Aircraft Landing Gear Systems Market Analysis

The Aircraft Landing Gear Systems Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The COVID-19 pandemic has affected the aviation market in many ways, and the effect of the pandemic is expected to continue even during the forecast period. In the commercial sector, passenger traffic plummeted drastically in 2020, and it is expected to take 2-3 years to recover completely. The airlines' subsequent losses have resulted in the cancellation or deferral of aircraft orders, thereby reducing the demand. This is expected to affect the market for the related landing gear systems during the forecast period.

The increasing procurement of military aircraft, coupled with the demand for newer generation aircraft might propel the growth of the market for aircraft landing gear systems in the near future. Additionally, various new upcoming aircraft programs shall drive the demand for advanced, lightweight landing gears. Aircraft OEMs and landing gear manufacturers are heavily investing in the R&D of innovative technologies, and this is expected to lead to improved performance of landing gear systems.Advancements in material technology may provide various opportunities for the manufacturers of aircraft landing gear systems in the market.

Aircraft Landing Gear Systems Market Trends

Combat Aircraft Segment is Expected to Witness the Highest CAGR During the Forecast Period

Currently, the Combat Aircraft has the highest share in the market. As tensions between various global nations have increased, countries have been striving to enhance their aerial combat capabilities. Several nations have upgraded their existing combat aircraft or replaced their aging fleet with newer-generation aircraft with advanced features. With the growth in defense spending by several nations around the world, the industry has witnessed large-scale procurement and development activities for combat aircraft in the last few years. Technology advancements in stealth and precision weapons have been further supporting the development of combat aircraft. Globally, there is an increasing demand for combat aircraft, which is also increasing the demand for the related landing gear systems and components. For instance, in July 2021, Air Industries announced that it has received a follow-on long-term agreement (LTA) to support the F-35 Lightning II joint strike fighter (JSF) aircraft program. Air Industries will be responsible for manufacturing landing gear components for all three variants of the aircraft. The F-35 is one of the most advanced fighter jets globally. Over 700 F-35s have been delivered so far to the country and its partners. Therefore, the ongoing procurements and developments may increase the focus on this segment, and these are likely to be the reasons for its high CAGR during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth

Currently, Asia-Pacific is generating the highest revenue in the aircraft landing gear systems market. Asia-Pacific is one of the most traveled air routes in the world. With a high passenger traffic growth, several airlines in the region ordered new commercial aircraft in recent years. A major portion of commercial aircraft deliveries is expected to be in Asia-Pacific during the forecast period. Correspondingly, the demand for new commercial aircraft landing gear is also expected to be highest in Asia-Pacific in the coming years. Even in the military sector, there is a growing demand for new military aircraft generated from the Asia-Pacific region, as major countries look to modernize their fleet and increase their capability. China is leading the recovery of global commercial aviation due to great domestic demand, helping the airlines witness financial recovery. On the other hand, the general aviation industry is one of the emerging industries in China, and the country has taken measures to boost its development over the years. The country is also aiming at the indigenous development of commercial and military aircraft. It is expected to launch several indigenously developed aircraft, including narrow and wide-body commercial aircraft, fighter jets, and combat and non-combat helicopters, among others, during the forecast period. Similarly, India is one of the fastest growing aviation markets in the Asia-Pacific region. India became the biggest market for Airbus commercial aircraft in 2020 as the largest commercial aircraft manufacturer in the world delivered the highest numbers of aircraft (57) to the Indian carriers in that year. India is also a critical military aircraft market, as the country has been modernizing its aerial capabilities, both by procuring new aircraft and indigenously developing military aircraft. All these will generate demand for the related landing gear systems during the forecast period.

