African Beauty Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 3.79 Billion |

| Market Size (2029) | USD 5.29 Billion |

| CAGR (2024 - 2029) | 6.86 % |

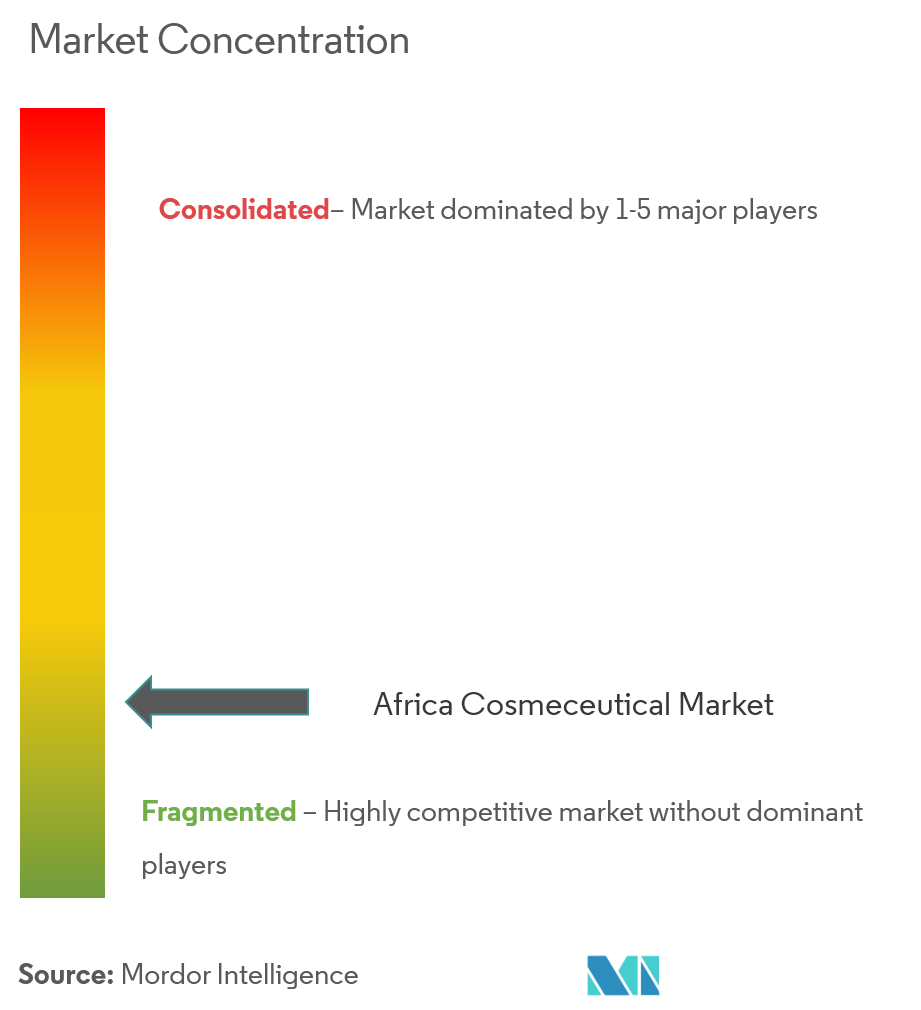

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

African Beauty Market Analysis

The Africa Cosmeceutical Market size is estimated at USD 3.79 billion in 2024, and is expected to reach USD 5.29 billion by 2029, growing at a CAGR of 6.86% during the forecast period (2024-2029).

- Fascination to look younger is increasing among the African population and the developing markets provide a huge platform for the growth of the market. The personal care and beauty industry has been growing at a fast pace over the past few years across all regions of Africa.

- The increasing awareness regarding personal hygiene and the importance that commercial products play in it is helping the market root itself strongly into the region.

- The fastest-growing middle-class sector and increasing urbanization trends are driving the African cosmeceuticals market. The appeal of such products is being considered as a Pan-African phenomenon, with more and more consumers willing to spend on such beauty and health products.

