3D Medical and Surgical Imaging Platform Market Analysis

The 3D Medical and Surgical Imaging Platform Market is expected to register a CAGR of 18% during the forecast period.

- There is an increased demand for 3D medical imaging due to its vast applications in cardiology and oncology. For instance, Heart valve replacement is one of the most common procedures in cardiology. Transcatheter aortic valve replacement is considered one minimally invasive heart valve replacement procedure. Positioning the new heart valve is a severe concern to surgeons. Surgeons prefer 3D angiography imaging software to view the anatomy during the placement of heart valves, as positioning a new heart valve seems crucial.

- Additionally, in May 2021, the National Health Service England (NHS) unveiled a unique technology called HeartFlow to detect and treat people with suspected heart disease quickly. Delivered under the NHS Long Term Plan, HeartFlow is claimed to convert a regular computed tomography (CT) scan of the heart into a three-dimensional (3D) image to enable the detection of coronary heart disease in 20 minutes, further driving the market growth.

- Due to the surging development of modern visualization methods and technology platforms, along with rising demand for 3D imaging in diagnosing and monitoring chronic diseases, the market is growing. A shift toward minimally invasive procedures and increasing adoption of hybrid operating rooms also provide traction for the market.

- Furthermore, in December 2021, WEHI (Walter and Eliza Hall Institute of Medical Research) researchers developed enhanced 3D imaging technology to model how breast cancer cells invade and spread into the bone and remodify themselves to fuel tumor growth. The research could guide the development of new therapies for patients suffering from cancers that are typically applied to the bone, including breast and prostate cancers.

- The rapid advancements in innovative imagining techniques are paving the way for the growth of the studied market. For instance, in February 2021, a research team led by UMass Lowell introduced a new 3D imaging technique to detect breast cancer and other diseases, including COVID-19. The noninvasive medical technology employs specialized contrasting dye that identifies breast cancer cells, allowing practitioners to visualize human tissue inside the body better. The dye amplifies the X-ray signal in tumors when combined with computed tomography (CT) scanner, called a "photon-counting spectral CT," which produces multi-colored, 3D images. The researchers claimed that the contrast agents, combined with spectral CT and machine learning, could lead to a more precise disease diagnosis and significantly assist in early intervention.

- Furthermore, the COVID-19 pandemic contributed to a 16% increase in the estimated number of deaths in OECD nations in 2020 and the first half of 2021, both directly and indirectly. Life expectancy has decreased in 24 of the 30 countries, and the pandemic has had a significant mental health impact. In addition, the pandemic has resulted in a substantial surge in healthcare spending across the OECD.

3D Medical and Surgical Imaging Platform Market Trends

Cloud Expected to Witness Significant Growth

- Cloud computing gives medical imaging a competitive advantage in raw data management. Depending on the medical imaging solution types and the industry's development level, cloud computing can be utilized in a variety of scenarios, including cloud image archiving, massive image data storage, and remote medical image disaster recovery, as well as cloud image-based software applications such as 3D healthcare image applications, mobile image reading, and imaging centers.

- The trend for enterprise imaging systems and Picture Archive and Communication systems (PACS) is moving to cloud-based solutions owing to their ability to solve several hospital issues. In addition, cloud-based systems support easier integration with large hospital electronic medical record (EMR) systems.

- Furthermore, hospitals and other healthcare facilities can minimize their IT infrastructure investment by utilizing cloud-based solutions. That means reducing labor costs through automating several repetitive management tasks. Therefore, the cloud is bringing a lot of scalabilities, and physicians can emphasize patients rather than IT concerns.

- Further, in August 2021, GE Healthcare introduced a next-generation, cloud-based Picture Archive and Communication System (PACS) called Edison True PACS. This new cloud-based diagnostic imaging and workflow solution is designed to support and enable radiologists facing increased rates of staff burnout and retirements to be more precise and efficient while keeping capital and IT resources under control. Moreover, this new solution offered AI-enabled decision support to help radiologists acclimate to higher workloads, augment exam complexity, and enhance diagnostic accuracy.

North America Expected to Hold Significant Share

- North America is expected to hold a significant share of the market due to the rising number of surgeries, increasing prevalence of chronic disease, and the growing adoption of the hybrid operating room by hospitals across the region.

