3D TSV Devices Market Analysis

The 3D TSV Devices Market is expected to register a CAGR of 6.2% during the forecast period.

- Rising demand for miniaturization of electronic devices drives the growth of the 3D TSV market. These products may be achieved by hetero system integration, which may give more reliable advanced packaging. With extremely small MEMS sensors and 3D packaged electronics, one can place sensors virtually anywhere and could monitor equipment in harsh environments, in real-time, to help increase reliability and uptime.

- 3D TSV in dynamic random-access memory (DRAM) that stores each bit of data in a separate tiny capacitor within an integrated circuit propels the growth of the 3D TSV market. Micron's 3D DRAM with re-architected DRAM achieves significant improvements in power and timing, which help in developing advanced thermal modeling.

- The recent COVID-19 outbreak is expected to create significant imbalances in the supply chain of the market studied, as Asia-Pacific, particularly China, is one of the major influencers of the market studied. Also, many of the local governments in the Asia-Pacific have invested in the semiconductor industry in a long run program, hence, expected to regain market growth. For instance, the Chinese government raised around USD 23 to 30 billion funds, to pay for the second phase of its National IC Investment Fund 2030.

- However, thermal issues caused due to a high level of incorporation is a challenging factor for the growth of the 3D TSV market. Since silicon via (TSV) provides the key connection in 3D IC integration, the difference of coefficient of thermal expansion (CTE) between silicon and copper is more than 10 ppm/K, which provides thermal stress when a thermal load is applied.

3D TSV Devices Market Trends

LED Packaging Will Have a Significant Market Share

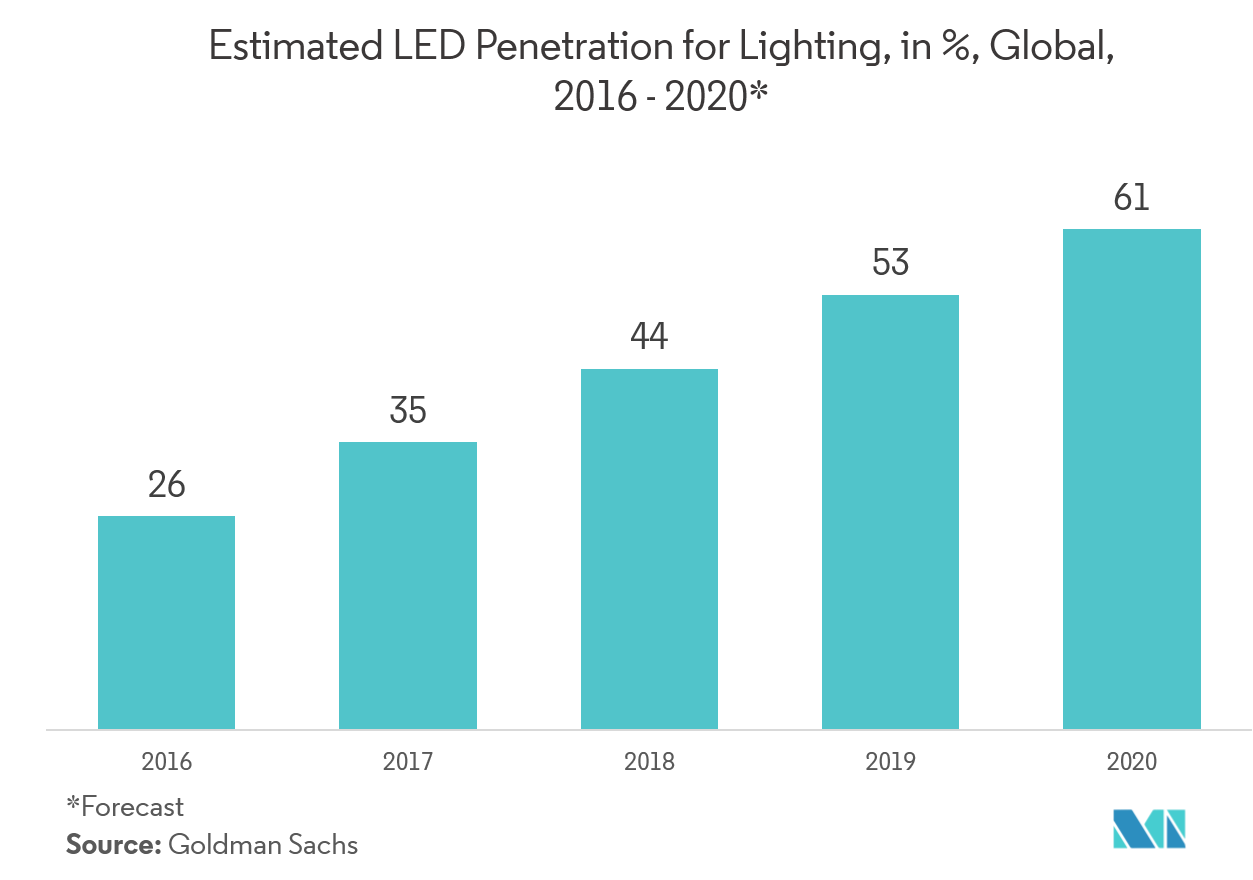

- The increasing use of light-emitting diodes (LED) in products has promoted the development of higher power, greater density, and lower-cost devices. The use of three-dimensional (3D) packaging through-silicon via (TSV) technology allows a high density of vertical interconnects, unlike 2D packaging.

