Adaptive Optics Market Analysis

The Adaptive Optics Market is expected to register a CAGR of 38.9% during the forecast period.

- In recent years, adaptive optics application in medical sciences such as in the field of ophthalmology and retinal imaging to reduce the optical aberrations has augmented the demand of the market. With the increasing demand for adaptive optics, various companies such as Iris AO Inc. are offering their AO systems specifically designed for the ophthalmology and retinal imaging. For instance, the National Institutes of Health and the Air Force are using Iris AO DMs for retinal imaging.

- Moreover, the application of AO systems in military and defense industry applications such as satellite imaging, free-space optical communication as well as laser weapon, among others, has gained significant traction, which is also driving the growth of the market. Companies such as Boston Micromachine Corporation are offering AO systems by partnering with various defense organizations. For instance, Boston Micromachine Corporation has partnered with NASA, US Naval Research Laboratory, AFIT, among others, for offering optical systems in their projects.

- The government organization, such as European Southern Observatory, has dedicated department of AO that provides ground-based adaptive optics observing capabilities overcoming the limitation of atmospheric turbulence. In December 2019, ESO signed contract with SENER Aerospacial for design and production of the support cell for M5 mirror of the extremely large telescope. With a primary mirror of 39-meter diameter, the ELT will be equipped with five mirrors in total. Two of the-M4 and M5-form part of the adaptive optics system of the telescope.

- However, the system's complex design which leads to high initial cost for the organization is restricting the adoption of adaptive optics systems globally.

Adaptive Optics Market Trends

Application in the Field of Astronomy is Expected to Grow Significantly

- Over the last twenty years, several exoplanets have been found, and their study has become a high priority in the scientific field. Direct imaging of nearby these exoplanets and the surrounding in which they form and evolve is challenging due to the smaller angular separation relative to the central star and high contrast ratio. To tackle these challenges, ground-based telescopes are needed to be equipped with adaptive optics systems optimized to get high-contrast images.

- In January 2020, National Science Foundation (NSF) newest Inouye Solar 4-meter Telescope produces the first image that uses adaptive optics to compensate for blurring created by Earth's atmosphere.

- Europe commenced the European Extremely Large Telescope (ELT) project to build the largest telescope for the study of the universe. The project is expected to complete by the year 2024 and will make extensive use of adaptive optics systems to gather 13 times lighter images possible today.

- In February 2020, ESO has given a contract to CILAS, in adaptive optics to built deformable mirrors for several instruments on ESO telescopes. CILAS will support research and technological development in Europe and ensure the availability of necessary technology for ESO telescopes.

- Furthermore, in February 2020, researchers from First Light Imaging (Meyreuil, France), Aix Marseille University (Marseille, France), and the University Grenoble Alpes (Grenoble, France) have created a SWIR camera for AO that has low noise for free-space optical communications that runs at 600 frames per second (fps) and has low size, weight, and power (SWaP) as well as low cost.

- With such more projects to come in the recent future the demand for adaptive optics sytems is expected to grow significantly in the astronomy industry.