- The region is witnessing an increase in automated 3D imaging scanners, and there is ongoing R&D development for 3D imaging. For instance, in July 2022, SMARTTECH expanded its line of 3D scanner accessories. Adding professional FOBA stands to the SMARTTECH accessory line expands the possibilities for the ergonomic use of SMARTTECH 3D scanners.

- The market across the region is significantly growing due to the increasing purchasing power of the healthcare settings, such as hospitals, long-term care centers, and advanced specialty centers. Moreover, compared to developing regions coupled with a favorable reimbursement scenario, a well-established healthcare infrastructure is anticipated to bode well for regional growth during the forecast period.

- Factors such as the growing adoption of automation in the healthcare sector and escalating demand for 3D imaging in diagnosing and monitoring chronic diseases are expected to provide plenty of opportunities for several healthcare companies to expand across the region.

- Further, in January 2022, Francisco Partners signed an agreement with IBM (US) to develop healthcare data and analytics assets from IBM, including Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software offerings, which are currently part of the Watson Health business.

3D Medical and Surgical Imaging Platform Industry Overview

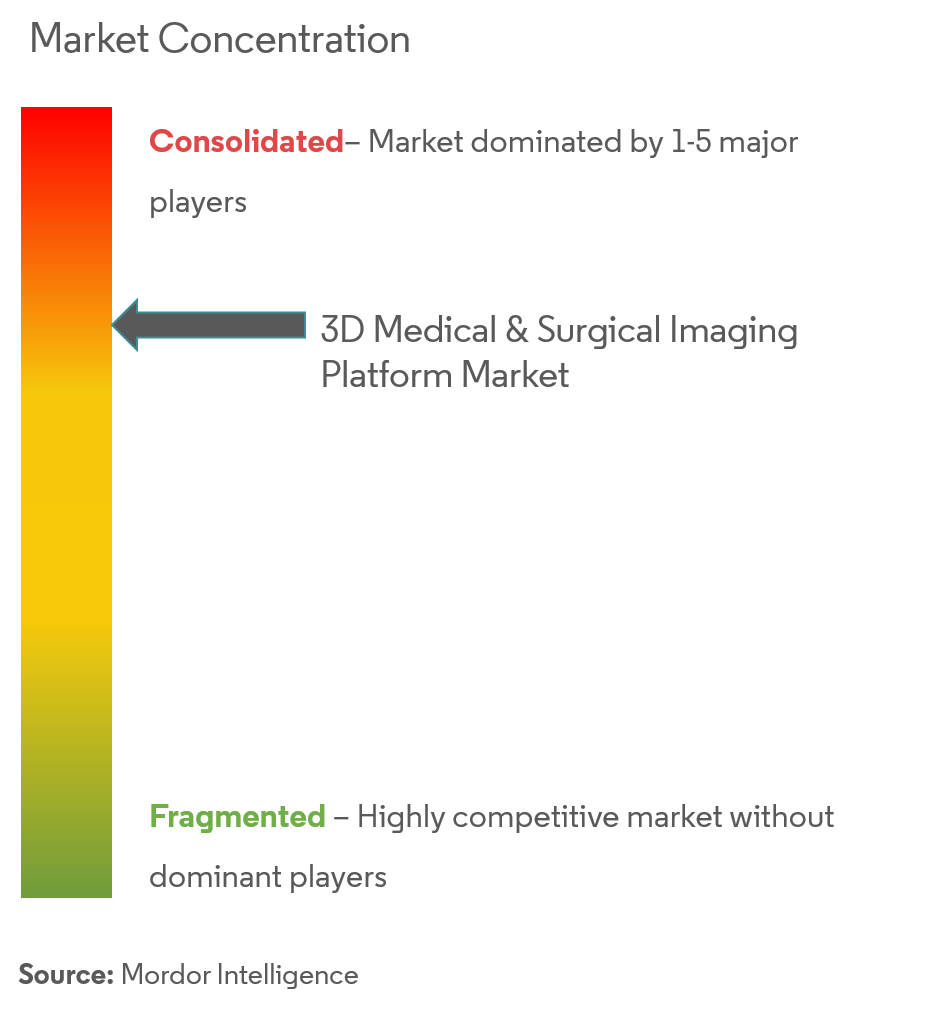

The 3D medical and surgical imaging platform market is consolidated owing to a few major players in the market. The market players are focusing on R&D to develop technologically advanced products to reduce the cost and side effects associated with the products. The players in this industry are continually working on improving their product portfolio to gain competitive advantages with mergers and acquisitions, partnerships, and constant innovations.

