3D Printed Medical Devices Market Analysis

The 3D Printed Medical Devices Market size is estimated at USD 4.63 billion in 2025, and is expected to reach USD 9.86 billion by 2030, at a CAGR of 16.32% during the forecast period (2025-2030).

- As per the Organ Procurement and Transplantation Network (OPTN), in 2018, around 27,281 organ implantations were performed in the United States. Further, over 120,000 people in the country were waiting for an organ transplant by the end of 2018. This shortage could likely be reduced by using 3D bioprinting. The 3D bioprinting method deposits 'bioink,' droplets of living cells or biomaterials, onto a substrate according to digital instructions to reproduce human tissues or organs.

- Moreover, this technology is providing the benefits of personalized treatments at an affordable price to the patients. For instance, 3D printed skin are incorporated on the body of a burnt victim. By using bio-printed skins, doctors minimize the need for skin grafting surgeries. Thus, by applying 3D bio-printed skin, doctors can transfer healthy skin cells to those injury parts, thus making the treatment faster and easier.

- All the above factors are expected to contribute significantly toward the growth of the market. However, securing approval from regulators might impede the widespread medical application of 3D printing during the forecast period.

3D Printed Medical Devices Market Trends

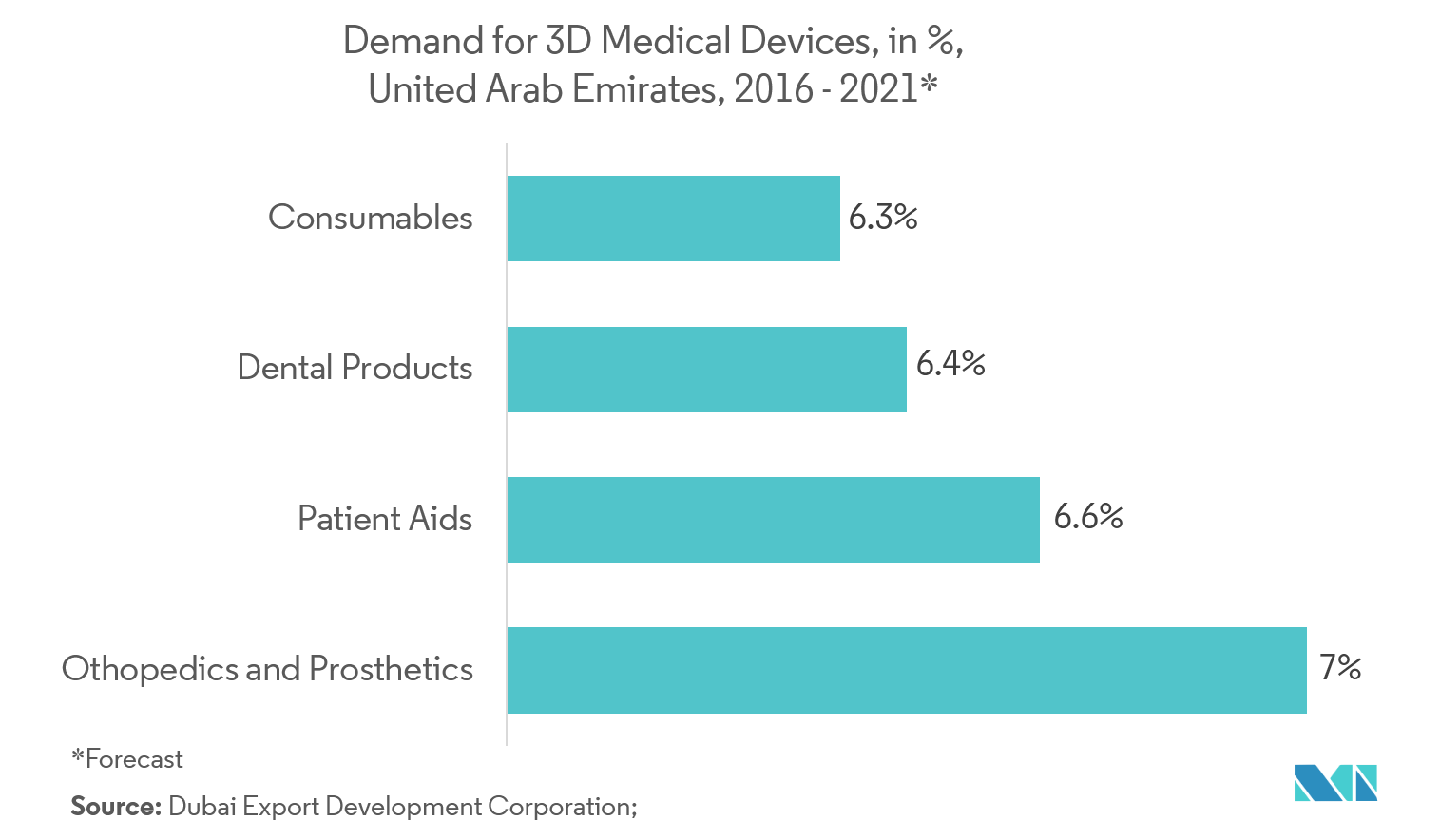

Orthopedics and Prosthetics is Expected to Have the Fastest Growth

- One of the advantages that 3D printers in medical devices provide is customized medical products and equipment. Thus the custom-built prosthetics and implants provide value addition for both patients and doctors. Also, customized implants, have a positive impact in terms of the time required for surgery, patient recovery time, and the success of the implant.