African Beauty Market Trends

This section covers the major market trends shaping the Africa Cosmeceutical Market according to our research experts:

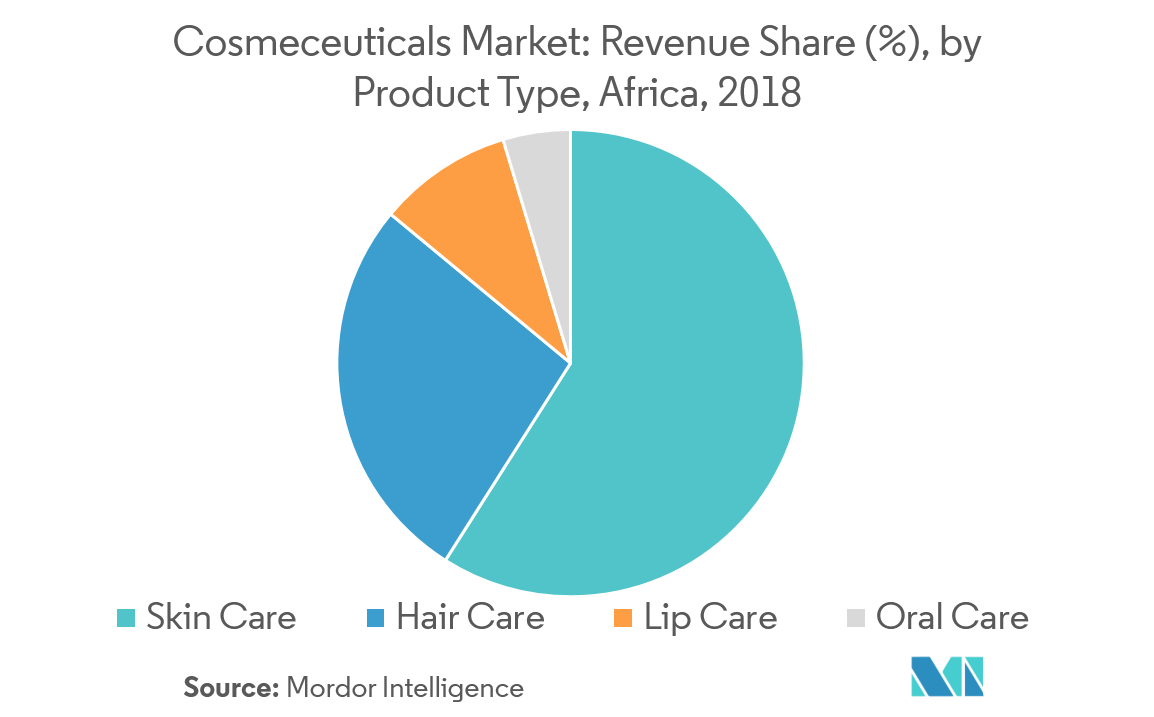

Haircare And Skincare Segments Holds Maximum Share

Skincare and haircare are expected to be the dominating segment, followed by oral care in the forecasted period. Among skincare, anti-aging sub-segment is expected to contribute maximum revenue over the forecasted period. Black South Africans’ skincare requirements are in stark contrast which increases the demand for skin care products including Anti-Aging, Anti-acne, sun protection, Moisturizers, Skin Whitening, etc. The latter’s skincare requirements rotate around anti-aging products, whereas the former’s prime concern is the uneven complexion and dark spots. Similarly, Africans likely to experiment with different hair and fashion styles, leading the growth of Haircare products such as shampoo and conditioners, Hair Colorants and Dyes.

South Africa Dominates The Cosmeceuticals Market

Though the term ‘cosmeceuticals’ started gaining momentum in the South Africans recently, it has now become one of the most preferred product categories in the country. The consumers are increasingly becoming more focused while purchasing beauty and personal care products, owing to a number of awareness campaigns and promotions run by associations and prominent players. Online retailers, such as Clicks, Absolute Skin, and Care to Beauty South Africa offer a wide range of cosmeceuticals products by international players, in order to cater to the rising demand from consumers. DermaFix and SOiL are few of the country-based manufacturers engaged in the manufacturing of advanced skincare products, including anti-aging, hyperpigmentation, acne, etc.

African Beauty Industry Overview

L’oreal, P & G, Unilever, and retailers such as Shoprite, Pick ‘n Pay, Massmart, Spar, and Metcash are opening the region for successful foreign goods entry. Acquisitions, expansions, mergers and joint ventures are some of the strategies being adopted by these players to increase their presence and market share in African cosmeceuticals market.