Aircraft Landing Gear Systems Industry Overview

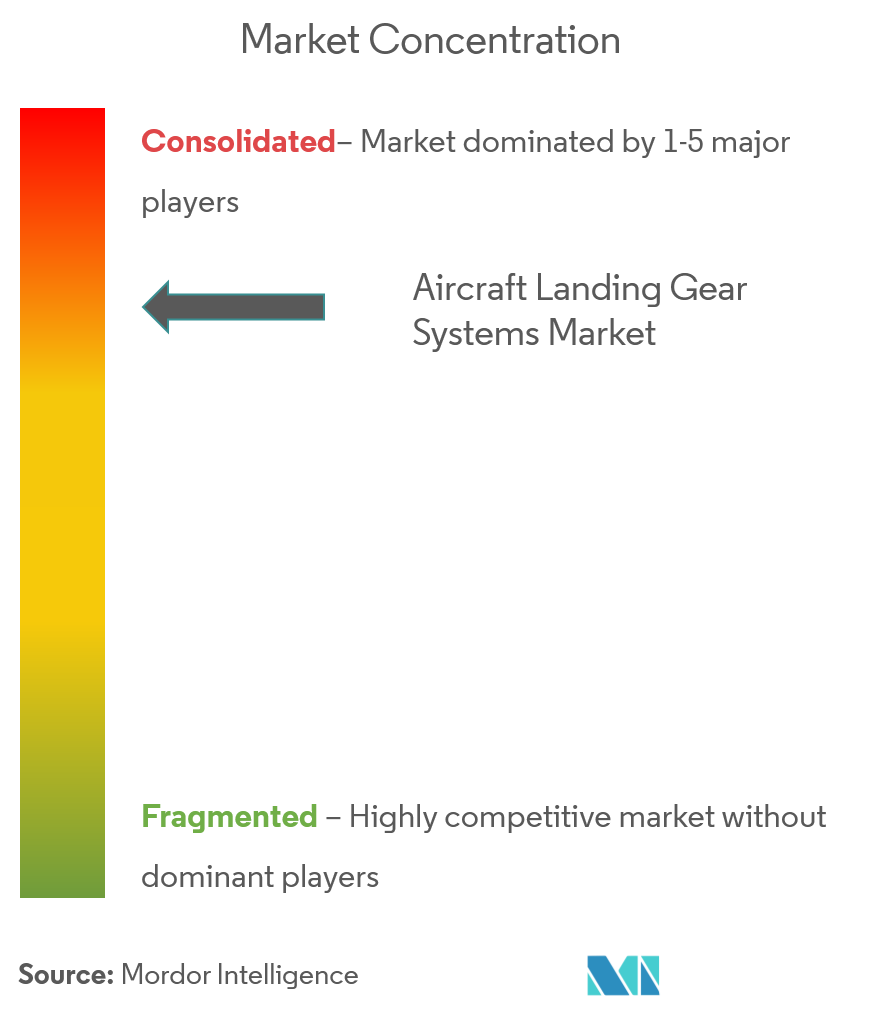

Safran SA, Liebherr-International Deutschland GmbH, Raytheon Technologies Corporation (Collins Aerospace), Honeywell International Inc., and Heroux Devtek Inc., are among the major players that are expected to have significant shares in the aircraft landing gear systems market, during the forecast period. Various initiatives and product innovations made by the companies have helped strengthen their presence in the market. Companies are focusing on expanding their manufacturing capacities to be able to cater to the increasing demand for landing gears. For instance, in February 2020, Raytheon Technologies Corporation (Collins Aerospace) announced its plans to invest USD 225 million in Landing Systems facilities. This includes constructing a new landing systems facility in Fort Worth, Texas, and expanding its carbon brake manufacturing facilities in Spokane, Washington, and Pueblo, Colorado. Such developments are expected to help the growth of the players during the forecast period.

Aircraft Landing Gear Systems Market Leaders

-

Safran SA

-

Heroux Devtek Inc.

-

Honeywell International Inc.

-

Raytheon Technologies Corporation (Collins Aerospace)

-

Liebherr-International Deutschland GmbH

- *Disclaimer: Major Players sorted in no particular order

Aircraft Landing Gear Systems Market News

In October 2021, Héroux-Devtek Inc. announced that it has entered into an agreement with aircraft manufacturer Lockheed Martin for the development of landing gears for its next generation of defense aircraft. The new contract will focus on the development of a completely new generation of landing gears for the OEM.

In May 2021, Safran Landing Systems announced that it has reached an agreement with Bell Textron Inc., to provide the landing gear system for the V-280 Valor aircraft. Based on the agreement, Safran Landing Systems will develop and manufacture a fully integrated Landing Gear System consisting of the Main Landing Gear, Tail Landing Gear, Wheels and Brakes, Extension/Retraction System, Steering System, Brake Control System, and Indication sensors.

Aircraft Landing Gear Systems Industry Segmentation

The aircraft landing gear systems market has been segmented by aircraft type into commercial aviation, military aviation, general aviation, and by gear position into nose, and undercarriage. The report also covers the market sizes and forecasts for the aircraft landing gear systems market in major countries across different regions. For each segment, the market sizing and forecasts have been provided in value (USD billion).

| Aircraft Type | Commercial Aviation | Narrow-body Aircraft | |

| Wide-body Aircraft | |||

| Regional Aircraft | |||

| Military Aviation | Combat Aircraft | ||

| Non-Combat Aircraft | |||

| Helicopters | |||

| General Aviation | Business Jet | ||

| Turboprop Aircraft | |||

| Piston Aircraft | |||

| Helicopters | |||

| Gear Position | Nose | ||

| Undercarriage | |||

| Geography | Asia-Pacific | China | |

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Europe | United Kingdom | ||

| France | |||

| Germany | |||

| Rest of Europe | |||

| Latin America | Brazil | ||

| Rest of Latin America | |||

| Middle-East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| Egypt | |||

| Rest of Middle-East and Africa | |||

Aircraft Landing Gear Systems Market Research FAQs

What is the current Aircraft Landing Gear Systems Market size?

The Aircraft Landing Gear Systems Market is projected to register a CAGR of greater than 3.5% during the forecast period (2025-2030)

Who are the key players in Aircraft Landing Gear Systems Market?

Safran SA, Heroux Devtek Inc., Honeywell International Inc., Raytheon Technologies Corporation (Collins Aerospace) and Liebherr-International Deutschland GmbH are the major companies operating in the Aircraft Landing Gear Systems Market.

Which is the fastest growing region in Aircraft Landing Gear Systems Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Aircraft Landing Gear Systems Market?

In 2025, the Asia Pacific accounts for the largest market share in Aircraft Landing Gear Systems Market.

What years does this Aircraft Landing Gear Systems Market cover?

The report covers the Aircraft Landing Gear Systems Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Aircraft Landing Gear Systems Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Aircraft Landing Gear Systems Industry Report

Statistics for the 2025 Aircraft Landing Gear Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Aircraft Landing Gear Systems analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.