- For instance, in January 2019, Apollo Hospitals, at Mumbai in India performed a 3D printed titanium skull implant on one it's patient. 3D-printed titanium implant was opted because it would closely replicate the shape of the patient's skull. These 3D printed implants are MRI compatible, decrease the risk of infections and most importantly can be made to fit the patient's form.

- Moreover, 3D printed prosthetics help in improving the posture and balance for people suffering from Achondroplasia, a genetic disorder characterized by short-limbed dwarfism that is apparent at birth. According to the National Organization for Rare Disorders, the estimated frequency of achondroplasia has ranged from about one in 15,000 to one in 35,000 births.

- Further, according to the World Bank, the estimated share of the U.A.E.’s population above the age of 65 will increase to 4.4% by 2030 from 1.1% in 2018. This will stimulate demand for healthcare in general and geriatric care in particular which will create a demand for orthopedics products related to knee and hips.

- The Governments of the UAE has pledged to create a world-class healthcare facility in the UAE. They also want to boost medical tourism in the UAE by establishing Dubai as the center. The Emirate’s good connectivity to the rest of the world through its airline and airport ensures that health tourists will be able to get to the Emirate in an expeditious manner.

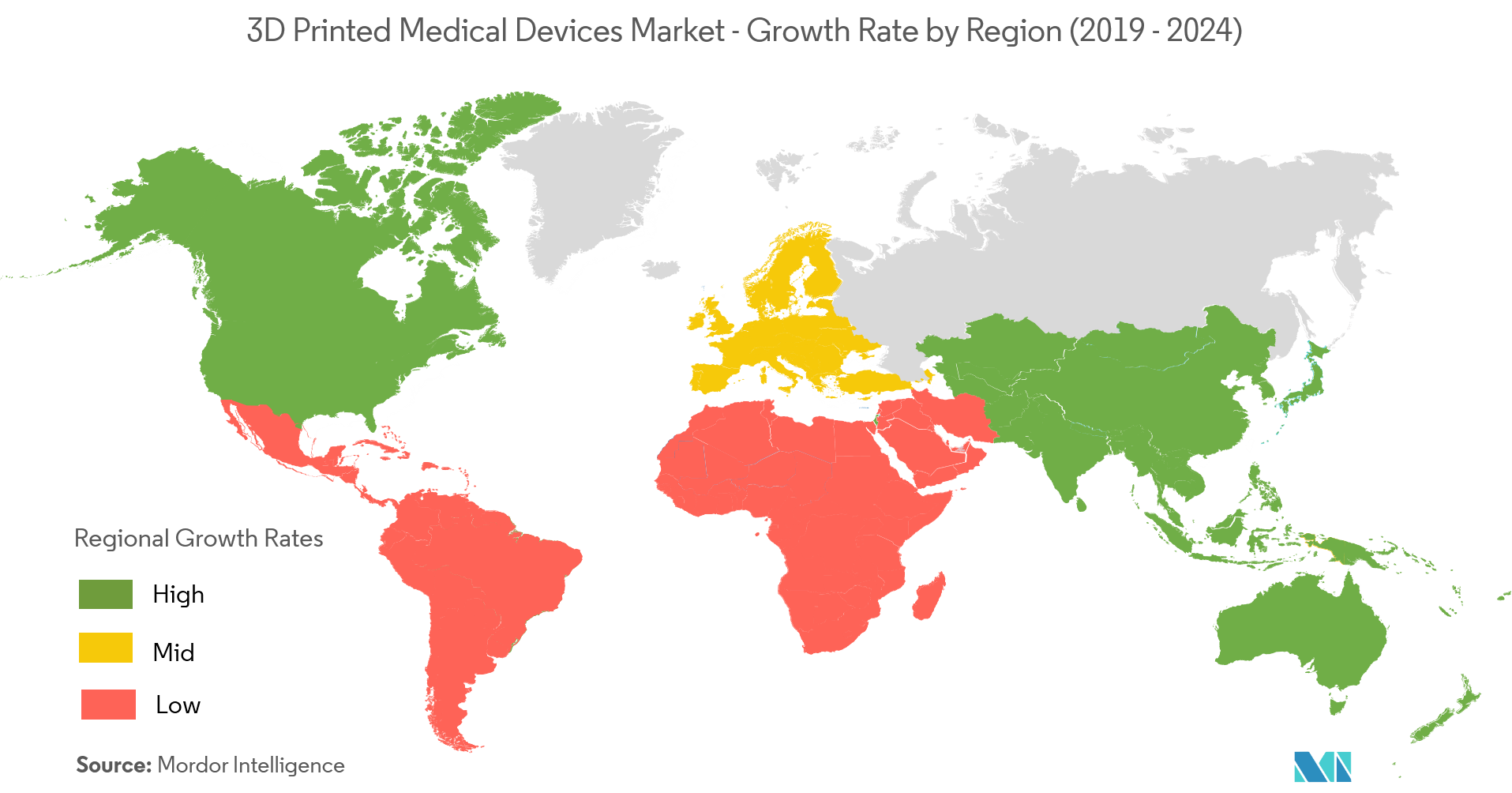

North America to Account for the Largest Market Share

- The United States medical devices industry is known for offering high-quality products using advanced technology resulting from significant investment in research and development.

