Aircraft Sensors Market Size

Aircraft Sensors Market Analysis

The Aircraft Sensors Market is expected to register a CAGR of 5.88% during the forecast period.

- The COVID-19 pandemic severely impacted the global aviation market; flight activity was muted for more than a quarter, and multiple aircraft orders were delayed, which led to a brutal disruption of the demand trajectory of aircraft sensors. Further, 2021 was marked as the year of transition; air passenger numbers are expected to be equivalent to or even surpass the pre-COVID levels by 2023, which is expected to drive the demand for aircraft sensors over the coming years.

- The innovation in safety and effective handling of aircraft would drive the aircraft sensor market. A modern aircraft integrates fly-by-computer systems, where signals from sensors monitor the various activities going on in the flight, such as thrust levels, pedals, and flight sticks. The information is then received by flight management systems that control surfaces like ailerons and flaps.

- Moreover, the increasing integration of the Internet of Things (IoT) in airplanes to gain real-time statistics is raising the utilization and need for sensors to generate more accurate data, which is expected to drive the aircraft sensor market. However, the major factor impeding the growth of the market is the high R&D, manufacturing, and maintenance costs of sophisticated sensors, which raise questions on the economic viability of emerging technologies to be integrated onboard next-generation aircraft.

Aircraft Sensors Market Trends

Temperature Sensor to Account for a Significant Share

- Temperature sensors play a crucial role in aircraft operations, being integrated into various parts of the aircraft, such as cabins, brakes, air ducts, inter-stage turbines, and hydraulic lines. Manufacturers of aircraft temperature sensors have to comply with industry standards and regulations to commercialize their products.

- One recent example of the importance of temperature sensors in aircraft is the introduction of Airbus' BelugaXL in July 2018. This next-generation aircraft with substantial cargo capacity requires multiple sensors, particularly temperature sensors, to regulate the optimum temperature in the cabin and cargo space. The high demand for sensors to monitor various parameters during flight or on the ground was driven by the BelugaXL's ability to transport large amounts of cargo. Similarly, Boeing's Dreamlifter, a significant cargo carrier, has also driven the demand for sensors worldwide.

- Furthermore, with the increase in air passenger traffic, aircraft original equipment manufacturers (OEMs) are expanding their manufacturing capabilities to meet the demand from end-users for new aircraft. This expansion will significantly increase the need for temperature sensors, especially in commercial aircraft, to ensure air passenger safety and comfort. This growing demand for temperature sensors in aircraft is expected to propel the growth of the market in the coming years.

North America to Dominate the Aircraft Sensors Market

Countries in North America, especially the US, have been making constant progress in terms of demand for new aircraft in all sectors (commercial, military, and general aviation). This demand is driven by factors such as rapidly growing passenger traffic and fleet modernization initiative undertaken by the US defense forces. Moreover, the need to maintain the airworthiness of the fleet, both scheduled and unscheduled maintenance, is carried out, which drives the demand from the MRO sector.

Moreover, US aerospace manufacturers are very competitive internationally. In terms of export sales, the industry contributed USD 143 billion to the US economy. The inward stock of FDI into the US aerospace manufacturing industry totaled more than USD 21 billion, depicting the scope for aircraft sensor manufacturers in the region. The United States is making deals with other emerging economies or countries to sell high-end military aircraft, which is likely to boost market growth over the forecast period.