African Beauty Market Leaders

-

L'Oréal SA

-

Procter & Gamble

-

Unilever PLC

-

Shiseido Co. Ltd

-

Bayer AG

*Disclaimer: Major Players sorted in no particular order

African Beauty Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Product Type

-

5.1.1 Skin Care

-

5.1.1.1 Anti-ageing

-

5.1.1.2 Anti-acne

-

5.1.1.3 Sun Protection

-

5.1.1.4 Moisturizers

-

5.1.1.5 Other Skin Care Product Types

-

-

5.1.2 Hair Care

-

5.1.2.1 Shampoos and Conditioners

-

5.1.2.2 Hair Colorants and Dyes

-

5.1.2.3 Other Hair Care Product Types

-

-

5.1.3 Lip Care

-

5.1.4 Oral Care

-

-

5.2 By Distribution Channel

-

5.2.1 Supermarket/Hypermarkets

-

5.2.2 Online Retail

-

5.2.3 Convenience Stores

-

5.2.4 Specialist Stores

-

5.2.5 Others

-

-

5.3 By Country

-

5.3.1 South Africa

-

5.3.2 Egypt

-

5.3.3 Others

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 L'Oreal SA

-

6.4.2 Procter & Gamble

-

6.4.3 Unilever PLC

-

6.4.4 Shiseido Co. Ltd

-

6.4.5 Bayer AG

-

6.4.6 Groupe Clarins SA

-

6.4.7 Beiersdorf AG

-

6.4.8 Johnson & Johnson Inc.

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

African Beauty Industry Segmentation

The African cosmeceuticals market offers a wide range of products broadly categorized under skincare, hair care, lip care, and oral care. Also, the market covers the products available across distribution channels Supermarket/Hypermarkets, Convenience stores, online Retail, specialist stores, others. Moreover, the study provides an analysis of the cosmeceuticals market in the emerging and established markets across the region, including South Africa, Nigeria, and Egypt.

| By Product Type | |||||||

| |||||||

| |||||||

| Lip Care | |||||||

| Oral Care |

| By Distribution Channel | |

| Supermarket/Hypermarkets | |

| Online Retail | |

| Convenience Stores | |

| Specialist Stores | |

| Others |

| By Country | |

| South Africa | |

| Egypt | |

| Others |

African Beauty Market Research FAQs

How big is the Africa Cosmeceutical Market?

The Africa Cosmeceutical Market size is expected to reach USD 3.79 billion in 2024 and grow at a CAGR of 6.86% to reach USD 5.29 billion by 2029.

What is the current Africa Cosmeceutical Market size?

In 2024, the Africa Cosmeceutical Market size is expected to reach USD 3.79 billion.

Who are the key players in Africa Cosmeceutical Market?

L'Oréal SA, Procter & Gamble, Unilever PLC, Shiseido Co. Ltd and Bayer AG are the major companies operating in the Africa Cosmeceutical Market.

What years does this Africa Cosmeceutical Market cover, and what was the market size in 2023?

In 2023, the Africa Cosmeceutical Market size was estimated at USD 3.55 billion. The report covers the Africa Cosmeceutical Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Africa Cosmeceutical Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the major factors driving the Africa Cosmeceutical Market?

The major factors driving the Africa Cosmeceutical Market are a) Increased focus on personal hygiene, beauty standards, and self-care practices b) Exposure to global trends and celebrity endorsements promoting cosmeceuticals

African Beauty Industry Report

The Africa Cosmeceutical Market is witnessing robust growth driven by a heightened consumer awareness of personal care and an increased presence of women in the workforce, especially notable in regions like South Africa. This sector is marked by a growing expenditure on products that not only enhance physical appearance but also provide pharmaceutical benefits like anti-aging and sun protection. The market is extensively segmented by product types including skincare, haircare, lip care, and oral care, with sub-categories such as moisturizers, anti-acne solutions, shampoos, conditioners, and colorants. Furthermore, the africa mascara market by product type is capturing attention within the broader cosmeceutical spectrum. Distribution channels vary across supermarkets, hypermarkets, specialty stores, convenience stores, and an expanding online sales landscape due to its wider reach and consumer convenience. The market tailors its offerings to meet specific local demands, fostered by strategic marketing and penetration of international brands establishing local bases, thereby spurring regional consumer engagement. Key geographical segments analyzed include North Africa, West Africa, East and Central Africa, and South Africa, each presenting distinct opportunities and market dynamics. For detailed insights and forecasts, access Mordor Intelligence™ Industry Reports offering a comprehensive view into the market trends and growth projections in the African beauty industry.Get a sample of this industry analysis as a free report PDF download.