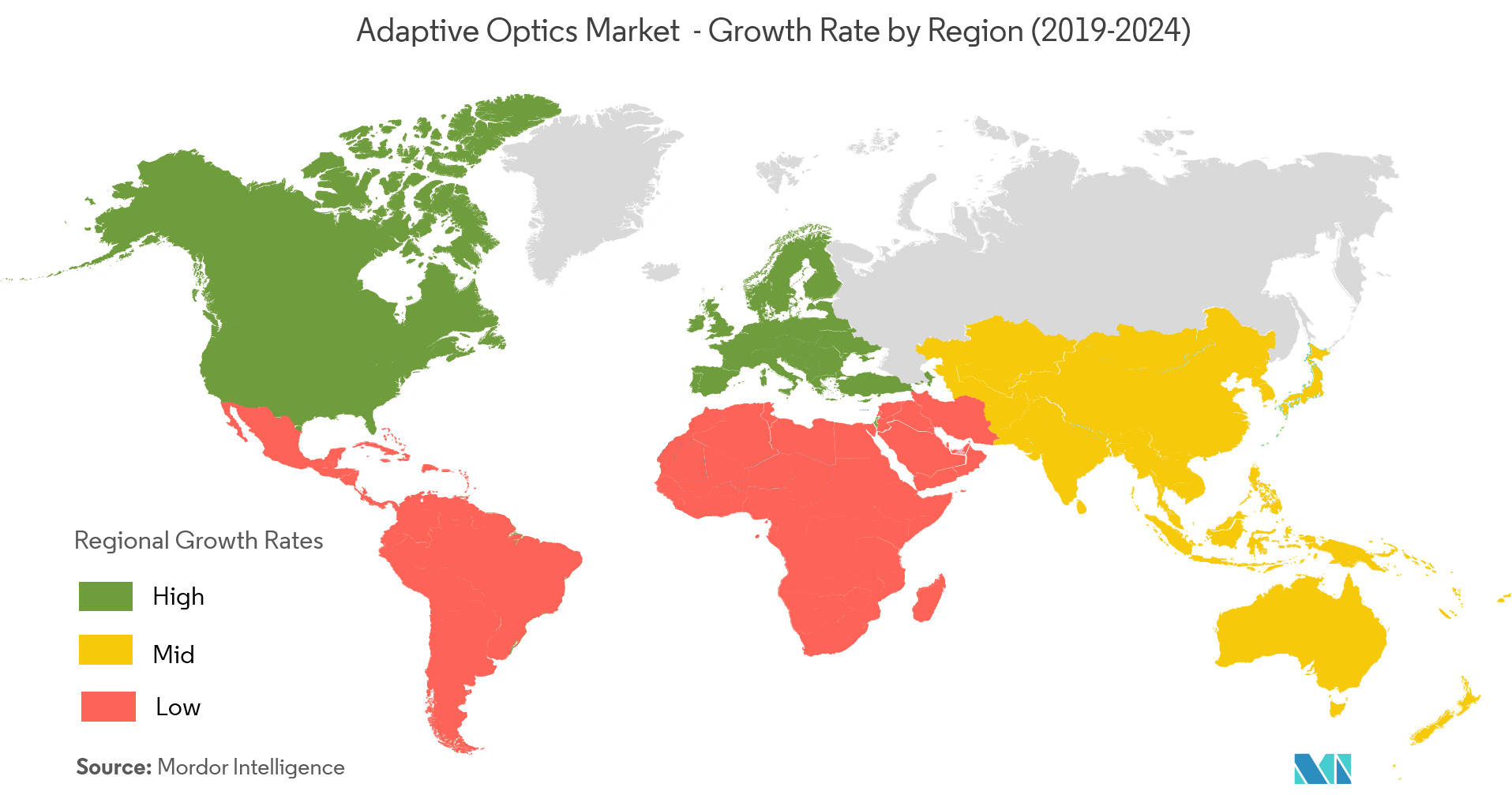

North America Region to Witness a fastest Growth

- Adaptive optics were historically developed for and are still being used extensively in defense applications across the world. The United States, with its high defense budgets and well-developed industrial defense complex, continue to use technologies like adaptive optics for developing high energy laser systems along with other applications. American defense spending is expected to continue to remain very high, and it is expected to drive the development of modern defense technology using adaptive optics.

- In addition to the Defense applications, the astronomical community has been an early adopter of this technology once it was declassified. The 200-inch Hale Telescope in California uses a laser in its adaptive optics system to correct the effects of atmospheric turbulence and enhance the capabilities of the telescope.

- There continues to be extensive research on the applications of adaptive optics in the field of healthcare across the universities and research laboratories of the North American region. The Institute of Optics, University of Rochester (USA), started by studying the potential for application of adaptive optics in ophthalmology and to correct most of the eye's aberrations to image the living human eye at high resolution and the trend has caught up with a number of universities investing resources to study applications of adaptive optics.

Adaptive Optics Industry Overview

The market for adaptive optics system is consolidated due to the presence of a few companies offering the solutions. However, the companies offering the sensors, software, and other hardware components are increasing, and further, the trend of companies providing and rental services are expected to expand in the forecast period. Some of the recent developments by the companies are as follows:

- July 2019 - Imaging Optics in collaboration with the EU-funded VOXEL project, developed an innovative way to create three-dimensional imaging without the high doses of X-ray radiation by adapting a technique called plenoptic imaging with the help of adaptive optics systems.

- June 2019 - TMT observatory signed a contract with CILAS to built TMT deformable mirrors for adaptive optics systems that will enable discoveries in the fields of astronomy, astrophysics, and cosmology.

Adaptive Optics Market Leaders

-

Flexible Optical B.V.

-

Boston Micromachines Corporation

-

Imaging Optic SA

-

Northrop Grumman Corporation

-

Phasics S.A

- *Disclaimer: Major Players sorted in no particular order

Adaptive Optics Industry Segmentation

Adaptive Optics are the technology that is used to enhance the performance of the optical ecosystem by minimizing the effect of incoming wavefront distortion by means of deforming a mirror such that it can compensate for the distortion. The scope of the study for the adaptive optics market is limited to AO systems offered by the vendors for various end-user industries considering the types of sensor technologies it is based on. However, the hardware components like sensors, drivers are not considered for market estimation.

| By End-user Industry | Military & Defence |

| Medical | |

| Industrial | |

| Consumer Electronics | |

| Astronomy | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Adaptive Optics Market Research FAQs

What is the current Adaptive Optics Market size?

The Adaptive Optics Market is projected to register a CAGR of 38.9% during the forecast period (2025-2030)

Who are the key players in Adaptive Optics Market?

Flexible Optical B.V., Boston Micromachines Corporation, Imaging Optic SA, Northrop Grumman Corporation and Phasics S.A are the major companies operating in the Adaptive Optics Market.

Which is the fastest growing region in Adaptive Optics Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Adaptive Optics Market?

In 2025, the North America accounts for the largest market share in Adaptive Optics Market.

What years does this Adaptive Optics Market cover?

The report covers the Adaptive Optics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Adaptive Optics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Adaptive Optics Industry Report

Statistics for the 2025 Adaptive Optics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Adaptive Optics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.