- June 2022 - Trivitron Healthcare plans to launch made-in-India CT-Scan and MRI in 2022-23. Because of its smart features, low cost, and portability will be used for better diagnosis in both the Indian and international markets. In addition, the company intends to open its second ultrasound manufacturing facility in India at Patalganga Industrial Area in Mumbai.

- November 2021 - Royal Philips, a global player in health technology, announced at the Radiological Society of North America the launch of new AI-enabled innovations in MR imaging. Philips' new MR portfolio of intelligent integrated solutions is intended to speed up MR exams, streamline workflows, optimize diagnostic quality, and help ensure radiology operations' efficiency and sustainability.

3D Medical and Surgical Imaging Platform Market Leaders

-

Ambra Health Inc.

-

Arterys Inc.

-

Brainlab AG

-

Depuy Synthes Inc.

-

Medtronic Inc.

- *Disclaimer: Major Players sorted in no particular order

3D Medical and Surgical Imaging Platform Market News

- October 2021 - Intelerad Medical Systems Inc. has agreed to buy Ambra Health, a cloud-based medical imaging manager, in a deal worth USD 1.7 billion. Ambra Health will be acquired over USD 250 million by Intelerad, a medical imaging software company backed by European buyout firm Hg.

- February 2021 - Brainlab has received FDA approval for its Loop-X Mobile Imaging Robot and Cirq robotic surgical system. The FDA approval allows the company to enter the US market with the Cirq robotic alignment module for spine procedures and the Loop-X robotic intraoperative imaging device.

3D Medical and Surgical Imaging Platform Industry Segmentation

3D medical imaging It's a method of obtaining a 3D volumetric image of multiple 2D images that are computer reconstructed using a mathematical "back-projection" operation to retrieve pixel data from projected image signals passing through a patient and detected by multichannel detector arrays all around the patient. Surgical imaging platforms allow physicians and surgeons to see internal images of the body, including organs and bones, prior to and during surgical procedures. These images aid reduce risk and speeding recovery. The studied market is segmented by Deployment such as On-premise, Cloud among various components, including hardware, software, and services in different Applications such as CT-Scan, MRI, Ultrasound, Neurological Imaging, and Spinal Imaging among multiple geographies.

| By Deployment | On-premise |

| Cloud | |

| By Component | Hardware |

| Software & Solution | |

| By Application | CT-Scan |

| MRI | |

| Ultrasound | |

| Neurological Imaging | |

| Spinal Imaging | |

| Other Applications | |

| By Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East & Africa |

3D Medical and Surgical Imaging Platform Market Research FAQs

What is the current 3D Medical and Surgical Imaging Platform Market size?

The 3D Medical and Surgical Imaging Platform Market is projected to register a CAGR of 18% during the forecast period (2025-2030)

Who are the key players in 3D Medical and Surgical Imaging Platform Market?

Ambra Health Inc., Arterys Inc., Brainlab AG, Depuy Synthes Inc. and Medtronic Inc. are the major companies operating in the 3D Medical and Surgical Imaging Platform Market.

Which is the fastest growing region in 3D Medical and Surgical Imaging Platform Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in 3D Medical and Surgical Imaging Platform Market?

In 2025, the North America accounts for the largest market share in 3D Medical and Surgical Imaging Platform Market.

What years does this 3D Medical and Surgical Imaging Platform Market cover?

The report covers the 3D Medical and Surgical Imaging Platform Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the 3D Medical and Surgical Imaging Platform Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

3D Medical Imaging Platform Industry Report

Statistics for the 2025 3D Medical and Surgical Imaging Platform market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. 3D Medical and Surgical Imaging Platform analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.