- TSV integrated circuit reduced connection lengths, and thus, smaller parasitic capacitance, inductance, and resistance are required where a combination of monolithic and multifunctional integration is done efficiently, which provides high-speed low-power interconnects.

- The embedded design with thin silicon membranes at the bottom optimizes the thermal contact and therefore minimizes the thermal resistance. Through silicon via (TSV) provides the electrical contact to the surface-mounted devices and mirrored sidewalls increase the package reflectivity and improve the light efficiency.

- The SUSS AltaSpray technology is capable of coating integration of 90° corners, KOH (Potassium Hydroxide) etched cavities, Through Silicon Via (TSV) ranging from a few microns to 600μm or more. The ability to produce conformal resist coatings on severe topography, such as TSV, makes them the ideal choice for wafer-level packaging in LED, which increases the market growth.

Asia-Pacific to Witness the Fastest Growth Rate Over the Forecast Period

- Asia-Pacific is the fastest-growing market as countries in the region, such as China, Japan, South Korea, Indonesia, Singapore, and Australia, have recorded high levels of manufacturing in the consumer electronics, automotive, and transportation sectors, which a key source of demand for 3D TSV market.

- Asia-Pacific is also one of the most active manufacturing hubs in the world. The rising popularity of smartphones and demand for new memory technologies have increased the growth of computationally intensive consumer electronics, thereby, creating a wide range of opportunities in this region. As silicon wafers are widely used to manufacture smartphones, the introduction of 5G technology is expected to boost the sales of 5G smartphones, which may grow the market in the telecommunication sector.

- In April 2019, in Korea, a collective laser‐assisted bonding process for 3D TSV integration with NCP( nonconductive paste) is made, where several TSV dies can be stacked simultaneously to improve the productivity while maintaining the reliability of the solder joints through Laser‐assisted bonding (LAB) advanced technology. These solder joints may increase the growth in consumer and commercial segments, which may increase the growth of the market.

3D TSV Devices Industry Overview

The 3D TSV devices market is fragmented as the market is diversified and the existence of large, small, and local vendors in the market creates high competition. Key players are Amkor Technology, Inc., GLOBALFOUNDRIES, Micron Technology Inc., etc. Recent developments in the market are -

- October, 2019 - Samsung developed the industry's first 12-layer 3D packaging for DRAM products. The technology uses TSVs to create high-capacity high bandwidth memory devices for applications, such as higher-end graphics, FPGAs, and compute cards.

- April, 2019 - TSMC certified ANSYS (ANSS) solutions for its innovative System-on-integrated-chips (TSMC-SoIC) advanced 3D chip stacking technology. SoIC is an advanced interconnect technology for multi-die stacking on system-level integration using Through Silicon Via (TSV) and chip-on-wafer bonding process enabling customers with greater power efficiency and performance for highly complex and demanding cloud and data center applications.

3D TSV Devices Market Leaders

-

Taiwan Semiconductor Manufacturing Company Limited (TSMC)

-

Samsung Group

-

Toshiba Corporation

-

Pure Storage Inc.

-

ASE Group

- *Disclaimer: Major Players sorted in no particular order

3D TSV Devices Industry Segmentation

The 3D tsv devices is a high performance interconnect technique that passes through a silicon wafer by a vertical electrical connection which lower power consumption and gives better electrical performance. On the basis of product, the sub-markets include mems, imaging, and optoelectronics, memory, advanced led packaging, CMOS image sensors, and others that drives the market.

| By Product Type | Imaging and opto-electronics | ||

| Memory | |||

| MEMS/Sensors | |||

| LED | |||

| Other Products | |||

| By End-user Industry | Consumer Electronics | ||

| Automotive | |||

| IT and Telecom | |||

| Healthcare | |||

| Other End-user Industries | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| France | |||

| United Kingdom | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Rest of the World | |||

3D TSV Devices Market Research FAQs

What is the current 3D TSV Devices Market size?

The 3D TSV Devices Market is projected to register a CAGR of 6.2% during the forecast period (2025-2030)

Who are the key players in 3D TSV Devices Market?

Taiwan Semiconductor Manufacturing Company Limited (TSMC), Samsung Group, Toshiba Corporation, Pure Storage Inc. and ASE Group are the major companies operating in the 3D TSV Devices Market.

Which is the fastest growing region in 3D TSV Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in 3D TSV Devices Market?

In 2025, the North America accounts for the largest market share in 3D TSV Devices Market.

What years does this 3D TSV Devices Market cover?

The report covers the 3D TSV Devices Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the 3D TSV Devices Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

3D TSV Devices Industry Report

Statistics for the 2025 3D TSV Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. 3D TSV Devices analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.