Aircraft Sensors Industry Overview

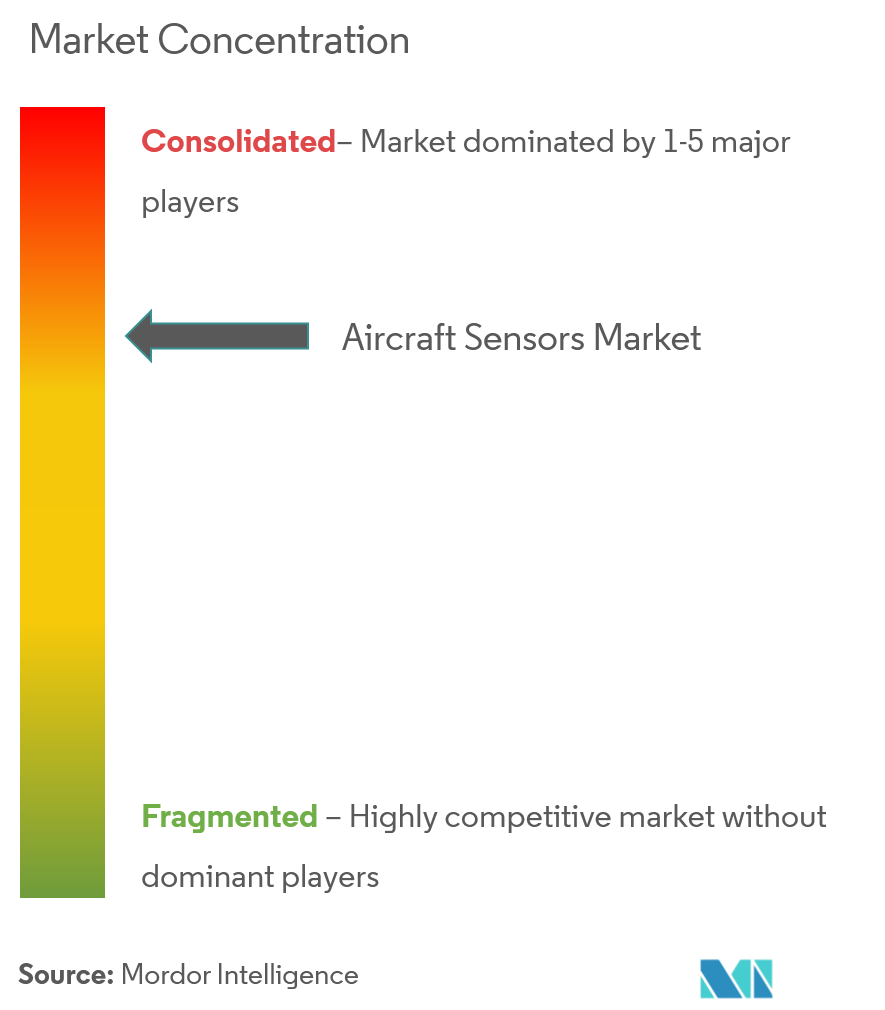

The major players in the Aircraft Sensors Market include TE Connectivity Ltd, Honeywell International Inc., The General Electric Company, Raytheon Technologies Corporation, and Safran SA, amongst others. These companies are associated with several active aircraft programs, thereby catering to a majority of the current demand generated by OEMs and MROs alike. Thus, the aircraft sensors market is rendered consolidated, with little or no scope for new market players due to high associated R&D costs and stringent regulatory and certification framework.

Aircraft Sensors Market Leaders

-

Honeywell International Inc.

-

Raytheon Technologies Corporation

-

The General Electric Company

-

Curtiss-Wright Corporation

-

Safran SA

- *Disclaimer: Major Players sorted in no particular order

Aircraft Sensors Market News

- February 2023: Northrop Grumman Corporation began the integration and testing of the new ultra-wideband Electronically-Scanned Multifunction Reconfigurable Integrated Sensor (EMRIS) to enable military forces 'to accelerate decision timelines and act collectively. The EMRIS architecture is easily scaled and reconfigurable, including a variety of mounting configurations, for wide applicability across platforms and domains, including aircraft.

- August 2021: Airbus SE announced the integration of Collins Aerospace's next-generation sensors to enhance visibility for commercial and military aircraft, while also improving on another critical operational parameter of fuel efficiency.

- January 2021: Honeywell Intenrational Inc. announced receiving funding from the United States Defense Advanced Research Projects Agency (DARPA) to create the next generation of inertial sensor technology that can be used in commercial and defense navigation applications.

Aircraft Sensors Industry Segmentation

Aircraft sensors are critical to providing accurate data for safe and effective flight times, as well as the take-off and landing of the aircraft, as they provide feedback on a wide array of aircraft operational parameters such as the temperature and pressure of the cabin, controlling the wings and flaps, and others.

The market is segmented by sensor type, aircraft type, and geography. By aircraft type, the market is segmented into commercial and business aircraft and military aircraft. By sensor type, the market is segmented into temperature, pressure, position, flow, torque, radar, accelerometer, proximity, and other sensor types. By geography, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

The report offers market value and forecasts in terms of USD billion.

| By Aircraft Type | Commercial Aircraft | ||

| Military Aircraft | |||

| General Aviation Aircraft | |||

| By Sensor Type | Temperature | ||

| Pressure | |||

| Position | |||

| Flow | |||

| Torque | |||

| Radar | |||

| Accelerometers | |||

| Proximity | |||

| Other Sensor Types | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| France | |||

| Germany | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Latin America | Brazil | ||

| Mexico | |||

| Rest of Latin America | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Rest of Middle East and Africa | |||

| Commercial Aircraft |

| Military Aircraft |

| General Aviation Aircraft |

| Temperature |

| Pressure |

| Position |

| Flow |

| Torque |

| Radar |

| Accelerometers |

| Proximity |

| Other Sensor Types |

| North America | United States |

| Canada | |

| Europe | United Kingdom |

| France | |

| Germany | |

| Italy | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Rest of Asia-Pacific | |

| Latin America | Brazil |

| Mexico | |

| Rest of Latin America | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Rest of Middle East and Africa |

Aircraft Sensors Market Research FAQs

What is the current Aircraft Sensors Market size?

The Aircraft Sensors Market is projected to register a CAGR of 5.88% during the forecast period (2025-2030)

Who are the key players in Aircraft Sensors Market?

Honeywell International Inc., Raytheon Technologies Corporation, The General Electric Company, Curtiss-Wright Corporation and Safran SA are the major companies operating in the Aircraft Sensors Market.

Which is the fastest growing region in Aircraft Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Aircraft Sensors Market?

In 2025, the North America accounts for the largest market share in Aircraft Sensors Market.

What years does this Aircraft Sensors Market cover?

The report covers the Aircraft Sensors Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Aircraft Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Aircraft Sensors Industry Report

Statistics for the 2025 Aircraft Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Aircraft Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.