- According to the American Society for Aesthetic Plastic Surgery, around thirty thousand breast augmentations were performed among women in the United States in 2018. This breast augmentation is one of the five most common surgical cosmetic procedures among women in the United States in 2018. Further, the use of 3D implant avoids the complications and side effects that are associated with other implants such as implant leaking, contracting, rippling, or rupturing. Additionally, it also reduces surgery time and increases patient recovery time.

- Moreover, opportunities for expansion of U.S. medical device comes from specific key ongoing policy and activities. For instance, the U.S. Food and Drug Administration (FDA) in 2017 has reviewed more than 100 devices that were produced on 3D printers. These include knee replacements and cranial implants.

- Additionally, the FDA is also working to establish a regulatory framework with regards to applying existing laws and regulations that govern device manufacturing patients they are treating. To keep pace with evolving technology as well as encourage and support innovation, the FDA is involved in several research activities.

- For example, in 2016, the Radiological Society of North America (RSNA) launched the 3D Printing Special Interest Group (SIG). Intending to support radiology-centered, hospital-based, point-of-care 3D printing to impact more patients, they had set up several committees to work in different areas. The areas include prosthetics, Anaplastology, regulatory and compliance, and simulations amongst others.

- Apart from being the world's largest producer of medical devices, the United States is the largest consumer of these as well. Thus, 3D printed medical devices market is expected to witness significant adoption in several areas of the United States healthcare sector.

3D Printed Medical Devices Industry Overview

The 3D printed medical devices market is moderately competitive in nature. Increasing interest in the adoption of this technology from the hospital and surgical centers across the globe is creating an immense opportunity for investors who are looking to capitalize on the future. Further, the increasing number of innovative start-ups in the 3D printing ecosystem is fuelling the growth of the industry. Some of the key players are Materialise NV, 3D Systems Corporation, and Hewlett Packard (HP) amongst others. Some of the recent developments are:

- November 2018 -3D Systems launchedSimbionix ARTHRO Mentor Express training simulator. This is a portable training solution to help medical professionals to learn surgical procedures for knees, shoulders, and hips on a portable and affordable tabletop platform.

- August 2018 -3D Systems launchedNextDent 5100 whichenableddental labs and clinics to produce dental devices faster while reducing material waste and capital equipment expenditure.

3D Printed Medical Devices Market Leaders

-

3D Systems

-

Materialise NV

-

SLM Solutions Group AG

-

Nano Dimension

-

Stratasys, Ltd

- *Disclaimer: Major Players sorted in no particular order

3D Printed Medical Devices Industry Segmentation

3D printing is a method that creates a three-dimensional object by building consecutive layers of raw material. Through this, the manufacturers can create patient-specific devices or devices with very complicated internal structures. Some of the medical devices produced by 3D printing include dental restorations such as crowns, and external prosthetics, surgical instruments and orthopedic and cranial implants. Also, 3D printing enables doctors to work faster, shorten patient theatre time, and improve operation results.

| By Offerings | Hardware | ||

| Software | |||

| By Type | Surgical Guides | ||

| Surgical Instruments | |||

| Prosthetics and Implants | |||

| Tissue Engineering Products | |||

| By Materials | Plastics | ||

| Metal & Metal Alloy Powders | |||

| Others | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | Japan | ||

| China | |||

| India | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Latin America | ||

| Middle-East & Africa | |||

3D Printed Medical Devices Market Research FAQs

How big is the 3D Printed Medical Devices Market?

The 3D Printed Medical Devices Market size is expected to reach USD 4.63 billion in 2025 and grow at a CAGR of 16.32% to reach USD 9.86 billion by 2030.

What is the current 3D Printed Medical Devices Market size?

In 2025, the 3D Printed Medical Devices Market size is expected to reach USD 4.63 billion.

Who are the key players in 3D Printed Medical Devices Market?

3D Systems, Materialise NV, SLM Solutions Group AG, Nano Dimension and Stratasys, Ltd are the major companies operating in the 3D Printed Medical Devices Market.

Which is the fastest growing region in 3D Printed Medical Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in 3D Printed Medical Devices Market?

In 2025, the North America accounts for the largest market share in 3D Printed Medical Devices Market.

What years does this 3D Printed Medical Devices Market cover, and what was the market size in 2024?

In 2024, the 3D Printed Medical Devices Market size was estimated at USD 3.87 billion. The report covers the 3D Printed Medical Devices Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the 3D Printed Medical Devices Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

3D Printed Medical Devices Industry Report

Statistics for the 2025 3D Printed Medical Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. 3D Printed Medical Devices analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.