- 6.3.8 Novotech Nutraceuticals Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. IMPACT OF COVID-19 ON THE MARKET

Algae Omega-3 Ingredients Industry Segmentation

The global algae omega-3 ingredients market offers ingredient types such as Eicosapentaenoic Acid (EPA), Docosahexaenoic Acid (DHA), and EPA/DHA applicable to food and beverage, dietary supplements, pharmaceuticals, and animal nutrition. By geography, the market studied covers the major countries in the region, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Type | Eicosapentanoic Acid (EPA) | ||

| Docosahexaenoic Acid (DHA) | |||

| EPA/DHA | |||

| By Application | Food and Beverages | ||

| Dietary Supplements | |||

| Pharmaceuticals | |||

| Animal Nutrition | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Spain | ||

| United Kingdom | |||

| Germany | |||

| France | |||

| Italy | |||

| Russia | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle East and Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle East and Africa | |||

Algae Omega-3 Ingredients Market Research FAQs

How big is the Algae Omega-3 Ingredients Market?

The Algae Omega-3 Ingredients Market size is expected to reach USD 1.26 billion in 2025 and grow at a CAGR of 13.36% to reach USD 2.36 billion by 2030.

What is the current Algae Omega-3 Ingredients Market size?

In 2025, the Algae Omega-3 Ingredients Market size is expected to reach USD 1.26 billion.

Who are the key players in Algae Omega-3 Ingredients Market?

Archer Daniels Midland Company, Koninklijke DSM N.V., Corbion N.V., Neptune Wellness Solutions and Polaris are the major companies operating in the Algae Omega-3 Ingredients Market.

Which is the fastest growing region in Algae Omega-3 Ingredients Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Algae Omega-3 Ingredients Market?

In 2025, the North America accounts for the largest market share in Algae Omega-3 Ingredients Market.

What years does this Algae Omega-3 Ingredients Market cover, and what was the market size in 2024?

In 2024, the Algae Omega-3 Ingredients Market size was estimated at USD 1.09 billion. The report covers the Algae Omega-3 Ingredients Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Algae Omega-3 Ingredients Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Algae Omega-3 Ingredients Market Research

Mordor Intelligence delivers a comprehensive analysis of the algae omega-3 ingredients market. We leverage decades of expertise in tracking omega 3 ingredients trends and developments. Our research encompasses the complete value chain, from algae oil market dynamics to algae-based ingredients applications. This includes a detailed analysis of DHA algae oil for food, beverage, and supplement applications. The report examines various segments, including the algae fats market, microalgae oil production, and emerging opportunities in docosahexaenoic acid (DHA) development.

Stakeholders across the industry, from omega 3 ingredients manufacturers to end-users, benefit from our detailed analysis. This is available in an easy-to-download report PDF format. The research provides comprehensive insights into algae-based animal feed and ingredients, EPA DHA omega 3 ingredients, and emerging trends in vegan omega 3 products. Our coverage includes detailed profiling of key china omega 3 powder manufacturers and analysis of popular products like nordic naturals algae omega. The report delivers actionable intelligence for businesses operating in the omega market, supporting strategic decision-making across the value chain.